Retirement Planning for the Self-Employed

- When it comes to saving for retirement, self-employed individuals have no access to corporate 401(k)s or other employer-sponsored plans. Like everything else related to their employment, the responsibility for retirement planning is theirs alone.

- Still, if you’re self-employed, you have many retirement planning options, some of which offer greater opportunities to reduce taxes and build retirement savings than the various employer-sponsored retirement plans.

- In this A Closer Look, we review several of the most effective and popular retirement planning options for self-employed individuals.

Being self-employed can offer a number of advantages, but a ready-made retirement plan is not one of them. No matter how you earn your self-employment income — as a business owner, an independent contractor, or perhaps by serving as a board director — you won’t be able to rely on a corporate 401(k) plan, a pension, or any other sponsored plan to save for your retirement.

You do, however, have a number of planning options that will allow you to reduce taxes and maximize tax-deferred retirement savings. In some cases, you may be able to make larger tax-deductible contributions than your corporate employee peers.

The Options

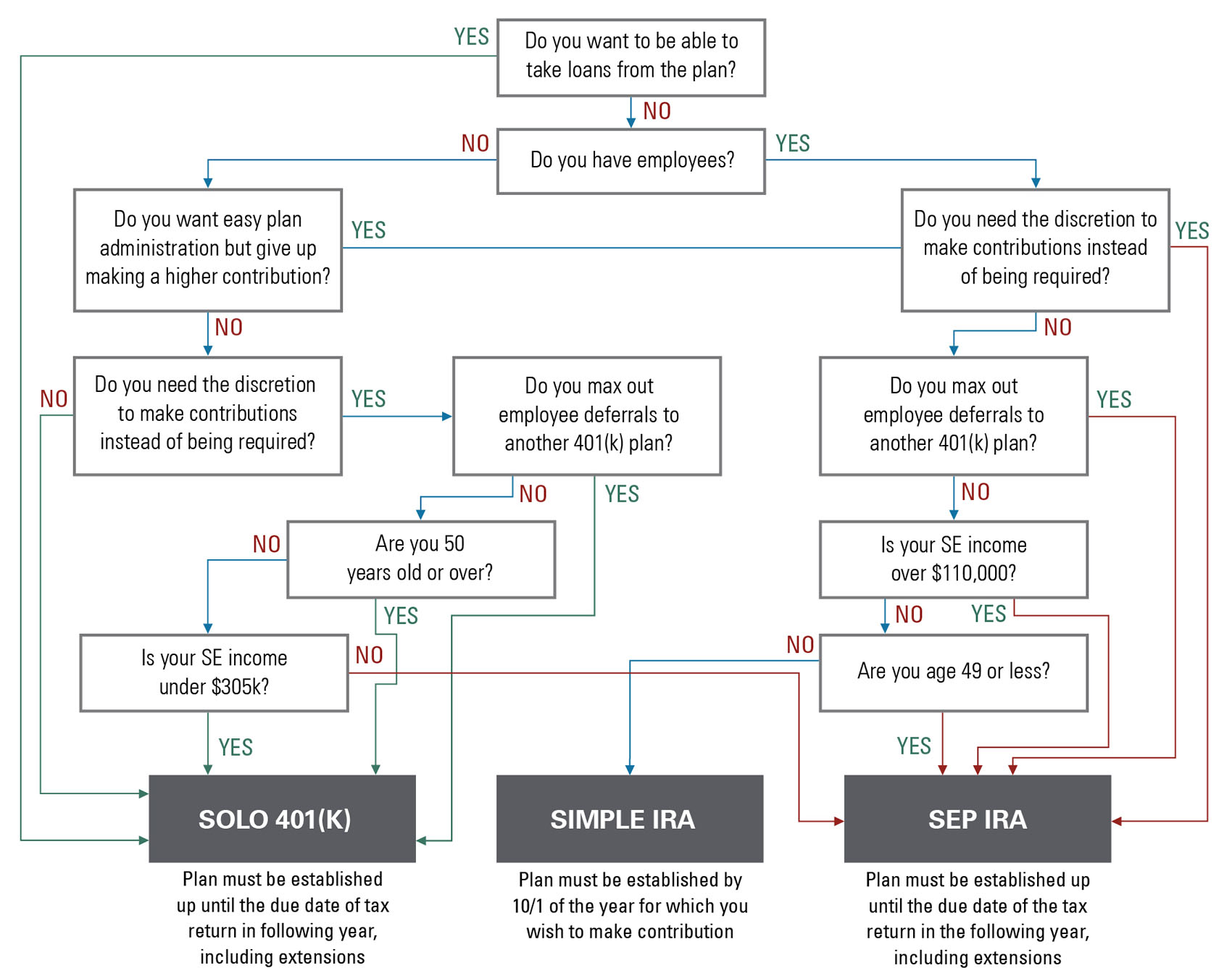

SIMPLE IRA plan (Savings Incentive Match Plan for Employees). A SIMPLE IRA plan allows self-employed individuals and some small employers to set up a tax-favored retirement plan for their own (and, if they have any, their employees’) benefit. Essentially, it is a written salary-reduction agreement that allows you, as an employer, to contribute salary reductions to a SIMPLE IRA on your behalf (and on behalf of eligible employees). They are easy to establish and require minimal paperwork and no special IRS reporting.

Among the potential disadvantages are comparatively low contribution limits ($14,000 per year, $17,000 if 50 years old or older, in 2022), an employer-match requirement of up to 3% of the employee’s salary or a single contribution of 2% of the employee’s salary if establishing SIMPLE IRAs for employees, and withdrawal penalties during the first two years of the plan. As detailed below, a solo 401(k) or SEP IRA will offer more tax efficiencies and higher contribution amounts for self-employed individuals without employees.

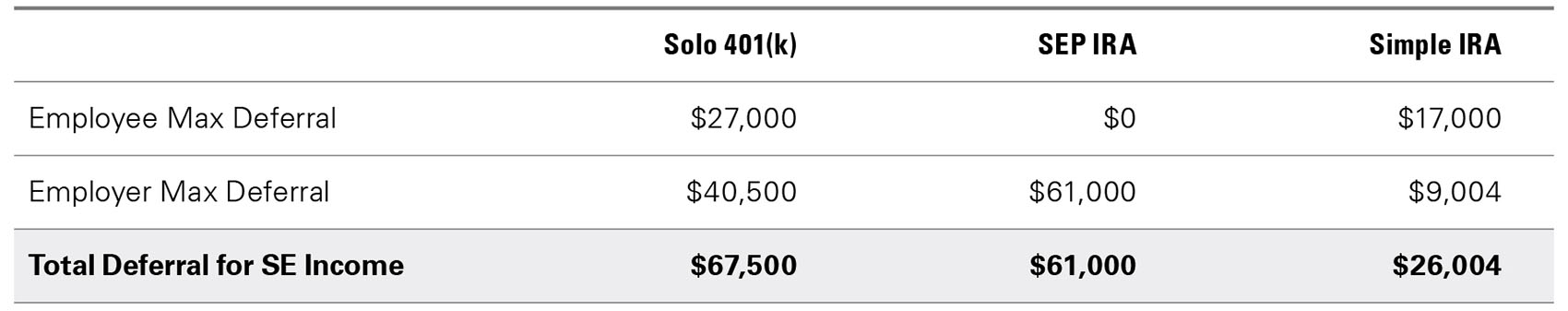

Solo 401(k). If you have no employees, you can use a solo 401(k). In some ways, these plans function like regular corporate 401(k)s, but they allow you to make contributions as both employee and employer. Additionally, solo 401(k)s offer flexibility to change the employee contribution amounts annually to match your saving needs.

The paperwork involved in a solo 401(k) is slightly more involved than for a SIMPLE IRA, and once your plan is greater than $250,000, you would need to file an annual IRS Form 5500-EZ (for custodial accounts at Bessemer this can be handled on your behalf). That said, solo 401(k)s can offer greater contribution potential than SIMPLE IRAs and SEP plans, depending on the amount of your self-employment income.

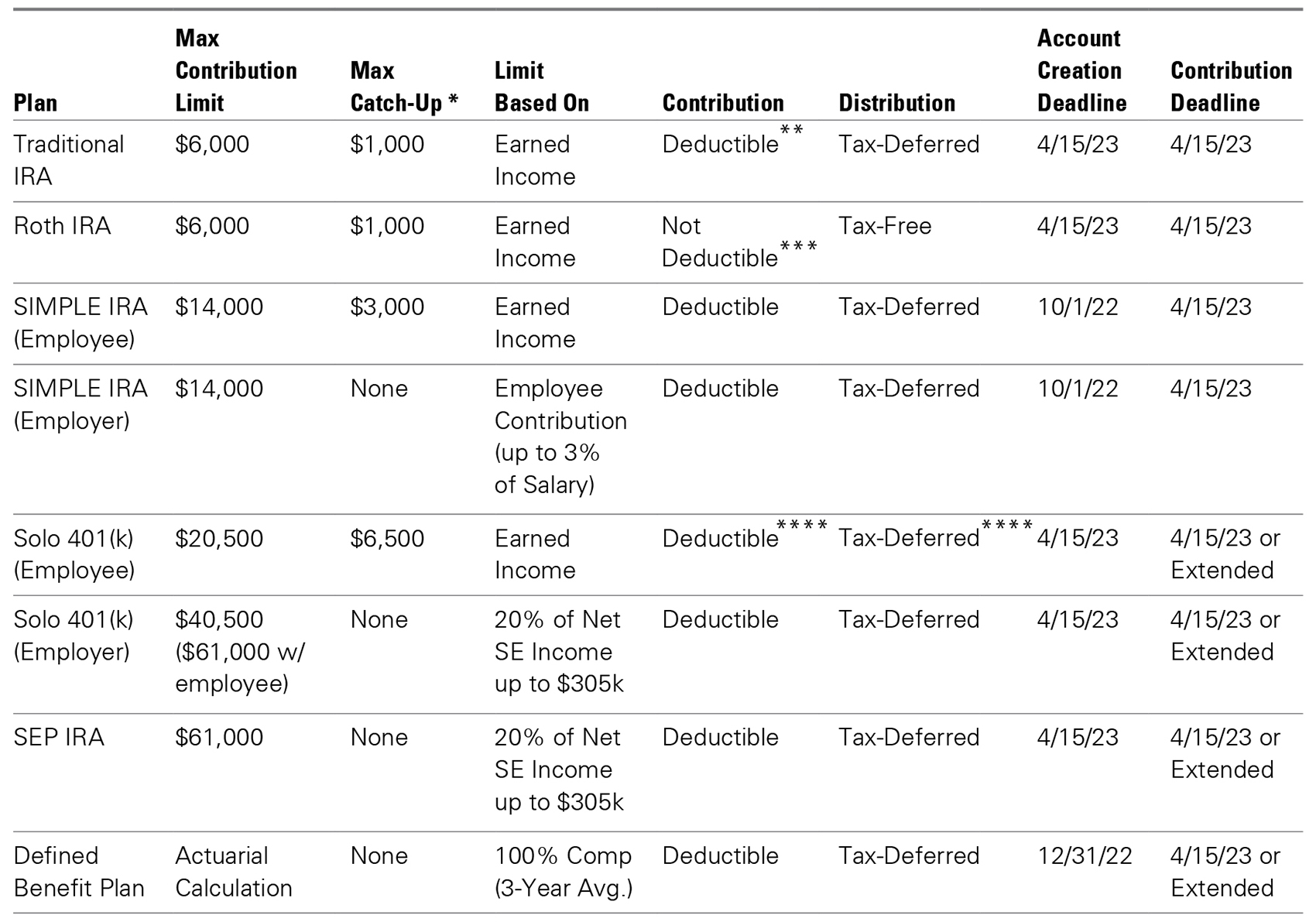

Exhibit 1: Solo 401(k) Example

Earned income calculated as net earnings from self-employment after deducting the plan contribution and one-half of the self-employment tax. Total earnings in this example are $315,000.

Source: Bessemer Trust

As employee, you can make elective deferral contributions up to 100% of your earned income on a pretax basis but not more than $20,500, or $27,000 if age 50 or older, in 2022. As employer, you can contribute up to 25% of earned income. For 2022, total contributions per taxpayer in both capacities cannot exceed $61,000 or $67,500 if age 50 or older. The employee contributions can alternatively be made to a Roth 401(k) if future tax-free distributions are desired over a current-year income deduction.

A solo 401(k) can also cover a spouse (with the same contribution limits) employed by the business.

Simplified Employee Pension (SEP IRA). A particularly easy and low-cost plan to set up and administer, the Simplified Employee Pension (SEP) allows employers to make contributions to a retirement plan for their employees. Unlike the Solo 401(k), employees do not make contributions. Instead of setting up a profit-sharing or money purchase plan with a trust, you (as employer) can adopt a SEP agreement and make contributions directly to an individual retirement account or an individual retirement annuity created for each eligible employee.

If you have no employees beyond yourself, you (as employer) would make contributions to the SEP for yourself (as employee). For 2022, you can make tax deductible contributions of up to 25% of your earned income, up to a maximum of $61,000, significantly higher than would be permitted with a traditional IRA. If you do have employees, however, you would also be required to make identical contributions for them as well. It should be noted that, even if you have earned income from solo activities, your ownership in other businesses may require you to make SEP contributions for the employees of those commonly controlled businesses.

Similar to the SIMPLE IRA and solo 401(k), plan assets grow on a tax-deferred basis; however, it should be noted that no loans are permitted from the plan. It is possible to roll over SEP assets to a Roth IRA.

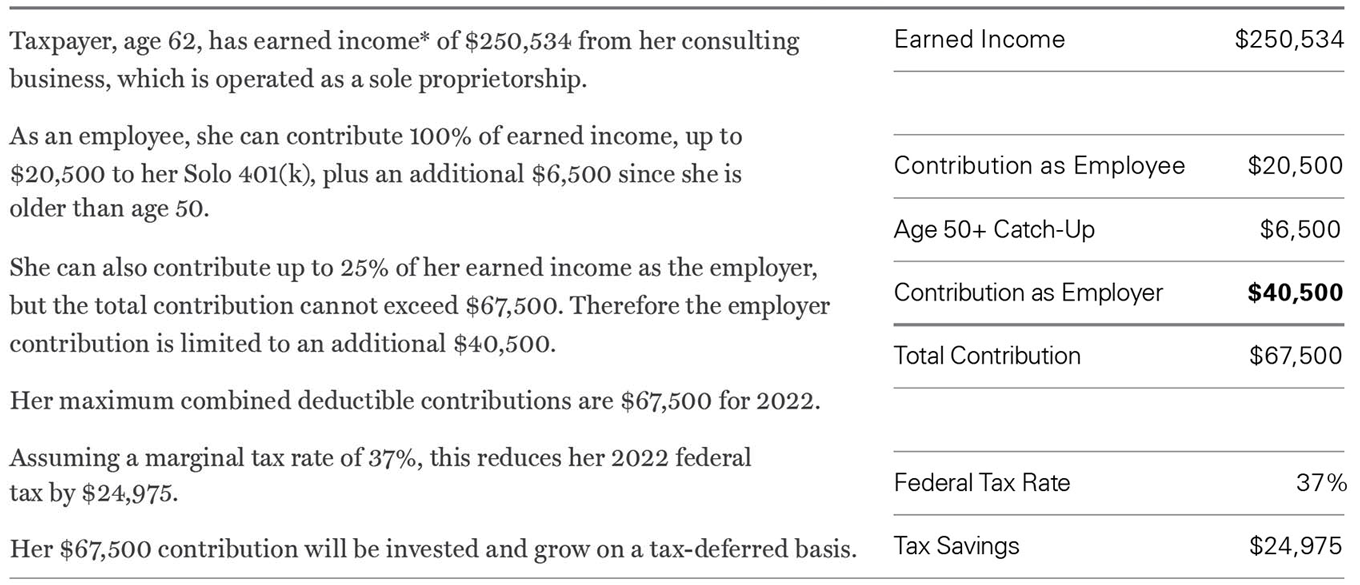

Other strategies: the backdoor Roth IRA. Despite its suspicious name, the backdoor Roth IRA is a legitimate way for high-income taxpayers to avoid the income limits that would exclude them from participating in a regular Roth IRA — and also contribute more than the regularly permitted amounts. For 2022, those annual contribution limits are $6,000 if under age 50 and $7,000 if 50 or older. The same limits apply to deductible contributions to traditional IRAs, but nondeductible contributions are also permitted, provided the individual has sufficient earned income, and there are no income-based restrictions on participation.

Exhibit 2: Expanded Example at $325,000 Total Earnings

SE = Self-employed.

Source: Bessemer Trust

The first step in creating a backdoor Roth IRA is to make contributions to a traditional IRA. You can then roll over the funds to a Roth IRA account in a conversion. Unlike a direct contribution to a Roth IRA, there is no limitation on the amount that can be converted, so you can roll over as much as you want. Be aware that this strategy works best for individuals who do not have existing non-Roth IRAs. The conversion of any previously untaxed funds, the contributions that you previously received a deduction for and their earnings, will be treated as taxable income. One of the primary benefits of a Roth IRA is that there are no required minimum distributions (RMDs), and when you or your heirs take distributions, they are not taxable.

A backdoor Roth IRA can be coupled with any of the retirement plans described above to further maximize your retirement savings.

The defined benefit plan. The most costly and administratively complex of the retirement plan options, the defined benefit plan also has the greatest potential to provide substantial — and predictable — benefits. Importantly, it can be accomplished in a short amount of time, even with early retirement, since employers can contribute (and deduct) more than under any other retirement plan.

Contributions are based on what is needed to provide definitively determinable benefits to plan participants (actuarial assumptions and computations are required to determine the exact amounts). Maximum annual deductible contributions can range from $100,000 to $500,000, or even more if used with a 401(k) plan. And if your spouse is employed by your business, the deductible contribution amounts could even double.

In other words, defined benefit plans offer the opportunity to lower your taxes significantly while also funding your own retirement.

Exhibit 3: Plan Attributes and Contribution Limits — 2022

** Traditional IRA contribution will be deductible if certain modified adjusted gross income (MAGI) thresholds are met; otherwise will be nondeductible.

*** ROTH IRA contributions are permitted based on MAGI. If individual exceeds MAGI threshold there is possibility to make a backdoor contribution.

**** Employee contributions to Solo 401(k) can be Roth – which would be nondeductible, and tax-free at distribution.

SE = Self-employed.

Source: Bessemer Trust

Conclusion

As a self-employed person, you have many effective retirement planning options to choose from. We’ve outlined the main features of some of the most popular approaches here. They range from the fairly straightforward to the complex and costly, and some offer more retirement savings opportunities than others. The best approach for you will depend on careful consideration of a number of factors — how many employees you have, the amount and consistency of your self-employment income, your savings goals, and many others — preferably in consultation with your tax and other advisors.

If you would like to learn more about self-employment retirement planning, Bessemer’s experienced tax consultants are available to answer your questions, review your options, and guide you through the process.

This material is for your general information. It does not take into account the particular investment objectives, financial situation, or needs of individual clients. This material is based upon information obtained from various sources that Bessemer Trust believes to be reliable, but Bessemer makes no representation or warranty with respect to the accuracy or completeness of such information. Views expressed herein are current only as of the date indicated, and are subject to change without notice. Forecasts may not be realized due to a variety of factors, including changes in economic growth, corporate profitability, geopolitical conditions, and inflation. Bessemer Trust or its clients may have investments in the securities discussed herein, and this material does not constitute an investment recommendation by Bessemer Trust or an offering of such securities, and our view of these holdings may change at any time based on stock price movements, new research conclusions, or changes in risk preference.