An Update on Cryptocurrency and Blockchain Technology

- The uncertain cryptocurrency regulatory environment in the U.S. remains an obstacle, but more clarity is expected in the near term.

- Cryptocurrency servicing continues to expand, but many providers lack full-service capabilities that may allow for seamless integration.

- Blockchain technology has vast business applications and remains in early stages of adoption.

- We believe that cryptocurrency continues to be an asset class that warrants significant caution from investors, while the blockchain technology remains an attractive investment.

Rocked by a number of high-profile collapses, scandals, and scams, cryptocurrencies have endured dramatic ups and downs, and most are currently trading well below their all-time highs. An uncertain regulatory environment has only added another layer of complexity. At the same time, however, blockchain technology (the technology that enables the existence of cryptocurrency) is experiencing continued growth and evolution into new applications beyond cryptocurrency.

In this Investment Insights, we provide an update on the cryptocurrency and blockchain technology space with a focus on the growth of investment offerings and heightened regulatory scrutiny around cryptocurrency. We also review the challenges of adopting Bitcoin and other cryptocurrencies as legal tender and the rise of central bank digital currencies. Lastly, we touch on various areas that may benefit from the incorporation of blockchain technology.

Cryptocurrency Investment Offerings Expand but Still Warrant Caution

In recent years, the number of financial firms entering the cryptocurrency space has seen a significant increase. Today, investors can gain exposure to cryptocurrency through public and private portfolios that are both actively and passively managed and through direct purchases of cryptocurrency on exchanges such as Coinbase and Gemini. Some large financial service companies are partnering with firms in the cryptocurrency space to offer custody and trading alongside traditional offerings.

At Bessemer Trust, we maintain no exposure to cryptocurrency within our traditional asset class portfolios and limited strategic exposure in our private asset investment offerings. More specifically, certain venture capital managers in our private equity program are making select infrastructure investments in areas where they observe increasing institutional and consumer user adoption globally, including crypto payments networks, digital collectibles tools, and gaming and social platforms. For example, one company that is a potential value driver in our portfolio, Narya.ai, deploys machine learning to find vulnerabilities in smart contracts on an automated basis before they are exploited, a security service of growing importance to blockchain developers.

While we have explored the possibility of providing services related to trading, safekeeping, and reporting on digital assets, we are taking a cautious approach due, in part, to the evolving regulatory environment. Still, we continue to monitor and follow the space. Specifically, in 2020, Bessemer formed the Cryptocurrency Working Group — a centralized multidisciplinary group established to develop intelligence and provide recommendations with respect to potential opportunities related to cryptocurrencies. The group is also responsible for creating the firm’s framework for keeping current on digital assets, services, and regulation.

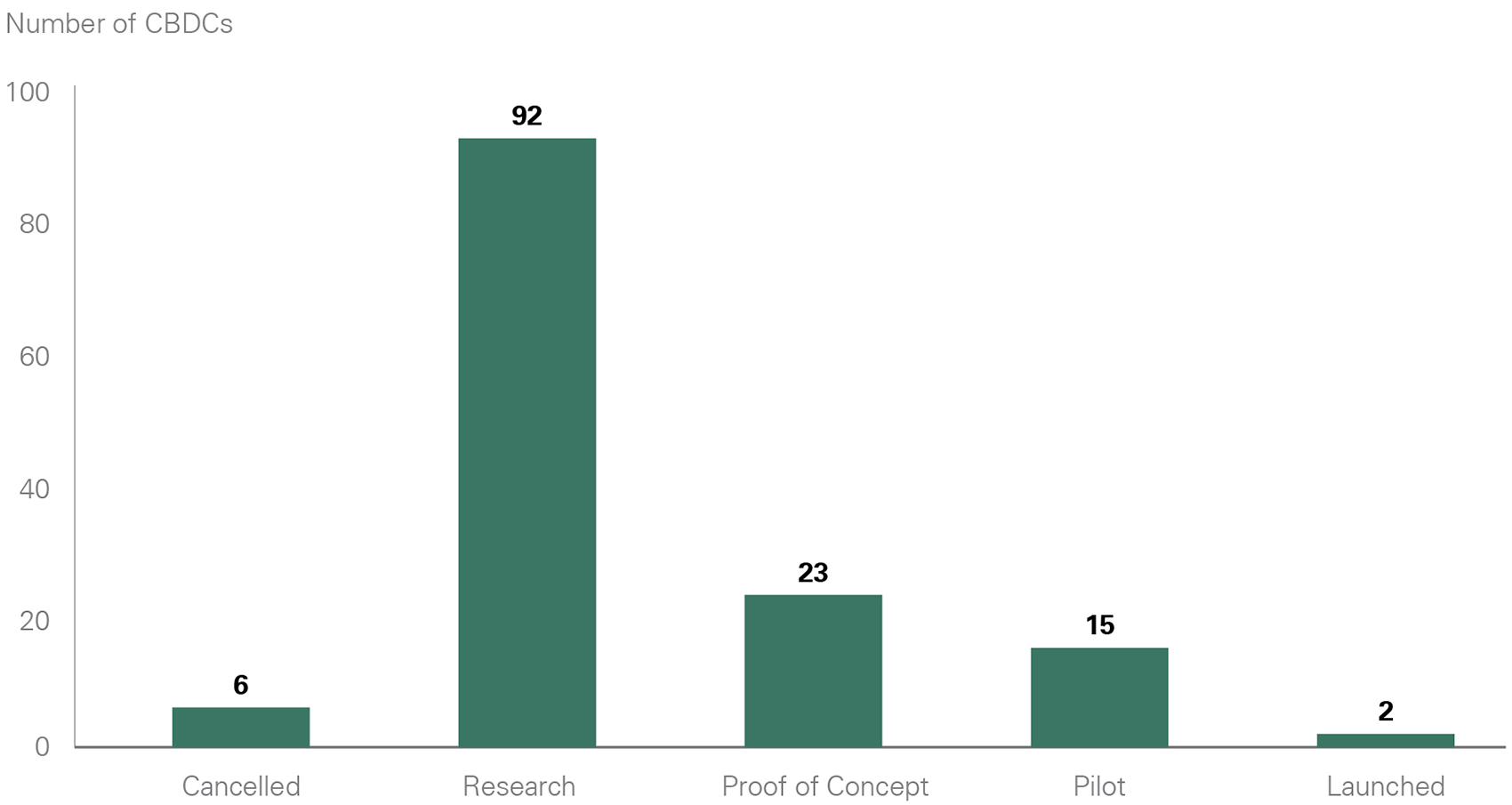

Cryptocurrency funds are also relatively new to the marketplace and offer limited track records for our investment professionals to analyze. That said, we do expect Bitcoin and other cryptocurrencies to remain more volatile than traditional asset classes (Exhibit 1). As a result, they will likely only appeal to investors with a high risk tolerance. Most recently, for instance, Bitcoin has seen a material drawdown, falling 55% from 67,734 per U.S. dollar on November 9, 2021, to 30,391 per U.S. dollar on June 30 of this year. In the same time period, the S&P 500 and U.S. bonds declined 5% and 12%, respectively, while gold appreciated 5%.

Exhibit 1: Bitcoin’s Annualized Return and Volatility Since 2010 Versus Other Major Asset Classes

Key takeaway: Bitcoin could deliver higher returns relative to other asset classes but comes with significantly higher volatility.

Bitcoin could deliver higher returns relative to other asset classes but comes with significantly higher volatility.

Past performance is no guarantee of future results.

Source: Bloomberg

Cryptocurrencies Under Scrutiny

The future of cryptocurrency regulation remains uncertain, but we believe that it does have the potential to evolve in the near future, prodded by high-profile disasters in the cryptocurrency space. Following the catastrophic failure of cryptocurrency exchange FTX, for instance, we saw an increase in legislative proposals and initiatives from the U.S. Securities and Exchange Commission (SEC) and broader government designed to provide greater investor protection and increased transparency.

While most cryptocurrency participants believe that cryptocurrency is not a security, the SEC is challenging that notion through litigation. In fact, Gary Gensler, chair of the SEC, has declared that every digital asset (except for Bitcoin, which he views as a commodity) is a security and therefore subject to the same registration, disclosure, and other requirements as any other security.

If the courts rule in favor of the SEC, there will be a notable impact on existing cryptocurrency exchanges as none are registered as national securities exchanges. Two cases to watch closely are the SEC versus Bittrex and the SEC versus Coinbase. In March, the SEC charged the trading platform Bittrex with failing to register as a national securities exchange, broker, and clearing agency under the claim that six coins sold on the exchange — Dash, Algorand, Naga, OMG, Monolith, and IHT Real Estate Protocol — are securities. In June, the SEC charged Coinbase for failing to register as a national securities exchange, broker, and clearing agency under the premise that at least 13 coins that Coinbase has on its exchange are “crypto asset securities,” including Solana’s SOL, Cardano’s ADA, and Polygon’s MATIC. This comes just a few months after Coinbase sued the SEC for failing to respond to Coinbase’s petition requesting that the SEC propose and adopt rules to regulate coins that the SEC considers securities.

There are also numerous legislative proposals in the House and Senate that are focused on strengthening investor protection and increasing transparency in the cryptocurrency marketplace. Though it remains unclear which of these, if any, will become law, there is bipartisan support to impose regulations.

The regulatory landscape is further complicated as a result of the differing state laws that govern cryptocurrencies. For instance, New York State requires that all entities that store, hold, or maintain custody of cryptocurrencies for state residents obtain a BitLicense issued by the state. Other states — such as Wyoming, Florida, and Texas — do not require such a license and are generally considered more cryptocurrency-friendly. This situation is unlikely to be resolved any time soon as 37 state governments proposed legislation addressing cryptocurrencies or the broader digital assets space in 2022.

El Salvador’s Bitcoin as Legal Tender Experiment

El Salvador’s Bitcoin as Legal Tender Experiment Under President Nayib Bukele, El Salvador’s government voted to adopt Bitcoin as legal tender in September 2021, making it the first country to recognize the currency as legal tender. The country’s other legal tender currency is the U.S. dollar. The rationale for the adoption was to reduce dependency on the U.S. dollar, increase financial inclusion (about 65% of the population is unbanked), and increase the speed of remittance transfers, which make up about 26% of that country’s GDP. Unfortunately, the experiment is falling short of these goals. In January of 2022, President Bukele tweeted that there are 4 million users of the app Chivo, which allows its users to exchange, send, and receive bitcoin and U.S. dollars commission free (El Salvador’s population is 6.5 million). However, a report by the National Bureau of Economic Research (NBER) indicates that more than 60% of Chivo’s early downloaders have not made a transaction after spending the free bitcoin (valued at $30) that was offered to every Salvadoran who downloaded the app. Additionally, a survey by the Salvadoran Chamber of Commerce suggests that only 14% of businesses have transacted in bitcoin, and it is estimated that only about 20% of firms accept bitcoin. These issues, combined with limited access to internet-enabled smartphones and the volatility of bitcoin, are proving to be major obstacles for widespread adoption of the digital currency.

The Central African Republic (CAR) was the second nation to follow in El Salvador’s footsteps, adopting Bitcoin as legal tender in April 2022. Similar to El Salvador, one of the main drivers behind this decision was its hope to expand banking access to the nation’s roughly 90% of unbanked individuals. The country, however, repealed legislation that gave Bitcoin legal tender status this year following the lack of widespread adoption as well as political pressure from the Bank of Central African States (BEAC), which manages its other legal currency, and the Economic and Monetary Community of Central Africa (CEMAC).

We do not believe that any developed nation will adopt cryptocurrencies as legal tender. Developed nations already have stable and heavily utilized currencies, strong central banks, and few unbanked individuals. Issues such as limited access to the internet, smartphones, and large informal sectors also threaten the success of widespread adoption of cryptocurrencies in many emerging economies.

Alternatively, we do see the potential for countries’ central banks to issue digital versions of their existing currencies, which we will touch on in the “Central Bank Digital Currencies” section of this report.

Central Bank Digital Currencies in the Pipeline

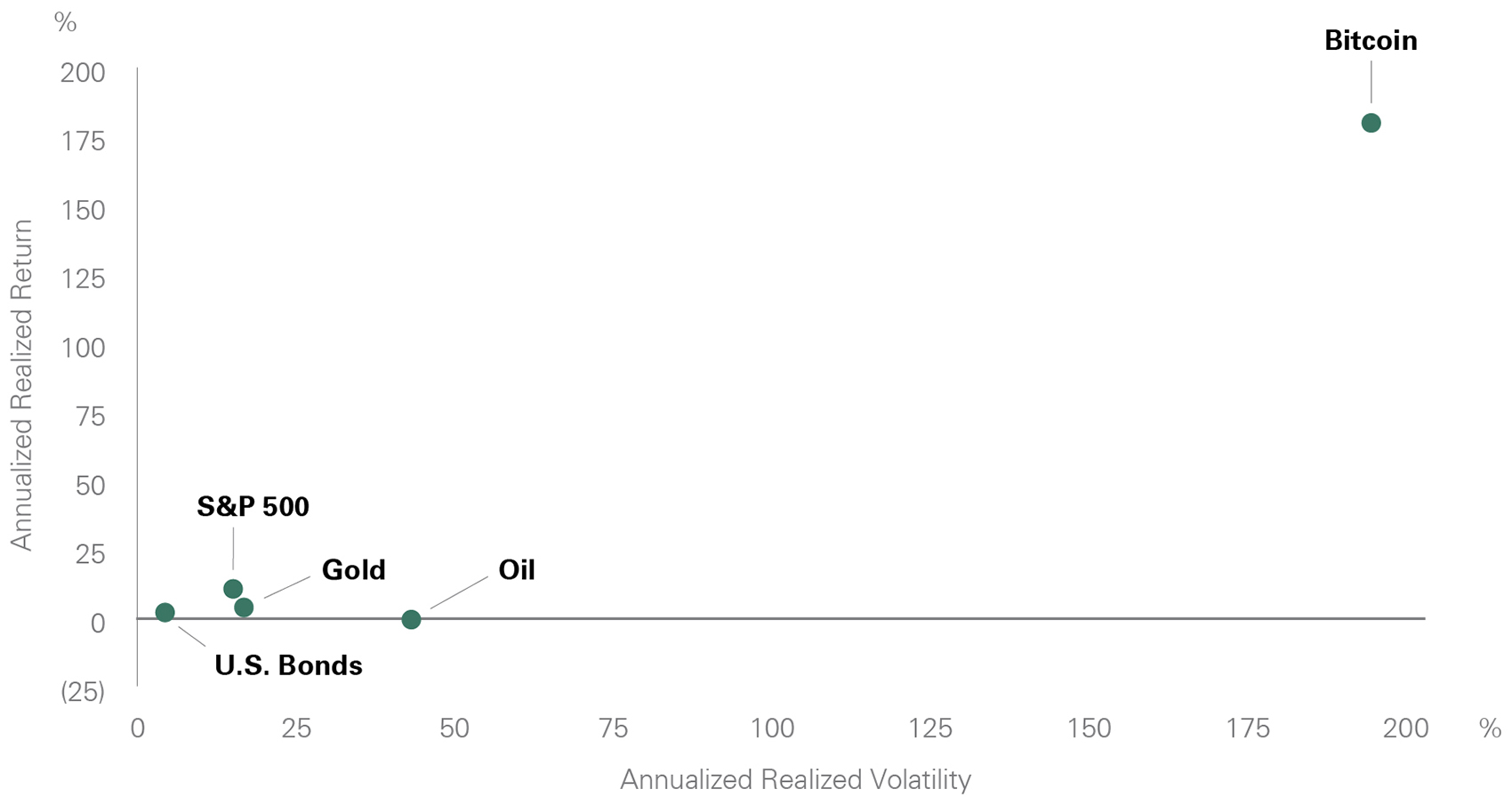

Central bank digital currencies (CBDCs) are being explored by many central banks globally, including the Federal Reserve. According to the CBDC tracker, 138 CBDCs are currently under examination. Most are in the research phase, six have been cancelled, and two have launched (Exhibit 2). The central banks of the Bahamas and Jamaica launched the Sand Dollar in 2020 and JAM-DEX in 2022, respectively. Both serve as digital versions of their traditional fiat currencies. Residents can send and receive money using their CBDCs instead of traditional fiat. The two countries were motivated to launch digital forms of their currencies as they sought to increase financial inclusion and the speed of the transactions. Many emerging markets are exploring CBDCs for similar reasons.

A CBDC is a digital form of a government-issued currency, such as the U.S. dollar or euro, and is issued by a central bank, such as the Fed or European Central Bank (ECB). CBDCs may be held by individuals, banks, or large institutions. CBDCs are not cryptocurrencies, but many are built on blockchain or similar technologies.

On a relative basis, developed economies such as the U.S. have less of an incentive to launch CBDCs given their strong existing banking systems and potential fears of disruption. In the U.S., two main forms of money are available to the public: traditional fiat currency issued by the Federal Reserve and digital balances held by commercial banks at the Federal Reserve. The latter would be most affected by the issuance of a digital dollar as the Federal Reserve would, as the issuer of the currency, maintain the deposit base, potentially cannibalizing commercial bank deposits. The Federal Reserve has stated that it does not want to disrupt or replace existing payment options and must consider how a digital dollar would affect aspects of the economy including the cost and availability of credit. While the risks are material, there are some benefits, including faster and cheaper cross-border payments, increased financial inclusion, and direct access for households and businesses to central bank money. Given the severity of these risks, we expect the U.S. and other developed market countries to be behind emerging nations in issuing CBDCs, and some may opt out entirely.

Blockchain Technology Application Still in Early Stages

Blockchain technology is the technology that supports Bitcoin and many other cryptocurrencies, but it has widespread applicability beyond cryptocurrencies. We discuss its operations in more detail in our recent Investment Insights “Bitcoin and Blockchain Technology.”

Many companies continue to explore uses for blockchain technology, including operations-related tasks such as supply chain management, transaction processing, and data storage. Additionally, as various new applications for the technology continue to emerge, most pure-play blockchain companies are early stage, driving private equity and venture capital firms to launch blockchain funds, with some entirely dedicated to this space. In fact, according to Crunchbase, there are 9,909 worldwide blockchain companies, more than one third of which are based in the U.S., and only 1% are traded publicly.

In the following paragraphs, we highlight three business areas that are utilizing blockchain to improve efficiency and data tracking and provide some examples of companies that are involved in the space, none of which Bessemer has any direct investments in.

Medical records. Today, medical records are stored across various platforms, and it is the responsibility of individuals to share their records with health care providers. Blockchain technology has the power to change this dynamic by creating a sharable database for various health care providers to access. Additionally, there is an added layer of security as blockchain is difficult to hack. Some companies — such as MedicalChain, Avaneer Health, and BurstIQ — have developed blockchain technology intended to tackle medical record keeping, but we are likely years away from widespread adoption.

Aviation. Blockchain technology is already being used to track both GPS data and loyalty programs, but other applications are in the works. For instance, airline maintenance records are not yet digitized, which makes it challenging to track the inspection and repair history for a fleet of airplanes. Companies such as LeewayHertz are developing blockchain solutions to help digitalize airplane records and thereby increase transparency for consumers.

Energy. Some energy companies are using blockchain to track energy sources. Specifically, Shell is exploring a blockchain technology that will allow it to track original sources of energy and in turn have the ability to distinguish between renewable sources and traditional sources. Others, such as Siemens Energy, have developed renewable energy certificates via blockchain technology to prove to consumers that their products were produced using renewable energy.

Conclusion

We will continue to monitor the cryptocurrency and blockchain spaces through various firm initiatives, such as our Cryptocurrency Working Group. Looking beyond the cryptocurrency space, CBDCs have the potential to improve financial inclusion and payment processing speeds, particularly in emerging economies with underdeveloped financial sectors. We also maintain a positive view on the blockchain technology and its potential to improve business tasks such as record keeping and process implementation.

Past performance is no guarantee of future results. This material is provided for your general information. It does not take into account the particular investment objectives, financial situations, or needs of individual clients. This material has been prepared based on information that Bessemer Trust believes to be reliable, but Bessemer makes no representation or warranty with respect to the accuracy or completeness of such information. This presentation does not include a complete description of any portfolio mentioned herein and is not an offer to sell any securities. Views expressed herein are current only as of the date indicated, and are subject to change without notice. Forecasts may not be realized due to a variety of factors, including changes in economic growth, corporate profitability, geopolitical conditions, and inflation. The mention of a particular security is not intended to represent a stock-specific or other investment recommendation, and our view of these holdings may change at any time based on stock price movements, new research conclusions, or changes in risk preference. Index information is included herein to show the general trend in the securities markets during the periods indicated and is not intended to imply that any referenced portfolio is similar to the indexes in either composition or volatility. Index returns are not an exact representation of any particular investment, as you cannot invest directly in an index. Digital currencies are highly volatile and not backed by any central bank or government. Digital currencies lack many of the regulations and consumer protections that legal-tender currencies and regulated securities have. Due to the high level of risk, cryptocurrency should be viewed as a purely speculative instrument. Private equity investments are not suitable for all clients and are available only to qualified investors.