Charitable Giving Under OBBBA:

Tax Strategies for 2025 and Beyond

- New tax rules are reshaping the deductibility of charitable contributions for high-income taxpayers. Some limits are tightening, others are becoming permanent, and a few new incentives are being introduced.

- Thoughtful timing and strategic planning can improve after-tax outcomes while supporting your philanthropic intentions.

- Consider accelerating select gifts now and evaluating strategies that could help you give more effectively under the new rules, such as using donor-advised funds and adopting a multiyear plan that coordinates cash and non-cash giving.

The newly enacted One Big Beautiful Bill Act (OBBBA) brings meaningful tax changes for high-income taxpayers starting in 2026. In particular, several new rules governing the deductibility of charitable contributions add complexity and limit the tax benefit.

If you’re planning to make a large charitable gift in the near future, consider revisiting your timing — especially before year-end — as the tax environment ahead creates a new set of considerations, particularly with regard to the size and timing of gifts. By acting early and with intention, you can support the causes you care about while also making the most of available tax benefits.

The strategies that follow can help you navigate these changes and give more effectively — now and in the years ahead.

Key Strategies for 2025: Make the Most of the Current Rules

Beginning in 2026, two new tax rules will limit the value of annual charitable deductions:

- You’ll only be able to deduct gifts that exceed 0.5% of your adjusted gross income (AGI) — a new floor that didn’t exist before. For donors who typically give below the 0.5% floor, this could mean missing out on deductions in future years. However, there are several tax strategies that could help avoid this scenario, notably “bunching” gifts in 2025.

- If your income puts you in the highest tax bracket, the value of your deductions will be capped at 35%, reducing the potential tax benefit — a new limit on the tax benefit of deductions. You’ll only receive up to 35 cents of tax benefit for every dollar you deduct. Importantly, this 35% cap is applied after other limits, such as the new 0.5% AGI floor and the existing AGI percentage ceilings (generally 60% for cash gifts and 30% or 20% for noncash). For high-income taxpayers, this further reduces the after-tax value of charitable gifts and makes timing, structuring, and vehicle selection even more important.

What the New 0.5% Floor Means

If your AGI is $1 million in 2026 and you donate $20,000, only the portion of the gift above $5,000 (0.5% of AGI) is deductible — in this case, $15,000. Bottom line: Annual giving that doesn’t exceed the 0.5% AGI threshold may produce no tax benefit beginning in 2026 — a key reason why strategic timing and gift sizing matter more than ever.

Front-Load Giving Using a Bunching Strategy

A bunching strategy allows you to group multiple years’ worth of charitable gifts into one tax year to generate a larger deduction — and with major rule changes coming next year, it may be especially valuable to act before year-end.

Bunching can be matched with complementary strategies to increase tax efficiency and philanthropic impact.

Use Donor-Advised Funds to Maximize Flexibility

Pairing a bunching strategy with a donor-advised fund (DAF) can add valuable flexibility to your giving. A DAF allows its account holder to make a large tax-deductible contribution in one year and draw upon that contribution to recommend grants to charities over time. This structure enables donors to select recipients and determine grant amounts without undue time pressure.

Additional benefits of using a DAF include:

- Potential for tax-free growth of contributions

- Simplified recordkeeping for charitable contributions

- Opportunities to engage family members in philanthropic decisions

As a Bessemer client, you have exclusive access to a Bessemer DAF account. To find out more, please contact your Bessemer advisor.

Give Appreciated Stock

Contributing long-term appreciated stock (LTAS) remains highly tax-efficient, especially when used in 2025 to complement a bunching strategy or fund a DAF. Donors can avoid embedded capital gains tax on stock held for more than one year while receiving a deduction equal to the stock’s fair market value, subject to AGI limits.

Making gifts in 2025 with these strategies in mind can help you take advantage of more generous tax benefits before the new 0.5% AGI floor and the 35% itemized deduction cap take effect in 2026.

Case Study: Why 2025 Timing Matters

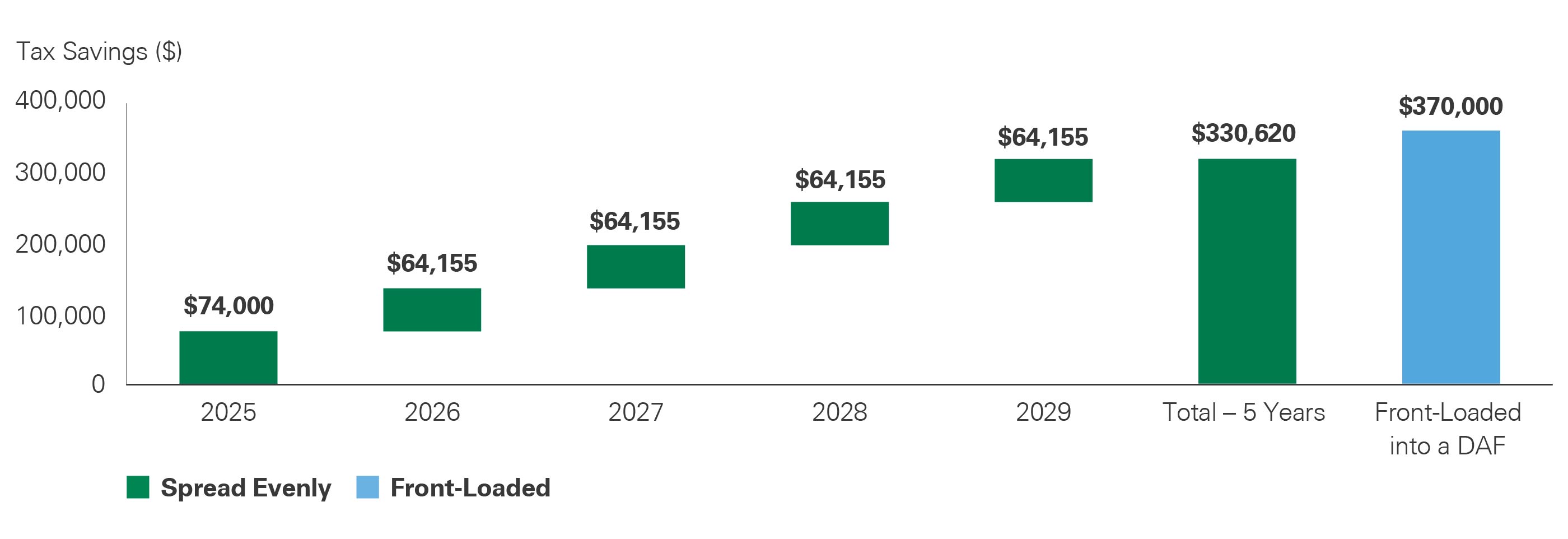

Key takeaway: A family with annual AGI of $3.34 million plans to give $1 million to charity. The table below compares the impact of front-loading the full amount to a DAF in 2025 versus giving in equal $200,000 increments over five years, based on current tax law (37% top rate in 2025) and future rules, including a 35% deduction cap and a 0.5% AGI floor starting in 2026.

A comparative table illustrating the after-tax outcomes of a family with $3.34 million in adjusted gross income giving $1 million to charity. One column models front-loading the entire gift into a donor-advised fund in 2025 at the higher 37% tax rate under current rules. The other models spreading $200,000 per year over five years under future rules that include a 0.5% adjusted gross income floor and a 35% deduction cap starting in 2026. The exhibit shows that timing the full donation in 2025 results in greater allowable deductions and higher total tax savings compared to spreading the gifts across multiple years.

Strategies for 2026 and Beyond: Planning Under the New Rules

Coordinate QCDs and SALT Planning

For those age 70½ or older, qualified charitable distributions (QCDs) from IRAs continue to be an effective strategy, especially in the new environment:

- QCDs reduce AGI directly and don’t rely on itemizing, mitigating the effect of the 0.5% floor and the overall limitation on itemized deductions for high-income taxpayers.

- QCDs satisfy required minimum distributions (RMDs).

- By lowering AGI, QCDs can help preserve deductibility of state and local taxes (SALT), which remain capped but may be more favorable when AGI is reduced.

Note: DAFs do not qualify for QCDs; only direct gifts to eligible public charities are permitted. Additionally, each taxpayer is limited to a QCD of $108,000 in 2025. This amount increases to $115,000 in 2026.

Sequence Roth Conversions After QCDs

If QCDs are part of your plan, consider making them early in the year to reduce AGI and satisfy RMDs. This can improve the tax environment when evaluating Roth conversions later in the year. Coordination with marginal tax brackets, Medicare premium adjustments, and SALT deductibility should be considered with the Roth conversion.

Other Rules to Know

Starting in 2026:

- A charitable deduction of up to $1,000 (single filer) or $2,000 (married filing jointly) becomes available to nonitemizers for cash gifts to qualified public charities. This does not apply to gifts made to DAFs, supporting organizations, or private foundations.

- Improved coordination rules will make it easier to combine cash and non-cash gifts in the same year without conflicting AGI limits. For example, taxpayers will be able to use cash gifts to “top off” their long-term appreciated stock donations and still take full advantage of the 60% AGI limit for the cash portion — something not possible under earlier rules.

And in 2027:

- A new nonrefundable federal tax credit (up to $1,700 per taxpayer) becomes available for contributions to state-approved K–12 scholarship organizations. Taxpayers must choose between taking the federal credit or a deduction, and any state benefit reduces the value of the federal credit.

Crafting a Plan That Works for You

There’s no one-size-fits-all approach to charitable planning — especially in a changing tax environment. The right strategy depends on several factors, notably your philanthropic and legacy goals as well as timing and your individual financial profile.

With key rule changes taking effect in 2026 and a limited window of opportunity in 2025, now is a valuable time to review your charitable giving plans. Whether you’re considering a large gift, thinking of establishing a donor-advised fund account, or coordinating IRA distributions, proactive planning today can help maximize your impact tomorrow.

Your Bessemer Trust advisor, together with our tax and donor-advised fund professionals, can help you navigate these changes and develop a personalized giving strategy that aligns tax efficiency with your philanthropic priorities.

More On Charitable Giving

The information and opinions contained in this material were prepared by Bessemer Trust, and is for informational purposes only. It does not take into account the particular investment objectives, financial situation, or needs of any individual client. This material is based upon information obtained from various sources that Bessemer Trust believes to be reliable, but Bessemer makes no representation or warranty with respect to the accuracy or completeness of such information. The views expressed herein do not constitute legal or tax advice; are current only as of the date indicated; and are subject to change without notice. Bessemer Trust does not provide legal advice. Please consult with your legal advisor to determine how this information may apply to your own individual situation. Whether any planned tax result is realized by you depends on the specific facts of your own situation at the time your taxes are prepared.