The Real Estate Legacy Challenge: Keeping Your Home in the Family

- Keeping a family home as a legacy for future generations is a complex undertaking and difficult to do successfully.

- Managing the relationships between family members, the diverse financial capabilities of individual family members, the inevitable differences of opinion about how to keep and use the home, and the costs of maintaining the property — all of these issues are difficult to accommodate in planning.

- If you're hoping to retain your home for future generations, and willing to grapple with the many challenges, a plan that establishes a suitable ownership structure, provides funding to care for the home, and establishes policies and practices that foster family harmony offers the greatest chances for a lasting legacy.

Real Estate Is Personal

For many families, summer homes, ski houses, ranches, farms, and even apartments are often retreats where family ties are strengthened and cherished memories are created. They are places of deep emotional attachment, and the desire to retain them for the enjoyment of future generations is only natural.

That said, retaining a home over multiple generations is, in our experience, highly dependent on the personal relationships of the individuals involved and rarely successful after the first generation.

While the complexities of tax and estate planning often drive property retention plans, family dynamics and practical management issues are just as important.

Being mindful of the needs of future generations who may have different priorities, interests, and connection with the property than you do today is essential but difficult to address in a management plan.

Working with experienced real estate and planning professionals, you can craft a comprehensive strategy for managing your home that:

- Accomplishes necessary tax and estate planning.

- Addresses high-level decision-making processes, such as major renovations and transfers of authority.

- Establishes effective policies and practices for day-to-day governance.

- Accommodates your family's changing needs and desires over time.

Nevertheless, the interpersonal, or “softer,” considerations — along with the financial commitments of property retention — typically stress even the best planning

Creating a shared-use plan with your family can reduce the potential for discord and make the ownership experience more rewarding.

Avoiding a House of Cards

The seemingly small and mundane issues of day-to-day use can often get in the way of successful estate planning. Simple things — like cleaning or replacing a broken screen door — can generate resentment that builds into conflict over time.

Creating a shared-use plan with your family can reduce the potential for discord and make the ownership experience more rewarding.

In broad terms, a well-crafted governance plan should address the following:

- Fairness. A family member’s ability to use the property can be affected by travel time, available vacation, and financial circumstances. An effective governance plan considers different situations and levels of usage among family members.

- Differences of opinion. One family member wants to install central air conditioning while another prefers to continue the longstanding practice of opening windows and letting the breeze blow through. Or maybe some family members look for perfection in terms of property upkeep while others are comfortable with a more casual approach.

In short, differing opinions about maintenance and improvements can cause discord. The most successful plans encourage cooperation while accounting for differing priorities, aesthetic preferences, and financial commitment within a structure that provides processes for resolving disputes. Issues may be addressed internally, or when necessary, some plans include engaging an impartial mediator. - Ownership flexibility. Even in the closest-knit families, some family members may eventually wish to sell their interest in the home. A clear way to transfer an interest encourages successful long-term (and useful) retention of properties.

- Plan for revisions. A well-crafted plan should be specific and alterable with straightforward provisions designed to encourage harmony and cooperation.

Long-Term Management

With the above guidelines in mind, what specific considerations for crafting an effective long-term management plan should you address?

While issues (and their solutions) will be unique to your individual family and property, many of the same considerations do tend to crop up over time:

- Use. It is a good idea to establish a clear understanding about who can use the property and how:

- Is it okay for college-age family members to use the property with friends?

- Should divorced spouses with children be permitted to enjoy the house?

- Can family members bring pets? Will they responsible for damage?

- Will renting the house to unrelated parties be acceptable? If so, how will available rental periods and fair market rents be determined?

- How is unequal usage by family members treated?

- Occupancy Cost. Use of the property by family members will generate added expense directly related to any occupancy. You may consider establishing occupancy fees paid in advance of use. This type of fee for the variable cost of cleaning, small repairs, and property management associated with use can encourage responsibility and foster feelings of fairness among family members not using the property.

- House rules. If a property can accommodate multiple family units, many families find it helpful to establish “house rules” that help family members minimize conflicts when they are using the property together (quiet times, cleanup responsibilities, etc.) and, for any property regardless of the size, to ensure basic standards of care.

- Calendaring. A sensible reservation system is critical. Among the many options:

— First come, first served.

— Rotating first selection.

— More complex arrangements with limitations on total number of days.

Whatever you decide, the plan should be clear and modifiable by the participants.

Especially in the early years, it may be helpful to schedule periodic reviews and discussion about how the calendaring plan is working and what sort of modifications could make sense. - Preparing the home for use. Depending on the frequency of use, the number of family members, and the nature of the home, guidance around opening, cleaning, and small repairs or replacement of items after use should be established and well understood:

— How should the house be cared for?

— Who cleans after use?

— What is the responsibility of any user to point out needed repairs?

— Who can hire and instruct vendors, and should there be a third-party manager?

These may seem like simple matters, but good planning should result in a great benefit for all who enjoy the property in the future.

You should think about the broader impact of needed capital resources on generational wealth since future generations are likely to have divergent means and may have other needs for the resources dedicated to the home.

- Finances. It’s important to be realistic about the condition and functional age of your home. The capital needed on reserve and prudently invested to care for the property can vary considerably depending on the desired outcome.

As part of your legacy, will there be adequate funds available to meet the property’s long-term operating and capital needs as well as contingency for unexpected costs? Without sufficient reserves, any expectations of long-term retention of the property are likely not realistic and will place a burden on future family members.

An annual budget for property operation and improvements is a good starting point for capital planning. It is helpful to consider the current operating costs of the property, the value of the home and any other structures, and the estimated useful life for the improvements.

You should think about the broader impact of needed capital resources on generational wealth since future generations are likely to have divergent means and may have other needs for the resources dedicated to the home.

- Written approval of the plan. While having your family periodically agree to the plan in writing sounds very formal, it can be a simple process.

Being reminded about the terms of the agreement can have a positive influence on the participants. - Transparency. Establish a process where family members receive timely information regarding calendar, budget, and decision-making.

Successful Shared-Use Agreements Are Highly Detailed

It's almost impossible to be too granular when it comes to shared-use agreements. A few sample provisions illustrate how personal and detailed these can be:

- Each of the Parties is entitled to their own bedroom in the house (“Personal Bedroom”), which shall be the bedroom each Party occupied when the main house was built.

- Each of the Parties can bring up to two “bedrooms’-worth” of guests. Additional guests may be invited, subject to prior approval by the President.

- If you have eaten any food or drinks that you did not purchase, replace them. If you have used the last paper towels or toilet paper, replace them (these costs can be shared among the users of the house if necessary).

- John Smith may use the master bedroom or any room in the guest house, subject to providing one week’s advance notice to the Managing Member.

- Make the beds with clean sheets and put clean towels in the bathrooms. Make sure all dirty linens have been cleaned and returned to the proper bedrooms.

- With respect to common areas, the Parties acknowledge that there will be a ‘stand-still’ with respect to decorating, and that no changes will be made unless all Parties are in agreement. Personal Bedrooms will not be subject to this ‘stand-still’ arrangement, and you may furnish at your discretion.

As you can see, the practical nature of these rules depends on personal responsibility and cooperation of all the parties. As disarmingly simple as they are, it is easy to see how they can fail if a family member does not cooperate.

Transferring the Property

If you’re thinking about passing your home on to future generations, you should consider a number of questions:

- How is the property going to be transferred to the next generation in a way that enhances the chances for a successful outcome for your family over time? Outright? In trust? In a corporate entity?

- When should control of the property be transferred to the next and subsequent generations?

- To whom should the property be transferred? To the entire next generation or only to a select few? If the latter, will you provide compensating gifts/bequests for the others?

These considerations center on the intricacies of tax and estate planning, a full discussion of which is beyond the scope of this paper.

All of the following approaches can achieve the goal of transferring a property to family members, but they do so in different ways.

- Direct transfer as a gift or bequest. While it is possible to transfer a home directly to family members via a bequest in a will, doing so is unlikely to fulfill any of the desire to preserve ownership across generations since the individuals will each have deeded interests in the property and control will be vested in them.

What It Really Costs to Keep a Home in the Family

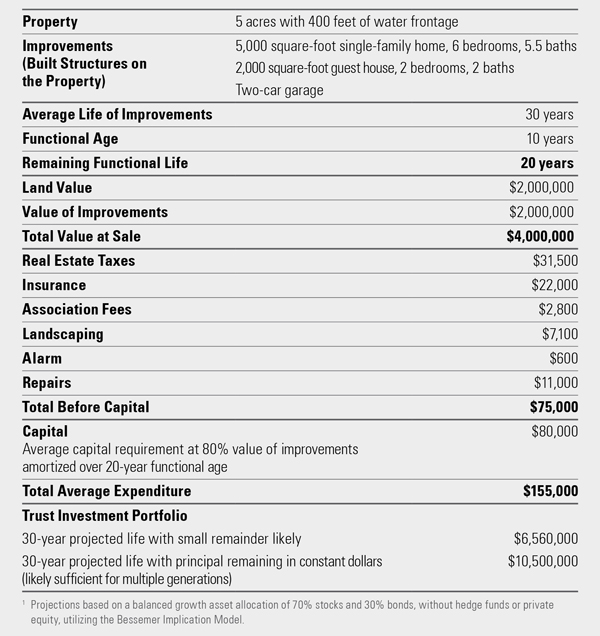

How much money would you need to place in a trust (or other vehicle) to provide enough income to pay for all of the annual operating and capital needs of a home? In the following example, we provide two estimated projections1 for maintaining a home valued at $4 million. In each case, the trust would need to provide an average of approximately $155,000 per year to cover upkeep, repairs, insurance, and real estate taxes, as well as capital investment to maintain the improvements:

- A single-generation retention, based on a 30-year projection in a balanced growth model portfolio with a likely small residual value at the end of the term: You would need to place over $6 million in the trust.

- Retention over multiple generations, based on a 30-year projection in a balanced growth model portfolio with a high likelihood that the trust funding would remain in constant (inflated) dollars at the end of term: You would need to put more than $10 million in the trust.

No estimates of income taxes on the trust investments were taken, since they are highly dependent on location, treatment of gains, and taxable income. Allowance for income taxes would require additional initial funding in each example.

- A trust provides greater control of management, use, and sale but is difficult to revise. Placing the vacation home in an irrevocable trust allows for greater control of property management and decisions regarding the use, management, and sale of the property.

- The trust agreement can define roles and expectations for the next generation.

- Trusts can provide protections for the property in the event of divorce, family disputes, and actions by creditors.

- Income-producing assets can be placed in the trust to allow for cash flow to pay ongoing property maintenance, reducing family burdens.

- Irrevocable trusts cannot be easily changed or revised. They offer little flexibility when it comes to transferring ownership, adding owners, or paying for expenses

The Two Biggest Reasons Plans Fail

Funding. Long-term real estate retention plans are problematic when underfunded. If your goal is to have successive generations of your family involved with the home, it’s likely that your descendants will have differing financial means. An otherwise well-crafted plan that fails to provide sufficient funding can undermine the intent of your generosity.

Flexibility. When you establish a multigenerational home retention plan, you’re setting the stage for descendants you have not met and who may well have different perspectives, priorities, and even tastes than you do. In addition, over time, conditions at the property may change due to development or other community economic changes. It’s important to craft a management plan flexible enough to adapt to changing family and other circumstances.

- A limited liability company (LLC) and limited partnership (LP) offer the greatest amount of control and flexibility. These entities are often used within a trust to isolate the real asset from the balance of the trust or to allow proportionate interests to be held in separate trusts. Either within a trust or as an independent entity, holding a vacation home in a business entity allows for greater control over property management and disposition than is possible with a simple transfer.

- With the formation of an LLC or LP, you can establish an ownership structure that meets your expectations regarding managing the property (how expenses are paid, repairs/maintenance, usage, and renting to third parties, etc.), memorializes processes for avoiding and resolving family conflicts, and ensures the family’s wishes are met until the LLC or LP winds down or is dissolved.

- Governing documents establish guidelines and parameters for how members or partners can transfer or dispose of their interest.

- Unlike an irrevocable trust, governing documents can be revised as needed when situations and goals change.

- An LLC can be funded with income-producing assets to help maintain the property.

- LLCs provide significant protections against liability claims, creditors, family disputes, divorce, and attempts to force a sale.

Many of these ownership structures can be quite complex and may be used in combination — e.g., a trust owning an LLC with title to the property. The right choice will depend upon numerous family-specific factors as well as a thorough professional review of the relevant tax and estate planning implications.

Should a Future Sale Be Prohibited?

While the goal of keeping a home in the family is understandable, and a possibility with proper planning, the desire to retain it across multiple generations could diminish over time, and any plan should provide for an ability to sell the property.

Future generations may not have the same connection to the family home as you do, and regular use of the property by geographically distant family members may not be feasible. It may become too costly to maintain the property, or there may be financial needs to support with the proceeds from the sale of the property.

There should always be an available avenue to sell the property and either retain the proceeds for the benefit of the family or distribute them. However, the governance for a sale may be restrictive to ensure that a sale is prudent and supported by a sufficient proportion of the members involved at the time.

Create a Plan that Works for You and the Future Generations

Keeping a home in the family over multiple generations is a complex undertaking involving family dynamics, practical management issues, and the myriad tax and estate planning intricacies involved in the transfer. In most cases, it will be challenging, and caution should be taken when considering this type of legacy.

If you do decide to pursue a long-term property retention plan, clear and open family communication and the guidance of experienced planning professionals to formulate a flexible strategy will offer the best chances for a lasting legacy.

If you would like to learn more about preserving your home for future generations, please contact your client advisor, who can arrange for you to speak with our real estate advisory and estate planning professionals.

Past Performance is no guarantee of future results. This material is for your general information. It does not take into account the particular investment objectives, financial situation, or needs of individual clients. This material is based upon information obtained from various sources that Bessemer Trust believes to be reliable, but Bessemer makes no representation or warranty with respect to the accuracy or completeness of such information. Views expressed herein are current only as of the date indicated, and are subject to change without notice. Forecasts may not be realized due to a variety of factors, including changes in economic growth, corporate profitability, geopolitical conditions, and inflation. Bessemer Trust or its clients may have investments in the securities discussed herein, and this material does not constitute an investment recommendation by Bessemer Trust or an offering of such securities, and our view of these holdings may change at any time based on stock price movements, new research conclusions, or changes in risk preference.