Art Collecting as a Philanthropic Pursuit

- People collect art for many reasons — for personal aesthetic reasons, to support the arts or a specific artist, and as an investment, to name a few.

- But many may not be aware of the philanthropic potential of art collecting to benefit communities, academic research, and the creation of art for generations.

- In this A Closer Look, we explore various philanthropic approaches that art collectors might want to consider and highlight some important tax planning information.

Over time, an art collection can grow significantly for a variety of reasons. Individual artworks might be inherited from a relative, picked up along the way on trips and vacations, purchased in support of a specific artist’s career, or bought as an investment. And, of course, acquiring art may simply come as a response to a desire to be surrounded by objects of significance and beauty. Beyond the poetic dimension that collecting art can bring to your life, the process of collecting and the collection itself can provide many societal benefits.

In this A Closer Look, we apply a philanthropic lens to the practice of collecting art and identify several strategies for supporting the arts, local communities, academic research, and artistic production for generations. We examine a variety of paths that you might consider, ranging from alignment with an existing institution to establishing your own museum, or thinking creatively about how nontraditional pathways for your collection can make a difference. We also share important tax planning information that we believe should be considered whatever your future ambitions for your collection may be.

Influence Through Intention When Building a Collection

Philanthropic efforts can contribute greatly to your sense of identity and can also be a means of creating a richer and more fulfilling life. When a passion also provides a means of effecting change in society, it can multiply the positive outcomes in many different ways.

Addressing a need in an existing public collection. One of the most common paths to make an impact through an art collection is to fill a gap that is not being addressed by traditional institutions. These institutions are often restricted by budgets or board leadership as to what they can acquire and how quickly. Especially for younger organizations, it can be a major challenge to provide context for contemporary works of art within the greater canon of art history because objects of historical significance may be out of reach. The inverse may also be true: An organization has significant holdings from the past but lacks the ability to acquire significant contemporary works that might give new relevance to the overall collection. What is crucial in this scenario is to have a strong relationship and ongoing dialogue with the institution to ensure that you have a clear understanding of what the institution truly wants and needs.

- Case in point: Since childhood, a young collector was surrounded by Ethiopian artifacts that had significant meaning to her family. As she became involved in the contemporary art world, she realized that she was primarily drawn to classical African works of art because she saw them as a way of connecting to a part of herself and her ancestry. She framed her acquisition philosophy in this arena and started a collection that views the genre through a different lens than those used by individuals who have historically collected African antiquities. With the U.S. art market focused on contemporary Black art, and museums amassing many important contemporary works by these artists, this collector decided to focus her efforts on classical African art with the purpose of eventually placing her collection into conversations with works of art by contemporary Black artists. Through her careful curation of distinct antiquities, she is aiming to bridge the gap between past and present, carefully curating a collection that many institutions will be eager to accept.1

Supporting living artists. Collectors are at the center of the arts ecology and play a great role in determining the vibrancy of the sector. Providing financial assistance and grants to individuals is one of the surest ways to make a major impact in a person’s life; however, the tax law narrowly defines situations where direct payments to individuals qualify as deductible charitable contributions. Supporting artists directly by purchasing their works can serve a similar purpose by making a major impact on their lives and careers. Support of artists directly offers the fuel to keep the creative process moving forward and enables artists to continue working. When you purchase a work of art in the primary market, you place yourself into the narrative of the artist’s career and artistic legacy, putting power and agency directly into the hands of the artist. As Marcel Duchamp said, “I don’t believe in art, I believe in artists,” and taking on a similar ethos can be one of the most effective ways of supporting the arts ecosystem and creative economy.

- Nonprofit highlight: Art for Change connects socially conscious art collectors with accomplished contemporary artists and their work. The majority of the proceeds go directly to the artist under the ethos that direct investment in individuals is vital to a thriving cultural community.

Strategic donations or loans of art. Lending or donating works for exhibitions and as a resource for scholarly research can be a deeply appreciated method of supporting your favorite institution, curator, or arts scholar, who may be struggling with exhibition costs or accessing works of art crucial to achieving academic objectives. While generally only outright transfers will result in an income tax deduction, collectors may wish to donate fractional interests of a collection to achieve similar tax benefits over an extended period. Lending programs or donations of works of art to smaller or regional museums or institutions of learning is a great way to engage new audiences (the tax rules for this are complicated, and tax advisors should be consulted before making fractional gifts).

- Case in point: A couple who loved the fine arts had built a collection over several decades featuring works by artists with whom they had personal and professional relationships. One artist had executed large-scale, site-specific, ephemeral works of art in different locations across the globe — ranging from urban centers to remote natural locations. In one of this artist’s works, the project played a pivotal role in transforming the community’s image and its relationship to the arts, which deeply resonated with the couple (one of whom had personal ties with this community). The couple decided to donate the portion of their collection related to this specific project to the city’s regional art museum as a historical record of the transformative event. It was also meant to act as a resource for the institution to contextualize contemporary art by those local artists who had been influenced by the work.

When institutions have been sluggish in collecting certain artists or genres, a donation of a work of art or earmarked cash can act as an agent of change by altering the course of a museum’s collecting trajectory, bringing new vibrancy to an institution, and attracting new audiences. A collector can help speed along changes that otherwise might take much longer, or not happen at all. These types of restricted-use cash contributions frequently provide meaningful tax savings to the collector.

- Case in point: An American organization, founded with the mission of making a European museum more accessible to American visitors, began by underwriting the translation into English of wall labels, publications, and audio guides. As the organization’s work advanced, there was growing interest from the board of trustees’ chairman in having American artists better represented in the permanent collection. Through his own collection, he first helped coordinate an exhibition on the subject together with American museums, foundations, and other private collectors. Then, through a combination of gifts designated for the acquisition of works of art and promised gifts from his own collection of important works by American artists, the organization was successful in making the museum’s curators amenable to further additions of and investment in American art. This culminated in a commission of a permanent installation by a renowned American artist in the museum’s galleries.

Safeguarding Your Vision — Deciding on a Path Forward

Leaving the collection in the family. For some families, the shared passion of art collecting across generations brings family members closer together and ensures that the investment in an art collection will be a relevant and important part of a family legacy. Like other illiquid assets, a family art collection may require complex estate planning to successfully pass to the next generation. And one threshold distinction should be made: Is it the collection or the collecting that you are trying to hand down? If it is the love and joy of collecting, consider ways in which you can inspire future generations of your family to embark on the same journey, without giving them a collection in which they are not personally interested. For more information, please see “The Fine Art of Transferring Your Treasured Collections.”

Donating your collection to an existing institution. When considering donating a collection to an existing institution, your creativity and flexibility will be an advantage to achieving your goal. Here’s why. Art museums are often hesitant to accept an entire collection, preferring instead to select only those works that would be important for them to acquire. If keeping your collection intact is of the highest priority, consider a smaller arts institution and endowing the collection with a structured cash contribution, or an organization that isn’t focused on the arts at all but still has a way to leverage a collection in a meaningful way in support of its mission.

- Case in point: After her retirement from the tech industry, a collector built an extensive collection of contemporary art. At a certain point in her life, she then had to decide on a “forever” home for it. Having no heirs with an interest in the collection, her obvious choice would have been a prestigious cultural institution — but she had quite a different mise-en-scène in mind for the objects she had so lovingly brought together. Over the course of several years, she donated portions of her collection to hospitals, with the majority of the works going to a school for children and young adults with severe autism. The school operated on the premise that a welcoming and uplifting environment is essential in aiding their students to meet their full potential. The collector felt that filling the school with vibrant paintings and peppering the grounds with thought-provoking sculptures fell right in line with the school’s approach and that it would be the perfect place for her collection to live and be of service.2

- Nonprofit highlight: Organizations such as RxART place contemporary art in children’s hospital settings in order to create engaging, uplifting, and healing environments at no cost to the hospitals.

Donations to existing museums present the most common form of tax-deductible contributions of artwork, especially since the donor can receive a tax benefit for the current fair market value of the donation. For large collections that have been held by collectors for many decades, this can present an opportunity to relieve themselves of the built-in tax liability on the appreciation. Special care must be taken to ensure that the donor does not run afoul with the IRS. Donated artworks must be owned for more than one year prior to the donation, and the receiving organization must use the collection to further its charitable purpose. If the organization sells the donated artworks within three years of contribution, the donor’s tax deduction may be reduced to their cost basis.

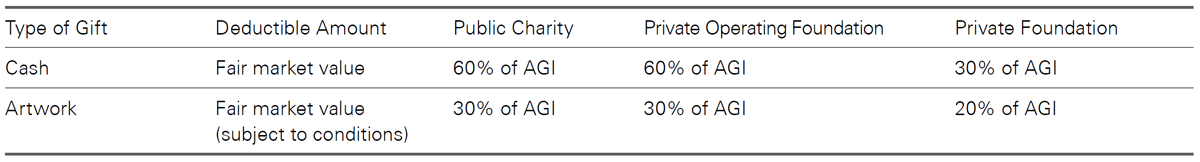

Exhibit 1: Contribution Limitation by Receiving Organization

Exhibit 1: Contribution Limitations by Receiving Organization is a table that depicts charitable deductible limitations for cash and artwork for different organizations. For cash, the deductible amount is fair market value up to 60% of adjusted gross income for donations to public charities and private operating foundations and 30% of adjusted gross income for private foundations. For artwork, the deductible amount (subject to limitations) is 30% of adjusted gross income for public charities and private operating foundations and 20% private foundations.

When exploring this path, there are many pitfalls and requirements that one should keep top of mind. To start, all donations valued at more than $250 require contemporaneous written acknowledgment, and Form 8283 is required when noncash donations greater than $500 are made. Artwork valued at more than $5,000 must be appraised by a qualified appraiser, and if the donation is greater than $20,000 in value, the appraisal must be attached to a fully completed Form 8283, which is crucial to ensure the potential tax deduction will be approved. In addition to satisfying the documentation on the fair market value of the donated piece, it is also important to report the cost basis. Failure to comply with any portion of these requirements could result in a disallowed deduction. As always, we recommend seeking comprehensive tax and legal advice before making a final decision to ensure that all details are in order.

Establishing a private operating foundation. For those who wish to keep their collection and vision intact, establishing a private operating foundation to hold the collection may be an option to consider. In recent decades, this has been the go-to solution for many top contemporary collectors who refuse to bend to an existing institution’s own curators. One of the most well-known and historic of these may be the Barnes Foundation in Philadelphia, whose core collection is the singular vision of its founder, Albert C. Barnes — and you can still experience these works hung in exactly the same way that he intended back in 1922. More contemporary examples of this approach include the Rubell Museum in Miami, a city where this format is especially popular, and The Brant Foundation Art Study Center with locations in Connecticut and New York, which has a robust lending program.

However, the number of art-focused private operating foundations that have closed is surprisingly large, and those that last are exceedingly rare. Founders often fail to appreciate just how much it will cost to build, run, and maintain a private museum that becomes a business. Similar to other startup businesses, founders are required to have significant continuous involvement and find themselves replenishing working capital year after year.

When a project no longer fulfills the objectives of the founders, or if they are not getting the results they desire, and the space proves to be a major drain on resources, founders often have a change of heart and shut them down. Spaces that rely on a single founder afford total control but, without the proper framework and ample funding by way of a sizeable endowment or continued financial support, they are extremely fragile and do not guarantee the safe harboring of a collection in perpetuity.

- Case in point: Two brothers — who had founded and managed a successful multibillion-dollar business together — amassed a 1,500-work collection of contemporary art representing major blue-chip modern and contemporary artists. Rather than donating the collection to an institution, they wanted to preserve their artistic vision and decided to purchase a historic building in a major U.S. city and found their own museum. Taken by the excitement of the project initially, they soon discovered that it’s much more fun to build a museum and open a collection to the public than to actually run it. After only two and a half years of stop-and-go operations, and on the heels of a public dispute with museum staff, they made the decision to close the foundation, despite the massive investments they had made and the widespread acclaim that the collection itself received.3

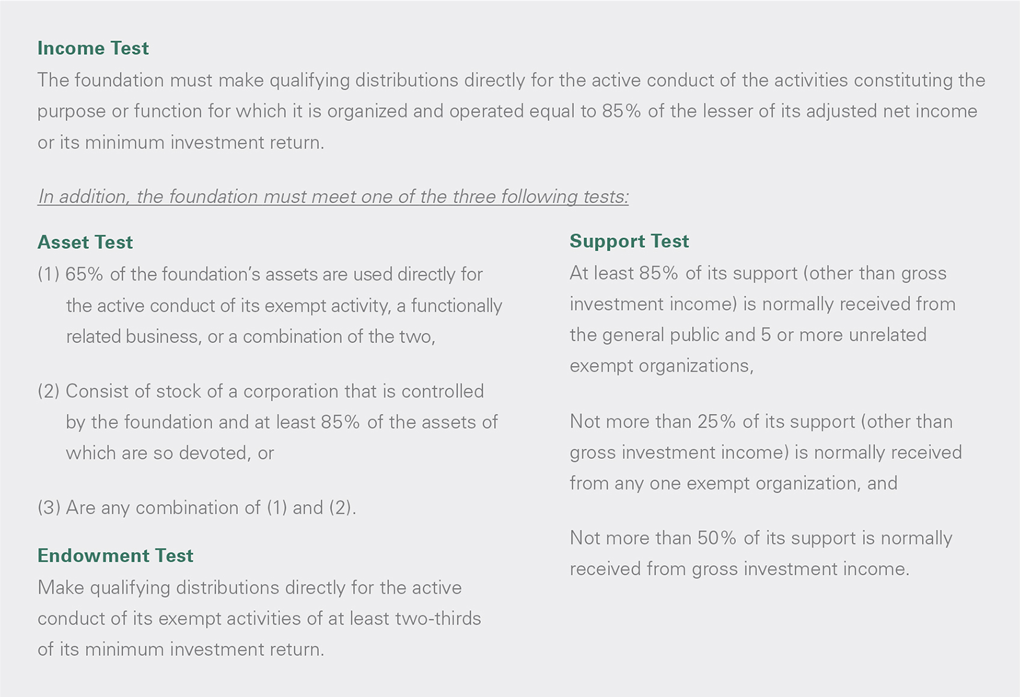

As reflected in Exhibit 1, private operating foundations are afforded more generous charitable deduction limitations for donors than traditional grant-making private foundations. This is largely due to the more restrictive nature that private operating foundations must adhere to in order to maintain their operating status with the IRS. Generally, these foundations must pass both the income test and one of the secondary tests reflected in Exhibit 2, which in the end puts more pressure and responsibility on the founder, as grantmakers and private donors may be hesitant to support these foundations financially, and fundraising from the general public is nearly impossible due to their closed and private nature.

Funding an arts foundation with an art collection. Using an art collection to fund a private foundation could be a worthwhile path in furthering any charitable goal, including supporting the arts. The idea here is that art works would be sold over time, and the proceeds would be used to fund organizations that promote the ecosystem of artistic production.

- Case in point: A leading artist of the 20th century left the entirety of his estate — which included hundreds of works of art that he had created and his own private art collection drawn from his personal relationships with other leading artists of his era — to a foundation that was created upon his death. He laid careful plans for the vision of the foundation and ensured that its mission of advancing the visual arts was included in his instructions. The foundation would fund its future activities through the thoughtful sale of the works of art that he had left. To execute the founder’s intentions, the foundation put a grantmaking program in place that has since grown to become one of the country’s top funders of innovation in contemporary art. His foresight and generosity continue to this day in supporting thousands of artists and bolstering the national arts ecosystem in a meaningful and direct way.

Private foundations, including those focused solely on the arts, require careful consideration regarding the long-term investment and management of the foundation’s assets. Generally, private foundations will be required to make grants of at least 5% of the foundation’s assets annually. The IRS requires that foundations obtain a valuation regarding the fair market value of the illiquid assets every five years. The private foundation may have to sell pieces over time to meet the cash needs to satisfy the grant requirement.

Exhibit 2: Private Operating Foundation

Exhibit 2: Private Operating Foundation describes two tests that private operating foundations must pass to maintain their operating status with the IRS: the income test and one of three other tests — the asset test, the endowment test, or the support test. For the income test, The foundation must make qualifying distributions directly for the active conduct of the activities constituting the purpose or function for which it is organized and operated equal to 85% of the lesser of its adjusted net income or its minimum investment return. The asset test requires (1) 65% of the foundation’s assets are used directly for the active conduct of its exempt activity, a functionally related business, or a combination of the two, and (2) consist of stock of a corporation that is controlled by the foundation and at least 85% of the assets of which are so devoted, or (3) Are any combination of (1) and (2). For the endowment test, the foundation must make qualifying distributions directly for the active conduct of its exempt activities of at least two-thirds of its minimum investment return. For the support test, at least 85% of its support (other than gross investment income) is normally received from the general public and 5 or more unrelated exempt organizations, Not more than 25% of its support (other than gross investment income) is normally received from any one exempt organization, and not more than 50% of its support is normally received from gross investment income.

Alternatively, the founder may have to make additional contributions if the foundation finds itself without sufficient cash. Collectors wishing to fund a private foundation with works of art to be sold and receive a tax benefit will be subject to the cost basis and reduced AGI limitations in Exhibit 1. With this in mind, it may make sense to fund the private foundation in tranches over time or in coordination with a liquidity event to maximize the tax savings. Consideration must also be given to where the collection will be displayed or stored. Generally, this cannot be in the founder’s home or other property.

Conclusion

Collecting art can capture your imagination, stir your soul, and bring a deeper sense of enrichment. Within the context of greater society, an art collection can also inspire creativity; help contextualize history and difficult social issues; express specific cultures, values, and new ideas; and promote healing and well-being. Using an art collection as a tool in a philanthropic pursuit, whether through a gift to a museum or existing institution, or by creating a new private foundation, whether operating or grant-making, can help support these worthy goals.

Further Reading

- “The Fine Art of Transferring Your Treasured Collections” by Jaclyn Feffer. Bessemer Trust A Closer Look (September 16, 2019)

- “The Art Collector’s Handbook: The Definitive Guide to Acquiring and Owning Art” by Mary Rozell

- “Art Patronage in the 21st Century” by The European Fine Art Foundation, 2020

- “Collecting with a Conscience: How to Benefit Others While Building the Collection of Your Dreams” by Artspace Magazine, 2018

- “The Conscious Art Collector: How to cultivate meaning, empower purpose, and ignite passion at home and work” by Spar Street

- “Visualizing the Enduring Impact of Art Collectors,” Carnegie Mellon University

- Christie’s collecting guides

- How the Next Generation of Art Collectors Is Making Its Mark by Mekita Rivas. Shondaland, 2021

- In Defense of Philanthropy by Beth Breeze. Agenda Publishing, 2021

- Not here to stay: what makes private museums suddenly close? by Georgina Adam. The Art Newspaper, February 13, 2020

This summary is for your general information. The discussion of any estate planning alternatives and other observations herein are not intended as legal or tax advice and do not take into account the particular estate planning objectives, financial situation or needs of individual clients. This summary is based upon information obtained from various sources that Bessemer believes to be reliable, but Bessemer makes no representation or warranty with respect to the accuracy or completeness of such information. Views expressed herein are current only as of the date indicated and are subject to change without notice. Forecasts may not be realized due to a variety of factors, including changes in law, regulation, interest rates, and inflation.