Holding Family Businesses in Trust

- Only 30% of family businesses manage to survive into the second generation, and only 12% to the third. The reason is often straightforward: inadequate business succession planning.

- Establishing a trust to hold family businesses can help achieve a successful transition. Bessemer Trust has substantial experience serving as trustee for family business owners seeking to enhance their wealth and preserve their legacy by holding their companies in trust as part of a comprehensive business succession plan.

- Bessemer Trust is itself a company held in family trusts that is now in its seventh generation of family leadership. We know — firsthand — the benefits of holding businesses in trusts.

Family Company Trusts Enhance Business Succession Planning

For family business owners, many of the most pressing long-term financial goals center on business succession planning — family control, management continuity, liquidity alternatives, impartiality toward beneficiaries, tax minimization, and family wealth preservation.

Yet most family business owners wait too long and devote too little attention to this critical element of business continuity and wealth preservation.

Why does this happen? Often, putting off long-term planning is simply the result of the more immediate and consuming day-to-day demands of managing and growing a business.

At other times, the reasons can be related to business owners’ desire for control and an understandable reluctance to address their own mortality. The stark choice appears to be between taking responsibility for the future by developing and implementing a plan (even when it seems premature) or simply ignoring the inevitable.

Whatever the explanation, instead of a thoughtful process that evolves over time, the frequent result is a rushed response to a sudden business challenge (perhaps the introduction of a disruptive technology) or a leadership vacuum triggered by an unexpected illness or the lack of an heir apparent. In many cases, control passes abruptly to an unprepared successor or even a non-family member with different priorities. All too often, a business nurtured for decades unravels, and family wealth dissipates.

Trusts can help avoid such an unfortunate outcome. They provide a legal framework for certainty in leadership and a corporate trustee to administer elements of the succession plan for future generations — along with all of the usual benefits of trusts, such as equitable treatment of beneficiaries by a seasoned and impartial trustee, minimization of gift and estate taxes, and wealth preservation and asset protection for beneficiaries, among others.

Benefits of Holding Family Businesses in Trust

Establishing trusts to hold family company assets and transfer assets from one generation to another is a central goal of many estate plans. In its simplest form, the family business owner, as grantor (or creator of the trust), delivers the shares of the family company to the trustee, who is charged with holding and managing the assets in trust for the benefit of the trust’s beneficiaries, often including the spouse and succeeding generations. Such arrangements offer a number of benefits:

- Certainty in leadership. The trust serves as a legal framework for certainty in leadership with a corporate trustee to administer a succession plan for future generations. Whether transitioning to the next generation of a family or overseeing outside management, the trust structure ensures that the wishes of the family’s patriarch/matriarch are achieved.

- Equitable treatment: impartiality toward beneficiaries. As the interests of family company trust beneficiaries can sometimes be at odds, having a corporate trustee ensures that the interests of all family members are taken into consideration objectively and fairly when decisions are made.

- Efficient planning: tax minimization. Using various funding techniques for the trust, your corporate trustee can help minimize the gift taxes and estate taxes applicable to the family business. For example, families can use their gift and generation-skipping tax exemptions for gifts of stock to the trust, or they can sell stock to the trust for a promissory note. Many jurisdictions, including Delaware, allow for trusts to have perpetual existence (e.g., a dynasty trust), thereby avoiding these taxes in the future.

- Financial security: family wealth preservation. A corporate trustee has a fiduciary duty to follow the dictates set forth in your trust document. These can often include preserving and enhancing the family business held in trust and, if appropriate, monetizing the business at the highest possible valuation. At Bessemer Trust, we exercise this responsibility objectively, minimizing conflicts of interest and stress to family relationships. Our familiarity with the family’s overall wealth profile enables us to make informed decisions with the best interests of all family members as our highest priority.

- Asset protection. The use of a trust for succession planning has proven beneficial for creditor protection when it comes to lawsuits and preserving company assets within the family in the case of divorce proceedings.

Bessemer’s Administrative Duties as a Trustee

As a directed trustee, Bessemer Trust Company of Delaware, N.A., assumes the responsibilities set forth in the trust, which may include some or all of the following:

- Safekeeping of the trust agreement (and amendments) and other trust records, and keeping an office in Delaware for trustee meetings and other trust business

- Serving as custodian of assets

- Handling all other administrative functions (distributions, federal and state tax compliance, etc.)

- Originating, facilitating, and reviewing trust accountings, or reports

- Originating and facilitating communications with co-fiduciaries, beneficiaries, and others, and responding to their inquiries

- Executing transaction documents related to directed assets and taking other steps as requested by the investment advisor

- Preparing, as a courtesy to the investment advisor, draft direction letters and subscription documents for directed purchases of interests in alternative investments

- Ensuring federal and state tax compliance

Alternative Trust Structures for Family Businesses

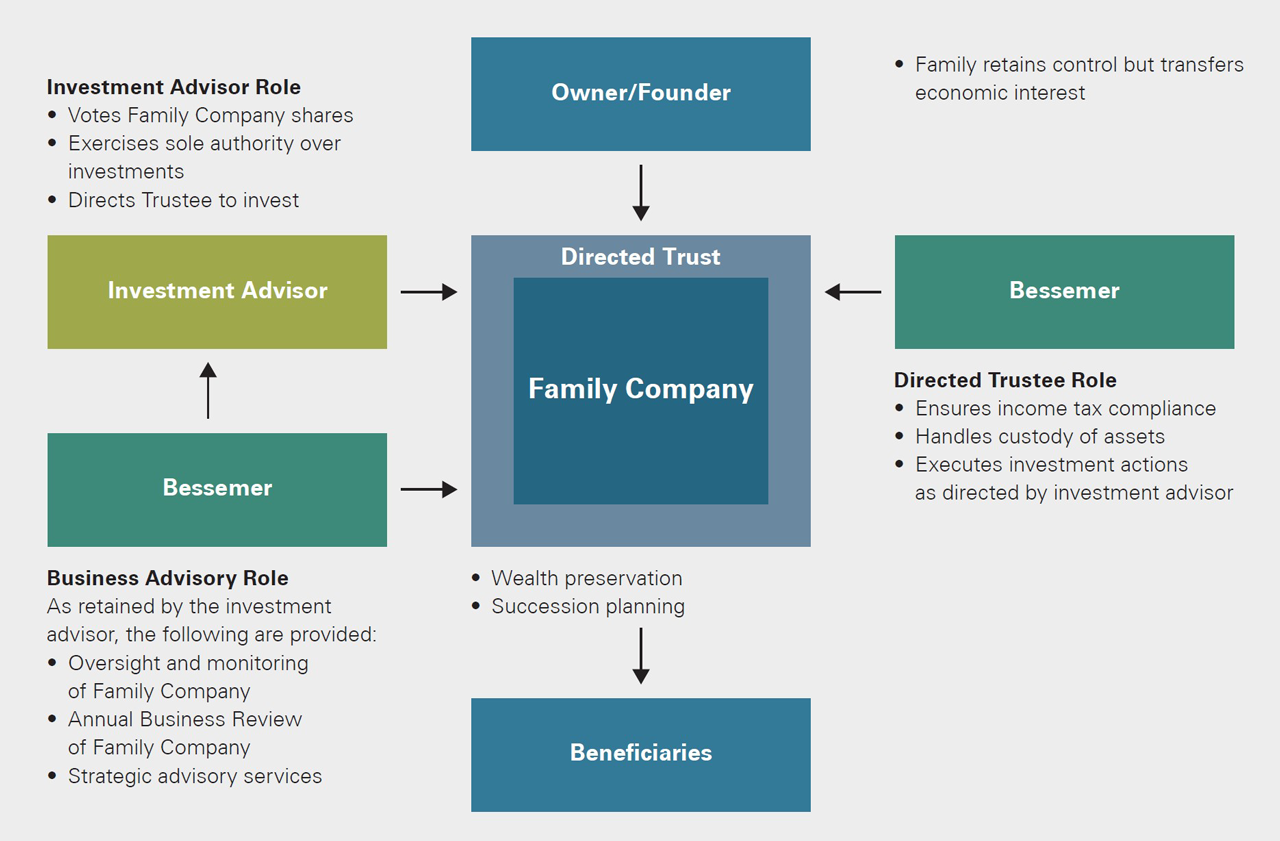

Two primary forms of trusts are used for business succession planning — directed trusts and discretionary (managed) trusts.

Both types of trusts offer the benefits outlined above, and both directed and discretionary trustees fulfill all necessary administrative duties — safeguarding trust assets, making distributions, record keeping, tax preparation and filing, among others — in accordance with your intentions, as expressed in the trust instrument.

Where directed and discretionary trusts differ relates largely to the degree of control you (or your family members) exercise over company operations.

Directed Trusts

In comparison to a discretionary trust arrangement, a directed trust offers two unique benefits:

The ability to continue managing the company. With a directed trust, you or another family member may retain operational control of the company as a fiduciary (an investment advisor). In this case, you (or a family member) manage all company trust assets while your corporate trustee (that is, the directed trustee) performs only administrative tasks and any other duties assigned by you. One example of these “other duties” might be having your directed trustee manage the securities portfolios and related assets in the trust while you continue to manage company operations and provide strategic direction.

The ability to consolidate family control. Family business owners tend to place a high priority on maintaining family control through the ownership of company shares or at least a majority of the voting rights — fragmented ownership is a critical issue in multigenerational family businesses. Using a directed trust enables the family to aggregate ownership and retain collective control of company management and the transfer procedures for shares. These can range from strict prohibitions against any transfer outside the family to preemptive rights provisions and detailed buy/sell arrangements among family shareholders to maintain family control.

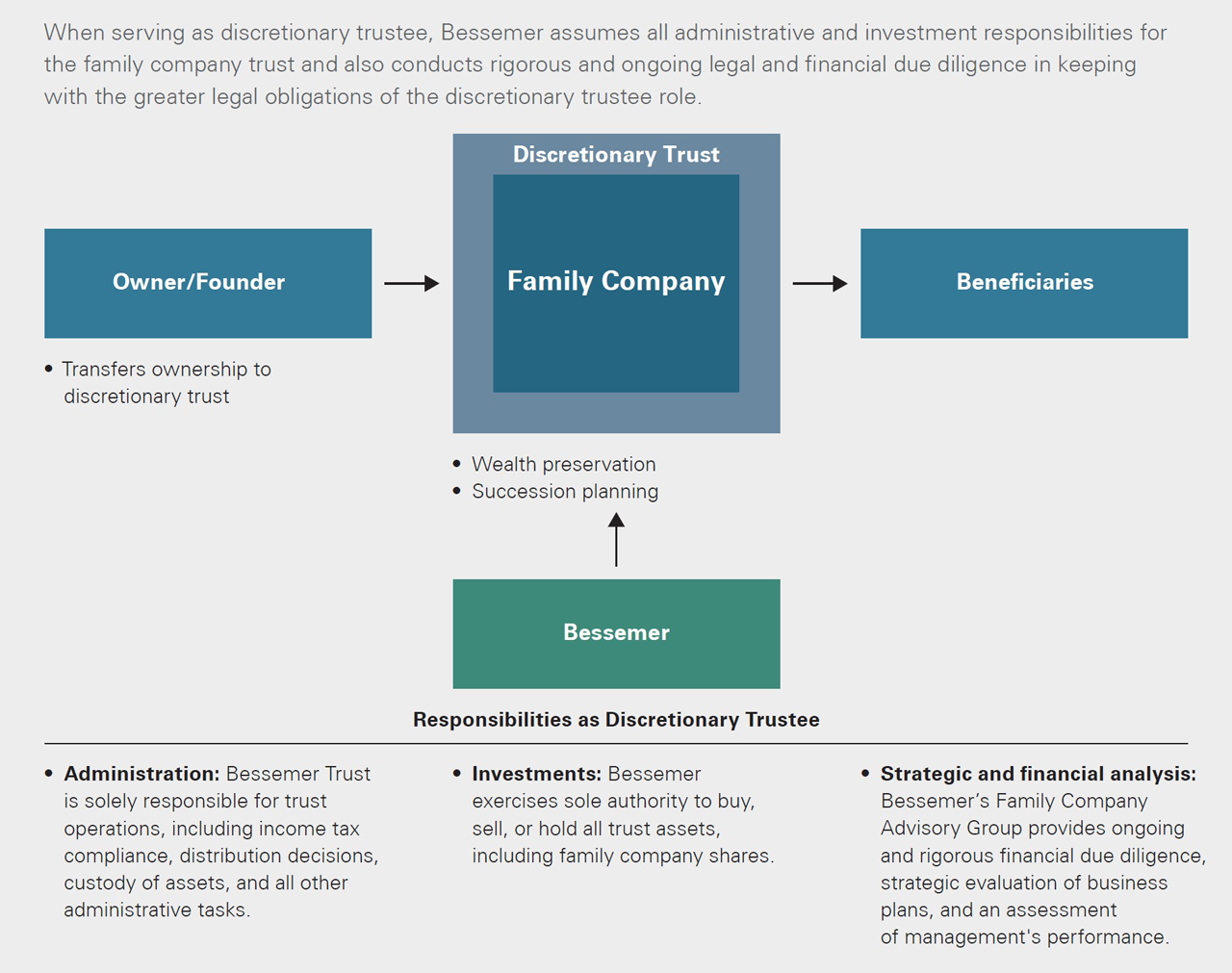

Discretionary Trusts

Discretionary trustees are empowered with responsibility for supervising the management of the family business and voting the shares of the company.

Trustees with full discretion are solely responsible for the investments and operations of the trusts holding the shares of the family business. They have the sole authority to buy, sell, hold, or make other investment or management decisions with the assets.

The discretionary trustee also makes an assessment of the management team’s business plan and evaluates whether the management team, especially if it is nonfamily, is appropriate for the challenges being faced.

The Discretionary Trust with Ongoing Due Diligence

Transitioning From Directed to Discretionary Trusts

Choosing between a directed trust and a discretionary trust can be challenging. At Bessemer, we have found that many family business owners prefer a directed trust while they are living so that they, or their family, retain control, as investment advisor, of the company’s operations and vote the shares. This tendency leads some family business owners to provide for the directed trust to be converted to a discretionary trust when the current leadership becomes incapacitated or passes away. Preparing for this transition may include the retention of the Family Company Advisory Group to allow it to gain familiarity with the business. If there is a strong heir apparent, however, who may assume the investment advisor role, then the transition to a discretionary trust may be postponed for a second generation.

Bessemer’s Commitment to Family Business Owners

Bessemer Trust is a company held in family trusts that is now in its seventh generation of family leadership. We know — firsthand — the benefits of holding businesses in trusts.

We also have more than a century of experience serving families of substantial wealth, and we have significant experience and expertise serving as trustee for clients seeking to hold their companies in a trust as part of a comprehensive business succession plan.

While many firms avoid serving as trustees for trusts that hold family businesses, and often limit themselves to serving only as directed trustees when they do, we are equally adept at serving as a directed or discretionary trustee, and at managing the transition from directed to discretionary trustee.

Bessemer has a dedicated Family Company Advisory Group with extensive experience in corporate finance, transaction execution, and succession planning and stewardship. Since its formation in 2005, the group has worked with hundreds of family companies operating in most major industry groups and ranging in value from $50 million to over $50 billion.

We are particularly distinguished by our close alignment with family business owners:

We help ensure continuity of family management. Family business owners often seek to promote next-generation family members into positions of responsibility and eventually leadership for family management continuity. Still, the selection of the next generation of leadership is a strategic decision. In addition to securing the continuity of the family business legacy as appropriate, we can also provide an objective perspective to encourage the equally important interim or permanent transition to nonfamily leadership when necessary. This might include, for example, situations in which the next generation is either very young or uninterested in the business and an overly rigid “family only” policy could jeopardize the future of the business.

We can advise on liquidity/cash flow alternatives. Arrangements can be made to provide distributions to family members and nonfamily employees. We can also help structure procedures that offer periodic liquidity opportunities and formal exit strategies for nonmanagement family members and the next generation.

For example, to ensure adequate liquidity without diluting family control, some trust arrangements provide for put rights that allow family company shareholders to sell a prudent percentage of their shares back to the company on a predetermined timetable.

Meaningful dividends paid on a consistent basis in accordance with a formula tied to company performance can also be an important source of cash flow.

We provide thorough and ongoing oversight and monitoring. Each year, as part of our role as trustee for a family company held in trust, the Family Company Advisory Group conducts a review of the operating performance and strategic positioning of the business. Our objective is to protect the value of each company held in trust for the beneficiaries and also develop ways to enhance the performance of the business. We provide this ongoing service to families seeking in-depth understanding of their company’s operations together with a sensitivity to the special nature of an anticipated family transition.

Company Held in Trust Case Study*

The elderly matriarch of a multigenerational family business that manufactured industrial products was near retirement and wanted to finalize her leadership succession plan. Although her grandson, in his mid-30s, was showing real promise as VP of Operations, at that point, no family members were well positioned to become CEO of the company. The family was committed to continuing its ownership of the business, but for the first time in almost 100 years, a family member would not be managing the company. There were concerns about whether a professional manager would sustain the family’s values and properly mentor the grandson to ultimately run the company.

Longer term, the matriarch was concerned about maintaining the family business legacy for future generations. There was a redemption plan in place to provide liquidity for shareholders who wanted to diversify or cover personal expenses, but some were unhappy with the discounted valuation of the shares determined by an outside appraisal firm. More profoundly, the matriarch was worried that after she was no longer involved, the CEO might convince the family that it was best to sell the company. The matriarch’s goal was securing a commitment to long-term growth and the enhancement of the family business legacy.

At this critical juncture, the family decided to place the company in a directed trust and appointed Bessemer as co-trustee with the matriarch. This accomplished several immediate objectives and laid the foundation for the future. In its fiduciary role, Bessemer’s Family Company Advisory Group would provide detailed oversight and monitoring of the company’s operations to ensure it maintained its competitive positioning under the nonfamily CEO’s leadership.

Bessemer would also perform an annual valuation of the company to confirm that a reasonable price was offered through the redemption plan. Finally, Bessemer committed to provide guidance to the grandson and serve as a sounding board as he developed into a future leadership role.

The trust structure was also flexible enough to maintain the family business legacy. Working with the matriarch, Bessemer as co-trustee supported continued ownership of the family business in trust. Bessemer also agreed to expand its fiduciary responsibilities after the matriarch was no longer capable and assume the role of discretionary trustee of the trust holding the business. In that enhanced role, given the expressed wishes of the family, Bessemer would be empowered under most circumstances to hold the family business in trust for future generations.

We also offer a broad range of in-house corporate finance advisory services and transaction expertise. We can help you take advantage of strategic opportunities and protect your family’s financial security, providing strategic planning, corporate governance assessment, and succession planning. We can also facilitate valuation analyses, strategic transactions, and liquidity events while retaining family control, as well as partial or complete family exits through strategic partnerships, divestitures, and the sale of companies.

In the early years of a family company held in a directed trust, when you engage the Family Company Advisory Group, our oversight and monitoring processes help us develop a detailed understanding of the company and management team prior to a possible appointment as discretionary trustee. This evolutionary approach also allows families to get to know our team and become more familiar with our capabilities.

When a family business is held in a discretionary trust, we deepen our knowledge of the company and management team even further, voting the shares on your behalf and representing your interests when, for example, there is a management-led buyout or an unsolicited offer to purchase the company. As discretionary trustee, we are responsible for determining whether it is in the best interests of the family to sell the family business and, if so, deciding how to maximize the company’s value through the optimal liquidity event.

In the end, we know that a family business is often a family’s largest asset and greatest source of wealth, so succession planning is critically important to achieving strategic objectives and realizing financial and wealth-transfer goals. Placing a family business in a trust can serve as a catalyst to help achieve many of these goals.

Bessemer’s Family Company Oversight and Monitoring Process

Our annual oversight and monitoring process for companies held in trust is designed to protect the interests of the beneficiaries by monitoring the performance of the management team and the operating results of the company held in trust.

Document Review

- Review of the company’s prior-year financial statements, accounting letter (if applicable), annual report to shareholders, and SEC filings (if applicable).

- Review of industry equity research, comparable company earnings and announcements, comparable acquisitions, and other industry developments (e.g., regulatory changes or technological advances).

Company Visit and Management Meetings

- Prepare questions based on the document review for the company’s senior management to address in face-to-face meetings with us at the company’s headquarters. Questions relate to macroeconomic issues as well as the specific operating and financial performance of the company for the prior fiscal year and forecasts for the upcoming year.

Written Report

- Provide a detailed write-up of the company visit and management meetings, including in-depth analysis of the company’s market position and financial performance. This often entails follow-up with company management by telephone or email to expand on our in-person discussion.

Valuation Analysis

- Conduct a comprehensive valuation analysis for the family and the board of directors. This involves the research and application of market and company financial information in accordance with appropriate valuation methodologies.

Family Meeting

- Presentation of the findings of the oversight and monitoring process. Answer questions from family members relating to the company’s business, operating results, and strategic direction.

- Conduct additional analysis, as needed, to respond to questions from the family.

Industry and Market Monitoring

- Ongoing review of industry M&A developments as well as monitoring management’s ability to integrate past transactions and realize expected synergies.

Bessemer Trust Committee Review

- Presentation of a formal written report at the annual meeting with the Bessemer Committee for Companies Held in Trust, including a recommendation with respect to the appropriate classification of the company (i.e., In Good Standing, Under Moderate Review, or Under Serious Review).

- For discretionary trusts, annual reviews include an assessment of the appropriateness of retaining the company or pursuing a diversification strategy that might include a recapitalization with increased dividends, the sale of a minority interest, or a sale of the entire company.

The level of detailed analysis, frequency of visits and other contacts with the company’s management team, and overall time committed vary depending upon the size and complexity of the company’s business, the prevailing macroeconomic and market conditions, and the level of activity within the industry sector during that year — as well as whether it is a directed trust or a discretionary trust.

For more information, please contact:

- Bryant W. Seaman III, Head of Family Company Advisory, at (212) 708-9314

- George W. Kern, Regional Director, Bessemer Trust Company of Delaware, N.A., and Senior Fiduciary Counsel, at (302) 230-2684

This material is for your general information. The discussion of any estate planning alternatives and other observations herein are not intended as legal or tax advice and do not take into account the particular estate planning objectives, financial situation, or needs of individual clients. This material is based upon information from various sources that Bessemer Trust believes to be reliable, but Bessemer makes no representation or warranty with respect to the accuracy of completeness of such information. Views expressed herein are current only as of the date indicated, and are subject to change without notice. Forecasts may not be realized due to a variety of factors, including changes in law, regulation, interest rates, and inflation.