Trade, AI, and the Road Ahead Plus A Year of Transition

Executive Summary

- Market volatility rose meaningfully in the first quarter, driven by heightened policy uncertainty, tariff escalation, and sharp sentiment shifts — in addition to questions about the evolution of U.S.-China AI competition.

- Although the probability of a recession has increased, it is not our base case. Fundamentals are currently solid — credit spreads are tight, inflation expectations are anchored, and interest rates have moved lower.

- While volatility may persist in the near term, we see a stronger likelihood of sustained market gains in the second half of the year. Portfolio positioning reflects a thoughtful balance between trimming strength, reinforcing core positions, and opportunistically building exposure to high-quality businesses at more attractive entry points.

In our recent year-ahead outlook, “2025: A Strong Foundation for a Year of Transition,” we wrote that “the new year is set to bring both U.S. political and geopolitical volatility given increased policy uncertainty after the U.S. elections … this backdrop will surely create periods of heightened anxiety.” Indeed, during the first quarter, the United States Policy Uncertainty Index spiked to levels seen only twice before — in 2008, during the Global Financial Crisis, and in 2020, amid the COVID-19 pandemic (Exhibit 1).

Trade policy is now the primary focus of markets, with unprecedented tariffs causing both consumers and businesses to pull back, negatively impacting sentiment. The Conference Board Consumer Confidence Index and the NFIB Small Business Optimism Index have both retreated from their post-election highs as economic uncertainty has grown. Now, with President Trump’s Liberation Day announcement providing more detail on tariffs, the probability of a material impact on real economic growth has increased. Financial markets are not waiting for fundamentals to shift, with stocks selling off aggressively to start the second quarter.

A sharp rise in policy uncertainty followed reports that Chinese artificial intelligence (AI) company DeepSeek had launched a large language model (LLM) said to rival OpenAI’s ChatGPT in performance — at a fraction of the cost. While the full accuracy of these claims remains in question, the launch underscores China’s accelerating progress in AI and intensifies the U.S.-China AI rivalry. DeepSeek’s R1 model demonstrated that high-performing LLMs can potentially be trained and deployed more efficiently, requiring fewer GPUs than models such as ChatGPT-4 and Meta’s LLaMA 3. This development has prompted investors to reassess the growth potential of major U.S. technology firms — including Nvidia, Microsoft, and Broadcom — whose stock prices have fallen more than 20% from recent record highs.

We explore both the shifting policy landscape and China’s AI advancements in more detail on page 7.

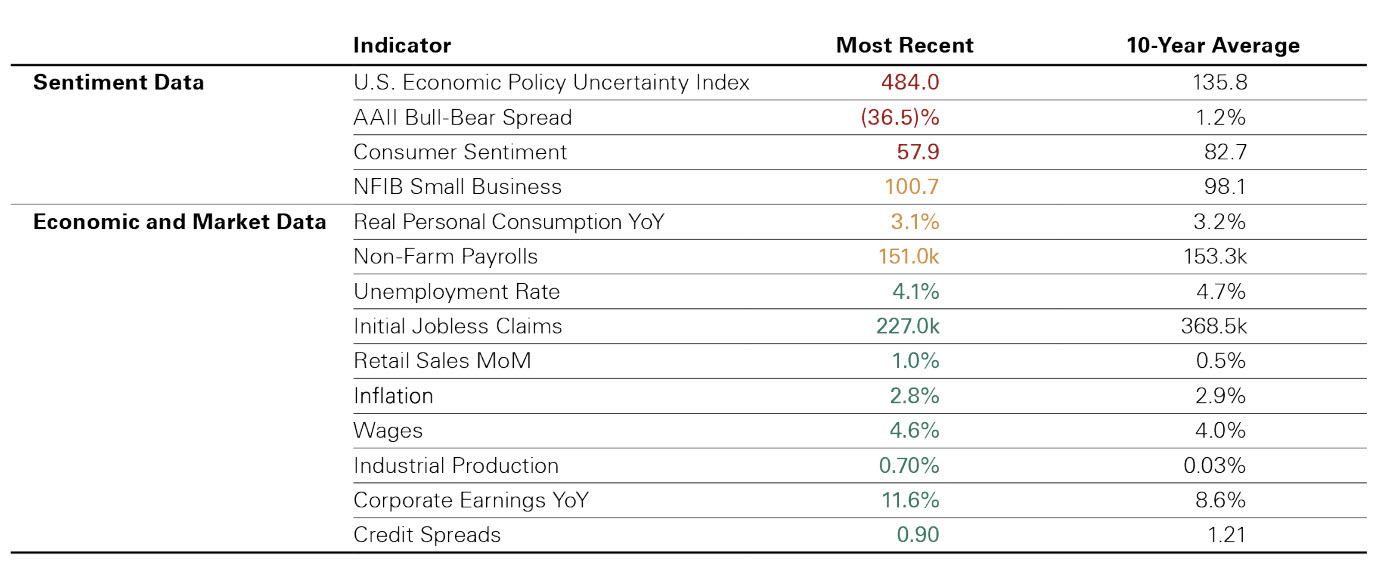

Exhibit 2: Sentiment vs. Economic and Market Data Relative to Their 10-Year Averages

Key takeaway: Uncertainty is having a more pronounced impact on soft data — e.g., sentiment and survey data — relative to hard economic and market data.

Uncertainty is having a more pronounced impact on soft data — e.g., sentiment and survey data — relative to hard economic and market data.