Powering the AI Age: Challenges in Global Electricity Generation and Opportunities for Nuclear Energy

- The rapid expansion of energy-intensive artificial intelligence is accelerating demand for stable, high-capacity electricity, transforming data infrastructure into a power challenge.

- A global push for decarbonization and energy security is fueling a resurgence in nuclear energy, with supportive policy, technological innovation, and rising investment. Small modular reactors (SMRs), in particular, offer great promise but are still in the early stages of development.

- While the nuclear industry faces a number of hurdles — including a limited pool of commercial-stage companies and long development timelines — strong policy support and rising strategic relevance create compelling opportunities for well-positioned investors.

The rapid growth of artificial intelligence (AI) is ushering in a new era of electricity demand. Unlike previous waves of digital innovation, today’s AI workloads — especially those powering large language models — are highly energy-intensive. Data centers require vast amounts of continuous power to operate the graphics processing units (GPUs) and cooling systems these models require.

Training a single large language model (LLM), such as OpenAI’s GPT-5 or Google’s Gemini, can consume tens of gigawatt-hours (GWh) of electricity, enough to power thousands of U.S. homes for a year.

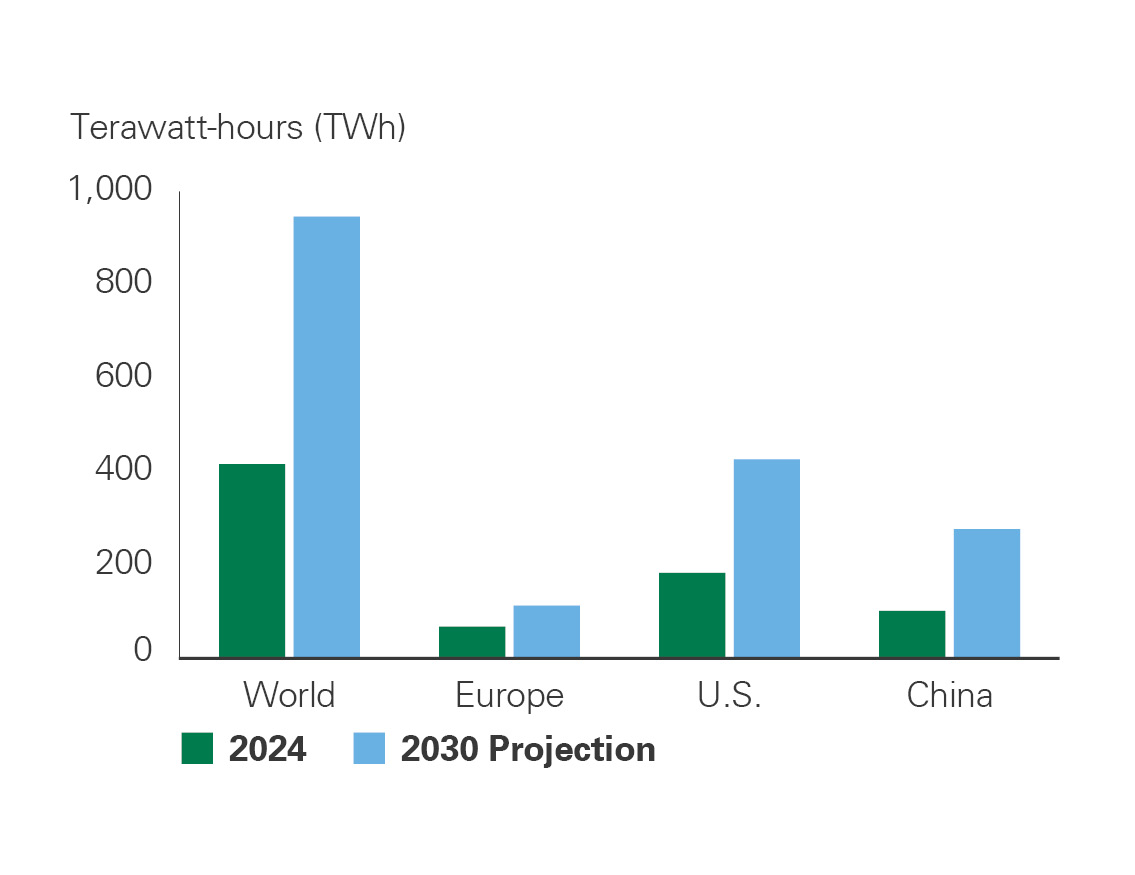

As a result, the AI revolution has evolved from a computing story to an electricity infrastructure challenge. The International Energy Agency (IEA) projects that electricity demand from global data centers will more than double to 946 terawatt-hours (TWh) by 2030 (Exhibit 1). Most of this growth is expected to be in the U.S., Europe, and China. Globally, data centers are projected to consume approximately 7% of the electricity supply by 2030, up from just 3% in 2020. These forces are driving a global resurgence in nuclear energy, reshaping its role in the future energy landscape.

Nuclear Power Resurgence

As the world grapples with rising energy demand and carbon emission reduction goals, nuclear energy is re-emerging as a critical component of the global energy mix. Once hampered by decades of stagnation and underinvestment, the sector is now gaining momentum from policy support, technological progress, and new investment flows.

Nuclear energy has long been a clean and reliable power source. However, the potential for serious accidents with broad environmental consequences has limited its adoption. Incidents such as Three Mile Island (1979), Chernobyl (1986), and Fukushima (2011) significantly dampened global support. However, in recent years, sentiment has shifted. Many governments now view nuclear energy as an essential part of energy security, particularly for nations seeking to meet decarbonization goals.

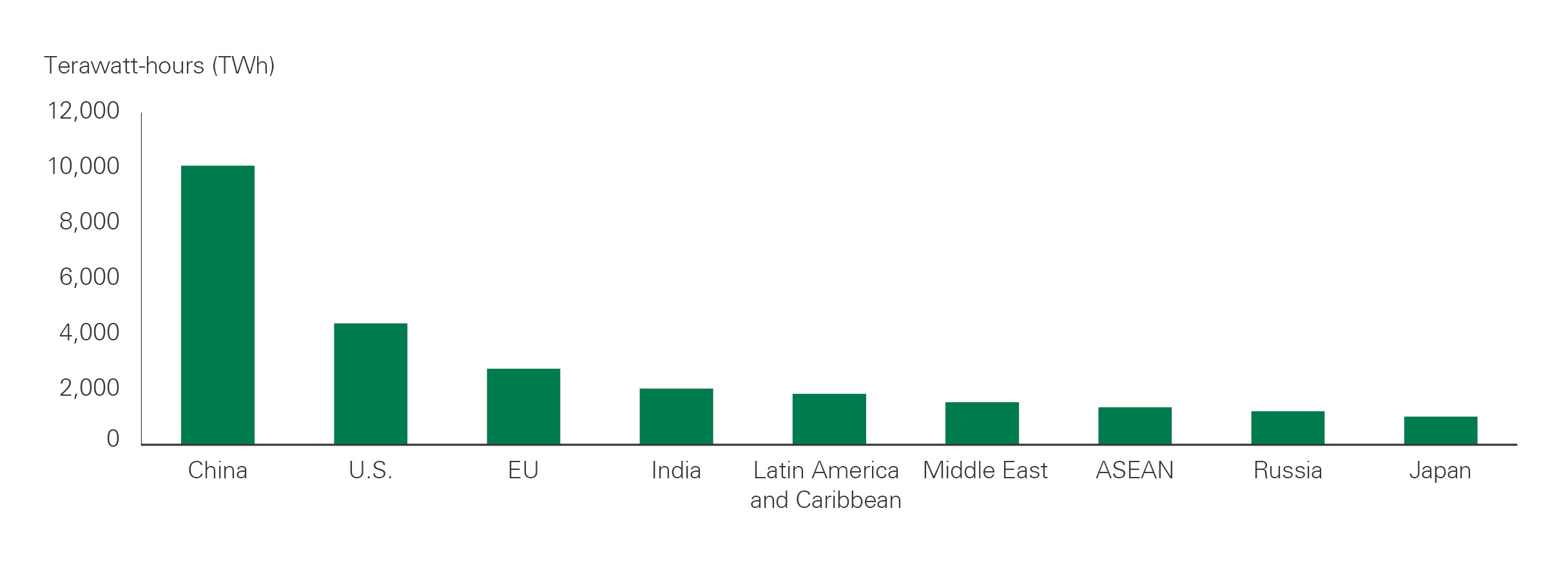

Exhibit 1: Data Center Energy Consumption by Region

Key takeaway: Electricity demand from data centers is expected to more than double by the end of the decade.

A multi-region chart illustrating how electricity demand from data centers is projected to more than double by the end of the decade. It breaks down projected consumption by major geographic regions — including the U.S., Europe, and China — highlighting that AI-driven data centers will account for a rising share of total electricity use globally. The exhibit supports the narrative that AI infrastructure is transforming the power demand landscape.

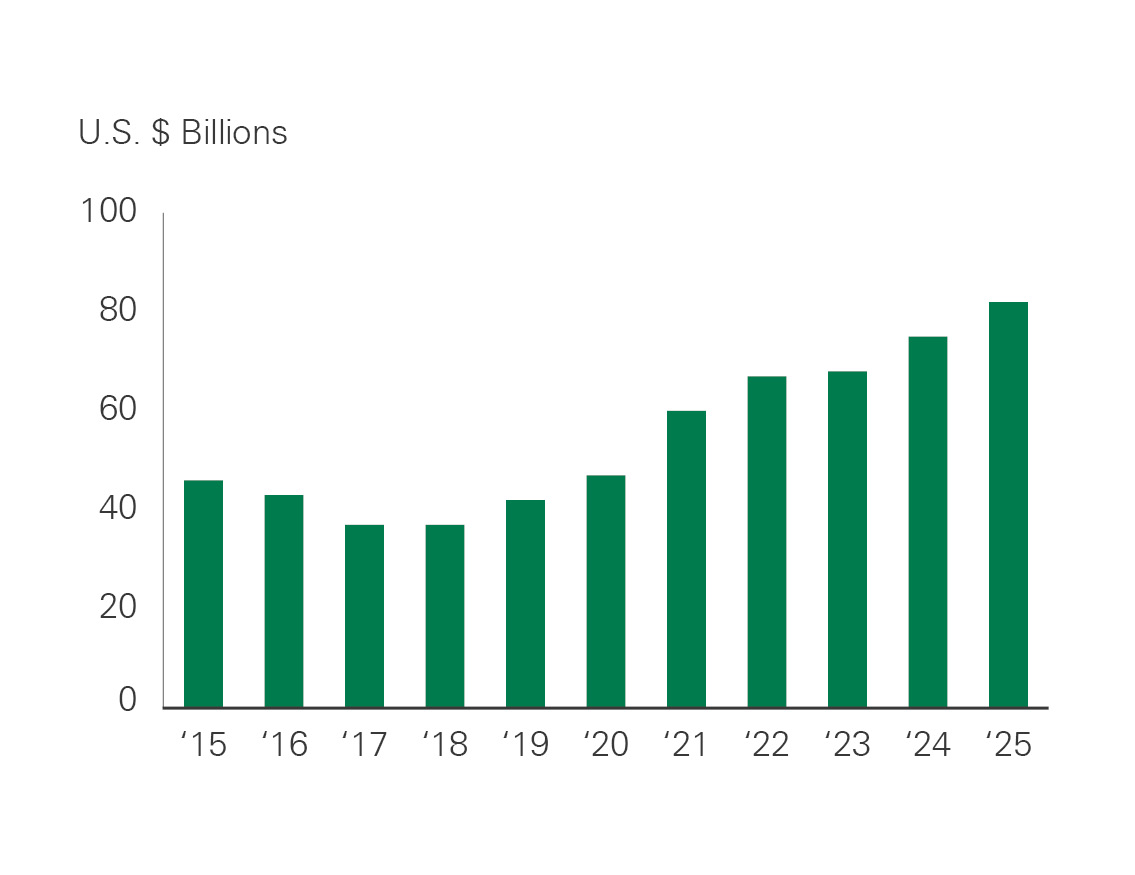

In the U.S., policy has recently turned decisively pro-nuclear. A March 2025 Gallup poll found that 61% of Americans support nuclear energy, up from 44% in 2016. There is a growing recognition of nuclear power’s low-carbon credentials and reliability in the face of rising energy demand from AI, data centers, and industrial reshoring. Globally, investment in nuclear power grew at a 12% CAGR over the past five years (Exhibit 2). Government subsidies and production tax credits, such as those in the Inflation Reduction Act (IRA), have been key drivers. Private sector engagement has also increased dramatically, with technology companies such as Amazon, Microsoft, and Alphabet signing power purchase agreements (PPAs) with nuclear reactor developers.

Nuclear Power Outlook

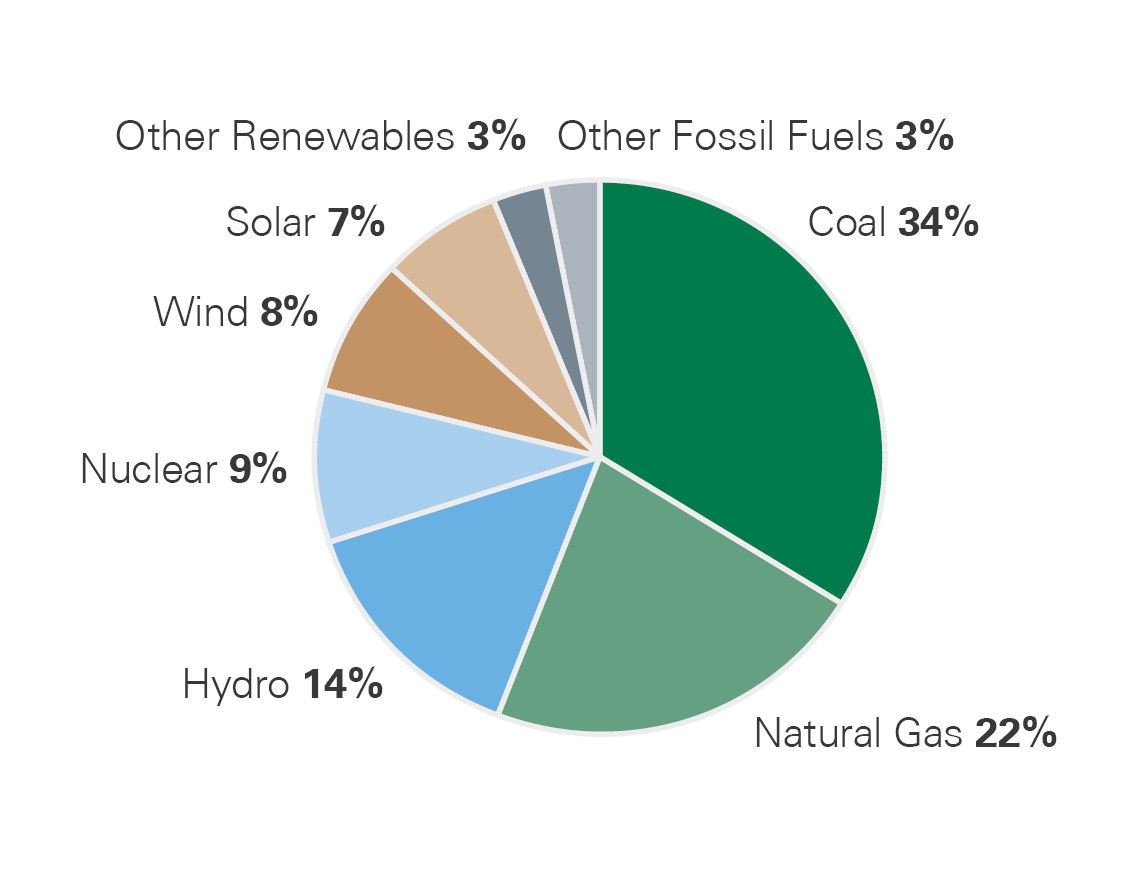

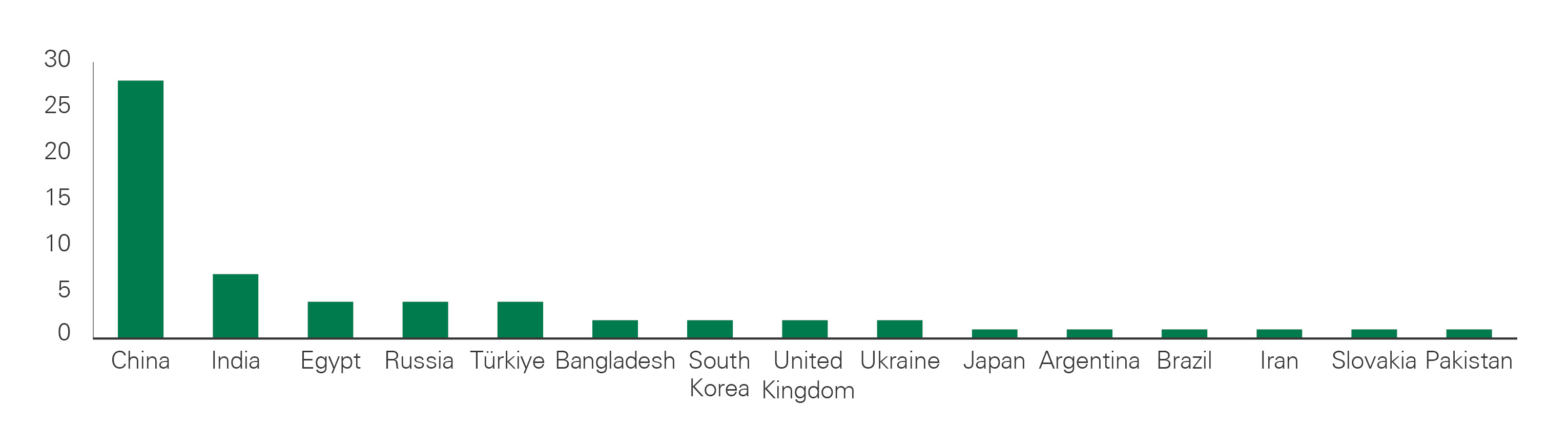

As of 2025, there are approximately 440 operational nuclear reactors globally with a total power capacity of nearly 400 gigawatts (GW), supplying about 9% of the world’s electricity (Exhibit 3). Nuclear power has a high geographic concentration, with 10 countries — led by the U.S. — accounting for roughly 80% of operating reactors and 85% of total global capacity. Currently, 61 nuclear reactors are under construction across 15 countries, with 59 scheduled to come online by 2032, mostly in China and India (Exhibit 4).

Exhibit 2: Global Investment in Nuclear Energy (2015 to 2025)

Key takeaway: After a period of stagnation, investment in nuclear energy has increased substantially over the past five years.

A decade-long investment chart showing how global nuclear energy investment stagnated in earlier years but has increased substantially through 2025. The exhibit details investment figures from 2015 to 2025, illustrating renewed capital flows into nuclear power technologies and infrastructure as energy security concerns and AI-related electricity demand rise.

Exhibit 3: Share of Global Electricity Generation 2024

Key takeaway: Nuclear power represents a relatively small percentage of global electricity generation capacity.

A global electricity generation chart for 2024 showing what share of total generation is supplied by nuclear power compared with other energy sources (like coal, gas, and renewables). The exhibit demonstrates that, while nuclear power remains a smaller share of overall generation, its reliable and low-carbon attributes position it as a key component in meeting increasing electricity demand.

According to the International Atomic Energy Agency (IAEA), global nuclear generating capacity is expected to rise to 950 GW by 2050. In the U.S., the Department of Energy (DoE) projects a tripling of capacity from 100 GW to 300 GW by 2050. However, most of the projected growth in the near term will come from life extensions and capacity expansions of existing plants.

Despite this promising outlook, risks remain for the sector. A key supply chain bottleneck could be purified and enriched uranium — the main fuel source for nuclear reactors. Uranium demand is forecasted to nearly double over the next 20 years, while supply is expected to decline post-2030, creating a potential structural deficit. In addition, nuclear projects typically have long construction timelines, with many experiencing delays, cost overruns, or both. Despite renewed government support in many countries, construction projects still face lengthy regulatory approval processes and political risks that could delay or cancel development.

Technological Innovation: Small Modular Reactors

Small modular reactors (SMRs) are among the most exciting recent nuclear technology innovations. SMRs are small by definition and produce up to 300 megawatts (MW) of power, compared to 1,000+ MW for traditional reactors. Unlike conventional reactors, SMRs can be factory-fabricated and shipped to their location, reducing construction risk, improving scalability, and enabling deployment in remote or off-grid locations. SMRs’ flexibility makes them more suitable for industrial co-location, such as for AI data centers.

Exhibit 4: Nuclear Reactors Under Construction by Country

Key takeaway: New reactor construction is concentrated in a handful of countries, led by China.

A bar chart listing countries with nuclear reactors under construction as of May 2025. It shows China leading by number of new reactors, followed by other nations investing in expanding capacity. The exhibit highlights geographic concentrations of nuclear build-out and underscores the strategic energy competition among countries responding to rising demand from digitization and AI.

SMRs have several other important advantages, such as passive safety systems, lower fuel requirements that limit the risk of catastrophic failures, and standardized designs that allow for faster deployment (five to seven years versus 10 to 15 years for traditional reactors). Some designs also require less frequent refueling.

SMRs come with a few drawbacks as well. Generally, it costs more to produce the same amount of electricity in an SMR than in a traditional large-scale reactor. In addition, SMRs typically require a higher level of uranium enrichment. Uranium purification and enrichment capabilities are concentrated in a small number of countries and could become a supply chain bottleneck with the growth of SMRs. Most advanced SMR designs require high-assay low-enriched uranium (HALEU), a type of higher enriched uranium. Russia is currently the only country that produces HALEU in large commercial volumes — posing a strategic vulnerability for the U.S. and other Western countries.

While SMRs show long-term promise, it will take many years for them to make a meaningful impact on the global electricity grid. As of 2025, only two SMRs are operational, one each in China and Russia. Western countries are expecting the first reactors to begin commercial operations in 2029.

Competition Between the U.S. and China

Over the past two decades, China has become the global leader in electricity production, surpassing the U.S. in both scale and speed of expansion. This shift is increasingly viewed as a critical dimension of global economic and technological competition.

As of 2024, China’s total electrical energy generation capacity exceeds 10,000 TWh, more than double the U.S. capacity of about 4,500 TWh (Exhibit 5). This gap is expected to widen, with China projected to add capacity at triple the rate of the U.S. over the next 25 years. China has pursued a broad-based strategy for electricity generation, simultaneously expanding coal production and leading the world in renewable energy — China accounts for approximately 40% of global solar and wind capacity and 30% of hydropower capacity.

Electricity prices in China are also significantly lower than those in the U.S., particularly for industrial users, who benefit from long-term contracts and vertically integrated state-owned utilities that prioritize low-cost power delivery. Industrial electricity costs are approximately $0.09 (USD) per kilowatt-hour (kWh) in China, compared to $0.16 in the U.S. This cost advantage enables Chinese firms to scale faster in capital-intensive industries such as semiconductors, electric vehicles, and AI data centers.

For the U.S. to remain competitive, it can utilize several policy levers such as expanding high-voltage regional transmission networks, lowering electricity costs for strategic industries such as AI and semiconductors, and streamlining permitting for solar, wind, and nuclear development. Nuclear energy — particularly SMRs — will also be critical in meeting grid reliability and environmental goals.

Exhibit 5: Global Electricity Generation Capacity

Key takeaway: China’s electricity generation capacity is a strategic advantage. The U.S. needs government policies that encourage aggressive capacity expansion to stay competitive.

A global bar/column chart showing total electricity generation capacity across major countries. China’s capacity is shown to be significantly higher than that of the U.S. and other major producers, illustrating a strategic advantage in energy infrastructure. The graphic underscores how China’s larger and lower-cost electricity base could give it an edge in powering energy-intensive sectors like AI and semiconductors, while U.S. policymakers focus on expanding capacity through policy support and nuclear deployment.

Company Spotlight: BWX Technologies

Bessemer holding BWX Technologies (BWXT) plays a crucial role in the global nuclear ecosystem. Headquartered in Lynchburg, Virginia, BWXT is a specialized manufacturer of nuclear components and the sole supplier of nuclear reactors for the U.S. Navy’s submarine and aircraft carrier fleets. The company’s capabilities extend beyond the defense sector into commercial nuclear power. For example, BWXT manufactures reactor pressure vessels, steam generators, and other critical components used in both conventional and next-generation nuclear power plants.

BWXT is deeply integrated into the SMR value chain, supplying components for GE Hitachi’s BWRX-300 design and participating in the U.S. Department of Defense’s Project Pele to develop mobile microreactors. It is also the only U.S. company licensed to fabricate HALEU — a major advantage as domestic fuel supply becomes a strategic priority.

BWXT stands to benefit from a broad range of structural drivers: consistent defense revenue, life extensions for existing reactors, growth in portable nuclear power, and government support for fuel development. Moreover, growth is expected to accelerate over the second half of the decade as the U.S. Navy begins to replace its Virginia-class submarines with the next-generation attack submarine SSN(X). We believe BWXT is well positioned as nuclear energy becomes both an energy and national security priority.

Investment Outlook

The investment outlook for nuclear power is increasingly attractive, though pure-play opportunities remain limited. Many companies with nuclear exposure are diversified industrial conglomerates or utilities, making it difficult to isolate the performance of their nuclear segments.

For example, General Electric’s nuclear business is operated through its joint venture with Hitachi under GE Vernova, a Bessemer holding that also has wind, gas, and grid businesses. We believe GE Vernova is likely to benefit from the global electrification investment cycle, but the company’s nuclear business generates less than 10% of total revenues.

Japanese companies Mitsubishi Heavy Industries and Hitachi participate in reactor design and servicing but derive most of their revenue from other verticals, such as aerospace, defense, and conventional infrastructure.

Additionally, many nuclear-related companies are still in the early stages of commercialization or depend heavily on regulatory approvals and long permitting cycles. This is especially true for many promising SMR developers, which often grapple with high capital needs, long permitting cycles, and no commercial revenue. Their success depends on licensing, private funding, and government support.

Similarly, large utility operators such as Southern Company and Dominion Energy have nuclear power capabilities, but their overall valuations and growth are also influenced by regulated rate base expansion and other renewable deployments.

Given these dynamics, the most compelling nuclear investments share several attributes: strong cash flows from existing operations, specialized manufacturing capabilities, diversified exposure to next-gen nuclear technologies such as SMRs, and strong alignment with public policy. While the nuclear investment landscape is still maturing, companies that offer both short-term cash generation and long-term technological optionality are well positioned to benefit from the structural tailwinds driving the industry’s global revival.

A Resurgence With Real Momentum

Global electricity demand is projected to double by 2050, driven by population growth, rising standards of living, and increasing electrification across various sectors. At the forefront is the accelerating deployment of artificial intelligence, which is reshaping data infrastructure and placing unprecedented pressure on power grids.

As a reliable, clean, and scalable baseload option, nuclear power is regaining relevance. It is also likely to play a crucial role in the U.S.’s economic and geopolitical competition with China.

Despite these tailwinds, investors must navigate a complex landscape. Pure-play nuclear companies are rare, many projects face long regulatory approval timelines, and new technologies such as SMRs have non-trivial execution risk.

Still, the strategic need is clear. As the world races to accommodate a new era of electricity-intensive technologies, the convergence of public policy, private capital, and global climate goals presents an exceptional growth opportunity for nuclear energy.

Past performance is no guarantee of future results. This material is provided for your general information. It does not take into account the particular investment objectives, financial situations, or needs of individual clients and should not be construed as financial or legal advice. This material has been prepared based on information that Bessemer Trust believes to be reliable, but Bessemer makes no representation or warranty with respect to the accuracy or completeness of such information. This presentation does not include a complete description of any portfolio mentioned herein. Views expressed and information contained herein are current only as of the date indicated and are subject to change without notice. Forecasts may not be realized due to a variety of factors, including changes in economic growth, corporate profitability, geopolitical conditions, and inflation. The mention of a particular security is not intended to represent a stock-specific or other investment recommendation, and our view of these holdings may change at any time based on stock price movements, new research conclusions, or changes in risk preference. Index information is included herein to show the general trend in the securities markets during the periods indicated and is not intended to imply that any referenced portfolio is similar to the indexes in either composition or volatility. Index returns are not an exact representation of any particular investment, as you cannot invest directly in an index and an index is unmanaged and has no expenses.