Land Conservation: How to Protect and Preserve Nature’s Legacy in Perpetuity

- Land has both symbolic and practical importance, playing a unique and critical role across society.

- There are significant personal benefits to land conservation that should be taken into consideration together with the benefits to communities, the planet, and future generations.

- While conserving and potentially donating land can be complex, your team at Bessemer Trust can help you navigate the process.

Landowners are increasingly seeking strategies to preserve habitats, safeguard biodiversity, protect local heritage, and ensure equitable access to open spaces for generations to come.

If you are thinking of protecting land that you own, there is much to know and different paths you might take. Among the most popular and effective strategies: conservation easements and donations to private foundations, public charities (such as land trusts), or government entities including local, state, or national park systems and municipalities.

As complicated as these options may seem, they are worth exploring for the potential emotional and financial benefits to you and your family — as well as the lasting impact they can have on communities, humanity, and the planet.

The Big Picture

In the U.S., there are about 2.3 billion acres of land. About 1.3 billion acres (60%) of this land is privately owned, with varying amounts of private ownership in different states.

Across the U.S., urban areas have more than quadrupled since 1945. This development includes structures (homes, buildings, factories) and infrastructure (roads, bridges, utilities). The American Farmland Trust reports that 11 million acres of farmland have been lost to development in the last 20 years alone.

Put another way: In the U.S., 1.5 million acres on average are converted annually from natural or agricultural use to urban and suburban development. That is the equivalent of adding a new city nearly twice the size of Los Angeles every year — covering an area roughly the size of Delaware.

On the other hand, between 2010 and 2020, more than 61 million acres were voluntarily conserved by land trusts, a 15-million-acre increase over the decade. This change has likely been driven by the growing awareness of the need to preserve open space as well as tax provisions that encourage land conservation.

Phipps Family — Bessemer Trust’s founding family, the Phipps, donated 20 acres in 1948 to preserve a significant portion of the Atlantic coast from development. Today, Phipps Ocean Park is one of two public beaches in the city of Palm Beach, Florida.

Permanent Protection

There are several paths you can take to preserve land held by your family. The most straightforward way is to donate it either to a nonprofit or private foundation that has a mission aligned with your goals, a land trust dedicated to conservation, or a government parks entity. Donating property during your lifetime, rather than by bequest, can provide valuable income tax benefits in addition to the estate tax benefits available either way.

The most widely used method for land preservation is through a conservation easement. An estimated 38 million U.S. acres are under a conservation easement today.

A conservation easement is a publicly recorded deed restriction that represents a permanent, legally binding agreement between a landowner and a qualified organization — typically a land trust, government, or other permissible entity. These agreements are designed to protect a property’s conservation values by restricting certain types of development or use in perpetuity, regardless of who subsequently owns the land — be it your heir, a foundation, or a land trust. Land trusts, also known as land conservancies, are nonprofit organizations that often play a central role in this process. They may either hold title to land or accept and oversee conservation easements to ensure long-term alignment with preservation or restoration goals. When an easement is donated, the landowner generally retains ownership and continues to manage the property, subject to the easement’s terms.

What appeals to many landowners is that conservation easements enable them to receive significant tax benefits, achieve their preservation goals, and possibly have limited use of the land — while still retaining ownership of the property (including any existing structures) in accordance with the easement’s conditions.

Indeed, many owners opt against donating their conservation easement land. For example: Ted Turner, one of the largest private landowners in the U.S., has placed substantial portions of his land under conservation easement but has retained ownership.

Easement terms vary and can be tailored, but the goal is always to conserve the land by keeping it either in its natural state, or with a specific beneficial restricted use, such as a working farm, ranch, or sustainable timber enterprise. An easement can be placed on the land in question in its entirety or in part, and partial easements can define its future use. At the owner’s discretion, some conservation easements also permit public access for recreational use, such as hiking or bird watching.

It is important to note that such restrictions reduce the property’s market value. Some of the reduction in value may be offset by tax benefits and may also benefit adjacent land retained without restrictions, for example, by the preservation of views or landscape. It is important to take care in the establishment of any easement to ensure that it will accomplish your aims, provide the protection sought, and balance the financial benefit with this intent.

Although a primary effect of many easements is to limit future residential or commercial development, an easement’s main function is to protect and preserve the property’s important conservation values. Sometimes this can be accomplished while still allowing certain forms of development.

This may be important if donating the land to a private foundation as an added layer of future protection, but an easement may be unnecessary if the land is being donated to a public charity or government entity whose mission is the conservation of land. Donating land subject to a conservation easement to the same organization that holds that easement can create legal issues under the doctrine of merger in some states and should generally be avoided.

Finally, if there is a mortgage on the property, the owner must agree to let the easement take priority. Without this agreement, a foreclosure could extinguish the easement — and the donation wouldn’t qualify for a tax deduction.

Tax Benefits

Even with retained ownership, conservation easements can confer tax benefits on landowners. However, if tax reduction is the primary motivation, the best approach may be to donate the land to a public charity.

While you may donate land to a private foundation, it is less common than donating to a public charity — because the tax benefit is reduced. There are additional complexities if there is an outstanding mortgage on the land when contributing it to a private foundation that would need to be taken into consideration.

Retained Ownership

Tax breaks for landowners who engage in conservation easements and retain ownership can be meaningful:

- Federal income tax deduction — The deduction is based on the reduction in the land’s value due to the restrictions imposed by the easement. Landowners are eligible to deduct up to 50% of their adjusted gross income (AGI) each year, with their unused portion carried forward and available for use for up to 15 years. Qualified farmers and ranchers may deduct up to 100% of their AGI.

- Estate tax deduction — By reducing or eliminating development rights, a conservation easement reduces the market value of the property, which in turn can reduce the overall value of the estate — and therefore the federal and state estate taxes owed. Additionally, certain tax provisions allow for a further reduction in estate taxes for land that is under a qualified conservation easement, which can offer meaningful benefits. Some farmers may also qualify for other tax benefits related to how their land is valued, though not all will meet the requirements.

- Property tax relief — It is possible, and relatively common, for property taxes to decrease due to a conservation easement. However, that reduction depends on local tax rules and how the land was initially assessed. For example, easements on agricultural or open space may not see a significant tax reduction, as they already have a lower tax rate based on current use rather than potential for development.

- State taxes — Many states offer tax breaks for conservation easements; it’s important to check with your tax advisors to determine what may be available in your state. Among the most generous is Virginia, which allows landowners to claim a credit of 40% of the appraised fair market value of the land at the time of donation. For tax years beginning January 1, 2023, the land preservation tax credit is limited to $50,000 per taxpayer, per tax year. Any unused credit may be carried forward for 10 years.

Donating Land in Full

Tax benefits are significantly greater if the land is donated in its entirety, with or without an easement:

- Federal income taxes — The landowner may qualify for a charitable deduction based on the full fair market value of the property at the time of the donation.

- Capital gains taxes — Landowners can avoid capital gains taxes that would have been owed if they had sold the land at a profit.

- Estate taxes — The value of the property is removed completely from the landowner’s estate.

- Property taxes — The former owner is no longer responsible for property taxes.

- State income taxes — Landowners may be eligible to receive state tax credits.

Note that for a donated conservation easement to qualify for tax benefits, it must serve a valid conservation purpose. However, if you donate the land outright, this specific requirement usually doesn’t apply — though general rules for charitable contributions still do.

Partial Donations

It is possible to donate partial interests in easements or land outright by transferring ownership rights over time or splitting the donation among multiple parties.

However, partial interests must generally be held by a qualified entity, such as a tax-exempt organization or government agency. A landowner who owns only a fractional interest in real property typically cannot place a conservation easement on it without the agreement of the other co-owners.

One additional strategy that may be of interest is donating a remainder interest in a personal residence or farm. In this scenario, a donor can retain the right to live on or use the property during their lifetime, while the charity receives full ownership after that period — potentially qualifying the donor for an immediate charitable deduction.

Professional Assistance Is Advised

Easements and land donations in general are major commitments that require careful planning and independent financial, tax, and legal advice. Donating an easement also necessitates a strong working partnership with a third-party recipient, i.e., the charity or government entity.

Despite the complexities, in a world where the pressures of development and urbanization are ever increasing, protecting land in perpetuity may be worth considering.

If you are interested in learning more about how you might leverage your landholdings for conservation purposes, please contact your Bessemer advisor.

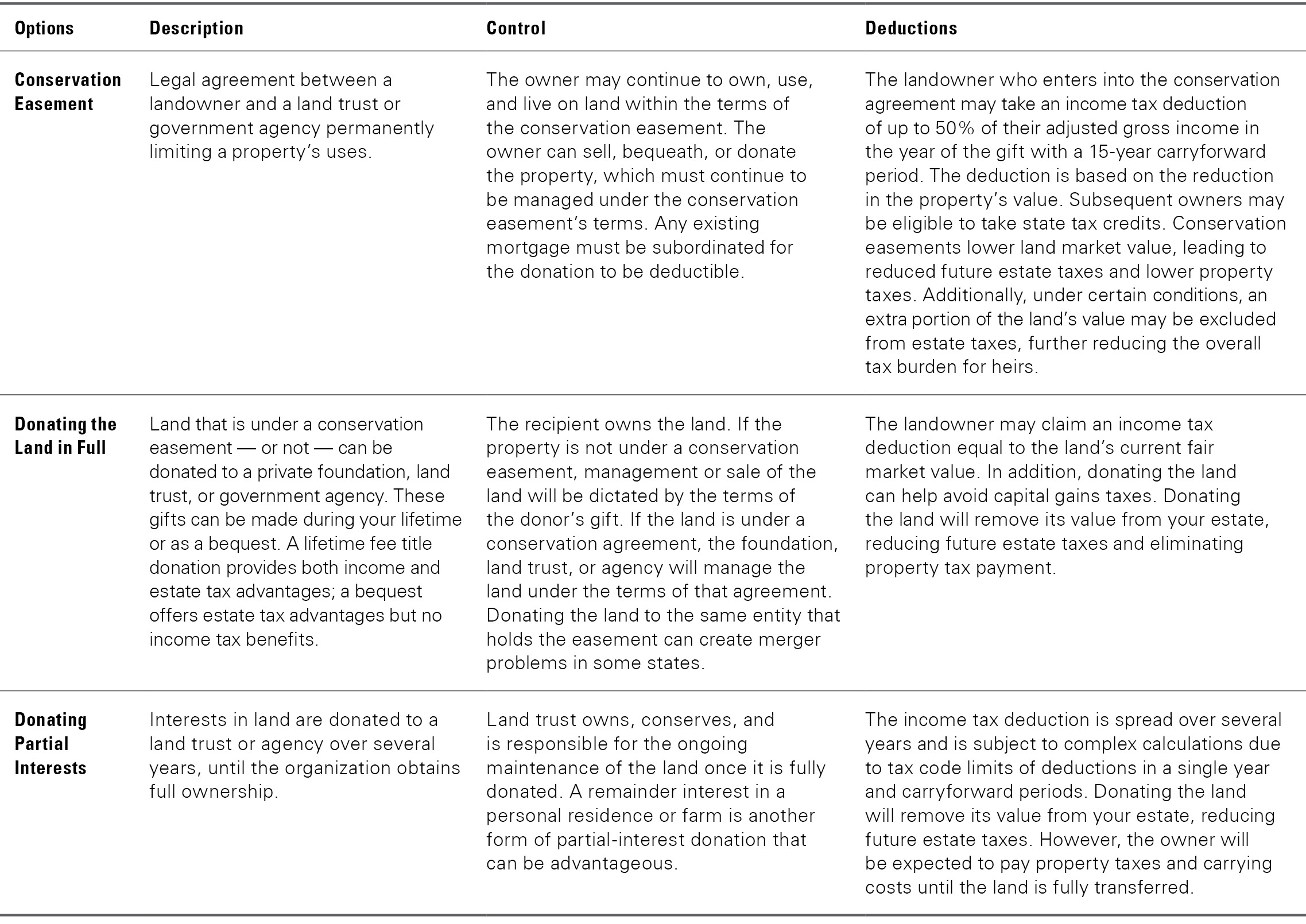

Which Path to Preserving Land Might You Take?

| Options | Description | Control | Deductions |

| Conservation Easement | Legal agreement between a landowner and a land trust or government agency permanently limiting a property’s uses. | The owner may continue to own, use, and live on land within the terms of the conservation easement. The owner can sell, bequeath, or donate the property, which must continue to be managed under the conservation easement’s terms. Any existing mortgage must be subordinated for the donation to be deductible. | The landowner who enters into the conservation agreement may take an income tax deduction of up to 50% of their adjusted gross income in the year of the gift with a 15-year carryforward period. The deduction is based on the reduction in the property’s value. Subsequent owners may be eligible to take state tax credits. Conservation easements lower land market value, leading to reduced future estate taxes and lower property taxes. Additionally, under certain conditions, an extra portion of the land’s value may be excluded from estate taxes, further reducing the overall tax burden for heirs. |

| Donating the Land in Full | Land that is under a conservation easement — or not — can be donated to a private foundation, land trust, or government agency. These gifts can be made during your lifetime or as a bequest. A lifetime fee title donation provides both income and estate tax advantages; a bequest offers estate tax advantages but no income tax benefits. | The recipient owns the land. If the property is not under a conservation easement, management or sale of the land will be dictated by the terms of the donor’s gift. If the land is under a conservation agreement, the foundation, land trust, or agency will manage the land under the terms of that agreement. Donating the land to the same entity that holds the easement can create merger problems in some states. | The landowner may claim an income tax deduction equal to the land’s current fair market value. In addition, donating the land can help avoid capital gains taxes. Donating the land will remove its value from your estate, reducing future estate taxes and eliminating property tax payment. |

| Donating Partial Interests | Interests in land are donated to a land trust or agency over several years, until the organization obtains full ownership. | Land trust owns, conserves, and is responsible for the ongoing maintenance of the land once it is fully donated. A remainder interest in a personal residence or farm is another form of partial-interest donation that can be advantageous. | The income tax deduction is spread over several years and is subject to complex calculations due to tax code limits of deductions in a single year and carryforward periods. Donating the land will remove its value from your estate, reducing future estate taxes. However, the owner will be expected to pay property taxes and carrying costs until the land is fully transferred. |

This material is for your general information. It does not take into account the particular investment objectives, financial situation, or needs of individual clients. This material is based upon information obtained from various sources that Bessemer Trust believes to be reliable, but Bessemer makes no representation or warranty with respect to the accuracy or completeness of such information. The views expressed herein do not constitute legal or tax advice; are current only as of the date indicated; and are subject to change without notice. Forecasts may not be realized due to a variety of factors, including changes in economic growth, corporate profitability, geopolitical conditions, and inflation. Bessemer Trust or its clients may have investments in the securities discussed herein, and this material does not constitute an investment recommendation by Bessemer Trust or an offering of such securities, and our view of these holdings may change at any time based on stock price movements, new research conclusions, or changes in risk preference.