The Power of Perspective:

A Focus on What Could Go Right

Executive Summary

- The U.S. economy continues to defy recession calls, with low unemployment, stable jobless claims, and resilient consumer spending driving strong retail sales and consistent activity across income groups.

- Supportive policy, broadening corporate earnings, and AI-driven innovation are reasons for optimism. The 2025 tax legislation and resumed Fed rate cuts are providing fresh stimulus, while second-quarter earnings exceeded expectations and are strengthening across sectors and company sizes. At the same time, investment in artificial intelligence — projected to top $360 billion this year — is driving long-term productivity gains.

- Our portfolios remain modestly overweight equities, with a focus on areas where we see long-term opportunity — including healthcare, technology, infrastructure, energy, and durable consumer platforms with pricing power.

It is a quirk of human nature that we are drawn more to what can go wrong than to what might go right. This is not simply a matter of temperament. It is deeply rooted in both our biology and our psychology. Evolution has trained us to be alert to danger. As Morgan Housel writes in The Psychology of Money, “Optimism sounds like a sales pitch. Pessimism sounds like someone trying to help you.” In other words, warnings of trouble command our attention in ways that hopeful narratives rarely do.

Behavioral finance has long documented this imbalance. The concepts of loss aversion and negativity bias demonstrate that the threat of losses is felt more acutely than the prospect of gains. Investors, like all people, are wired to overweight risks, dangers, and negative headlines. In a 24-hour news cycle, where crises are magnified and amplified, this natural bias can easily become distorted into a perpetual sense of impending doom.

None of this is to deny that risks exist. Geopolitical tensions, shifting monetary policy, and pockets of economic fragility are all real, and they deserve thoughtful consideration. But an exclusive focus on what could go wrong risks leaving investors with an incomplete picture. As Housel also observes, “Pessimism just sounds smarter and more plausible than optimism.” Yet history has shown that progress, innovation, and resilience are the quieter, but often more decisive, forces shaping markets and economies over time.

The truth is that risks and opportunities coexist. Every investment outlook must grapple with both. But because human instinct tends to lean so heavily toward the negative, it’s important to rebalance the conversation. In this Quarterly Investment Perspective, we do just that. Rather than cataloging the many challenges facing markets — a task that is all too easy — we focus on the positive forces that we believe will serve as the marginal drivers of the economy and financial markets in the quarters ahead.

Our goal is not to dismiss the risks, but to remind ourselves, and our clients, that optimism has a place in investing.

At the start of the year, we laid out our case that 2025 would be a year of transition, with volatility ultimately supported by a strong macroeconomic foundation. Volatility and uncertainty were primary market themes earlier in the year, largely driven by fast-moving policy shifts in Washington. That said, we must acknowledge the remarkable resilience of many foundational elements of our economy, particularly given how frequently investors have predicted an imminent recession in recent years. In our view, the critical elements of economic growth remain in place just as markets turn their attention to more pro-growth variables such as lower interest rates, fiscal stimulus from the One Big Beautiful Bill Act (OBBBA), and continued AI-driven capital expenditures.

Foundations of Growth

While labor demand has softened modestly in recent months, unemployment remains low at 4.3%, and initial jobless claims, or layoffs, are stable at an average of about 230,000 over the last three months — well below the longer-term average of 377,000. While demand has eased, supply has adjusted, with slower immigration this year reducing payroll growth needed to maintain balance in the broader labor market.

Even amid a somewhat softer jobs market, the U.S. consumer continues to show resilience. The August control group retail sales report, which feeds directly into the calculation of GDP, rose 0.7% month-over-month, surpassing expectations of 0.4% and above its historical average. At the same time, company commentary suggests that consumers are holding up better than headlines imply. Visa, a Bessemer holding, underscored continued U.S. consumer strength. On the company’s latest quarterly earnings call, President Ryan McInerney noted, “Within the U.S., while spending growth differed among consumer spend bands, all spend bands in Q2 remained resilient and consistent with past quarters.”

Finally, the U.S. continues to demonstrate its entrepreneurial and technological leadership, with hyperscaler investments in artificial intelligence (AI) projected to exceed $300 billion in 2025. We view each of these dynamics as key reasons to remain optimistic, despite the often noisy headlines.

Coming Policy Support

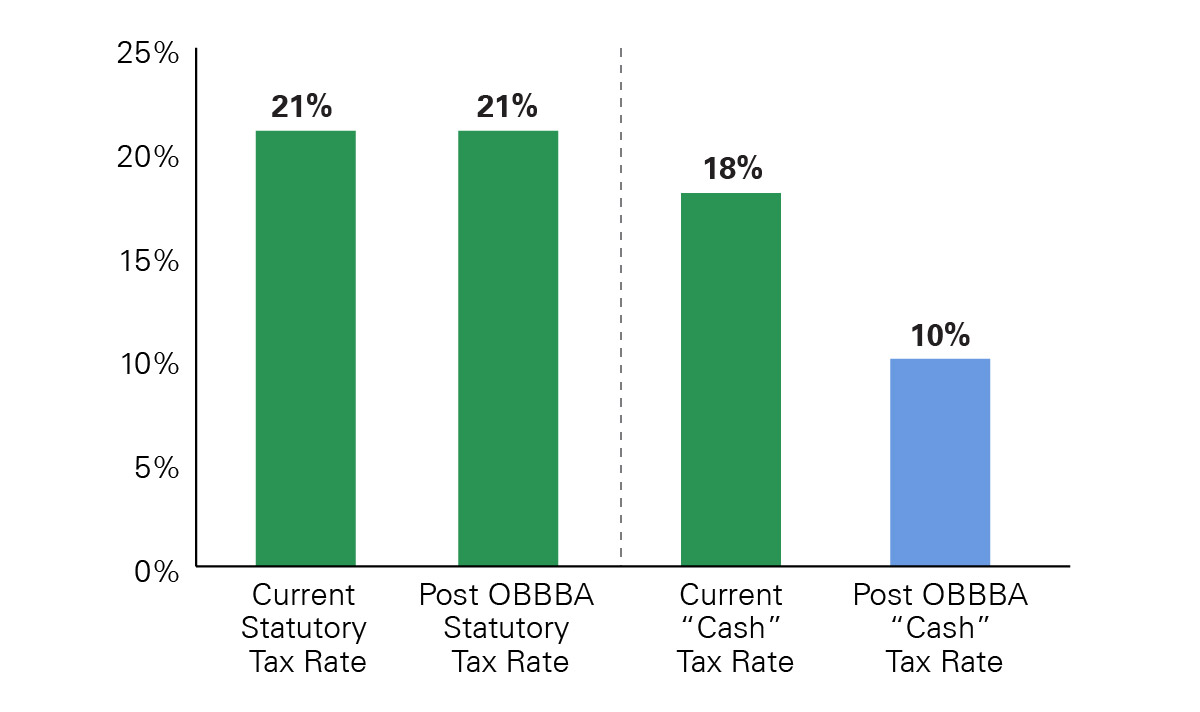

We now have more policy clarity, with both fiscal and monetary policy poised to provide a boost to economic growth. Not only does the OBBBA extend prior tax cuts, but it provides for an estimated $150 billion in new consumer stimulus in fiscal year 2026, including a higher SALT deduction, expanded child tax credit, and elimination of tax on tips. Corporations will also benefit from an estimated 8-percentage-point reduction in the cash tax rate paid in 2025 and 2026 due to accelerated depreciation provisions (Exhibit 1). Taken together, these developments give us reason to remain constructive on the U.S. economy and markets as the effects of the new tax legislation materialize. Thus far, companies have received more than $100 billion in cash for R&D and capital goods investments made this year, as part of the retroactive accelerated depreciation of the OBBBA. This compares to just $94 billion of incremental tariff revenue received by the government since March 1. The tax bill is helping companies more easily absorb the impact of higher tariffs.

Exhibit 1: OBBBA Reduces Cash Tax Rate to Prior Lows

Key takeaway: Corporate margins are set to benefit as they face a lower median tax rate under the new tax bill.

Exhibit 1: OBBBA Reduces Cash Tax Rate to Prior Lows Corporate margins are set to benefit as they face a lower median tax rate under the new tax bill. As of August 29, 2025. Source: Bloomberg, Congressional Budget Office, Morgan Stanley

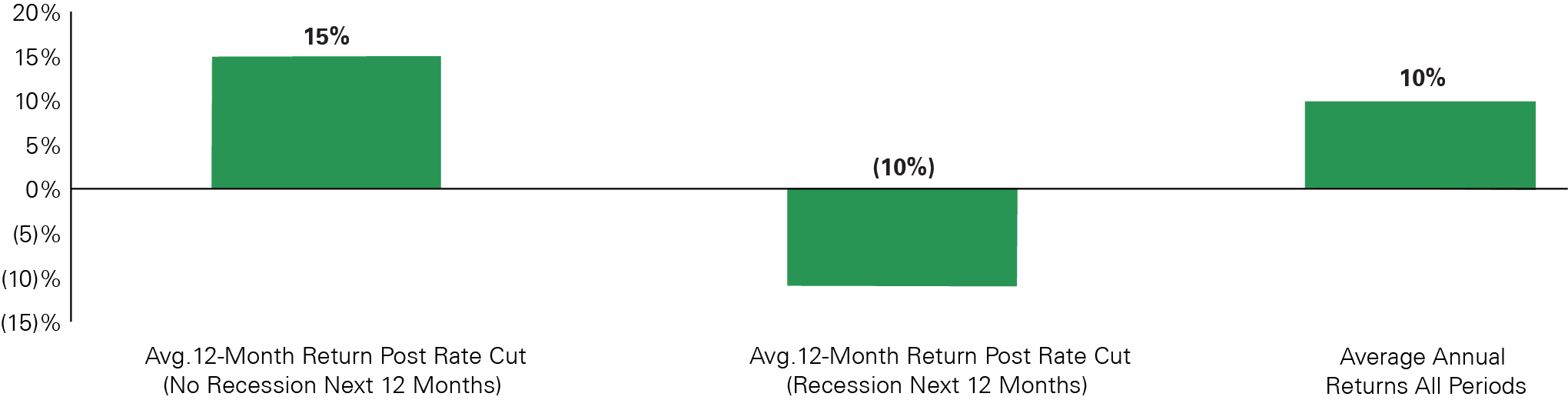

On the monetary side, interest rates are also poised to fall as the Federal Reserve resumes its easing campaign, which is expected to continue through at least 2026. Inflation has remained relatively contained, and a cooling labor market has shifted the Fed’s reaction function toward employment-related risks. With interest rate cuts resuming in September, we see the combination of lower rates and continued economic expansion as supportive for risk assets (Exhibit 2).

Exhibit 2: S&P 500 Performance Following Rate Cuts Under Different Economic Environments

Key takeaway: Historically, the combination of rate cuts and economic growth bodes well for S&P 500 returns.

Exhibit 2: S&P 500 Performance Following Rate Cuts Under Different Economic Environments. Historically, the combination of rate cuts and economic growth bodes well for S&P 500 returns. As of December 18, 2024. Source: Bloomberg, Federal Reserve

In addition, small business optimism rose to a six-month high in September — a key gauge of the private sector’s confidence and risk appetite to invest and hire. The stock market has started to anticipate this shift with the smallcap Russell 2000 index up more than 10% year-to-date — recently reaching all-time highs.

While the tariff picture remains fluid, we now have a clearer range of possible outcomes as deals continue to be struck with key trading partners. Although April’s tariff headlines triggered sharp market volatility, we looked beyond the immediate market selloff and maintained our modest overweight to equities. Bessemer portfolios have benefited from maintaining this conviction, as equities have posted solid year-to-date gains.

Earnings

Second-quarter earnings per share (EPS) and revenues for the S&P 500 index increased year-over-year by 12.0% and 6.4%, respectively. The breadth of better-than-expected corporate results also expanded with 81% of S&P 500 companies reporting a positive EPS surprise. The long-term average of EPS surprise is 75%. Similarly, 81% also reported revenues above estimates, above the long-term average of 64%. Gains were largely driven by mega-cap technology, financial services, healthcare, and select consumer companies. Aggregate earnings in the information technology sector rose to $145.1 billion, a 20% year-over-year increase. These gains more than offset weaker results in energy, materials, and consumer staples — sectors that saw earnings declines.

Current third-quarter earnings forecasts suggest further upside and broadening. As of this writing, 53% of S&P 500 companies have issued positive EPS guidance — above both the five- and 10-year averages of 43% and 39%, respectively. Earnings growth is expected in eight of 11 sectors, with revenue growth in 10 of 11 sectors. Looking ahead to 2026, all 11 sectors are projected to post earnings and revenue growth. Since 1970, 10 of 11 sectors have posted positive returns in the 12 months following the first Fed rate cut, with the strongest gains delivered by the consumer discretionary (13.7%), consumer staples (13.2%), and healthcare (9.9%) sectors.

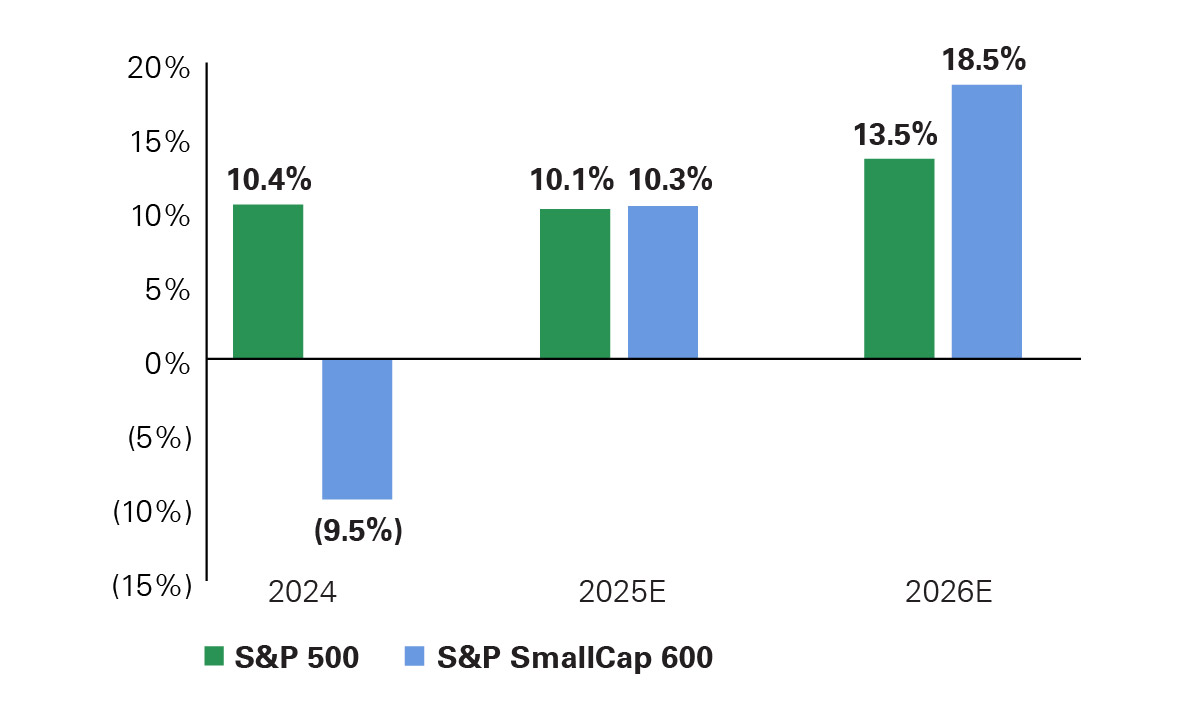

Encouragingly, this broadening extends beyond large-cap equities. Mid- and small-cap companies have adapted to the higher interest rate environment, and their earnings outlook has improved meaningfully. In fact, small-cap stocks are now expected to grow their earnings faster than large-cap stocks in 2026 (Exhibit 3) — a welcome change following several years of narrow earnings leadership.

Exhibit 3: S&P 500 vs. S&P SmallCap 600 Year-Over-Year Earnings Per Share Growth

Key takeaway: Earnings growth is set to broaden next year, with small caps expected to outpace large caps.

Exhibit 3: S&P 500 vs. S&P SmallCap 600 Year-Over-Year Earnings Per Share Growth. Earnings growth is set to broaden next year, with small caps expected to outpace large caps. As of September 30, 2025. Source: FactSet

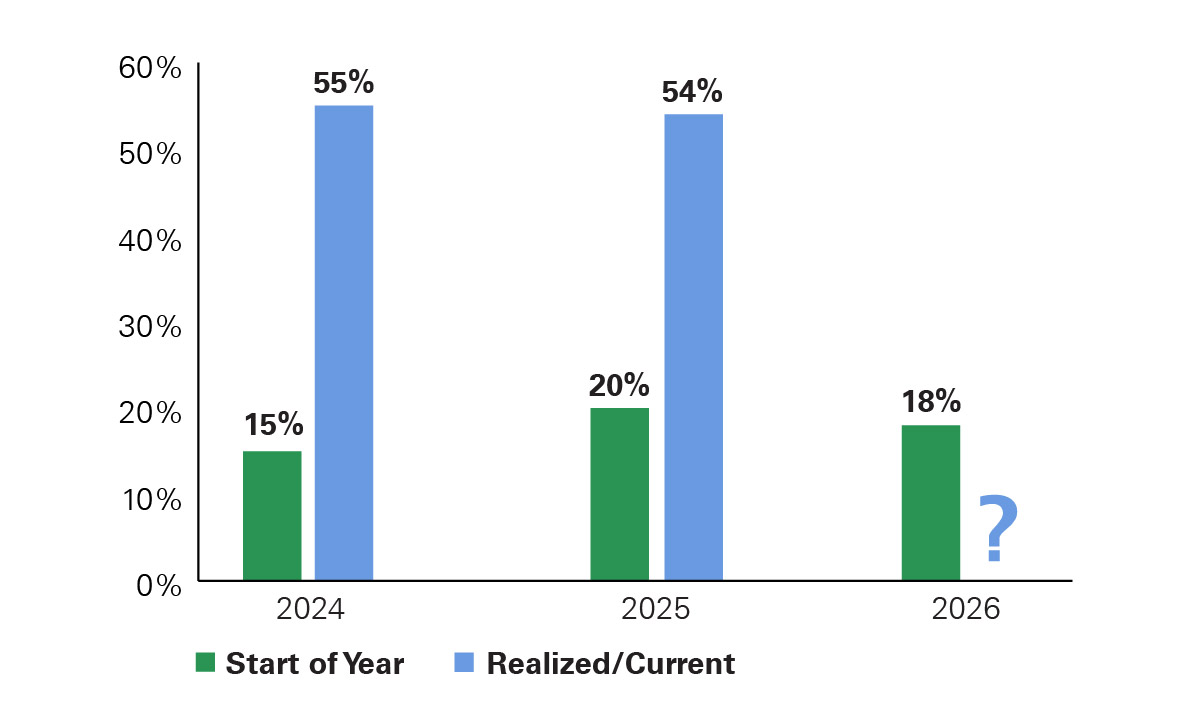

As mentioned in the previous section, massive investments continue to drive profits in AI, cloud infrastructure, and data-center-related businesses. Second-quarter 2025 capital expenditures by the Magnificent 7 companies accounted for roughly a third of the total capex spend for the entire S&P 500. Capital expenditures from the leading hyperscalers (AWS, Google, Meta, and Microsoft) have increased more than 150% from 2020 to 2024. Initial forecasts for 2025 capex growth continue to be revised upward (Exhibit 4).

Exhibit 4: Estimates vs. Actual Tech Capital Expenditure Growth

Key takeaway: Markets persistently underestimate capital expenditure growth rates, with continued expansion likely in 2026.

Exhibit 4: Estimates vs. Actual Tech Capital Expenditure Growth. Markets persistently underestimate capital expenditure growth rates, with continued expansion likely in 2026. As of September 4, 2025. Represents equal-weighted average of Amazon, Google, Meta, Microsoft, and Oracle. Source: FactSet, Goldman Sachs

For example, Oracle announced a deal in which OpenAI would purchase $300 billion worth of compute power over a five-year span starting in 2027. Oracle, determined to become a major player in AI, saw its stock gain 36% the day after the deal was announced.

Market Leadership and Valuation

Recent sector and industry performance would be unusual if investors were anticipating a severe economic slowdown. For example, the relative performance of consumer discretionary vs. consumer staples has reached new highs (Exhibit 5), led by strong gains from airlines and automobile components. Banks and small-cap stocks are also trading above their 200-day moving averages, signaling positive near-term momentum.

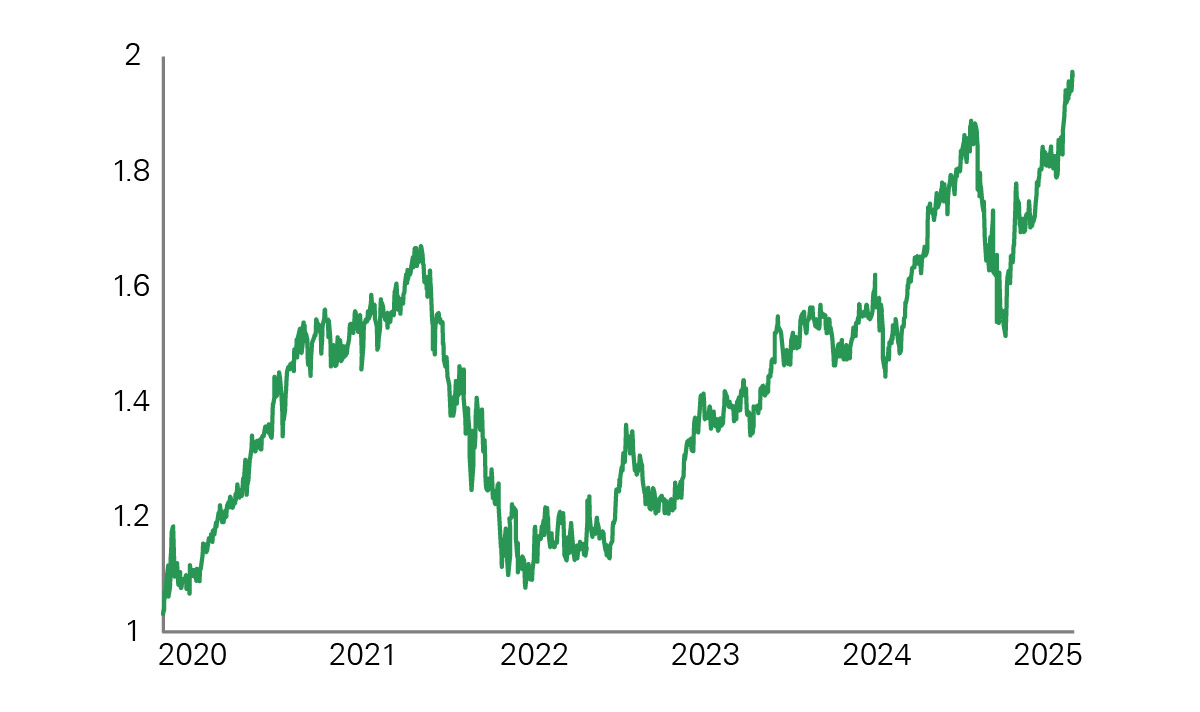

Exhibit 5: S&P 500 Consumer Discretionary Relative to Consumer Staples

Key takeaway: The consumer discretionary sector is outperforming staples, signaling market optimism over economic growth.

Exhibit 5: S&P 500 Consumer Discretionary Relative to Consumer Staples. The consumer discretionary sector is outperforming staples, signaling market optimism over economic growth. As of September 12, 2025. Source: Bloomberg

At the same time, the S&P 500 index’s 12-month forward price-to-earnings ratio sits near 23, which is in the 98th percentile relative to long-term history. However, it’s important to note that the sector composition of the index has changed over time, making direct comparisons with historical valuation levels less meaningful. Today, the information technology sector represents more than one-third of the S&P 500 index, compared to just 14% a decade ago. Adjusting for this shift in sector composition, today’s valuations would fall in the 88th percentile — still elevated but less extreme.

Increased Capital Markets Activity

After a slower start to the year than we anticipated, initial public offering (IPO) and mergers and acquisitions (M&A) activity picked up alongside strong earnings growth and capital spending. IPOs increased 16%, including nine deals brought to market in June alone. In the first half of 2025, 109 U.S. IPOs — 18 more than in the first half of 2024 — raised $17.1 billion.

This past quarter also recorded the third highest quarterly M&A deal values in the past four years. Globally, there were more than 22,000 deals totaling $780 billion. Transaction values rose 23% year-over-year, with 14 announced transactions exceeding $10 billion. U.S. deals accounted for more than 53% of global activity. Rising IPO and M&A activity often signals that investors’ risk appetites and optimism for market gains are increasing.

Our optimism around the U.S. economic outlook stems largely from three factors: already evident and future productivity gains from AI, clarity on tax policy with the passage of the OBBBA, and a favorable regulatory backdrop that helps foster innovation and long-term growth.

AI adoption has shifted from isolated use cases to broader integration, with the potential to lift productivity growth across the economy. According to Federal Reserve reporting, between 20% and 40% of workers now use AI in the workplace. Evidence is mounting that AI is boosting productivity. For example, Intuitive Surgical, a Bessemer holding, is leveraging AI to improve surgical performance, training, and hospital efficiency. Eli Lilly, another Bessemer holding, recently announced the launch of Lilly TuneLab, a platform providing biotech companies access to its AI models to enhance the efficiency of new drug discovery. Eli Lilly remains a leading pharmaceutical company, and its new platform is poised to accelerate AI adoption across the industry.

We are also seeing critical shifts in the regulatory environment that could support key industries and the U.S. economy more broadly. For example, the Fed recently proposed changes to the enhanced supplementary leverage ratio framework that would lower reserve requirements for large U.S. banks from 5% to closer to 4%, potentially unlocking hundreds of billions of dollars in liquidity. Meanwhile, the Trump administration has taken a lighter regulatory approach in potential high-growth areas such as AI and cryptocurrencies. Clarity around new regulation has been stimulative for certain emergent technologies.

For example, the bipartisan passage of the GENIUS Act this summer further established a regulatory framework for a type of cryptocurrency known as stablecoins, potentially unleashing a new channel of U.S. Treasury demand from this emergent crypto technology while also setting up guardrails for innovation.

Policy and regulation will change over time, but the structural aspects of the U.S. economic system that make it an environment that fosters innovation and entrepreneurship persist. For example, many of the largest companies we are familiar with today were once venture-backed startups. We see parallels today to past technological transformations. The advent of AI and the anticipated productivity gains from broad implementation are possible in large part due to a unique culture of investment and support for startups in the U.S. For these and the other reasons mentioned above, we remain optimistic about the long-term prospects for drivers of U.S. growth.

Rising uncertainty in geopolitics is helping to strengthen European cohesion and boost the region’s growth prospects with the bloc moving toward deeper political, economic, and strategic alignment. While Bessemer portfolios remain overweight the U.S., we see attractive opportunities abroad, where valuations are appealing and new catalysts are emerging.

Europe has been pushed to rethink long-held taboos around debt-financed public investment, particularly in defense and infrastructure. Germany, Europe’s largest economy, is at the forefront of this movement, abandoning its traditionally austere fiscal stance to prioritize strategic resilience. In a landmark move, the new government under Chancellor Friedrich Merz passed a historic spending bill, unlocking up to €1 trillion for military modernization and infrastructure upgrades — once unthinkable in Berlin.

At the wider European level, the €750 billion NextGenerationEU fund, conceived at the height of the pandemic to lift member states out of lockdown-induced recessions, is now finally entering its full disbursement phase. Approximately €400 billion will be distributed as nonrepayable grants, with the remainder as low-cost loans. Crucially, this program represents a watershed moment in the EU’s fiscal architecture: For the first time, the bloc has issued substantial amounts of common debt, laying the groundwork for a more integrated fiscal union.

Over the coming 12 to 18 months, a wave of projects financed by the NextGenerationEU fund will break ground across the bloc, spanning semiconductor manufacturing, digital connectivity, cross-border rail, clean energy infrastructure, and public-sector digitization. Italy and Spain, among the largest recipients, have already begun deploying funds through their national recovery plans, with procurement and construction activity expected to ramp up through 2026. For many countries, this will provide countercyclical stimulus at a time of slowing global demand.

Taken together, these developments could generate substantial economic multiplier effects across the eurozone. What was once a fragmented and fiscally cautious bloc is evolving into a more cohesive and forward-looking economic union.

This year, Bessemer portfolios have increased exposure to European capital goods manufacturers, defense contractors, infrastructure firms, and utilities positioned to benefit from elevated public investment and construction demand. We have also added to European financials, which should see stronger asset quality and credit demand as investment projects move from planning to execution. These are multiyear themes anchored by policy commitment, public financing, and a shifting geopolitical environment.

Throughout this Quarterly Investment Perspective, we’ve focused on the many positive elements of the current environment. While we remain acutely aware of potential risks, we believe these potential drivers of volatility will be outweighed over time by the positive forces of economic and earnings growth, supportive policy, and rapid technological innovation.

Reflecting this outlook, our portfolios remain modestly overweight equities, with an emphasis on themes we believe will define the next cycle of growth. Healthcare innovation, particularly in medical therapies and devices, continues to present compelling opportunities. In parallel, the rise of AI data centers is reshaping energy demand, driving our focus on power infrastructure and sustainability leaders. We also see strength in consumer platforms with pricing power and global scale, which we expect to remain resilient amid shifting market conditions.

As we look ahead, our focus remains on identifying long-term opportunities while carefully navigating the complexities of today’s markets. We’ll continue to monitor developments closely and share our perspectives through continued communications.

As always, we welcome your engagement. Please reach out to your Bessemer advisor with any questions.

Past performance is no guarantee of future results. This material is provided for your general information. It does not take into account the particular investment objectives, financial situations, or needs of individual clients. This material has been prepared based on information that Bessemer Trust believes to be reliable, but Bessemer makes no representation or warranty with respect to the accuracy or completeness of such information. This presentation does not include a complete description of any portfolio mentioned herein and is not an offer to sell any securities. Investors should carefully consider the investment objectives, risks, charges, and expenses of each fund or portfolio before investing. Views expressed herein are current only as of the date indicated, and are subject to change without notice. Forecasts may not be realized due to a variety of factors, including changes in economic growth, corporate profitability, geopolitical conditions, and inflation. The mention of a particular security is not intended to represent a stock-specific or other investment recommendation, and our view of these holdings may change at any time based on stock price movements, new research conclusions, or changes in risk preference. Index information is included herein to show the general trend in the securities markets during the periods indicated and is not intended to imply that any referenced portfolio is similar to the indexes in either composition or volatility. Index returns are not an exact representation of any particular investment, as you cannot invest directly in an index. Alternative investments, including private equity, real assets and hedge funds, are not suitable for all clients and are available only to qualified investors.