Fixed Income Market and Positioning Insights

- Bond markets in 2022 have had the worst start in decades, with both interest-rate and credit-related sectors suffering simultaneously in what is usually a short- term phenomenon.

- Portfolios are conservatively positioned, with near-benchmark performance; our approach has benefited relative to managers who take greater duration and credit risk.

- When bond prices are down, it is best to hold on in our view; prices of high-quality issuers eventually tend to converge back to par with less volatility over time and with continued coupon payments.

- Bessemer portfolio positioning is cautious, with lower duration than last year; credit exposure is lighter as well but still is overweight due to strong fundamentals.

Despite Bonds’ Rough Start to 2022, Potential Has Improved

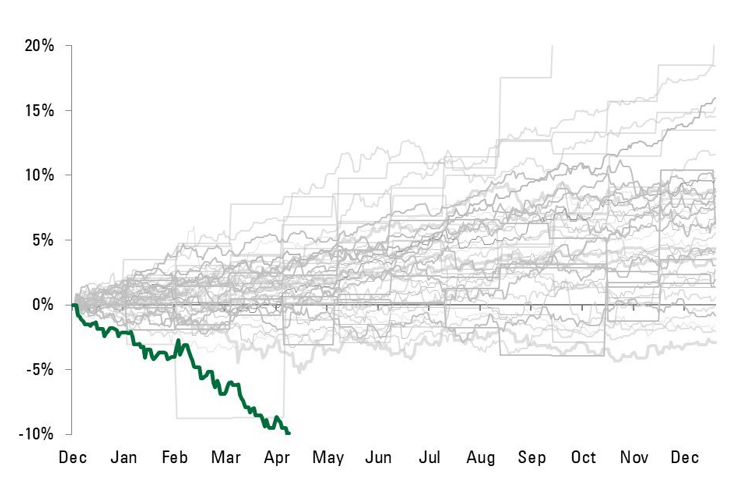

Occasionally, markets dish out a period of volatility and negative returns that can seem excruciatingly prolonged. Giving a bit more context to this year’s bond-market rout, it is painfully obvious that 2022 has had the worst start of a year since modern bond indices were created in the 1970s (see Exhibit 1). This year is even worse than the 1980 downturn that scarred a generation of bond holders, and one commentator claims it is the worst start since the U.S. bond bear market of 1788. We have seen a perfect storm of disruptions, culminating in the Russian invasion of Ukraine, which was not part of our calculus for this year. The war has further exacerbated two trends that were already in focus — higher commodity prices and disrupted supply chains — leading to higher inflation expectations and a more hawkish Fed. That is the bad news. If we take a deeper look, there is reason for hope.

One element that makes this cycle unique is that the Fed, unusually, has telegraphed its entire hiking cycle in advance. The Fed has signaled that it wants its policy rate, the fed funds rate, to be over 3% by early next year. Gone are the Greenspan, Bernanke, and Yellen days of painstakingly gradual quarter-point rate hikes, each followed by a statement like, “With this policy change, the FOMC feels monetary conditions are in balance.” The Fed then would hike again and say the same thing, over and over, forcing market participants to speculate over the future path of policy rates. This uncertainty allowed market rates to rise gradually.

Today, the Powell Fed has taken that uncertainty away, telegraphing that monetary conditions won’t be in balance until the policy rate is over 3%. As a result, the bond market has quickly built this entire progression of rate hikes into today’s bond prices. This has made the yield curve shift upward at breathtaking speed, causing bond prices to go down. 2-year Treasury yields have risen from 0.20% last August to 2.71% as of this writing. This 13-fold increase shows the market is already anticipating a long string of Fed hikes. 10-year yields have more than doubled to 3.00%, and of course, when bond yields go up, their prices go down. What does this mean for our clients’ portfolios?

Remember that bonds are debt instruments that are usually issued at par (which is a price of 100). Over a bond’s life, its daily price fluctuations become gradually less volatile as the bond’s life shortens and it finally matures at a price of par. Its coupon payments continue throughout, until maturity. Municipal bonds are often issued at a premium — above par — but because of the way they are treated for taxes, the same dynamics hold. Why is this dynamic important?

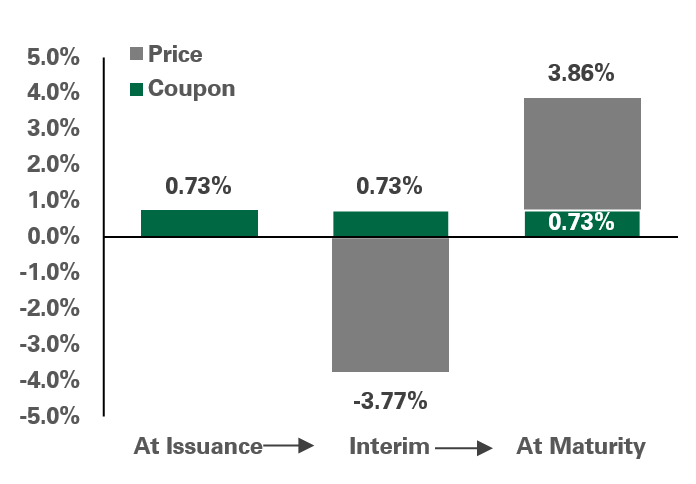

Pretend you bought a 2-year bond last December, at par, yielding 0.73% (see Exhibit 2). Then you glance at the Bessemer client website on April 22, and frustratingly, the price is down 3.77%. Obviously, you are not happy, but here’s some good news: If your Bessemer portfolio manager holds the bond to maturity, the loss will eventually be erased by a future 3.86% gain, and the bond will mature in December 2023 at par.

Exhibit 2: Hypothetical 2-Year Treasury Returns

Key takeaway: Bond losses may be erased when held until maturity

In addition, you will keep earning your coupon income over the entire period. Finally, if your portfolio manager decides to sell the bond at a loss, which can be good for tax purposes, and reinvest in another bond the manager believes will perform as well or even better, this can set up the portfolio for even better long-term returns. We employ this approach both in our clients’ managed accounts as well as in the bond mutual funds.

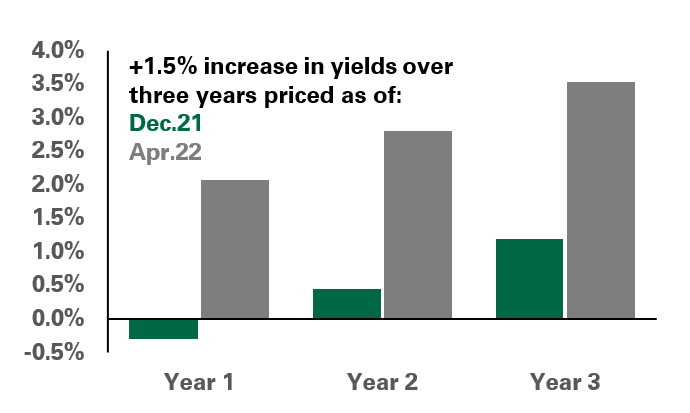

Occasionally, someone asks, “Why shouldn’t I just sell my bonds into cash until yields peak?” A strong case can be made not to sell. As market yields rise, the downside protection of your bonds increases. Consider the return of a 5-year Treasury, bought last December when the 5-year yield was 1.27%, and held for three years (see Exhibit 3). If market yields rise by 1.5% over the three years, returns are negative in the first year, and then positive by increasing degrees over the following two years as yields rise. If you were to buy this same bond on April 22, when the yield was 2.93%, the returns, in gray, are all positive over the ensuing three years — even as yields rise — and the returns keep improving over time. In nearly all cases, it is better to hold the bond than to sell and reinvest in lower-yielding cash.

Taxable Bonds

The three main drivers of corporate credit spreads are the macroeconomic environment, market supply and demand, and issuer fundamentals. We would highlight a few thoughts on each of these factors: 1) A weakening economy hurts corporate earnings and fundamentals, and although we don’t expect a recession anytime soon, the economy is gradually slowing from the extremely fast pace of 2021, pushing credit spreads wider. 2) When corporate-debt issuance and investor demand for debt are in balance, credit spreads tend to remain stable. This year, though, debt issuance has been greater than expected, while investors, fearing further volatility, have been less eager to buy bonds. This imbalance has acted to push credit spreads wider, depressing overall returns. 3) If basic credit fundamentals — such as leverage, cash flow, profit margins, and other business measures — are strong, credit spreads tend to contract. Currently, credit fundamentals are stronger than ever while in the early stage of a Fed-hiking cycle, and as a result of this positive influence, recent credit-spread widening has been modest and does not reflect recessionary expectations.

Portfolio exposure to credit has been reduced this year during periods of market strength but remains somewhat overweight relative to the benchmark to benefit from higher ongoing yields.

Our portfolio strategy has evolved from last year when portfolios were significantly exposed to the price-moving effects of interest-rate shifts (measured by “duration”). As of today, this exposure has been reduced to our long-term average, or neutral. This more cautious stance is designed to withstand ongoing bond-market volatility while maintaining portfolio income and longer-term upside potential. Portfolios have more exposure in short and long maturities than intermediate ones in order to generate higher yields and to help avoid potential volatility around changes in Fed-policy expectations.

For now, our positioning will remain cautious, waiting for opportunities to reestablish more credit and interest-rate exposure once we have more confidence that volatility will begin to calm, and that the Fed won’t need to tighten its policy more than what the market has already taken into account.

Municipal Bonds

Municipal bonds typically outperform Treasuries in difficult market environments, but this year has been different. Retail sellers emerged in force during January, driving prices downward, and seasonality also played a role, as municipals tend to suffer from selling pressure each April as investors liquidate assets to pay their taxes.

Valuations at the end of April had weakened to attractive levels across the entire yield curve. For example, the New York Transitional Finance Authority issued bonds in March that provided significantly higher yields, higher spreads, and cheaper valuation relative to Treasuries than a deal priced by the same issuer in August 2021. This trend has played out across the municipal market, creating opportunities to procure high-quality bonds for portfolios at very attractive valuations. These valuations do not reflect deterioration of underlying credit fundamentals but instead are driven by investor angst around broader macro-based market volatility.

Despite lower prices, the underlying fundamentals of municipal credits remain strong, balance sheets are generally the most robust in decades, supply remains manageable, and taxes remain high (meaning demand should rematerialize once volatility subsides). Portfolio duration has been reduced to near-neutral since last year, and we are watching for opportunities to take advantage of today’s higher market yields.

Credit Income

Positioning in the Credit Income portfolio, unlike other offerings in the credit sector, remains balanced between higher-yielding and defensive assets. Periods such as the past quarter, in which both types of assets go down simultaneously, are rare and usually short-lived. Nearly half of the portfolio is invested in non-Agency mortgage-backed securities (MBS), which typically have adjustable rates. This allows the portfolio to benefit from rising interest rates, receiving higher and higher income. Underlying the MBS market is the housing sector, which continues to have good prospects, and acts as a good diversifier in conjunction with more traditional Treasury and credit holdings, such as preferred securities, high-yield debt, and others. Over the long term, we expect the portfolio’s unique construction to continue generating relatively stable returns with attractive yields.

Conclusion

When bond prices are down, it is best to hold on and avoid selling, in our view. Bond prices of high-quality (non-defaulting) issuers, no matter how low they fall, eventually converge back to par, with less and less volatility over time, and their coupon payments continue throughout. Remember that as yields go up, downside protection becomes stronger, and returns rise. Even better, portfolio cash generation — from maturities, coupon payments, and sales — can be reinvested, generating higher and higher portfolio yields over time. Sometimes it can be beneficial to sell a bond at a capital loss if the plan is to realize that loss for tax purposes, and reinvest in other bonds that will perform even better as they approach maturity and move toward a price of par. Therefore, the rationale behind holding bond positions throughout a downturn is compelling.

Rest assured that by actively managing the securities in portfolios, employing a conservative approach, and staying invested, we aim to provide attractive long-term returns without undue volatility. Our goal, as ever, is to protect our clients’ irreplaceable wealth and to manage portfolios in a style that offers peace of mind, even through volatile times.

Past Performance is no guarantee of future results. This material is for your general information. It does not take into account the particular investment objectives, financial situation, or needs of individual clients. This material is based upon information obtained from various sources that Bessemer Trust believes to be reliable, but Bessemer makes no representation or warranty with respect to the accuracy or completeness of such information. Views expressed herein are current only as of the date indicated, and are subject to change without notice. Forecasts may not be realized due to a variety of factors, including changes in economic growth, corporate profitability, geopolitical conditions, and inflation. Bessemer Trust or its clients may have investments in the securities discussed herein, and this material does not constitute an investment recommendation by Bessemer Trust or an offering of such securities, and our view of these holdings may change at any time based on stock price movements, new research conclusions, or changes in risk preference.