Housing Market Fundamentals and Policy Implications

- Affordability continues to define today’s housing market, as years of underbuilding, higher home prices, and elevated mortgage rates have slowed turnover and made the path to homeownership more challenging — particularly for younger buyers.

- Policymakers are revisiting both housing and mortgage frameworks, with proposals that range from incremental adjustments to potentially more meaningful shifts in supply, liquidity, and borrowing costs.

- We explore the forces shaping this environment and what they may mean for portfolios invested across the housing and mortgage landscape.

The housing market — and, by extension, the mortgage market — remains a focal point for the administration, policymakers, and the American public. Over the past 20 years, the balance between housing supply and demand has been significantly disrupted, even as the U.S. population has continued to grow. Various research estimates place the current housing shortfall between 3.7 million and 6.0 million units nationwide. In this piece, we examine housing market fundamentals, the role of the mortgage market, and potential policy levers that could influence both. Each of these dynamics carries important implications for our investment portfolios.

If today’s housing challenge could be distilled into a single word, it would be affordability. Affordability shapes decisions around buying and selling homes. According to the U.S. Census Bureau, there are approximately 148.3 million housing units in the U.S., of which roughly 133.1 million are occupied; the remaining 15.2 million largely consist of second homes or vacant units. Data from the Census Bureau’s American Community Survey indicate that 60.6% of owner-occupied homes are financed with a mortgage, down from 65.6% a decade ago.

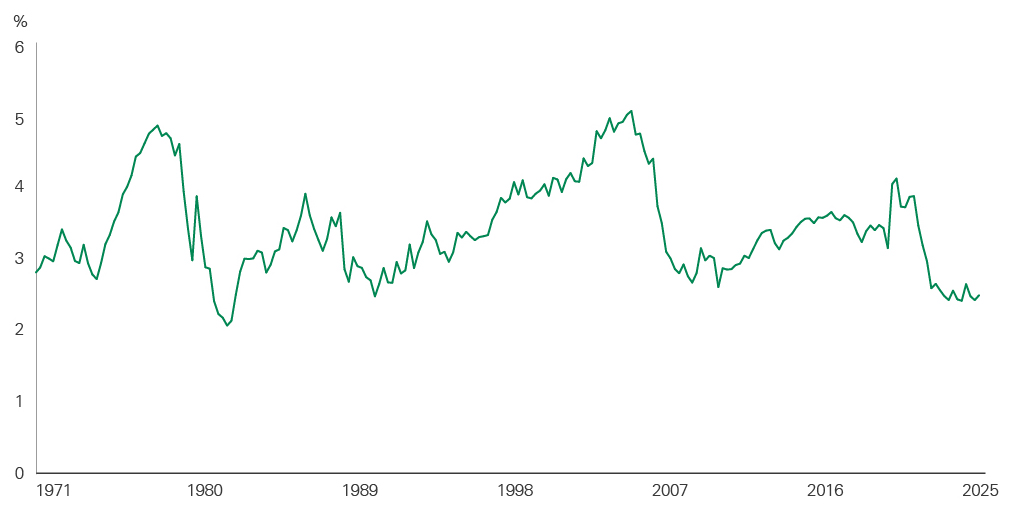

This decline in mortgage financing likely reflects higher interest rates and elevated home prices, both of which discourage housing turnover, as shown in Exhibit 1.

Exhibit 1: Existing Home Sales as a Share of Housing Stock Since 1971

Key takeaway: Housing turnover is near its lowest level in decades.

The chart tracks existing home sales as a share of total housing stock from 1971 through January 2026. Turnover peaked in prior housing cycles but has declined sharply in recent years, reaching levels near the lowest observed in decades. The visual underscores how elevated mortgage rates and affordability pressures have significantly reduced housing market activity.

Reduced transaction activity is a direct consequence of the sharp rise in mortgage rates over the past several years, resulting in what is known as a “mortgage rate lock-in.” It no longer makes financial sense to move, even downsize, when a person’s existing mortgage rate is significantly lower than prevailing market rates, as illustrated in Exhibit 2. When combined with steady home price appreciation, higher financing costs have made affordability a pressing national concern — particularly for younger households.

Exhibit 2: Mortgage Rate Lock-In Effect

Key takeaway: The effective average mortgage rate on outstanding debt is lower than current rates.

The chart shows two lines from 1990 through January 2026: the prevailing primary mortgage rate and the effective average rate on outstanding mortgage debt. In recent years, current primary rates have risen well above the average rate on existing mortgages, illustrating the “lock-in” effect that discourages homeowners from moving because their current mortgage rates are significantly lower than market rates.

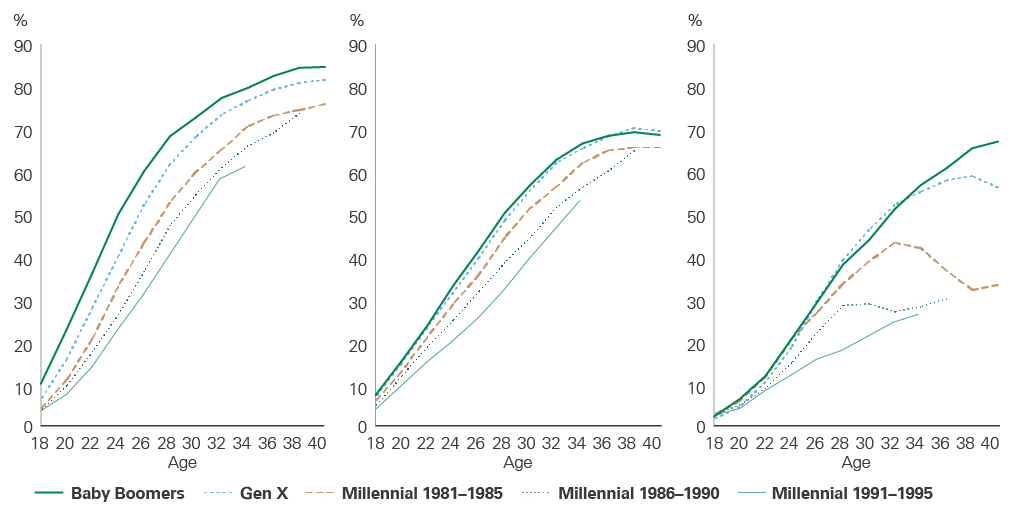

The ripple effects of the global financial crisis continue to shape homeownership trends relative to prior generations. Millennials, across age cohorts, are less likely to own homes than earlier generations were at similar stages of life. Historically, homeownership has followed major life events such as marriage and childbearing. While these milestones have become less common — or occur later — among younger generations, the decline in millennial homeownership exceeds what demographic shifts alone would imply, as evidenced in Exhibit 3.

Exhibit 3: Marriage Rates, Childbearing, and Homeownership

Key takeaway: Relative to prior generations, millennials are delayed in life events but greatly lag in homeownership levels.

The exhibit presents three side-by-side charts showing the percentage of each generation that has ever married, has a child, and owns a home between ages 18 and 40. While millennials are somewhat delayed in marriage and childbearing relative to baby boomers and Gen X, the gap in homeownership is substantially larger. The charts highlight that demographic timing alone does not fully explain the lower homeownership rates among millennials.

This dynamic has contributed to the emergence of the so-called “renter generation” and growing frustration around access to homeownership. In response, policymakers are increasingly exploring measures aimed at easing affordability pressures.

Upcoming election cycles may serve as a catalyst for renewed focus on housing-related policy levers. The rationale is straightforward: Younger voters may be more inclined to support administrations that address affordability concerns tied to one of the largest purchases of an individual’s lifetime.

One recent example is the proposed restriction on institutional investor home buying. The executive order provides broad direction but lacks detailed definitions — most notably around what constitutes a “large institutional investor.” Under the proposal, such entities would be subject to review by the attorney general and the chair of the Federal Trade Commission. Importantly, the order does not prohibit purchases outright; instead, it limits access to conventional mortgage guarantees. Additional provisions address built-to-rent homes and rental communities. That said, multiple research reports suggest institutional investors (in this case, defined as owning 50 or more properties) account for only 1%–2% of total home purchases, limiting the policy’s potential impact on overall affordability.

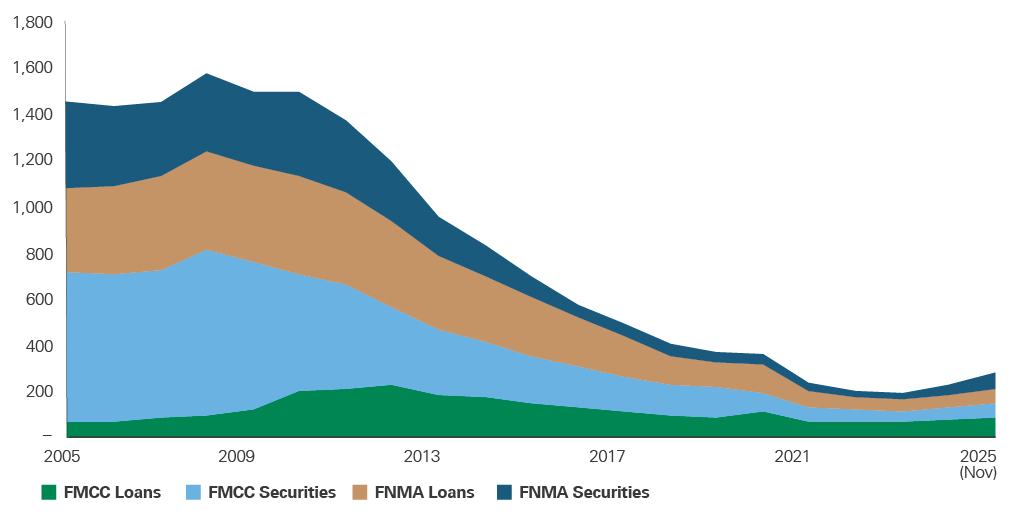

Another notable policy lever involves reform of the government-sponsored enterprises (GSEs), Fannie Mae and Freddie Mac. During the global financial crisis, both agencies were placed into conservatorship due to significant exposure to leveraged and deteriorating mortgage assets, raising questions about the implicit government guarantee backing their obligations. The Housing and Economic Recovery Act of 2008 (HERA) established the Federal Housing Finance Agency (FHFA) and imposed caps on the GSEs’ retained portfolios, which previously held substantial mortgage loans and securities, as detailed in Exhibit 4.

Exhibit 4: FNMA/FMCC Retained Portfolios

Key takeaway: Dormant GSE portfolios are quietly awakening and have capacity to grow.

The chart illustrates the combined retained portfolios of Fannie Mae (FNMA) and Freddie Mac (FMCC), separating loans and securities from 2005 through November 2025. Portfolio balances peaked prior to the global financial crisis, declined sharply following regulatory caps under HERA, and have recently begun to increase again. The visual suggests that previously dormant portfolios are beginning to expand, with room to grow under existing caps.

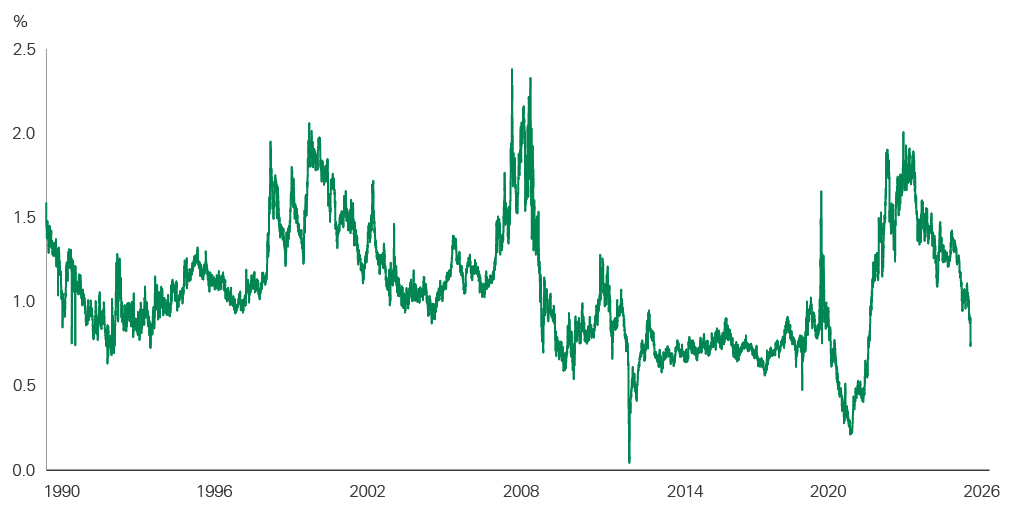

For much of the post-crisis period, these retained portfolios remained largely dormant. However, in the fourth quarter of 2025, the agencies resumed purchasing mortgage-backed securities (MBS), totaling approximately $50 billion. This activity helped compress mortgage spreads relative to Treasuries, directly reducing borrowing costs. In January of this year, the FHFA was directed to expand these purchases further. With the current retained portfolio caps set at $225 billion per agency — $450 billion in total — the GSEs have capacity to acquire roughly $200 billion in additional mortgages, which would compress the spread of mortgages over Treasuries. Given the political calendar, this activity could accelerate ahead of the November elections (Exhibit 5).

Exhibit 5: Mortgage Basis — Spread Over Treasury Bond

Key takeaway: MBS purchases reduce mortgage rate spread over Treasuries somewhat helping affordability.

The chart tracks the spread between mortgage-backed securities and comparable Treasury bonds from 1990 through January 2026. Spreads widened during periods of market stress, including the global financial crisis, and have fluctuated in recent years. The exhibit highlights how increased MBS purchases by the GSEs can compress spreads, modestly improving mortgage affordability.

Insights From Our Real Estate Advisory Team

- Many younger would-be homebuyers are pressing pause on a home purchase in favor of renting — by choice or simply because affordability remains out of reach. Mobility, student debt, elevated home prices, and mortgage rates still hovering near 6% are all playing a role. At the same time, the rising costs of repairs and maintenance, property taxes, insurance, and utilities may also be contributing to the hesitancy to own.

- For existing homeowners, higher mortgage rates remain a powerful deterrent to moving, resulting in limited inventory in most markets. As a result, while price appreciation has cooled in some growth markets, constrained supply is likely to hold overall home prices steady. Buyers who can pay cash or, in some cases, assume a seller’s mortgage are largely insulated from these rate headwinds. A meaningful decline in mortgage interest rates would require a drop in the 10-year Treasury yield, which we think is unlikely for the time being.

- Reflecting these trends, rental growth over the past year has remained solid in the multifamily properties Bessemer manages across select markets. However, operating costs have risen, and tenant concessions have been modestly increased to maintain high occupancy with tenants exposed to rising costs.

Andrew M. Feder

Head of Real Estate Advisory

Other Legislative and Policy Options

Beyond recent announcements, several additional policy avenues could stimulate housing activity. These measures could be pursued through congressional legislation, budget reconciliation, or executive authority. Examples include:

ROAD to Housing Act. This proposal would require congressional approval and may garner bipartisan support. While it includes potential federal tax credit adjustments, its primary focus is state-level deregulation — particularly zoning and permitting reform — that would directly address housing supply constraints.

401(k) and 529 withdrawals. This policy could be enacted through Congress or incorporated into a reconciliation bill. It would allow individuals to withdraw retirement or education savings without penalty for use toward a home down payment, targeting the demand side of affordability.

Mortgage assumability and portability. While less likely, these options remain under discussion. Assumability — potentially enacted by the FHFA — would allow a buyer to assume a seller’s existing GSE mortgage on a go-forward basis. Portability would permit borrowers to transfer their mortgage to a new property but would likely require congressional action and could face legal challenges related to due-on-sale clauses. Both measures would help alleviate mortgage rate lock-in, a key factor dampening housing turnover.

50-year mortgages. Proposed in 2025, this idea was ultimately dismissed due to concerns around excessive interest payments early in the loan’s life. While such loans would reduce monthly payments relative to 30-year mortgages, investor skepticism makes a revival unlikely.

Investment Implications

The housing market remains a sleeping giant. Historically, homeownership has represented the largest component of household wealth, and housing activity has the potential to contribute meaningfully to U.S. economic growth. While many proposed policy measures may have limited near-term impact, the downside to housing activity relative to historical levels appears constrained. Upside, though potentially slower to materialize, could be meaningful over time.

Bessemer portfolios maintain exposure across multiple segments of the housing market. Within equities, we hold positions with varying degrees of exposure across the housing ecosystem (e.g., mortgages, new construction, repair/remodeling). Currently, we hold positions in credit bureau holdings, Equifax and TransUnion, two of the main credit bureaus that provide essential individual consumer credit reports data and income analysis verification services that support banks and mortgage companies during mortgage origination and any new purchase or refinancing activity.

From a new construction standpoint, we hold positions within the roofing industry, including Carlisle Companies, a leading manufacturer of roofing materials and waterproofing solutions, and QXO, a leading roofing distributor of shingles, substrates, and components serving both the residential and commercial markets. Installed Building Products provides insulation and fire protection installation services. Repair and remodeling activity, often driven by existing home sales as many new homeowners undertake renovations after their purchase, is reflected in holdings such as Lowe’s Corporation, a leading home improvement retailer serving both do-it-yourself customers and professional contractors.

In fixed income portfolios, we hold both agency and non-agency MBS. Agency exposure provides a direct link to potential purchases by Fannie Mae and Freddie Mac through their retained portfolios. Non-agency exposure is concentrated in loans backed by median-priced homes with conservative loan-to-value ratios. Given the underlying housing fundamentals, the portfolio team views these positions as offering an attractive balance of risk and return.

Housing affordability remains central to the current low-turnover environment. Policymakers are likely to continue to focus on measures aimed at revitalizing housing market activity, potentially waking a sleeping giant. With this backdrop in mind, Bessemer’s investment teams are positioned in high-quality companies and fixed income holdings with strong credit characteristics.

Past performance is no guarantee of future results. This material is provided for your general information. It does not take into account the particular investment objectives, financial situations, or needs of individual clients and should not be construed as financial or legal advice. This material has been prepared based on information that Bessemer Trust believes to be reliable, but Bessemer makes no representation or warranty with respect to the accuracy or completeness of such information. This presentation does not include a complete description of any portfolio mentioned herein. Views expressed and information contained herein are current only as of the date indicated and are subject to change without notice. Forecasts may not be realized. The mention of a particular security is not intended to represent an investment recommendation. Index information is included herein to show the general trend in the securities markets and you cannot invest directly in an index.