Is a Family Office Right for You?

- Many wealthy families use family offices to manage their financial lives. These can range from one person handling household administration to large full-service teams of investment and wealth planning professionals, with every conceivable combination of in-house and outsourced service functions in between.

- Each family office approach offers different benefits and drawbacks, and the right decision for your family will depend upon careful consideration of costs, benefits, and the needs of your particular family.

- We explore the different family office structures and service options, the many considerations involved in setting up and running a family office, and ways of deciding whether a family office — or which type of family office — makes the most sense for your family.

For many wealthy families, family offices are an effective way to manage their complex financial lives — for both current family members and succeeding generations.

But what do we mean by “family office” exactly?

When people use the term family office, they usually mean an office dedicated to serving a single wealthy family; in fact, family offices are broadly classified as single family offices (SFOs) or multifamily offices (MFOs).1 Their names are largely self-explanatory — an SFO is run by and for a single family while an MFO manages the wealth of multiple families. Within those categories, however, are numerous potential variations that combine different levels of in-house and outsourced service functions.

A single family office can range anywhere from one person managing bill payments and household staff to a team of dedicated professionals providing investment, legal, insurance, risk management, compliance and regulatory, estate planning, tax, and other advice.

Whatever the approach, setting up and maintaining a family office can be costly and complicated, and there’s no simple formula for determining which family office structure — or if a family office at all — makes sense for you. You’ll need to carefully weigh the many costs and benefits of the various approaches in the context of your own particular family and its needs.

A few of the critical factors to consider include the net worth and complexity of your family’s wealth, including the variety of assets, liquid and illiquid, under management; the number and type of noninvestment services you require; the importance of direct control to your family; and the skills and qualifications of your family members.

In the end, some families decide that a full-service, integrated family office is the right decision. Some — and these can sometimes be families with existing single family offices — decide that a multifamily office or other external providers are the optimal solution. And others choose a combination approach, keeping certain services in-house and outsourcing the rest.

SFOs and MFOs: Advantages and Disadvantages

Both SFOs and MFOs are designed to help families oversee their assets and manage their wealth, but they offer different benefits and potential drawbacks:

- Single family office (SFO). An SFO centralizes the management of family wealth. The family owns and controls the office, which provides dedicated services according to the needs of family members. The family chooses its paid staff, and those staff members serve only that family. Single family offices can range in size from one employee to 50 or more depending on the specific services provided, which can vary widely, often including both in-house and outsourced services. A full-service SFO, for instance, provides a broad range of services, including financial planning, tax and legal advisory, risk management and insurance, philanthropic planning and strategy, succession planning, compliance and regulatory, operational/administrative, and concierge services.

- Given the broad range of potential services, it can be costly to staff a dedicated private office — and difficult to find, retain, and manage the right talent.

- Multifamily office (MFO). MFOs provide the same customized services as a comprehensive single family office but without the need to set up a separate family office infrastructure for each family. In fact, multifamily offices often start as a single family office but gradually evolve into a multifamily office as they begin accepting clients beyond the immediate family to achieve efficiencies of scale.

- That scale provides a number of advantages. MFOs can:

- Attract and retain needed expertise and so are able to provide dedicated teams of professionals servicing individual families. For many families, teams of experts in investments, trust and estate planning, tax advisory, and philanthropy can be a convenient one-stop solution.

- Be proactive when it comes to ongoing investments in technology and systems.

- Reduce expenses for member families as a result of cost sharing.

With MFOs, families have shared rather than exclusive access to talent, counsel, intellectual capital, systems, and other services; expertise and control of the family office no longer reside solely within the family.

Family Office Service Options

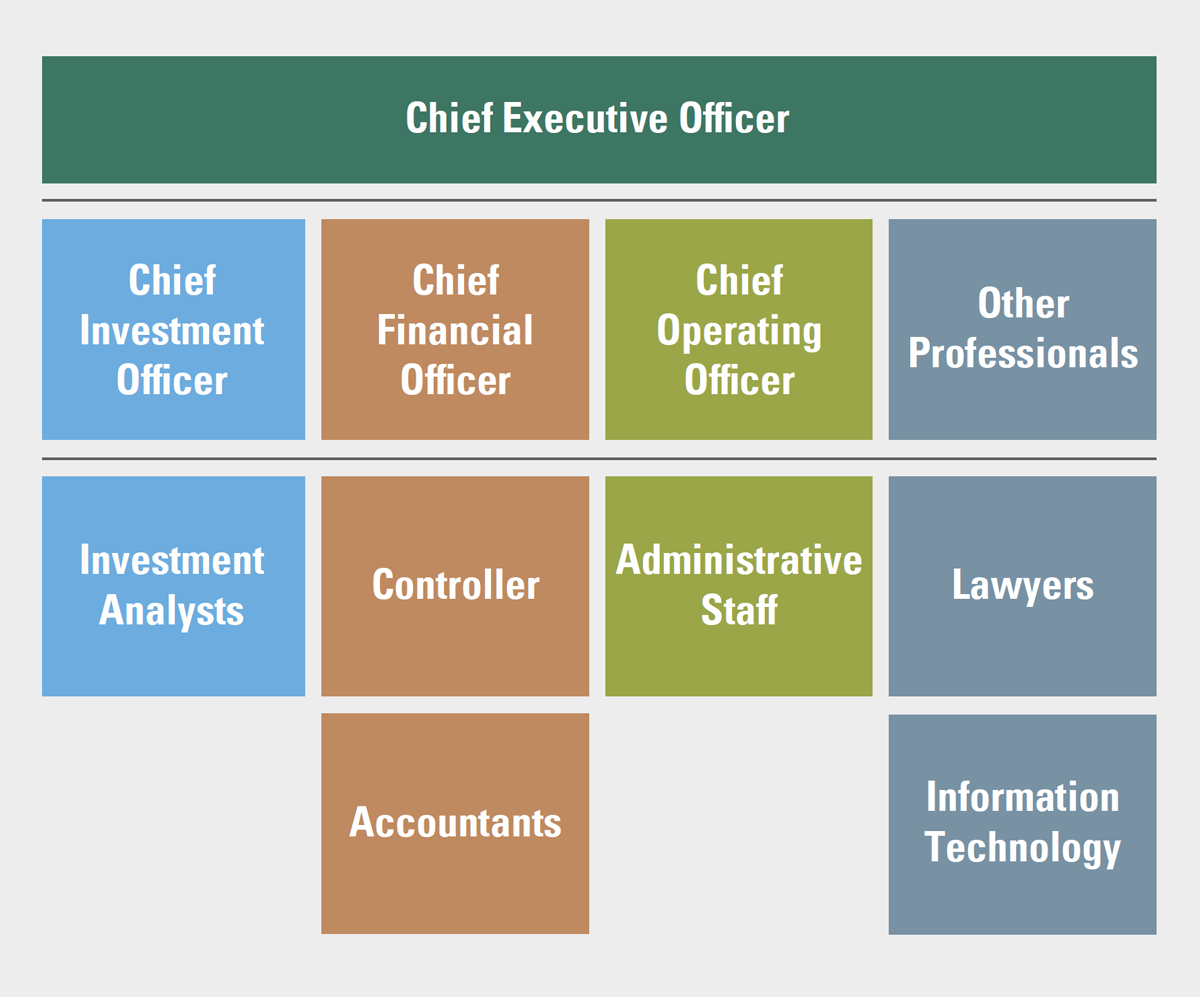

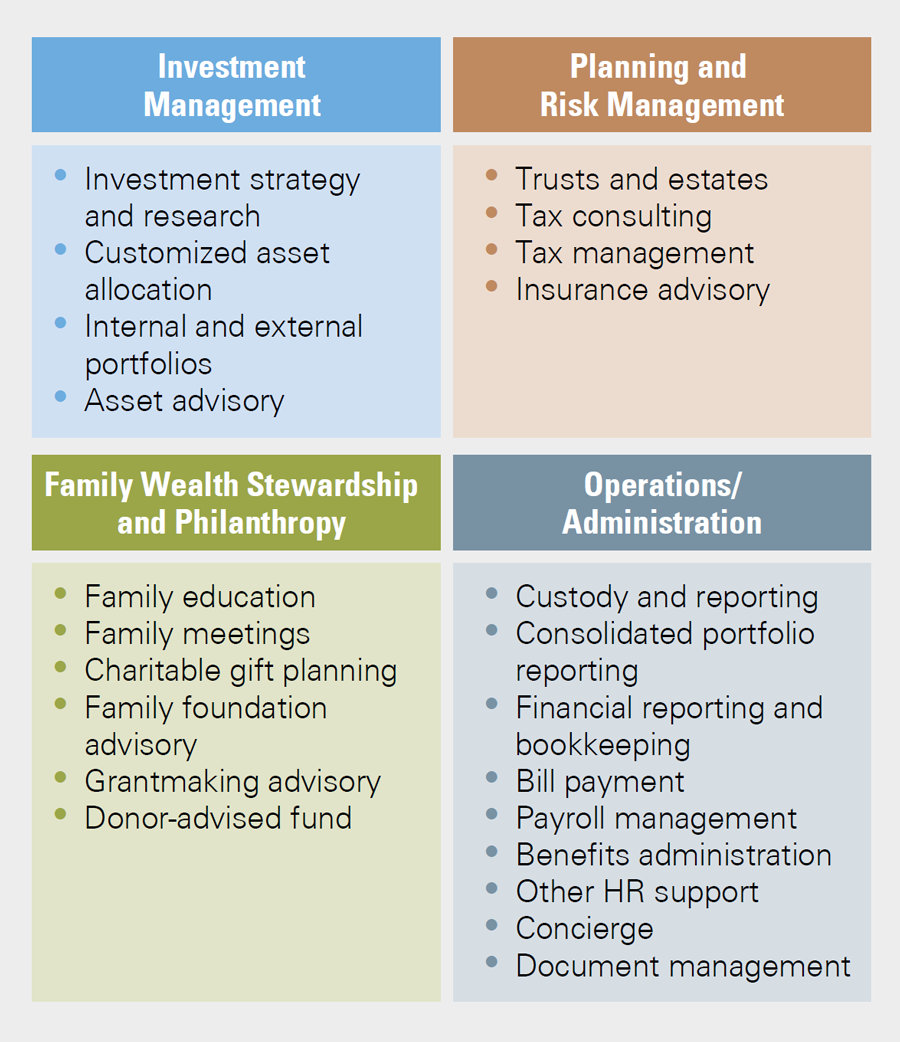

Family offices tailor their services to the needs of the individual family. A full-service SFO — and most MFOs — offer a wide range of services (see Exhibit 1).

Exhibit 1: The Range of Family Office Capabilities

A structured list showing the range of services a family office can provide, organized by category. The categories include Investment Management (e.g., investment strategy and research, customized asset allocation), Family Wealth Stewardship and Philanthropy (e.g., family education, meetings, charitable planning), Planning and Risk Management (e.g., trusts and estates, tax consulting, insurance advisory), and Operations/Administration (e.g., custody, reporting, payroll, document management). This exhibit conveys the breadth of offerings family offices can provide when managing a family’s financial and administrative needs.

Family Office Creation and Operation

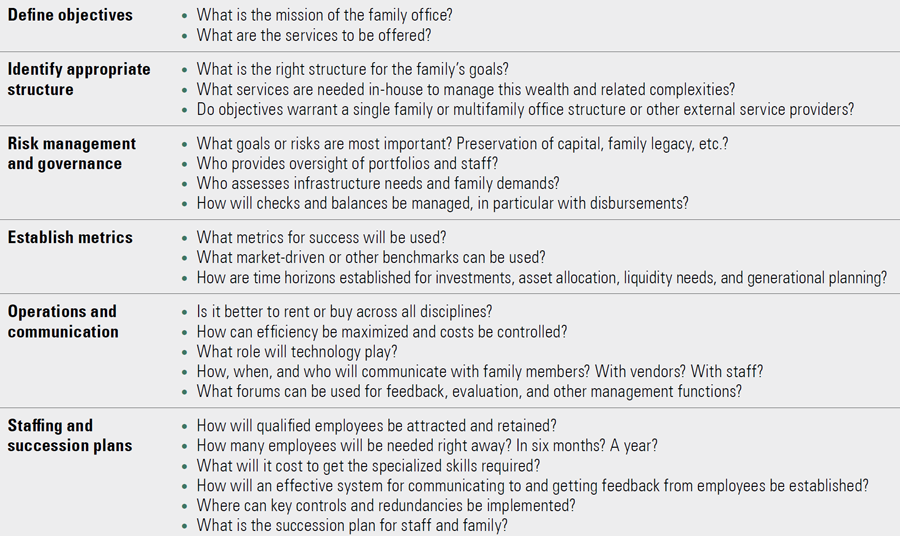

When considering whether a family office — or which type of family office — is the right choice for your family, the first step is clarifying your objectives, goals, and the services your family needs (see Exhibit 2).

What services will the office provide? How and where will the family office operate? What is the operational/administrative budget, and who pays? Which family member(s) will manage the office? If there is a family business, how will it relate to the family office?

Exhibit 2: Family Office Design Considerations

A table or checklist outlining the core considerations when determining whether to establish a family office and how to structure it. Elements include defining objectives (mission and services), identifying appropriate structure (single or multifamily office), risk management and governance priorities, establishing performance and market benchmarks, operations and communication planning, staffing and succession planning, and technology role. The exhibit helps families assess their needs and align organizational design with their goals.

Once you have a clear set of objectives and their relative importance, you’ll be able to determine what staff and structure are required — or, indeed, if you require a single family office at all. Many families decide that a multifamily office or investment managers paired with other external service providers are all they need.

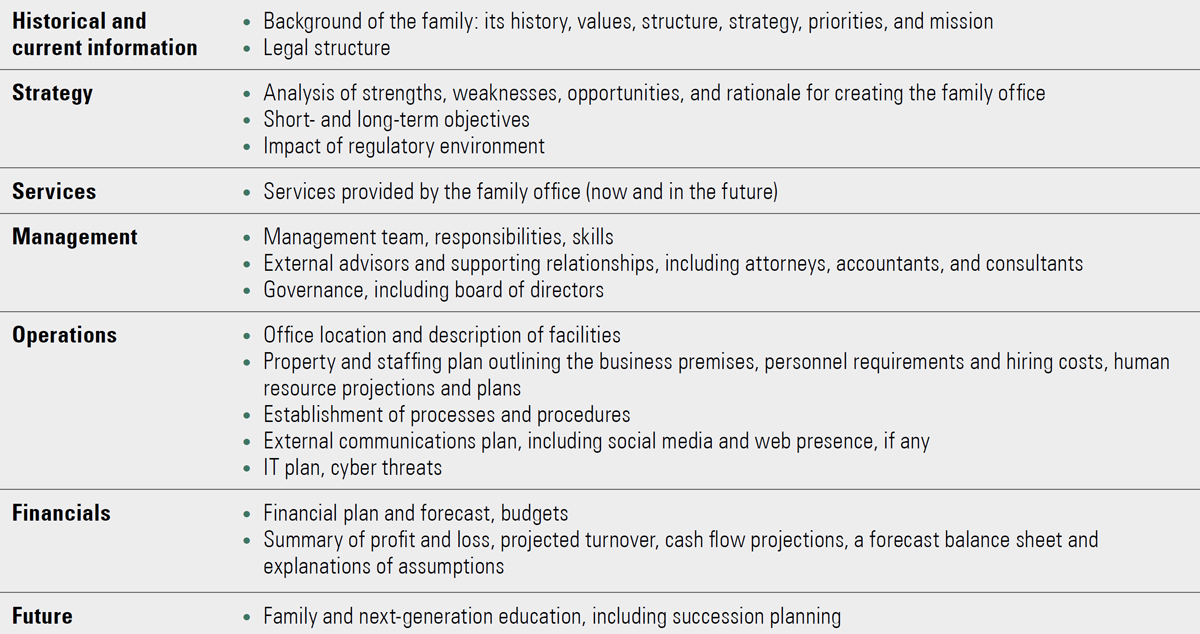

If you determine that an SFO is the right structure for your family, the next step is crafting a business plan with the help of a trusted advisor (see Exhibit 3).

Exhibit 3: Components of the Family Office Business Plan

A multi-section outline showing key components of a family office business plan. Sections include historical and current information (family background, legal structure), strategic analysis (strengths, weaknesses, opportunities), services offered now and in the future, management team and responsibilities, operational structure (location, staffing), financial plan (budget, forecast), and future education and succession planning. This exhibit frames the essential elements for building a family office that’s sustainable and mission aligned.

In-House or Outsource?

Which services are best maintained in-house? Which are best outsourced?

The main advantage of keeping key services in-house is direct family control of the family office.

On the other hand, managing a large pool of wealth can be time consuming and complex. An external advisor — with access to research tools and other resources not always available to in-house investment managers — can often ease the process and increase efficiency.

Key criteria in deciding which services to retain in-house and which to outsource include the following:

- The depth/breadth of expertise required — e.g., the nature of your family’s wealth, variety of assets, liquid and illiquid, under management — and the cost to acquire that expertise

- The benefits and cost of necessary technology

- The management time required

- The number and types of non-investment services required

- The skills and qualifications of family members

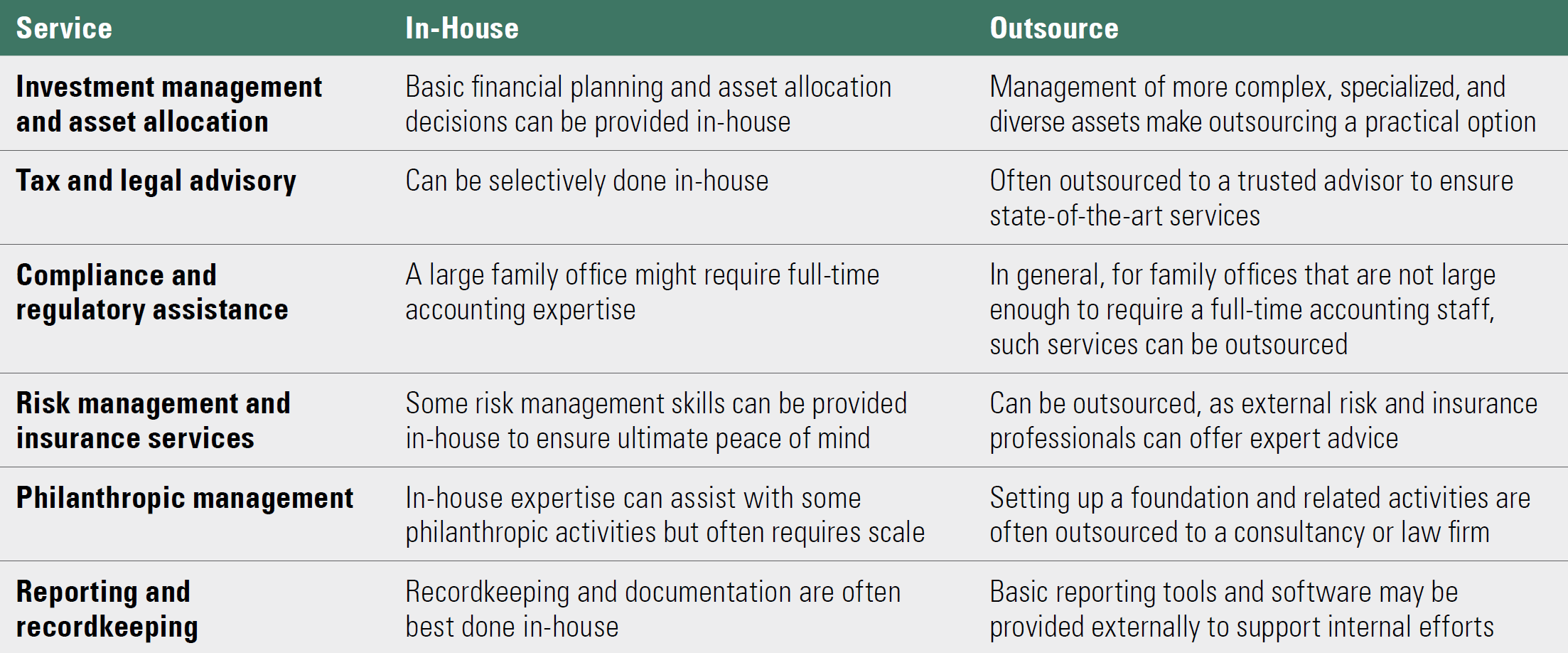

While it can be tempting to bring all services in-house, it’s often more efficient to handle key services in-house and, when necessary, retain a third-party service specialist with robust technology platforms and other resources for noncore services (see Exhibit 4).

Exhibit 4: What to Keep In-House? What to Outsource?

A table that compares various family office services and categorizes them based on whether they are typically handled in-house or outsourced. For example, basic financial planning and asset allocation may be done in-house, while complex asset management or regulatory compliance may be better outsourced. It helps families weigh control versus efficiency when building their service mix.

Cost Considerations

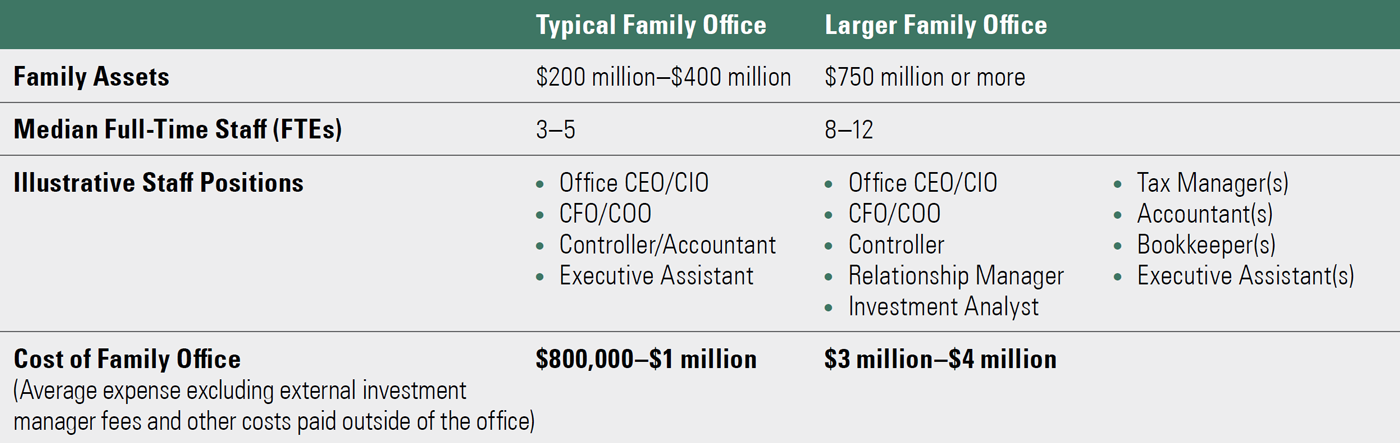

The cost of establishing and maintaining a family office depends on the scope of services required by your family.

Generally, for families with $200-$400 million in assets, family office setup can often include a wide range of services, involving costs for staff recruitment, compensation specialists, relocation, office space, and technology. Families with assets below $200 million, on the other hand, often choose to limit services provided, and so costs will typically be associated with administration, control of assets, and risk management.

But how much does it cost to run a family office? A full-service family office can cost $1 million or more (in some cases, much more) annually (see Exhibit 5).

Exhibit 5: What Does It Cost to Run a Family Office?

A comparative table outlining typical costs and staffing structures for family offices based on size. For families with roughly $200 million–$400 million in assets, a full-service family office might have 3–5 full-time staff; for larger offices ($750 million+), 8–12 staff. The table shows average annual operating costs, salaries, and roles such as CEO/CIO, CFO/COO, accountants, relationship managers, and other support. This exhibit clarifies the significant investment needed to run a dedicated personal family office.

Staff compensation and benefits represent a significant portion of total costs of a family office. In our experience, which is in line with most industry analysts, more than 60% of the total costs of a family office are generally allocated to staff compensation and benefits.

Basically, competition from hedge funds, investment banks, and other wealth management firms — including multifamily offices — can make it challenging and costly to find and retain advisors with the required expertise.

And the staffing requirements of a full-service SFO can be extensive (see Exhibit 6).

In addition to staffing, investing in various alternative asset classes — real estate, oil and gas, other commodities, private equity — increases the difficulty of portfolio monitoring, reconciliation, and reporting (the costs of regulatory and compliance reporting are high). You would need to build an in-house system integrating various asset classes or use an off-the-shelf application.

You would also need to factor in the costs of ongoing information technology (IT) maintenance, system upgrades, data backups, and risk management of systems, most importantly including cybersecurity.

Controlling the cost of operations — including staffing as well as overhead administrative costs, and the costs of running IT systems — is critical but often an ongoing challenge. In fact, these costs represent one of the main reasons families often opt for a multifamily approach, where the firm is able to spread costs over a larger asset base and achieve higher cost efficiencies.

Finding the Right Balance

Providing advice and full services under a comprehensive wealth management plan is typically beyond the ability of any single professional advisor. It requires a coordinated, collaborative effort by a team of professionals from the investment, legal, insurance, estate, and tax disciplines to provide the planning, advice, and resources needed.

But should you choose a single family office? A multifamily office? Or an approach that combines both?

The right decision usually comes down to a careful assessment of the amount of family wealth, the complexity of your family’s financial life, and your family’s particular priorities and objectives, including service needs.

With a full-service SFO, for instance, 100% of your team’s time is dedicated to helping you grow, preserve, and transfer your wealth. But you’ll pay a premium for that dedication. A single family office is almost never as cost efficient as a multifamily office due to lack of scale. Greater family wealth makes a fully integrated approach easier to justify. Even so, if you choose this approach exclusively, it will be critical to analyze costs and structure the SFO’s operations to help it remain cost efficient.

If instead you choose a multifamily office or other external service providers, you would trade the exclusive dedication of an SFO for lower costs and shared access to talent, counsel, intellectual capital, systems, and other services commensurate with your wealth.

For many families, however, the right choice is often a combination of the two approaches. You can manage as many aspects of your wealth as you want in-house via your own family office and collaborate with a multifamily office for other services.

While these considerations can often be quite involved, working with knowledgeable advisors and using a deliberate and thoughtful approach, you can customize a strategy that successfully manages your family’s wealth today and for generations to come.

If you’re looking to learn more about single family and multifamily offices, and the structures that might make sense for your family, please contact your Bessemer advisor.

This material is for your general information. It does not take into account the particular investment objectives, financial situation, or needs of individual clients. This material is based upon information obtained from various sources that Bessemer Trust believes to be reliable, but Bessemer makes no representation or warranty with respect to the accuracy or completeness of such information. The views expressed herein do not constitute legal or tax advice; are current only as of the date indicated; and are subject to change without notice. Forecasts may not be realized due to a variety of factors, including changes in economic growth, corporate profitability, geopolitical conditions, and inflation. Bessemer Trust or its clients may have investments in the securities discussed herein, and this material does not constitute an investment recommendation by Bessemer Trust or an offering of such securities, and our view of these holdings may change at any time based on stock price movements, new research conclusions, or changes in risk preference.