Market Update: Venezuela

What Happened?

On January 3, 2026, the U.S. captured and arrested Venezuelan President Nicolás Maduro following months of military buildup and increasingly aggressive rhetoric from the Trump administration. President Trump has suggested that the U.S. may assume direct control over Venezuela, though other senior officials have downplayed this notion, instead arguing that the U.S. could guide the country indirectly.

This does not appear to be a traditional case of regime change as the opposition party led by María Corina Machado does not appear to have a formal role in the transition at this stage. Instead, Maduro’s vice president, Delcy Rodriguez, is assuming control following Maduro’s removal.

Why Venezuela, and What’s the Immediate Financial Market Impact?

This move appears closely aligned with the National Security Strategy of the United States, the strategy document released by the Trump administration last November. That strategy emphasized a desire to assert what it described as a “Trump Corollary” to the Monroe Doctrine, now commonly referred to as the Donroe Doctrine. The framework asserts that the U.S. is the dominant power in the Western Hemisphere and will act to ensure regional stability and alignment with U.S. interests.

The strategy paper explicitly highlighted priorities including access to critical resources and supply chains, aggressive action against drug trafficking and narco-terrorism, mitigation of mass migration, and the reduction of foreign superpower influence in the hemisphere.

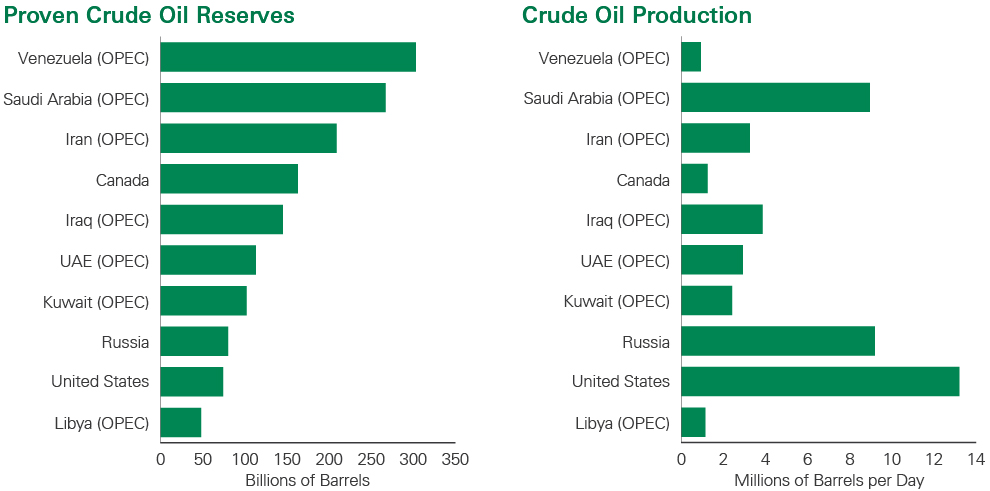

Viewed through that lens, Venezuela stands out as a country that intersects with several of these interests simultaneously. Regarding critical resources in particular, Venezuela is reported to hold the world’s largest oil reserves, yet output remains remarkably low (Exhibit 1) and has declined sharply over the past 15 years.

Exhibit 1: Untapped Potential

Key takeaway: Despite holding the world’s largest proven oil reserves, Venezuela’s oil production remains among the lowest globally.

This data visualization presents a side-by-side horizontal bar chart comparing proven crude oil reserves and current crude oil production across major oil-producing countries, with a strong focus on OPEC members and key non-OPEC global players. The chart provides a strategic snapshot of global energy supply dynamics and geographic concentration of oil resources.

On the left panel, titled “Proven Crude Oil Reserves”, countries are ranked by total reserves measured in billions of barrels. Venezuela (OPEC) leads decisively with the largest reserve base at approximately 300 billion barrels, positioning it as the world’s most resource-rich oil nation. Saudi Arabia (OPEC) follows with roughly 270 billion barrels, reinforcing its long-standing role as a global energy anchor. Iran (OPEC) ranks third near 210 billion barrels. Canada, the leading non-OPEC country on reserves, holds about 170 billion barrels, reflecting its oil sands dominance in North America. Other notable reserve holders include Iraq (OPEC), UAE (OPEC), Kuwait (OPEC), Russia, the United States, and Libya (OPEC), illustrating a heavy concentration of long-term oil reserves in the Middle East, Latin America, and North America.

On the right panel, titled “Crude Oil Production”, countries are ranked by daily output measured in millions of barrels per day. The United States leads global production at approximately 13 million barrels per day, highlighting its operational efficiency and shale-driven production model. Saudi Arabia (OPEC) and Russia follow closely at around 10 million barrels per day each, underscoring their pivotal roles in balancing global oil markets. Iraq (OPEC), Iran (OPEC), UAE (OPEC), and Kuwait (OPEC) demonstrate strong mid-tier production capacity, while Canada and Libya (OPEC) contribute more modest output relative to their reserve positions. Venezuela (OPEC) shows notably low production despite having the largest reserves, signaling geopolitical, infrastructural, and investment constraints.

Overall, the chart strategically contrasts resource endowment versus production execution, revealing that geographic oil wealth does not always translate into high output. The visualization supports macro-level insights into global energy markets, OPEC influence, North American energy leadership, and regional supply risk, making it highly relevant for discussions around energy policy, commodity markets, global geopolitics, and long-term investment strategy.

While some existing infrastructure could potentially be repaired to bring spare capacity back online, years of underinvestment suggest that significant capital and time would be required to materially increase production. Moreover, global oil markets are already in surplus, and prices have declined steadily since Russia’s invasion of Ukraine in early 2022.

It also remains unclear whether U.S. oil companies would be willing to commit capital without assurances regarding political stability, rule of law, security, future access to production, and the ability to sell oil freely on global markets. When Hugo Chávez nationalized Venezuela’s oil industry in 2007, companies were offered the option to restructure their holdings to give PDVSA, the state-owned oil company, a majority stake. Those that declined had their assets expropriated and still have outstanding claims worth billions of dollars.

While a change in leadership could eventually lead to renewed cooperation between the two nations, the near-term impact on oil markets is likely to be limited. The long-term opportunity is meaningful given Venezuela’s vast reserves, but the current state of infrastructure and the risk-reward profile for U.S. companies constrain any immediate supply response.

Broader Geopolitical Ramifications

While the immediate market implications are narrow, the geopolitical ramifications are potentially substantial. The National Security Strategy announced in November is now being actively implemented, with the Donroe Doctrine openly embraced by the administration. While many countries can exert economic pressure against U.S. actions, the U.S. maintains a significant military advantage, and this asymmetry may play an increasing role in its foreign policy.

The success of the operation could signal a more assertive U.S. approach in the region, which may heighten concerns among some Latin American governments — notably those of Cuba, Nicaragua, Mexico, and Colombia — regarding sovereignty and alignment with U.S. policy.

Greenland has also been singled out, with the president stating that the U.S. needs Greenland for national security purposes. Its strategic importance stems from its location between the Western and Eastern Hemispheres, its position along missile flight paths from Russia, key naval routes, and access to critical minerals. The key distinction is that Greenland is a territory of Denmark, a NATO ally, and already hosts a U.S. military presence. Beyond the Western Hemisphere, Iran remains in the administration’s crosshairs amid ongoing domestic unrest, and the U.S. employed military force there as recently as last year.

This action could set a precedent for other global powers. China, in particular, may interpret the U.S. use of force as signaling a greater tolerance for unilateral action, potentially influencing its own posture toward Taiwan. China considers reunification central to its national identity and views the current separation as a vulnerability for the Chinese Communist Party. Taiwan is also strategically vital due to its location along major maritime trading routes and its role in the semiconductor supply chain, particularly through Taiwan Semiconductor Manufacturing Company, the world’s largest semiconductor foundry. A shift in control over Taiwan and its surrounding waters could disrupt global trade and technology supply chains, with significant implications for financial markets.

China’s restraint to date is likely attributable to constraints in military readiness rather than strategic patience. While China’s military is superior to Taiwan’s, democratic allies of Taiwan — including the U.S., Japan, South Korea, Australia, and Europe — have stated they would assist Taiwan in the event of an invasion. As a result, China would need either the capability to confront multiple militaries simultaneously or to seize Taiwan so quickly that outside assistance could not arrive in time. Severe economic sanctions would likely follow such an action, and given China’s current economic challenges, this risk may weigh heavily on leadership decision-making. Public support within China for military action against Taiwan also appears limited.

If U.S. foreign policy increasingly prioritizes the Western Hemisphere, China may conclude that deterrence in East Asia has weakened. At the same time, the administration’s National Security Strategy document explicitly references Taiwan’s importance to the U.S. economy and states that “the United States does not support any unilateral change to the status quo in the Taiwan Strait,” though it stops short of offering explicit security guarantees.

Conclusion

The isolated incident in Venezuela has minimal near-term impact on financial markets. While the country holds vast oil reserves, the degraded state of its infrastructure means that significant investment and a long time horizon would be required to materially affect global oil supply.

However, geopolitical implications are more consequential. The action appears to mark the first major implementation of the Trump administration’s National Security Strategy, signaling a shift toward a more assertive posture in the Western Hemisphere. This represents a meaningful shift in U.S. foreign policy and could usher in a new geopolitical era.

Increased defense spending and near-shoring, two investment themes that have emerged in recent years, are likely to persist or strengthen in this environment. We continue to closely monitor this fluid situation and will adjust portfolios as risks and opportunities develop.

Past performance is no guarantee of future results. This material is provided for your general information. It does not take into account the particular investment objectives, financial situations, or needs of individual clients. This material has been prepared based on information that Bessemer Trust believes to be reliable, but Bessemer makes no representation or warranty with respect to the accuracy or completeness of such information. This presentation does not include a complete description of any portfolio mentioned herein and is not an offer to sell any securities. Views expressed herein are current only as of the date indicated and are subject to change without notice. Forecasts may not be realized due to a variety of factors, including changes in economic growth, corporate profitability, geopolitical conditions, and inflation. The mention of a particular security is not intended to represent a stock-specific or other investment recommendation, and our view of these holdings may change at any time based on stock price movements, new research conclusions, or changes in risk preference.