Concentrated Wealth:

How Much Is Too Much?

- Concentrated exposure to the right company can create enormous wealth. But concentrated wealth can also create significant emotional, financial, and tax-related challenges, particularly for public company executives navigating complex rules and regulations.

- Effective diversification strategies can help preserve wealth over time. An executive’s goals should guide the plan.

- At Bessemer, we have extensive experience helping owners of concentrated wealth diversify effectively while managing risk, taxes, and long-term objectives.

We’ve all heard the adage about putting all your eggs in one basket. But for owners of concentrated wealth, sorting this out can be complicated. For many, their concentrated exposure created their wealth in the first place, making the decision to let go deeply personal and emotional. And diversifying usually means paying a significant percentage of those winnings to the government in the form of tax.

Some holders of concentrated wealth, particularly senior executives of public companies, simply can’t diversify easily, don’t want to, or worry about the signals it might send to board members, employees, or the market. While this whitepaper focuses primarily on issues faced by public company executives, some of the issues covered are relevant to others with concentrated wealth — such as private business owners, retirees, or inheritors whose net worth is tied to a single company.

Executives with concentrated exposure to their company should engage in proactive planning that incorporates investment, legal, income and estate tax, and philanthropic considerations — ideally coordinated by a team of seasoned professional advisors.

Key Questions for Owners of Concentrated Wealth:

- How much exposure should I have to one company?

- What size of a diversified portfolio do I need?

- Can I diversify?

- How should I diversify if I have multiple exposures?

- Should I hedge my stock?

Why Diversification Matters

Executives may be overconfident, as familiarity with the company and confidence in their leadership team can lead to underestimating risk and delaying diversification. Personal identity may be closely tied to company success, creating emotional barriers to prudent decision-making.

If an investor were building a stock portfolio from scratch, they might own a minimum of 25 companies to reduce the idiosyncratic risk that one bad investment could materially disrupt the overall portfolio. If an investor holds 25 stocks, each weighted at 4%, and one drops 90% in value — or goes bankrupt — it would be disappointing but not catastrophic. In practice, investors generally own many more than 25 companies, including exposure to different capitalizations (sizes of companies) and geographies. But the goal is the same — ensuring your future net worth is not heavily tied to the fortunes of just one company.

The Downside of Concentrated Wealth

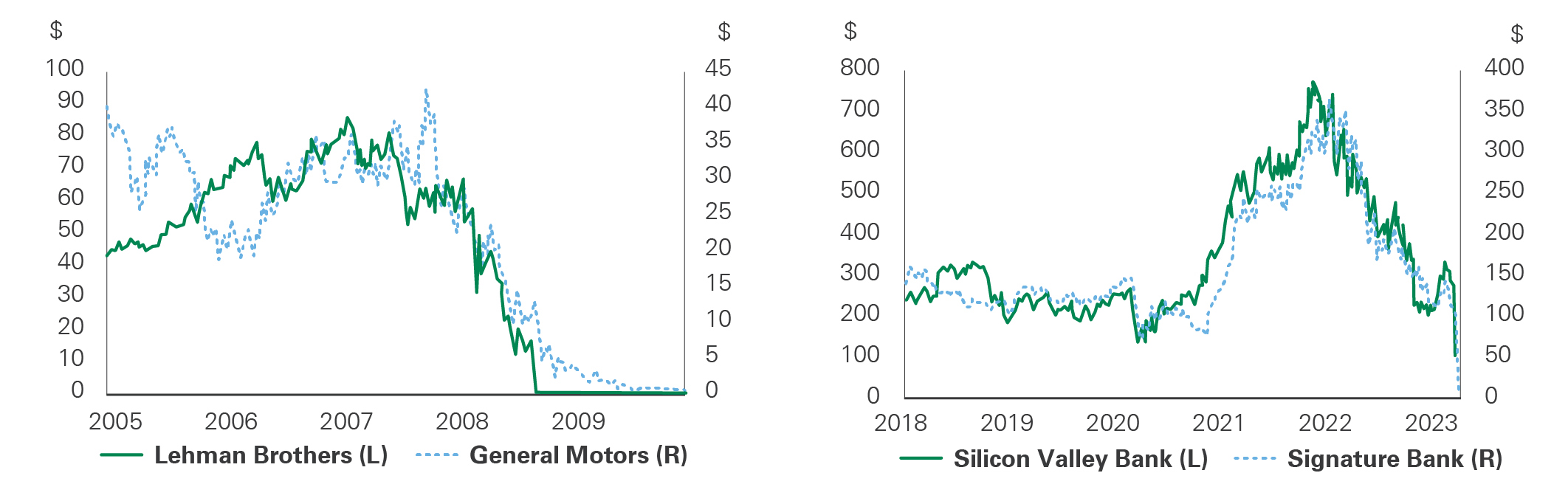

Sometimes very bad things happen to once prominent companies. The stories of Polaroid, Kodak, and Sears are well known — former industry leaders that failed to adapt, leaving shareholders with nothing. Exhibit 1 includes other examples.

Exhibit 1: The Ultimate Downside of Concentrated Wealth

Key takeaway: The ultimate risk of concentrated wealth is losing everything, which is rare but does happen.

Two adjacent line charts illustrate dramatic stock price declines for companies that suffered severe downturns. The left chart shows Lehman Brothers and General Motors falling toward zero during the 2008 financial crisis; the right chart tracks Silicon Valley Bank and Signature Bank, highlighting rapid collapses from peaks to near zero. This visual emphasizes the significant downside risk of highly concentrated equity positions.

Knowing that bad things can happen to leading companies and their shareholders, an owner of a concentrated position might aim to diversify so that their company represents roughly 4–5% or less of their net worth. Then, if the unthinkable happens, most of their wealth is protected. For corporate executives, this is often easier said than done, and sometimes not possible at all.

Once Prominent Companies with Stockholders Wiped Out

2001–2: Nortel Networks, Global Crossing

2008–9: Lehman Brothers, Bear Sterns, AIG, General Motors, Chrysler

2023: Silicon Valley Bank, Signature Bank

2025: Spirit Airlines, 23andMe

In some cases equity holders weren’t completely wiped out but suffered massive losses.

The Upside of Concentrated Wealth

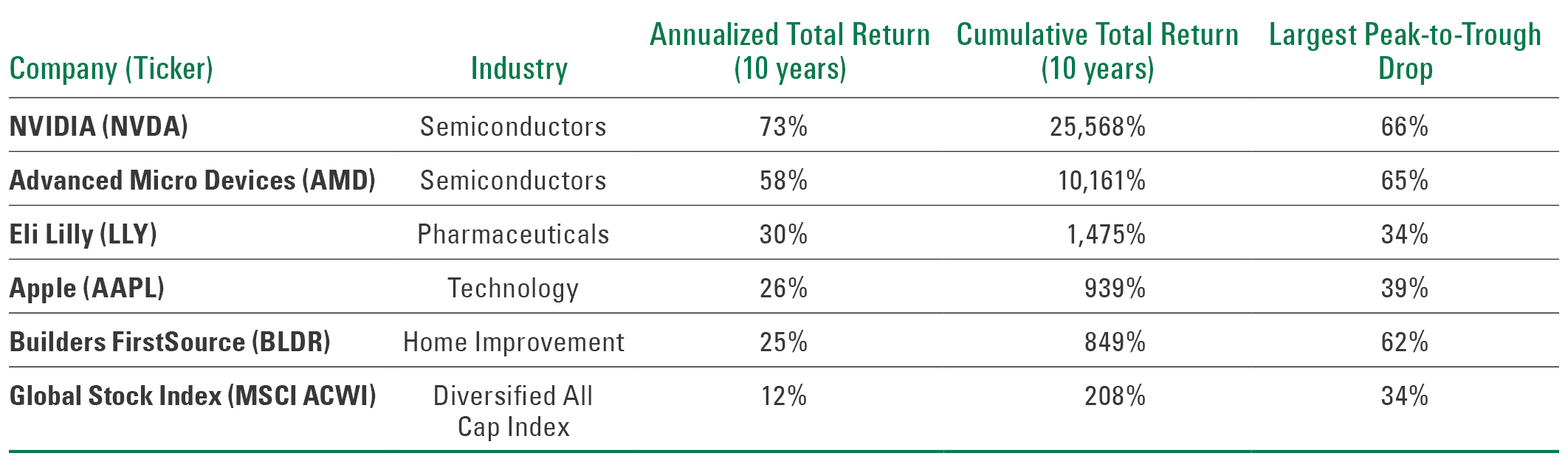

What if you told an NVIDIA executive 10 years ago to sell roughly 95% of their stock — and they did? The small amount they kept would still have performed remarkably well, but they would likely regret selling the rest. Exhibit 2 lists companies that have delivered extraordinary returns for their equity shareholders over the last decade. Concentrated wealth in the right company can be a powerful wealth builder.

But even these top-performing companies, that we can identify now with the benefit of hindsight, subjected their shareholders to major drawdowns along the way (see “Largest Peak-to-Trough Drop” column in Exhibit 2). An NVIDIA or Advanced Micro Devices executive would have seen two-thirds of their wealth disappear at some point over the last decade. Clearly, those who stuck it out were rewarded, but it can be a harrowing journey. Concentration brings the potential for both outsized returns and significant downside risk.

Exhibit 2: Concentrated Exposure Can Create Wealth

Key takeaway: Wealth concentrated in the right company can create enormous wealth, but the ride can be bumpy along the way.

A multi-column table lists several major companies alongside a global stock index, showing each entity’s industry type, annualized 10-year total return, cumulative 10-year total return, and the largest peak-to-trough drop over that period. The content highlights that while concentrated holdings in top-performing stocks may generate high long-term returns, they can also experience substantial interim volatility and drawdowns.

Clarifying Your Financial Goals

Advising owners of concentrated wealth isn’t as simple as telling them to sell all but 4–5% of their stock. The tradeoffs among risk, return, and taxes must be carefully considered. Exposure to the right stock could make you wealthy, while undiversified exposure to the wrong one can cause devastating losses — and it’s often impossible to tell which is which in advance.

Focusing on your financial goals first is a different way to think about diversification. How much do you need in a diversified portfolio (that is not dependent on one company) of stocks and bonds to meet your most important long-term goals? The answer is: It depends — on many things. Clarifying and quantifying your goals in advance is an integral part of the diversification process.

While we can’t know the future with certainty, financial modeling allows us to explore a wide range of potential outcomes for different variables. Key factors include investment horizon, future spending goals, gifting objectives (to family or charity), legacy priorities, capital market returns, and inflation.

As a simple example, assume executive Linda Smith wants to spend between $750,000 and $1 million per year, after tax and for life, with annual inflation adjustments. After running Bessemer’s Implication Model,1 we would conclude that a diversified 70% stock/30% bond portfolio of $25 million with a 4% initial withdrawal rate ($1 million in spending, growing with inflation) would give her roughly an 80% chance of meeting her spending needs over the next 30 years. If her initial withdrawal rate was 3% ($750,000 in spending, growing with inflation), her odds move to better than a 95% chance of success with that same $25 million portfolio. Regardless of how much stock she owns, focusing on $750,000 in annual spending and selling enough to set aside $25 million in a diversified portfolio (net of tax), would be a very prudent approach. No matter what happens to her company, she will be financially secure.

Strategies for Diversifying Concentrated Exposure

Regulatory Considerations for Executives

For public company executives, there are many rules to follow. There are times when executives simply can’t sell (e.g., blackout periods) or when they are in possession of material nonpublic information. Executives who are considered “insiders” under Section 16 of the Securities Exchange Act of 1934 must comply with strict reporting and other requirements, including Rule 144, which may require SEC or regulatory filings and adherence to volume and other sale restrictions. An executive must complete a Form 4 filing, which is a public disclosure submitted to the SEC whenever a company insider buys or sells shares of the company’s stock. Most companies also have internal policies and guidelines that govern what executives can and can’t do. The environment is complex — obtaining strong legal counsel is essential before moving forward with a diversification plan.

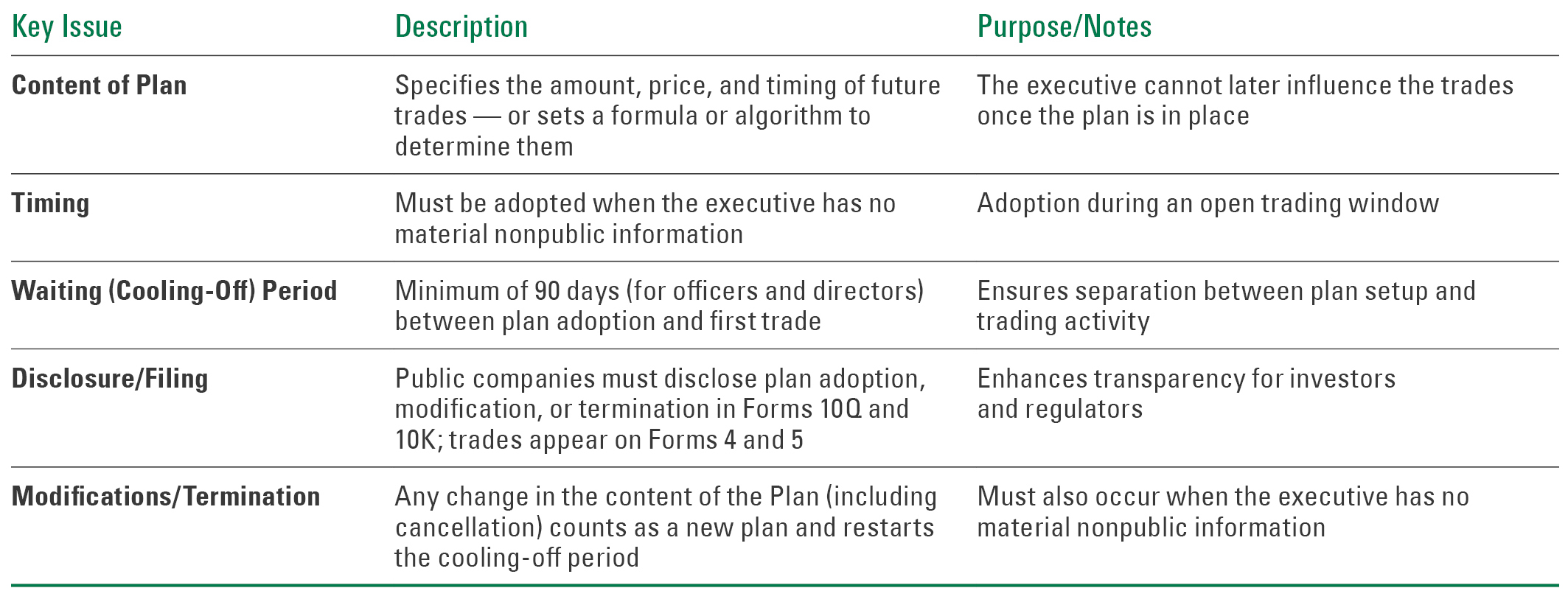

Diversifying Strategically: Managing Sales Through a 10b5-1 Plan

Large sales by insiders may be perceived by the market as a lack of confidence in the company, even if driven by sound financial planning. A 10b5-1 plan can help address this issue (Exhibit 3).

A 10b5-1 plan, established during an open trading window, allows an executive to diversify over time according to a predetermined plan. It signals to the market that the executive is pursuing a prudent, long-term diversification strategy rather than acting on a short-term view of the company’s stock. Key benefits of a well-executed 10b5-1 plan include disciplined diversification and affirmative defense against insider trading claims. This peace of mind allows executives to focus more on running the company and less on short-term share price movements.

Exhibit 3: 10b5-1 Plan Overview

Key takeaway: A 10b5-1 plan can help an executive diversify over time.

A structured table outlines the main components of a 10b5-1 trading plan used by corporate executives to diversify stock holdings. It explains plan purpose, timing of adoption, required cooling-off periods, disclosure and filing obligations, and rules for modifications or termination. The exhibit helps readers understand how the pre-arranged selling framework can support disciplined diversification while managing regulatory requirements.

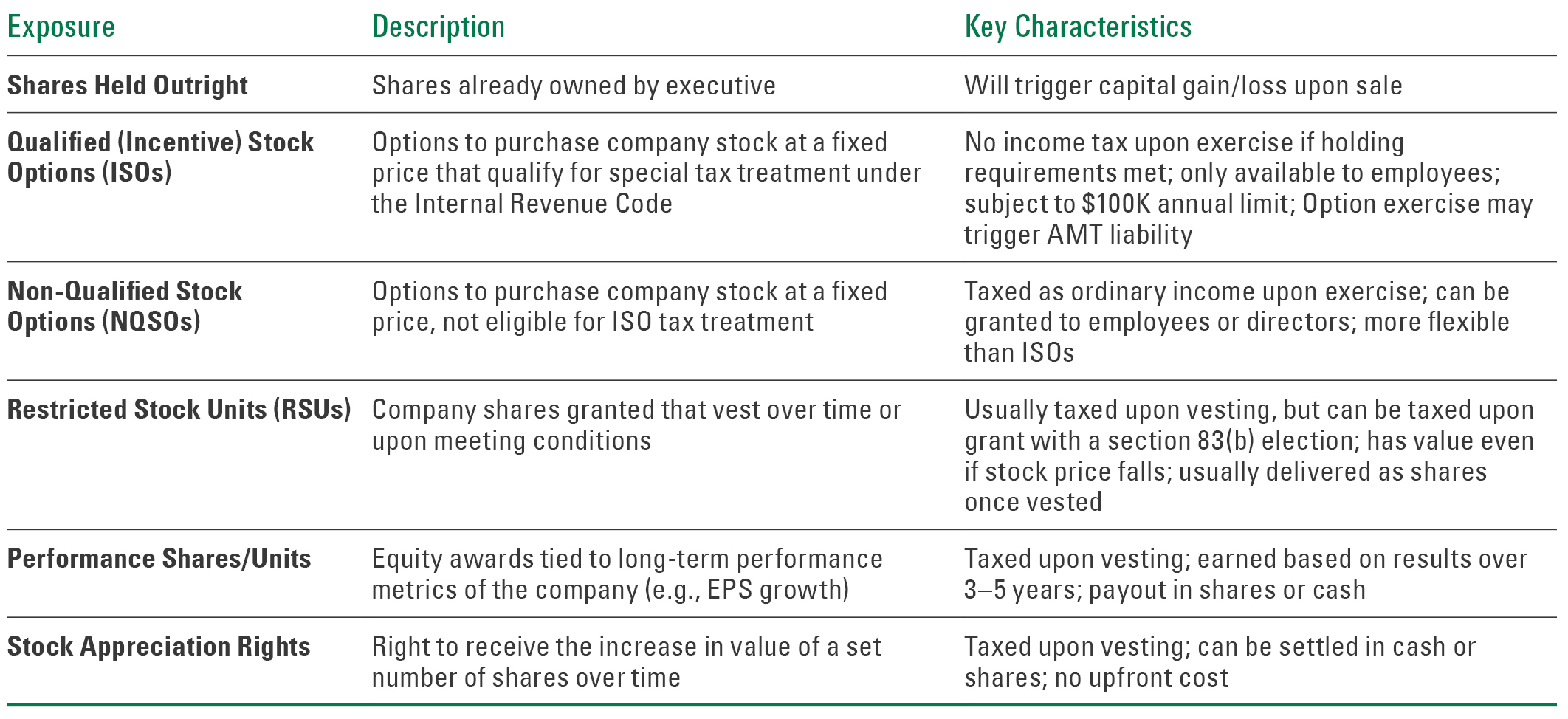

Multiple Forms of Exposure

Most executives have multiple exposures to their company. Importantly, their future wage income is highly correlated with the performance of the company and its stock price over time. In addition, executives often own stock outright and have additional exposure through stock options, restricted stock, and other forms of executive compensation (Exhibit 4).

Each exposure is unique, and the optimal diversification strategy depends on the executive’s specific situation. Most executives hold some shares outright. These may have been purchased to signal confidence to the board or market, or acquired through restricted stock that vested or option exercises over time.

Let’s say an executive read this whitepaper and determined they need to start building a diversified portfolio to feel financially secure. How do they start, given that each exposure carries unique tax and timing considerations?

As a simple example, assume Linda Smith holds:

- Directly held stock: If Linda sells the stock to diversify and it has a large, embedded gain, she will realize capital gains immediately. The good news is that if she has held the stock for more than a year, it will come with the lower federal long-term capital gains rate (23.8%). In some cases, however, that tax could have been avoided — for example, by donating shares to a charitable vehicle or by holding them until death, when heirs would receive a step-up in basis.

- Nonqualified stock options: If her options have already vested (meaning she is able to exercise them), ordinary income tax is due immediately upon exercise — and that tax can’t be avoided. The bad news is that these are taxed at her higher ordinary income tax rates. This tax is unavoidable, as most options must be exercised within a 10-year time frame.

So what does Linda do?

In many cases, exercising vested options and selling the shares immediately is the most efficient option. Once the option has been exercised, the shares can be sold without further tax cost. This may seem counterintuitive since capital gains tax on stock sales is typically lower than ordinary income tax on exercised options. However, one tax is potentially avoidable, and the other is not. Linda may not have enough nonqualified stock options to fully build a diversified portfolio, but they can be a good place to start, especially if any are set to expire soon.

As this simple example shows, the analysis is complex. Each form of exposure can have different rules, vesting schedules, and tax treatment, making coordinated planning essential. Having an integrated investment and tax team with expertise in executive compensation is critical to building an effective diversification plan.

Exhibit 4: Executive Compensation

Key takeaway: Executives often have a wide range of different exposures to their company.

A detailed table describes common forms of equity compensation and exposure for executives, including shares held outright, incentive stock options, non-qualified stock options, restricted stock units, performance shares or units, and stock appreciation rights. For each category, the exhibit provides key characteristics such as typical tax treatment, vesting schedules, payout structures, and associated risks, offering a clear reference on how each form contributes to concentrated wealth exposure.

Putting Proceeds to Work

Executives moving from concentrated to diversified exposure are transitioning from wealth creation to wealth preservation. The goal is to move from having most of their wealth tied to a single company to holding a diversified portfolio of stocks, as well as bonds and other asset classes.

The quickest way to reduce overall portfolio risk is by adding lower-risk assets such as bonds. But it is also important to build a diversified equity allocation as well — including large-, mid-, and small-cap U.S. stocks, as well as non-U.S. developed international and emerging market equities. Much of the risk of a single company is idiosyncratic, so adding broad stock market exposure reduces that risk. The right reinvestment approach can be customized for each client, but it usually includes exposures to a wide range of stocks and bonds, at a minimum.

Should I Hedge?

An executive with a large, concentrated stock position may prefer hedging over selling because selling can trigger significant capital gains taxes and eliminate future upside potential on the shares sold. Hedging the stock involves taking a position (e.g., using options or customized derivative structures) to mitigate the stock’s risk over a specific period of time. While potentially costly, it may be appropriate for executives who prefer to retain the stock, wish to defer tax costs, want to preserve a step-up in cost basis, or are an insider or affiliate. The tax treatment of hedging can be complicated depending on how the structure is settled, and care must also be taken to avoid a constructive sale, which would trigger immediate capital gains taxes.

For example (Exhibit 5), an exchange fund is a pooled investment vehicle that allows investors with highly concentrated stock positions to contribute their shares in exchange for a more diversified basket of securities without triggering an immediate taxable sale. Capital gains taxes are deferred, and if the executive is in the partnership for more than seven years, they can potentially extract shares of the more diversified portfolio. Exchange funds may be particularly interesting for older, retired executives who are trying to protect a potential step-up in basis while reducing their downside exposure during their lifetimes. While they may provide meaningful risk reduction and tax deferral, they also involve trade-offs: limited liquidity, long lock-ups, fees, and the possibility that the diversified portfolio may underperform.

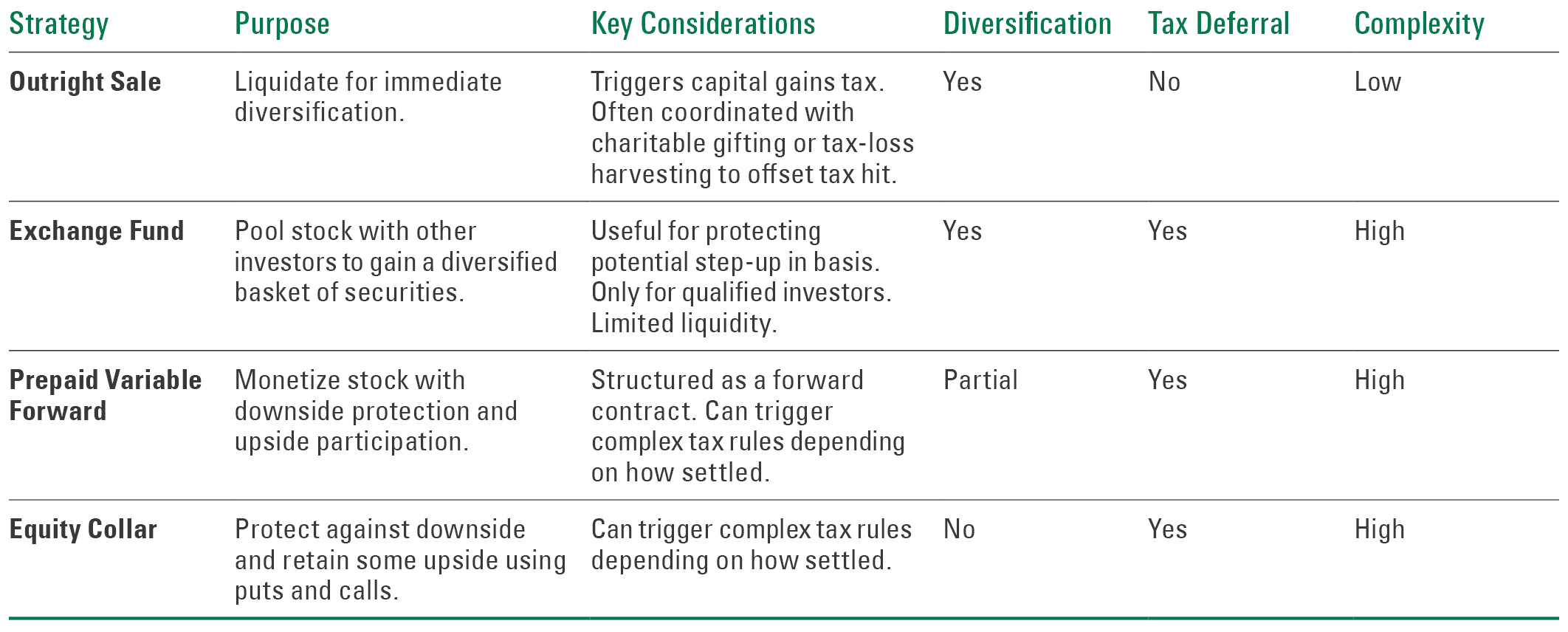

Exhibit 5: Selling vs Hedging

Key takeaway: Hedging alternatives should be evaluated, but there is no panacea — the right decision is unique to each client.

A comparative table shows different strategies executives might use to reduce concentration risk—such as outright selling, exchange funds, prepaid variable forwards, and equity collars—evaluated by purpose, diversification level achieved, tax deferral potential, complexity, and other factors. The exhibit highlights tradeoffs between methods and reinforces that the appropriate approach varies by individual circumstances.

Getting Back to the Family’s Goals

Integrating Concentrated Exposure with Wealth Transfer and Charitable Planning

In this diversification process, it is important for families and their advisors to step back and consider the big picture. A family’s goals — not taxes or short-term views on their company stock — should drive their plan. Executives developing a diversification plan should consider how their concentrated exposure might align with their multigenerational and charitable strategies. Two structures that are particularly interesting for holders of concentrated wealth are charitable remainder trusts (CRTs) and grantor retained annuity trusts (GRATs).

CRT

A CRT is a split-interest trust that provides income to a donor (the executive) for life or a set term, with the remaining assets eventually distributed to charity. A CRT funded with low basis stock is immediately able to diversify the concentrated exposure and reinvest the full proceeds without triggering a full, immediate tax hit (the tax ramifications occur gradually as the executive receives the income stream — the trust itself does not pay income tax). The executive also receives an upfront charitable income tax deduction based on the present value of the future charitable gift. The diversified portfolio inside the trust grows tax-deferred, while the executive receives an income stream. For executives seeking to diversify in a tax-efficient manner, create income, and support charitable causes down the road, a CRT can be an effective planning vehicle.

GRAT

A GRAT is an estate planning vehicle that allows a grantor (the executive) to transfer appreciating assets to heirs at little or no gift tax cost. Let’s say the executive, to be prudent, has diversified much of their exposure already, but they remain optimistic on their company shares. The executive can fund the GRAT with the directly held shares they retained, and if they are right and the stock continues to perform very well, much of the growth can occur outside of their taxable estate — which would otherwise be subject to a 40% federal estate tax rate. For executives trying to reduce their future estate tax burden and shift more money to the next generation, a GRAT can be a powerful tool with directly held shares that haven’t been diversified. Executives who are officers or directors or who own more than ten percent of any class of the company’s stock must be careful to comply with federal securities laws in the creation and administration of GRATs with the company stock.

How Bessemer Can Help

We have just scratched the surface on some of the issues facing executives who are holders of concentrated wealth. While diversification is often viewed through an investment and tax lens only, wealth transfer and charitable considerations loom large as well. Integrating investment, tax, and planning advice is essential for public company executives navigating these complex decisions. As a family office, Bessemer is uniquely positioned to provide objective advice on the many issues public executives face. To explore these strategies further, please contact your Bessemer advisor.

- Bessemer Trust’s Implication Model is a proprietary tool designed to help clients make better informed investment and spending decisions. Taking into consideration each client’s unique circumstances, the analytical model uses a Monte Carlo simulation to examine a wide range of potential outcomes for the capital markets. The model’s output highlights the likelihood of achieving different goals — for example, meeting spending requirements, growing assets, outpacing inflation, and managing risk.

Past performance is no guarantee of future results. This material is provided for your general information. It does not take into account the particular investment objectives, financial situations, or needs of individual clients. This material has been prepared based on information that Bessemer Trust believes to be reliable, but Bessemer makes no representation or warranty with respect to the accuracy or completeness of such information. This presentation does not include a complete description of any portfolio mentioned herein and is not an offer to sell any securities. Views expressed herein are current only as of the date indicated and are subject to change without notice. Forecasts may not be realized due to a variety of factors, including changes in economic growth, corporate profitability, geopolitical conditions, and inflation. The mention of a particular security is not intended to represent a stock-specific or other investment recommendation, and our view of these holdings may change at any time based on stock price movements, new research conclusions, or changes in risk preference.