HTML China and the U.S.:

A Firsthand Perspective

- Experienced firsthand, China presents a more nuanced and mixed picture than is reported in the media — regarding the health of the Chinese economy, the investment environment, its evolving role in the global economy, and relations with the U.S. We continue to maintain limited direct exposure to China in client portfolios.

- In the U.S., we continue to believe that the economy will avoid a severe recession, but that growth will likely slow. A choppy environment is likely to persist.

- We continue to favor equities and are maintaining our recommendation for an overweight relative to bonds. Portfolio exposures are oriented toward parts of the market that should outperform in a slower growth environment, tilting away from the most cyclically oriented sectors within equities and maintaining a longer duration versus benchmarks.

Q&A With Holly MacDonald

After her recent research trip to China, Bessemer Trust Chief Investment Officer Holly MacDonald sat down with Bessemer Trust Chief Investment Strategist Jeff Mills to discuss key insights that may have a notable impact on the global economy and financial markets. On page 8, we provide our broader take on recent economic and market developments and updates on Bessemer’s portfolio positioning.

Jeff: Before we talk about China, can you share Bessemer’s perspective on the current state of global affairs? I’m thinking specifically about the attacks on Israel.

Holly: We are shocked, angered, and profoundly saddened by the shocking terror attacks on Israel. The human suffering and loss of life is horrific, and our thoughts are with those in the direct path of conflict and the many others affected by this tragedy. There is no justification for violent actions intentionally taken against innocent civilians. While it is difficult to gauge the broader implications at this point, given both the situation’s severity and rapid evolution, there are a few key areas we are monitoring closely. We will continue to be in touch with our clients as the situation evolves.

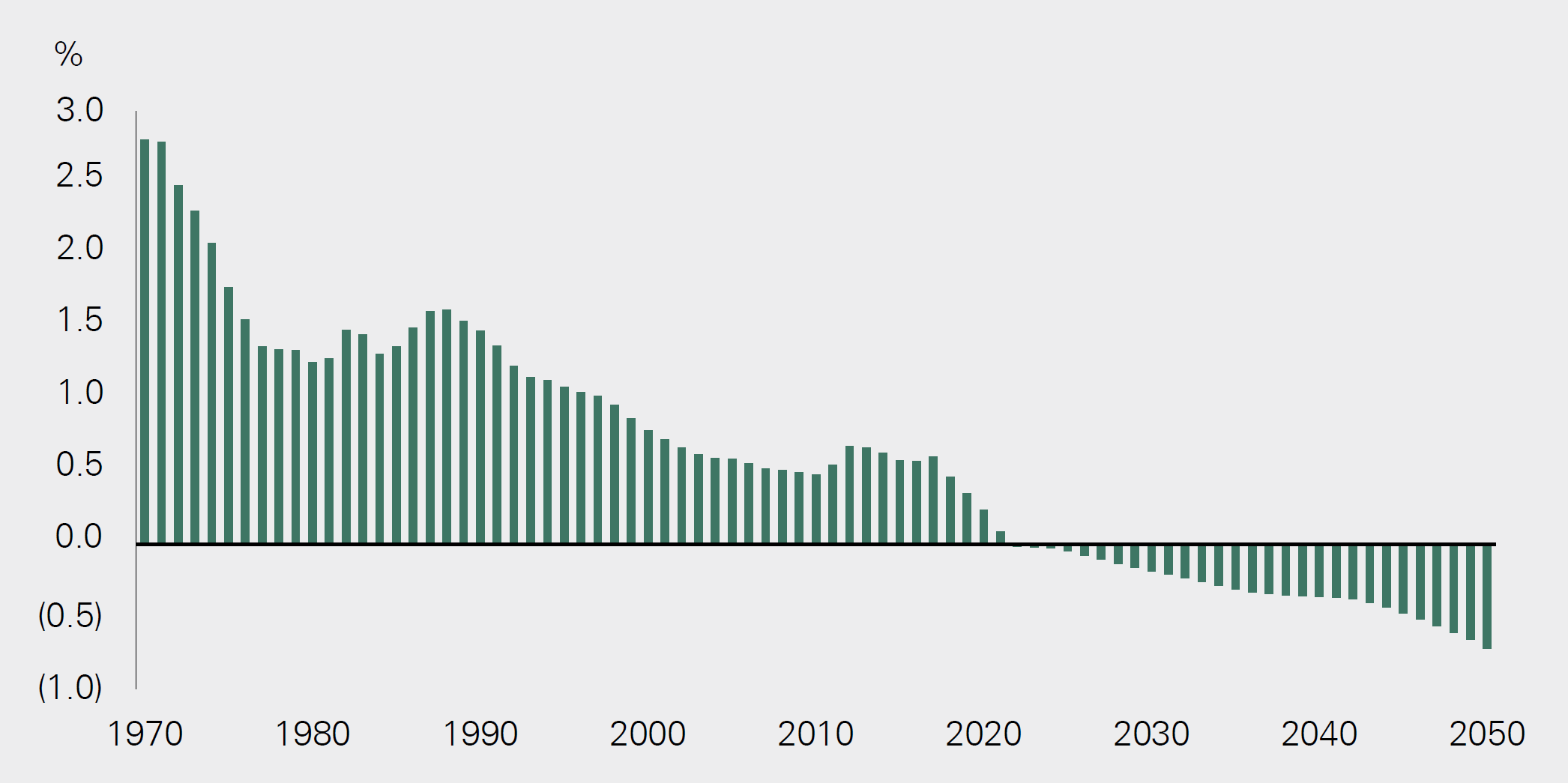

Exhibit 1: China Annual Population Growth and Forward-Looking Estimates

Key takeaway: Demographics in China are a structural headwind and impede China’s ability to stimulate the economy. Official statistics likely understate the problem.

Demographics in China are a structural headwind and impede China’s ability to stimulate the economy. Official statistics likely understate the problem.

Source: World Bank data

Jeff: Thank you, Holly. I know all of us at Bessemer share your deep concern and hope for the swift restoration of peace and stability in the region.

If I could, I’d like to turn our attention to your recent trip to China. What was the purpose of your trip, and do you have any big-picture takeaways?

Holly: I had the opportunity to travel with a small group of long-term investors and an external manager partner of ours who has both a strong local and global presence. Given the importance of China to the global economic and geopolitical outlook, as well as the lack of reliable information flow of late, it was important to get a firsthand view of the issues.

Overall, I found that there are many nuances to current issues that are not necessarily captured by Western media. The relationship between China and the U.S. is complicated. China is simultaneously a significant partner, a strategic competitor, and a systemic rival to the U.S. Some developments are more positive than reported, while others are more worrisome.

Certain structural issues, such as demographics, appear to be worse than commonly reported, with a rapidly decreasing working age population being most notable. At the same time, companies are reporting better clarity as it relates to regulation, which could encourage more entrepreneurship and investment.

Furthermore, although China’s growth rate has materially downshifted, the government’s ability to drive massive progress in a particular industry, such as clean energy, is being underappreciated.

As a result, the future of investing in China directly and indirectly should be targeted and account for higher risks as well as the nuances of the policy and growth outlooks. Even as tensions increase, and deglobalization trends persist, China will continue to play an important role in the global economy for some time.

Jeff: In recent weeks, we have seen headlines stating that Chinese policymakers continue to make it more difficult to get a full picture of their economy. I am told Chinese economists have been restricted from sharing negative news, and the government recently stopped publishing key youth unemployment data. Can you share observations from your recent visit that might add color to what appears to be a troubling trend?

Holly: From several off-the-record conversations with business leaders, entrepreneurs, economists, and strategists, my assessment is that some of the macroeconomic data is much worse than reported, especially related to demographics and employment. It is well known that China’s working population is declining, but the pace is likely faster than has been officially reported (Exhibit 1). Most likely, India has already overtaken China as the world’s most populous country — a huge milestone given China has held that position for centuries. At the same time, the government stopped releasing youth unemployment data in July after the June number exceeded 21%. Parsing through the data more carefully, the realized unemployment rate for 16- to 24-year-olds is likely at least double that when accounting for people who are working very few part-time hours. Long-term ramifications of the historic one-child policy and other factors are likely responsible for this.

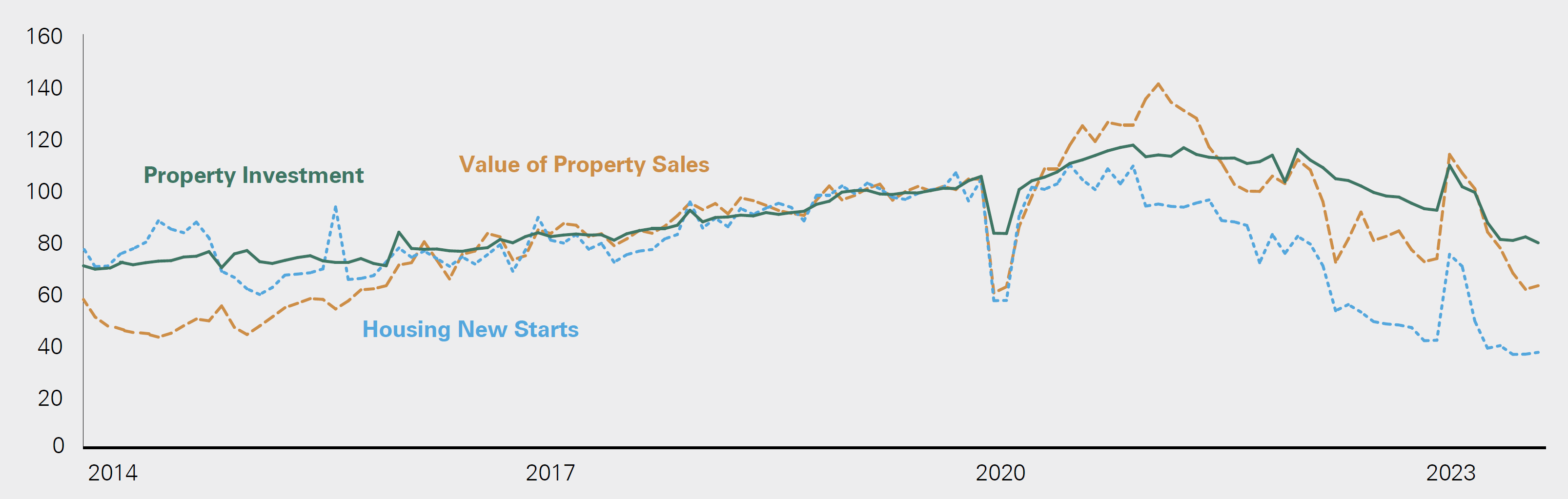

Exhibit 2: China Housing Activity Indicators

Key takeaway: Residential property metrics have weakened materially since Chinese leadership instituted more restrictive housing policies.

Residential property metrics have weakened materially since Chinese leadership instituted more restrictive housing policies.

Source: Deutsche Bank Research, NBS

Jeff: Beijing continues to ease, though it also remains cautious regarding further currency depreciation. Policymakers are straddling two goals: maintaining financial discipline while also boosting growth and confidence. Even as downside pressures mount, the balance remains tilted toward the former. Could you share any insight on the likely path of further stimulus as well as the implications for global growth?

Holly: A large stimulus plan is unlikely, but there is movement at the margin. I believe the “left tail” of additional downside risk is much less than has been the case in the past two years. Uniformly in our meetings, entrepreneurs and large-company representatives said that there is greater clarity on the regulatory landscape and room for them to invest. The government is focused on the power of technology to help the economy grow, and support for sectors such as electric vehicles can help mitigate weakness from the property sector. President Xi recently renewed his commitment for GDP to reach 5% this year, and I doubt he would have made that commitment so late in the year if he didn’t think it would be achieved. That said, future potential growth is likely in the 3%-4% range compared with double-digit growth in decades past, and therefore we should expect it to continue to slow in the years to come, albeit this lower growth will be coming from a much larger base.

Recent easing of constraints in the property sector, such as the lowering of down payment percentages for second homes, is unlikely to spark a meaningful rebound in the space (Exhibit 2). Authorities are trying to balance increased support for real estate without prompting speculation and much higher prices. This is a hard balance to achieve. One encouraging initiative I heard is that authorities may be discussing how to resolve the debt overhang of bad property loans, perhaps by creating a “bad bank” similar to the approach of the U.S. government in the wake of the financial crisis. This would be an important step forward for the economy.

Overall, I think economic activity is likely bottoming, but it would only be next year when more visible signs of improvement could start to emerge. It is important to keep in mind that given the strength of the government’s balance sheet at the national level, in contrast to weakness at the local government level, an acute financial crisis is unlikely. While undesirable, authorities have the wherewithal to backstop the financial system and broader economy should it be necessary.

Jeff: In terms of the broader impact on the global economy, how do you see China impacting the rest of the world as it navigates what could be, in the absence of more aggressive stimulus, a prolonged period of slow growth?

Holly: China is the second-largest economy in the world and has been a major contributor to global growth along with the U.S. As we have highlighted, there is unlikely to be aggressive stimulus, and potential growth is slowing, so I expect China to align with the trend of global growth rather than drive it going forward. I think this high-level observation, however, misses the more interesting point that China can often play the pivotal role within an industry or theme, which could then set the tone for the world.

China’s ability to shift its approach and ramp production in a particular industry is unparalleled, largely driven by the combination of an authoritarian government and sizable financial and human capital. I witnessed the power of this combination firsthand as it relates to the electric vehicle (EV) space. China produces high-quality cars at a fraction of the cost of production elsewhere; the EV adoption rate in Shanghai and Beijing was startling, and the impact on the much-improved pollution situation was impressive. This dramatic shift toward EVs has largely occurred in the last five years. With a greater share of the population now well educated, China can deploy any number of programmers and researchers to a new area very quickly, again, at a lower cost than elsewhere. This ability to focus and produce was also evident in e-commerce — China demonstrates a superior ability to monetize on e-commerce, beyond what we see currently in the U.S. China’s strength in this regard should not be underestimated, and we need to be prepared for China to disrupt various markets in the years to come, especially in areas that are closely aligned with its policy goals.

Jeff: Do you have a different read on the geopolitical tensions between the U.S. and China after your trip? Was there any discussion about the upcoming U.S. election cycle and its effect on relations?

Holly: I have been spending a lot of my personal research time trying to understand the history and complexity of the relationship between China and the U.S. Much of what I saw and heard confirmed what I have been learning from this work, and I will share some of those takeaways. To start with what was new or surprising, I will offer two observations. First, the dominant feeling among citizens related to the current geopolitical situation is fear. It is not anger or competitive drive from what I experienced, but fear that an aggressive U.S. policy will isolate China from the rest of the world and impact the daily life of its people as a result. I believe this is one of the less-touted reasons that the Chinese consumer has been more cautious as the economy has reopened. In contrast, while geopolitical stress is apparent in the U.S. news media and in some ways in the U.S. psyche and political dynamics, I do not believe it is a major factor driving U.S. consumption, which has remained robust.

Second, and perhaps related to this, I was somewhat surprised to learn that the Chinese perception is that the U.S. has become much more aggressive against China under President Biden than it was under President Trump. The two leadership styles are different, and it seemed there was a preference for the visible yet unilateral aggression under President Trump rather than the strategic, multilateral, and perhaps more understated approach of the Biden administration. The recent tactics of the Biden administration appear to have been quite effective in diminishing the global perception of China: In examining data looking at sentiment toward China from non-U.S. countries, readings now are almost uniformly at all-time low levels.

While China and the U.S. maintain an important economic relationship, I believe the current simmering conflict will continue for years to come. Neither country is likely to benefit from open or direct conflict, yet there is undeniable tension over the finite resources in the world. Securing these resources — whether oil, rare earth minerals, lithium, or other parts of the semiconductor supply chain — by definition, involves having relationships with companies and governments globally. This brings geopolitics to the forefront of economic negotiations, and it ups the ante for having a position or the position of geopolitical power.

As this contest unfolds, clashes seem inevitable, stemming at least in part from the different moral compasses that underlie the approach of the Chinese government relative to the U.S. In reading the philosophy of Mao, I have been struck by how directly at odds the focus on the masses over individual rights is in comparison to the founding principles of the U.S. The concept of “unalienable rights” so articulately outlined in the Declaration of Independence is completely contrary to an approach that places the common good above all else. I think these differences are compounded by the fact that China has very little diversity or immigration, with the Han Chinese making up 95% of the population, and it feels that the culture is becoming more insular. I found it difficult to navigate basic aspects of life during my time there as a foreigner, even in the major cities.

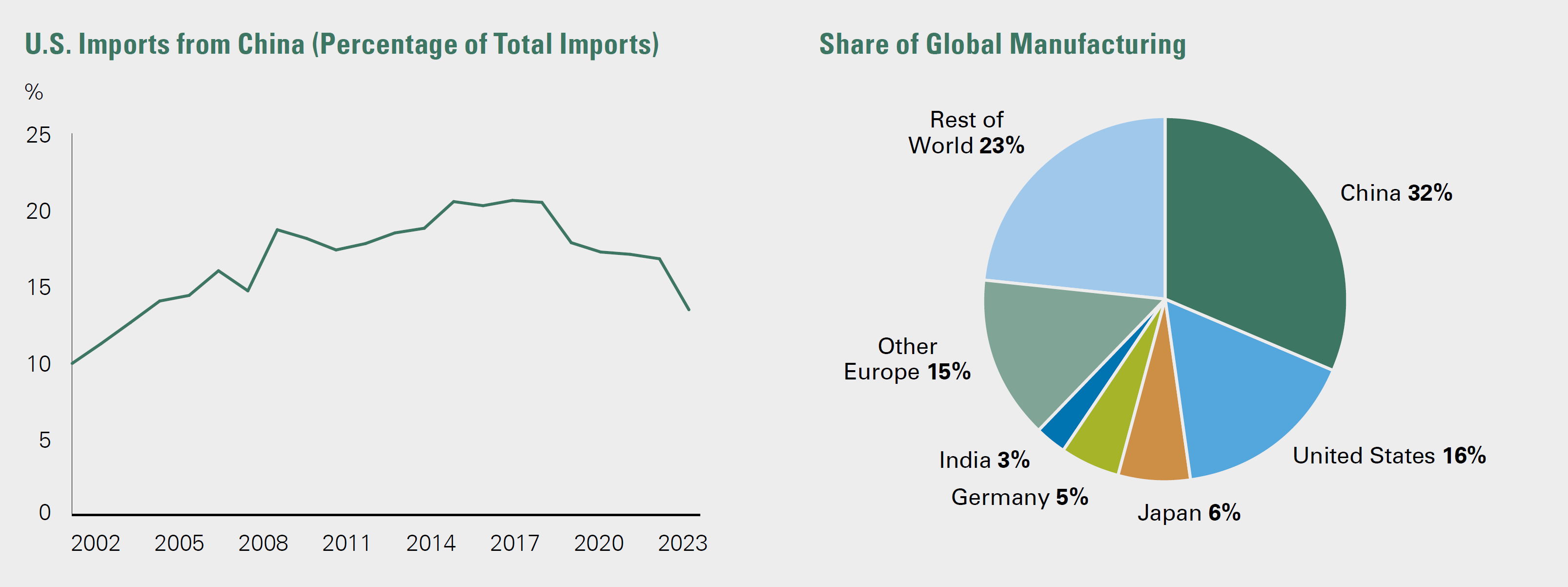

Exhibit 3: Imports to the U.S. Are Down, but China Remains a Major Global Manufacturer

Key takeaway: U.S. dependence on China as a trading partner has declined as imports from China have reached their lowest level since 2005; however, China still represents one third of global manufacturing.

U.S. dependence on China as a trading partner has declined as imports from China have reached their lowest level since 2005; however, China still represents one third of global manufacturing.

As of July 31, 2023. 2023 includes data through July.

Source: Strategas Research

Share of Global Manufacturing:

As of December 31, 2021.

Source: United Nations Statistics Division

Jeff: Were you able to get a sense for the Chinese people’s views in comparison to the Chinese government’s major priorities?

Holly: One takeaway that I think may be missed in some discussions is that the Communist Party is not the same thing as the Chinese people. I met with many entrepreneurs who were interested in having conversations with the goal of getting business done. They described their need to navigate the party and state without either of those factors being a driving force in their motivation and ambition. People are very open to Western brands and are merely trying to find the best value in their purchasing decisions. I witnessed anger at the severity of COVID lockdowns, difficult stories related to the one-child policy, and overall mixed views on the government’s approach to prioritizing the collective over individual human rights.

In terms of my assessment of the situation, I think the U.S. could do a far better job of marketing the advantages of our approach. In relationships with Africa and Latin America, where China has been increasingly active in supplanting the role that the World Bank and IMF historically played in driving development, we could be more strategic and emphasize the benefits the American approach has over the longer term. I am hopeful that the groups working to set our national policy and approach to China are carefully weighing how we can use America’s areas of strength to our advantage — whether our commitment to property rights, which engenders innovation; our advanced education systems; our commitment to fairness and diversity; or respect for individual human lives.

Jeff: How are we assessing the risks associated with China’s aggression toward Taiwan?

Holly: This risk falls in the category of “known unknown,” and we are spending time on scenario analysis related to the issue. The importance of Taiwan symbolically, economically, and strategically in the region is clear and suggests tensions will increase over time, in our view. That said, we think the risk of an imminent invasion is very low. I believe there is a broad appreciation now that the hurdles to China invading Taiwan are far higher than those of Russia invading Ukraine, both in and of themselves and in the wake of Russia’s problems. That said, China can take an array of actions short of full-scale war to undermine the Taiwanese economy or intimidate the people, ranging from maritime police actions to trade embargo to hybrid war. A blockade is likely the chief risk over the medium term, yet increasing pressure before Taiwan’s elections on January 13, 2024, would be hard to imagine. Should the Chinese Nationalist Party or Kuomintang (KMT) win the presidency and bring with it a new four- to eight-year period of cross-strait dialogue and strategic détente, China’s strategic objectives would likely be advanced without any overt effort. Regardless of the outcome, the new political setup following the elections will likely shift the game theory calculus around the situation. The situation is fluid and one we will need to analyze on an ongoing basis.

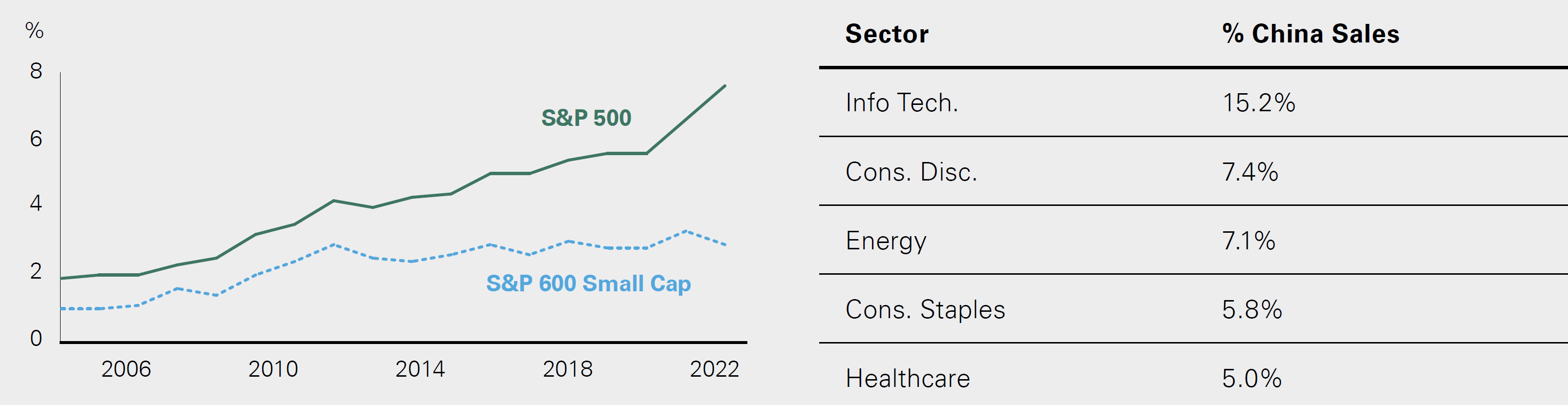

Exhibit 4: Percentage of China Sales

Key takeaway: The percentage of China sales for U.S.-domiciled companies has risen for large-cap companies, while small companies are less exposed to China.

The percentage of China sales for U.S.-domiciled companies has risen for large-cap companies, while small companies are less exposed to China.

Source: Piper Sandler

Jeff: Despite increasing tensions between the two superpowers and some hints of “deglobalization,” China and the U.S. remain interdependent. Today, U.S. imports from China are roughly $500 billion, representing 15% of all domestic imports. Another example, Apple, relies on China for a third of its production and a fifth of its sales. How much can these economies separate?

Holly: I believe separation will be slow in the aggregate even if it is quick for certain products. China is intricately linked in the global supply chain and remains an attractive marketplace for U.S. companies to sell products. Even though trade with China has fallen and Mexico has stepped in to become the top U.S. trading partner, a lot of this trade is merely moving through other markets (Exhibit 3). China overall continues to constitute about 30% of global manufacturing (Exhibit 3). For many industries, it is still much cheaper to produce in China. For example, for some pharmaceutical companies, it can be 20%-30% cheaper, so any “onshoring” efforts may be more akin to window dressing. That said, for strategically important goods, I think the separation can be quicker. Semiconductors are obviously in focus, and I believe shoring up any vulnerability to the complicated global supply chain in the space is a key objective of both the U.S. and China.

At the same time, it is hard to see the Chinese market completely losing its shine for U.S. and multinational companies. Gen X and Gen Y now make up 46% of the Chinese population (close to 500 million people), and they have greater education, more global exposure, and a higher propensity to spend than older generations. If the youth unemployment rate improves, the cohort will be a formidable force. For non-sensitive areas, such as apparel, coffee, and non-defense-oriented electronics, the risk-reward of engaging with China is likely to pay off. For as much as local brands and national pride have been touted, I was struck by the prominence of Starbucks and Apple stores and the proliferation of Lululemon outfits.

There are sensitive areas where the risk-reward in engaging with China is more complicated. Technologies involving data collection, artificial intelligence, and anything related to national defense or security will face the uncertainty of disruption, which may offset any cost or benefits of trading with China. I would expect greater separation in the economic ties related to these areas over time.

Jeff: How is Bessemer thinking about investing in China and emerging markets in general? Did any interesting themes emerge as a result of your visit?

Holly: Holdings of direct China exposure are 3% of Bessemer public equity portfolios; in comparison, 76% of the portfolios are invested in U.S. companies, 15% in other developed markets, 3% in other emerging markets, and the remainder is in cash. China makes up a much smaller share of portfolios relative to its global presence — it is the world’s second-largest economy and has the second-highest number of listed companies after the U.S. All of the issues discussed here complicate the investment landscape and explain our limited positioning. Additionally, we have a bias toward keeping our exposure liquid given that the situation can change quickly. Our small exposure is subject to significant due diligence largely via our external managers and other partners who have boots on the ground. Due diligence is understandably more difficult given data issues and questions on basic best practices. Our approach has been to work with managers who have the combination of a strong local presence and a clear appreciation for international standards in all areas ranging from accounting practices to human rights and everything in between.

Some may ask why we should have any exposure at all to China given the geopolitical dynamics. As a starting point, as a fiduciary focused on long-term returns for our clients to help them meet their financial goals, any blanket exclusions could pose a risk and must be carefully considered, obviously after accounting for all of the regulations to which we are subject. To completely exclude the second-largest economy in the world from our investable universe could compromise our ability to meet our clients’ financial objectives. Moreover, given the intertwined nature of the U.S. and China, it is not even possible to do this in our view. Currently, 7.5% of the total revenues of the S&P 500 are derived from China, and this metric jumps to 15% for the technology sector (Exhibit 4). Put another way, if you own Apple, Tesla, or Estée Lauder, you have significant exposure to China.

Given all of the nuances that exist related to China, this work is a priority for Bessemer’s investment team. Researching, evaluating, and debating aspects of the global economy and investment themes to find compelling opportunities is what motivates us to wake up in the morning, work hard, and collaborate with each other. To do this on behalf of our clients is a privilege. Thank you for placing your confidence in us.

Coming in for a Landing:

The Delicate Balance Between Growth and Inflation

Will higher interest rates drive the economy into a recession, or can a “soft landing” be achieved? This has been the primary question for investors since the Federal Reserve began its interest rate hiking cycle. In the second half of 2022 and heading into 2023, we believed expectations for an imminent recession were far too extreme. As an example, in late 2022, 91% of CEOs thought there would be a recession over the coming 12 months.1 Although out of consensus at the time, our more positive 2023 outlook dictated an overweight to equities versus bonds, which has been additive to year-to-date performance. Now, with the economy on more stable footing, a soft landing has become consensus. Amid that backdrop, we assess the future trajectory of both the economy and financial markets as we begin the final quarter of the year.

Interest rates and inflation continue to be the market’s focus, serving as key inputs into the likely path of economic growth and, importantly, corporate earnings. In the short term, investors will closely monitor the relationship between economic growth and inflation expectations, with the current market volatility reflecting the uncertainty of this delicate balance. In recent months, due to a series of above-consensus economic data, investors became comfortable with the narrative that an economic soft landing could be achieved. Today, investors are weighing to what extent above-consensus economic data could drive increasingly hawkish monetary policy and, subsequently, pressure stock market valuations. For context, the forward price-to-earnings ratio of the S&P 500 has decreased from a high of nearly 20x in July to 18x today. Additionally, as interest rates have increased in recent weeks, volatility in bond markets has again picked up, triggering intraday and intraweek volatility in equity markets as well. The S&P 500 gave back approximately 5% in September, though it remains positive at 12% on the year.

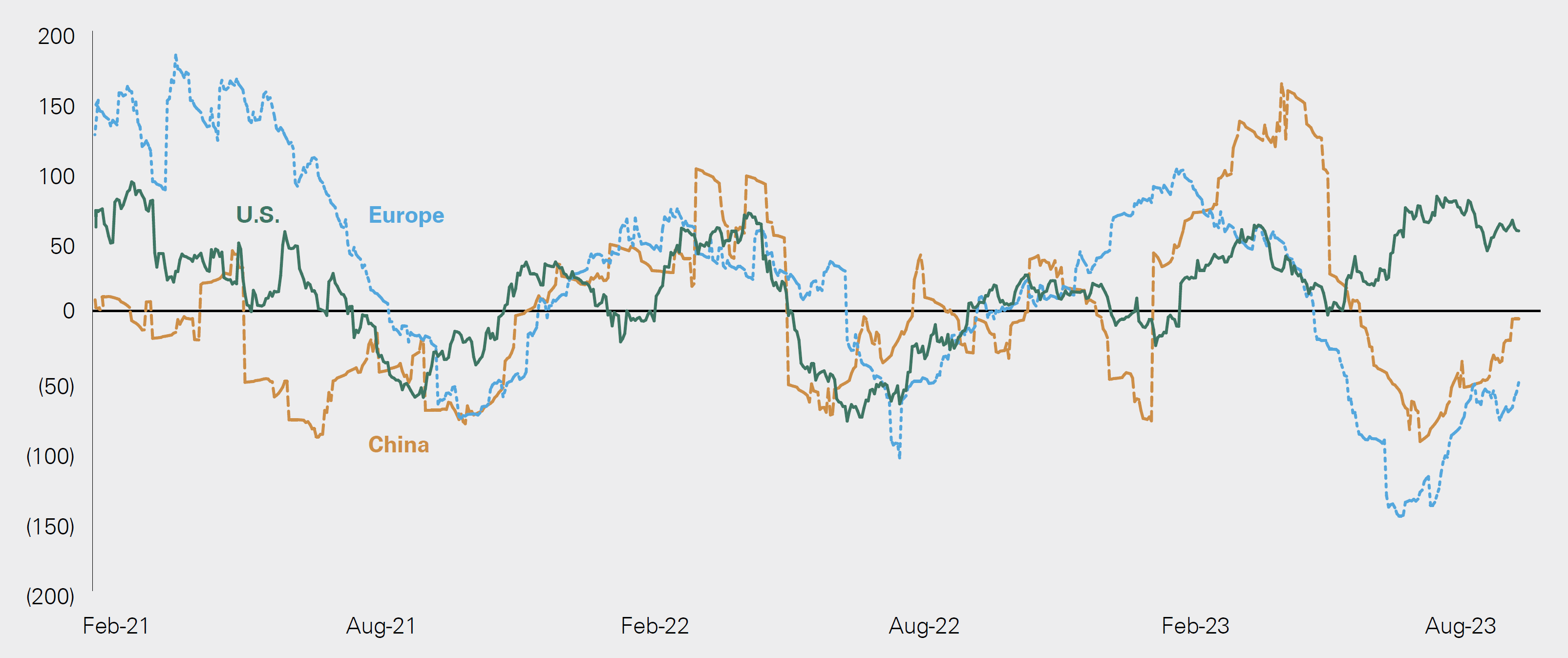

Exhibit 5: Economic Surprise Indices

Key takeaway: U.S. growth continues to beat expectations, while major international economies, although somewhat improved, have failed to do the same.

U.S. growth continues to beat expectations, while major international economies, although somewhat improved, have failed to do the same.

Source: Bloomberg

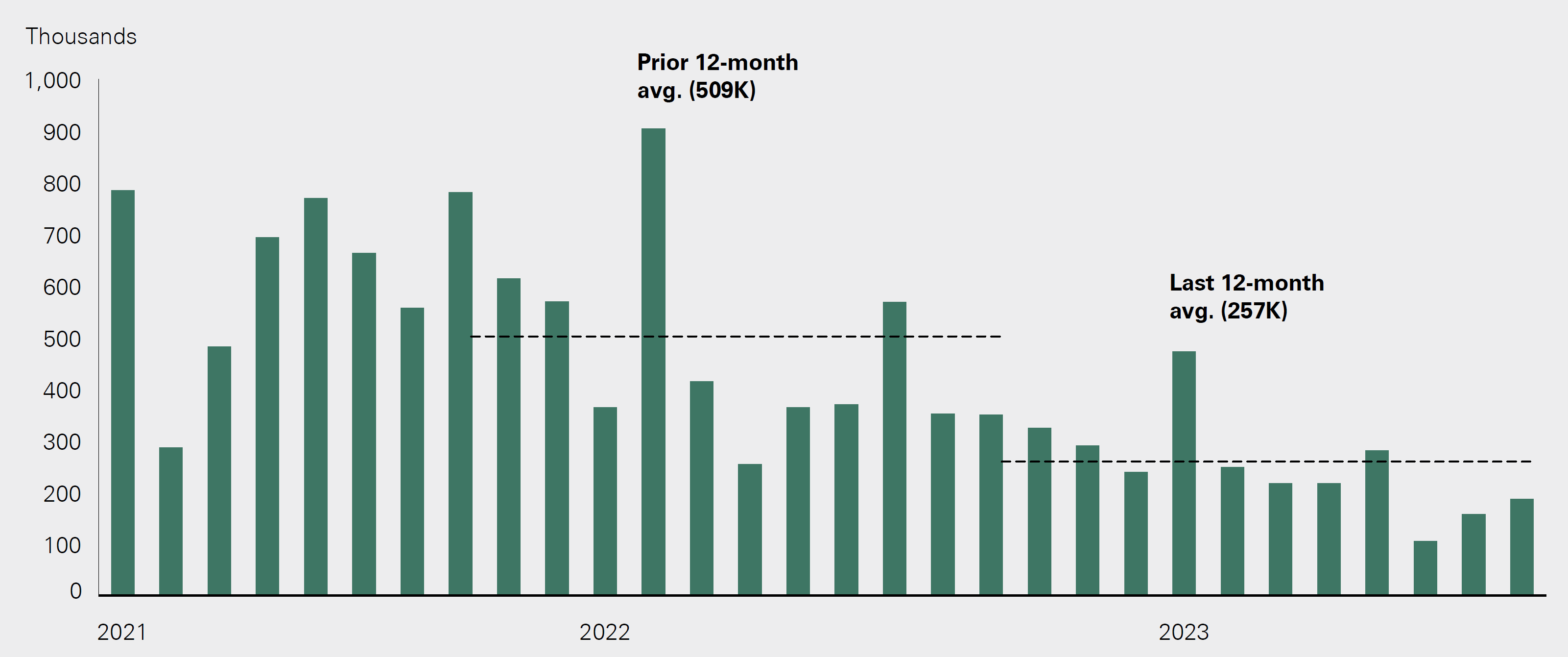

Exhibit 6: U.S. Employees Change in Nonfarm Payrolls

Key takeaway: Although the labor market is still strong, the pace of nonfarm payroll increases has softened as higher interest rates permeate through the economy.

Although the labor market is still strong, the pace of nonfarm payroll increases has softened as higher interest rates permeate through the economy.

Source: Bloomberg

We continue to believe the economy will avoid a severe recession, but at the same time, growth will likely slow from its current pace. Growth is estimated, by some economists, to reach a whopping 5% in the third quarter and is tracking around 2% on the year. Activity should slow to closer to 1% or below as higher rates make their way through the economy. Over time, we expect slower economic growth to place downward pressure on interest rates, and investors are likely to pay a premium for companies that can maintain solid levels of earnings growth in that environment. As a result, a sharper focus on security selection within industries that could face economic headwinds is likely to become increasingly important.

In the section below, we address 1) our view on the evolution of the economy, 2) the impact that may have on earnings expectations, and 3) how our forecast influences current portfolio positioning.

Amid economic data that is sending mixed signals about the future trajectory of economic growth, we believe there is enough evidence to conclude that the economy will slow further as we move into next year. Key to our view is that a severe recession is likely to be avoided, in large part due to the current strength of the labor market and, subsequently, the consumer. However, the lagged impact of monetary policy has yet to fully weigh on the economy, and bank lending conditions continue to signal slower growth ahead. There are both signs of strength and evidence of slowing in recent data.

Signs of Strength — the Consumer and Labor Market

Economic growth in the U.S. continues to surpass downbeat expectations from earlier in 2023. As seen in Exhibit 5, U.S. growth beat expectations, while major international economies, although somewhat improved since the summer, overall have surprised to the downside this year.

In addition, labor market dynamics reflect a jobs market that has cooled but remains on stable ground. This dynamic can be seen in monthly nonfarm payroll gains, which have declined to about 250k per month in the past 12 months from double that rate in the preceding 12 months (Exhibit 6). Job openings, an area in which the Fed looked to rebalance labor supply and demand, declined from a peak of 12 million in March 2022 to 9.6 million in August 2023. Thus far, the economy is striking the right balance — slower growth, but ample evidence of stability.

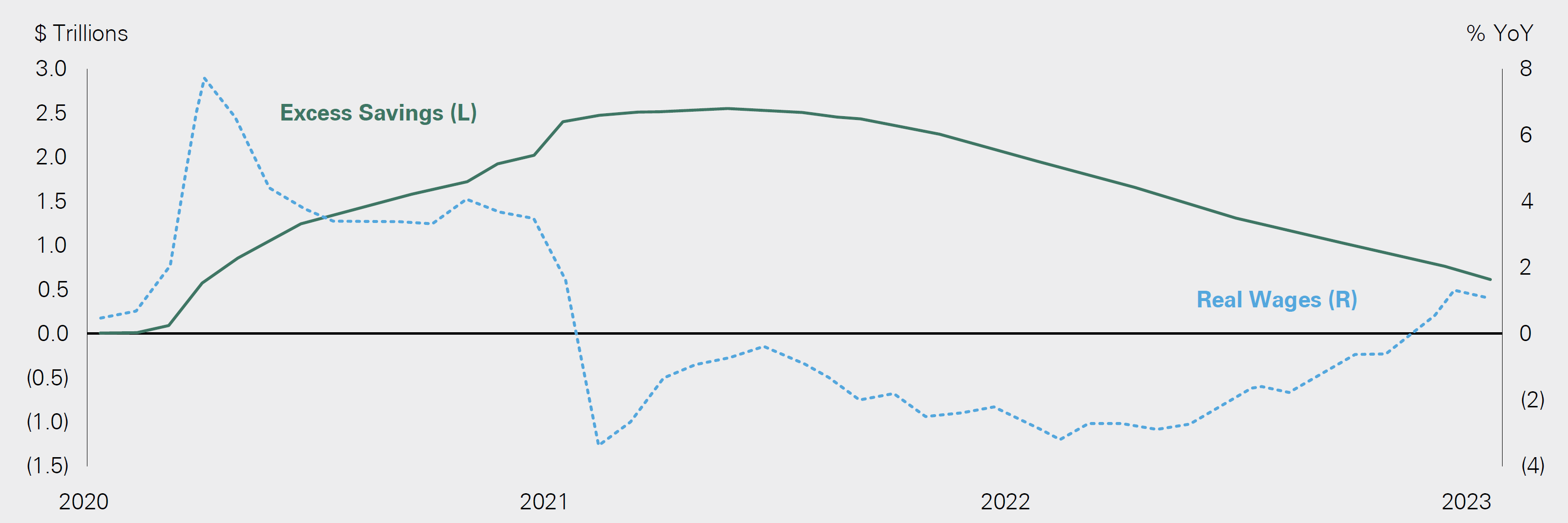

Wage growth is yet another example. While we have seen overall wage growth cool from elevated levels, real wages have turned positive given the decrease in inflation, helping support consumer purchasing power (Exhibit 7). As excess pandemic savings are depleted, rising real wages can continue to bolster consumer demand. Overall consumer spending is up 20.8% since January 2020, although some of this increase is due to inflation.

Exhibit 7: Excess Savings and Real Wages

Key takeaway: Consumers have been spending down excess savings, but real wages are now positive given the decline in inflation.

Consumers have been spending down excess savings, but real wages are now positive given the decline in inflation.

Source: Bloomberg, Federal Reserve

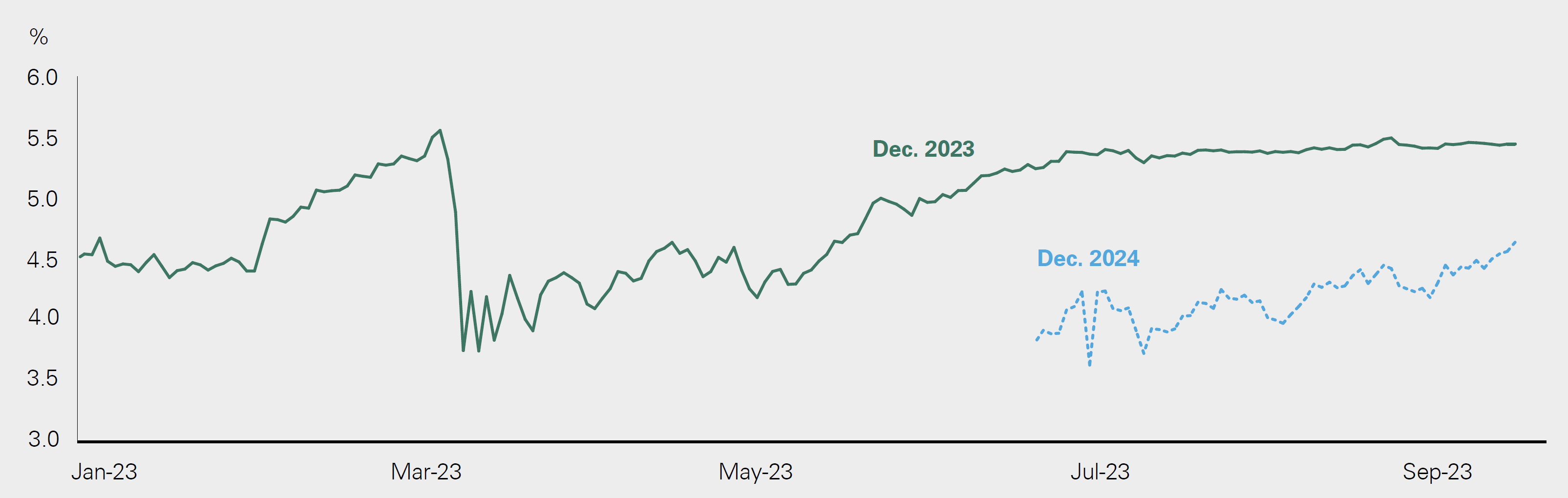

Slower, yet stable, economic growth is critical to maintaining the balance between investor expectations for a Fed pause and robust earnings growth forecasts for 2024. Growth that is too strong may cause investors to reprice 2024 interest rate expectations upward as they remove or push out forecasted rate cuts (Exhibit 8). In turn, higher-for-longer interest rates could have a negative impact on valuations, a reversal of this year’s dynamic, where expectations for lower rates boosted valuations — a primary driver of stock returns this year.

Exhibit 8: Market-Implied Fed Funds Rate

Key takeaway: As inflation trends lower, the bond market continues to price in rate cuts in 2024, highlighting the market’s confidence in the end of the tightening cycle.

As inflation trends lower, the bond market continues to price in rate cuts in 2024, highlighting the market’s confidence in the end of the tightening cycle.

Source: Bloomberg

On the other hand, growth that is too weak may encourage investors to reduce their expectations for 12% earnings growth over the coming 12 months, again forcing multiple expansion to do the heavy lifting for stocks.

Taken together, the package of data discussed above paints a clear picture of an economy that continues to grow. As a result, investors have steadily increased corporate earnings expectations for the next 12 months, from $230 per share at the start of the year to nearly $240 per share at the end of September.

The question remains: How much more will the economy slow, and how will that impact the evolution of currently supportive market fundamentals?

Challenges Ahead — Interest Rates, Lending Conditions, and Earnings Expectations

While the points above support our view that the economy will not enter a severe recession, we do see evidence of slowing.

Taking our cues from history, higher interest rates will continue to work their way through the economy. There are some factors that make the economy less sensitive to interest rates: housing is a smaller share of growth than in previous cycles, consumers and corporations have more fixed rate debt, and government infrastructure and other spending has not abated. However, we believe that the lagged effects will still be felt in terms of slower growth, though potentially not to the same extent as in prior cycles.

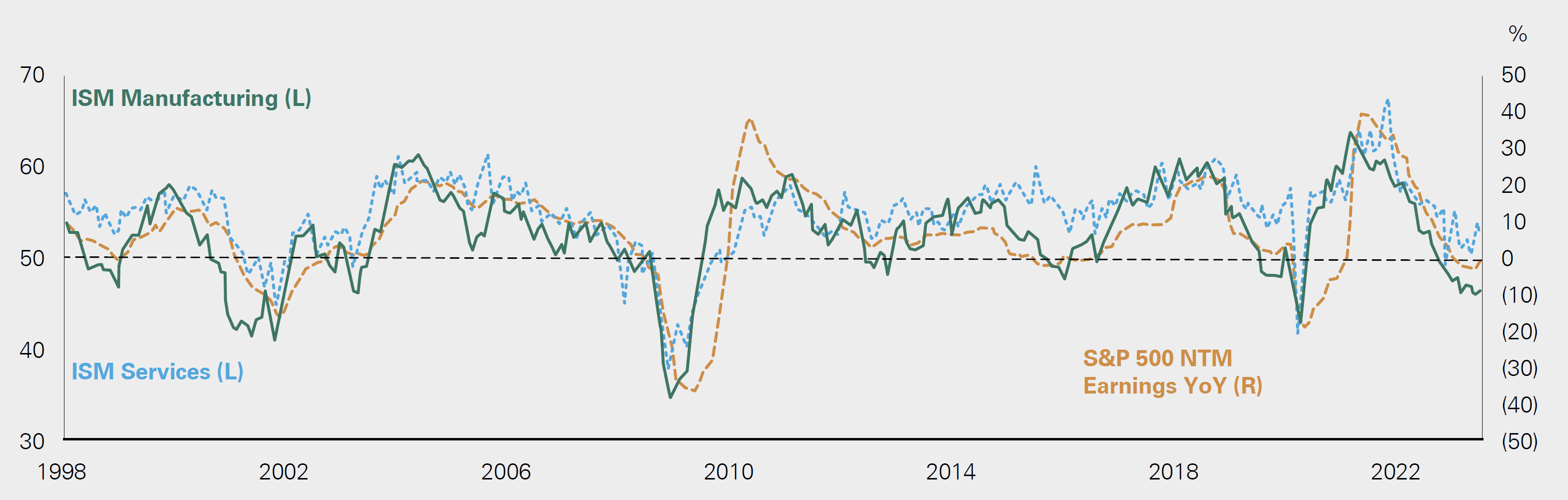

The historical lag between the beginning of a rate hiking cycle and the trough in the unemployment rate has averaged 23 months in the prior seven cycles, excluding COVID-19, which would indicate that we should see a steadier increase in unemployment during the first quarter of 2024. It has been common for stocks to rally at the end of a rate hiking cycle, but a steady increase in unemployment claims is often a sign that risk appetite will fade. Therefore, we are watching the labor market closely for any indication of a rise in initial unemployment claims. Although traditionally useful labor market indicators, such as small business hiring plans, are signaling the possibility of some weakness ahead, thus far the labor market remains strong. Leading economic indicators may also continue to be pressured given the historical lag time between higher interest rates and slower economic activity. Although manufacturing is now a smaller part of the U.S. economy, the historically high correlation between leading indicators such as the ISM Manufacturing PMI and forward earnings expectations persists (Exhibit 9).

Exhibit 9: U.S. ISM Manufacturing & Services vs. S&P 500 Next 12-Month Earnings

Key takeaway: There is a historically high correlation between leading indicators such as the ISM Manufacturing PMI and forward earnings expectations.

There is a historically high correlation between leading indicators such as the ISM Manufacturing PMI and forward earnings expectations.

Source: FactSet

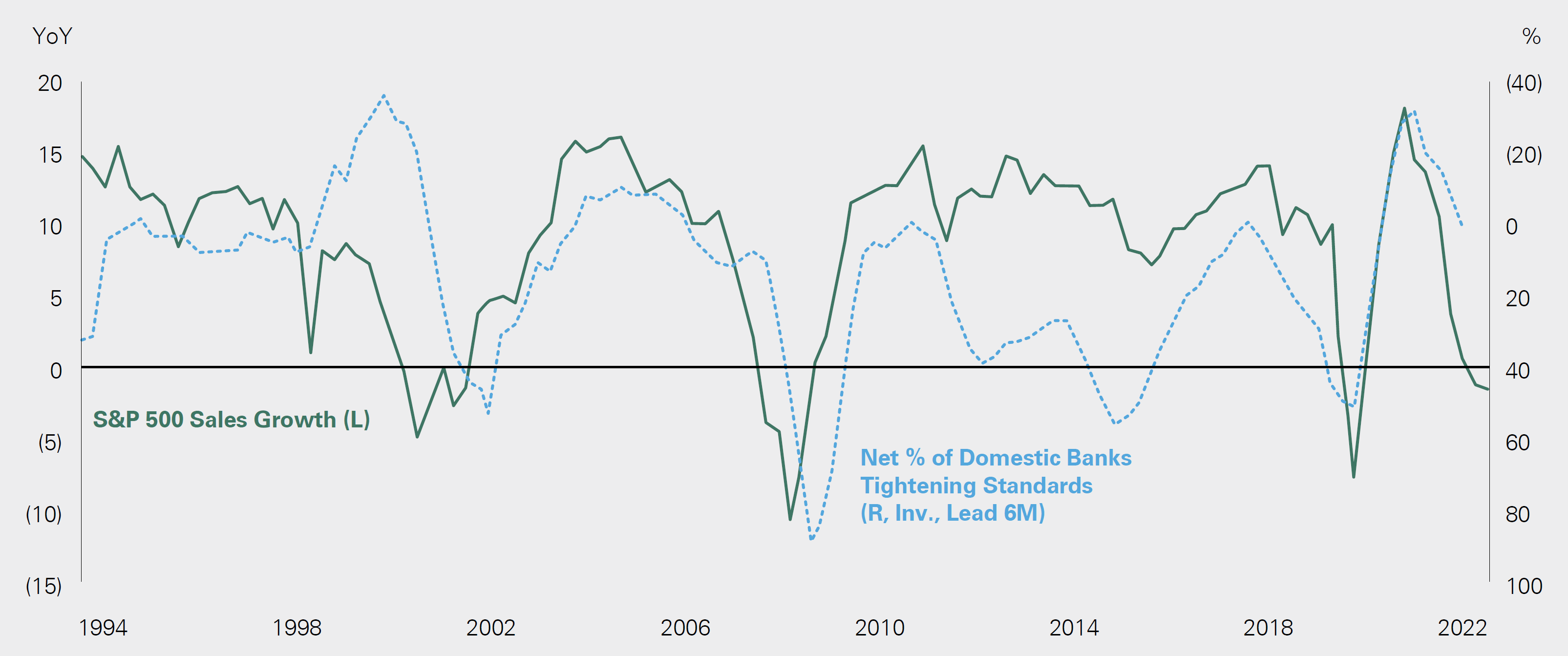

Historically, increasing interest rates have had a negative correlation to forward earnings growth. Again, the rise in interest rates over the past couple of years will serve as at least some headwind to both leading indicators of the economy and corporate earnings. Tighter lending standards would support this view given the historically high correlation between credit availability and S&P 500 sales growth (Exhibit 10). Pressure on sales growth may serve to induce corporations to protect profit margins by cutting costs, thus placing more consistent pressure on the labor market. These pressures could combine to reduce earnings expectations for 2024. There is not a straight read-through to equity prices from this dynamic, however, as changes in expectations for the Fed will affect multiples as well. With rates now at high levels, the Fed may shift to an easing bias abruptly in the year ahead that could again push multiples higher — perhaps enough to provide support to the market amid a backdrop of slow growth without a severe contraction.

Exhibit 10: Net Percentage of Domestic Banks Tightening Standards vs. S&P 500 Sales Growth

Key takeaway: Pressure on sales growth may serve to induce corporations to protect profit margins.

Source: FactSet

Investment Implications and Bessemer Portfolio Positioning

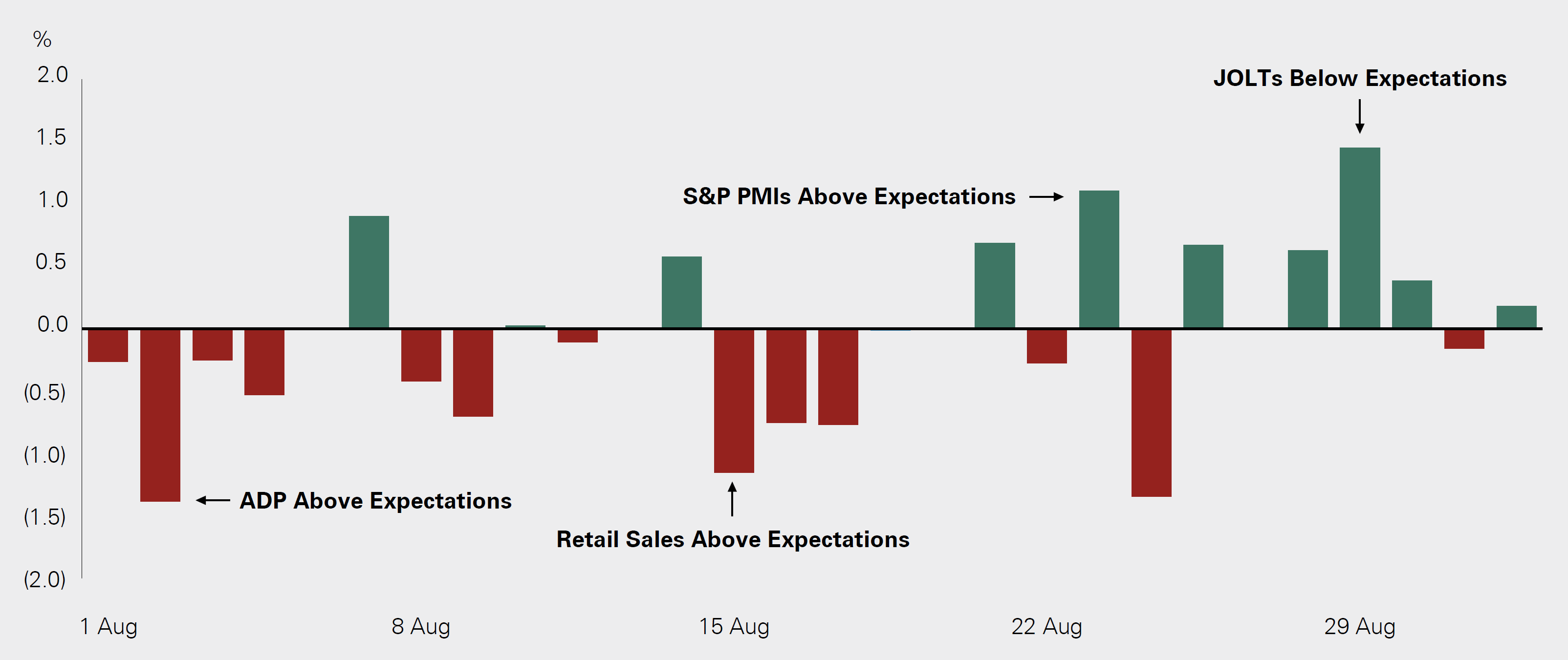

While we maintain our positive view on equities, we do not expect the outsized pace of equity gains seen so far this year to continue — a choppier environment, as we have experienced in recent weeks, is likely to persist. We believe the “bad news is good news” paradox can continue in the coming months, and fears of a more aggressive Fed are likely to dissipate as the market receives more evidence that the economy is in fact slowing. With the relationship between softening economic data and rising stock prices likely to continue in the near term, we maintain our recommendation for an overweight to equities relative to bonds (Exhibit 11). That said, stock and bond portfolio exposures are oriented toward parts of the market that should outperform in a slower growth environment.

Exhibit 11: S&P 500 Daily Price Returns

Key takeaway: We believe the inverse relationship between softening economic data and rising stock prices is likely to persist in the near term.

We believe the inverse relationship between softening economic data and rising stock prices is likely to persist in the near term.

Source: Bloomberg

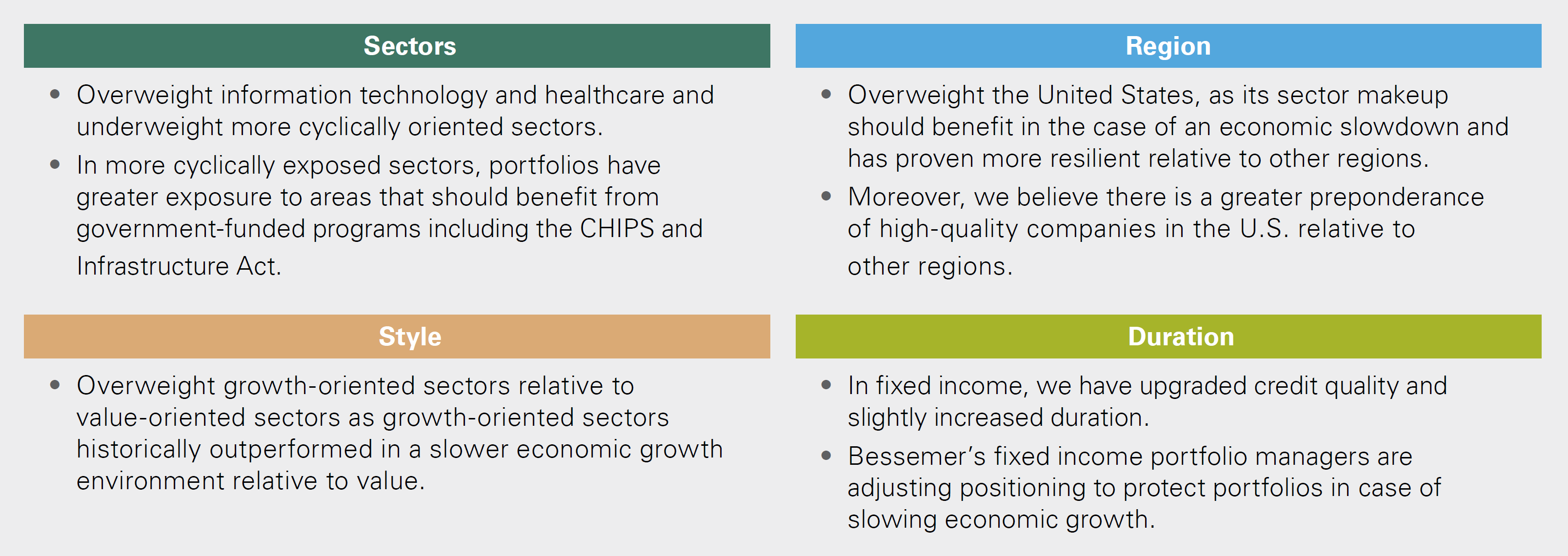

Within equity portfolios, we are tilting away from the most cyclically oriented sectors. Within bond portfolios, we maintain a longer duration versus benchmarks (Exhibit 12). We maintain our overweight to the U.S., where we see a larger opportunity set of high-quality companies with secular earnings power. Given our view that a severe recession is unlikely, we do not believe additional changes to mitigate risk are warranted at this time.

Exhibit 12: Asset Allocation Highlights

Key takeaway: We maintain exposures within our stock and bond allocations that are more representative of our slowing growth view.

We maintain exposures within our stock and bond allocations that are more representative of our slowing growth view.

Source: Bessemer Trust

Parting Thoughts

Thank you for reading our latest Quarterly Investment Perspective in what remains a dynamic market and economic environment. To that end, we will continue updating our clients in written communications, video, and interactive forums, and we welcome your engagement. Please reach out to your client advisor with any questions you may have.

Past performance is no guarantee of future results. This material is provided for your general information. It does not take into account the particular investment objectives, financial situations, or needs of individual clients. This material has been prepared based on information that Bessemer Trust believes to be reliable, but Bessemer makes no representation or warranty with respect to the accuracy or completeness of such information. This presentation does not include a complete description of any portfolio mentioned herein and is not an offer to sell any securities. Investors should carefully consider the investment objectives, risks, charges, and expenses of each fund or portfolio before investing. Views expressed herein are current only as of the date indicated, and are subject to change without notice. Forecasts may not be realized due to a variety of factors, including changes in economic growth, corporate profitability, geopolitical conditions, and inflation. The mention of a particular security is not intended to represent a stock-specific or other investment recommendation, and our view of these holdings may change at any time based on stock price movements, new research conclusions, or changes in risk preference. Index information is included herein to show the general trend in the securities markets during the periods indicated and is not intended to imply that any referenced portfolio is similar to the indexes in either composition or volatility. Index returns are not an exact representation of any particular investment, as you cannot invest directly in an index. Alternative investments, including private equity, real assets and hedge funds, are not suitable for all clients and are available only to qualified investors.