Equity Market and Positioning Insights

- We have written extensively about market volatility in our weekly investment updates. This Investment Insights takes a step back and examines the long-term drivers of equity valuations and returns.

- Bessemer portfolio managers have adjusted holdings to reduce volatility by adding exposure to companies in the healthcare, consumer staples, and utilities sectors.

- Longer term, we continue to view investments in high-quality businesses with scale and strong growth prospects as a winning strategy for those that have time on their side.

- Our sub-advised strategies are sticking to their process and taking advantage of opportunities as they present themselves.

Challenging Start to the Year for Equities

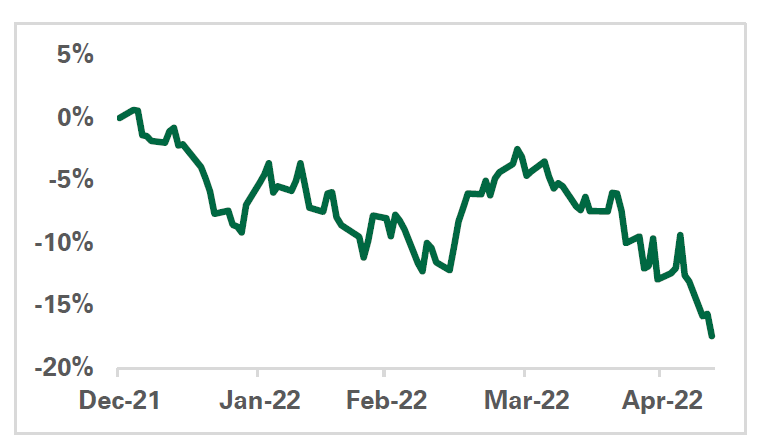

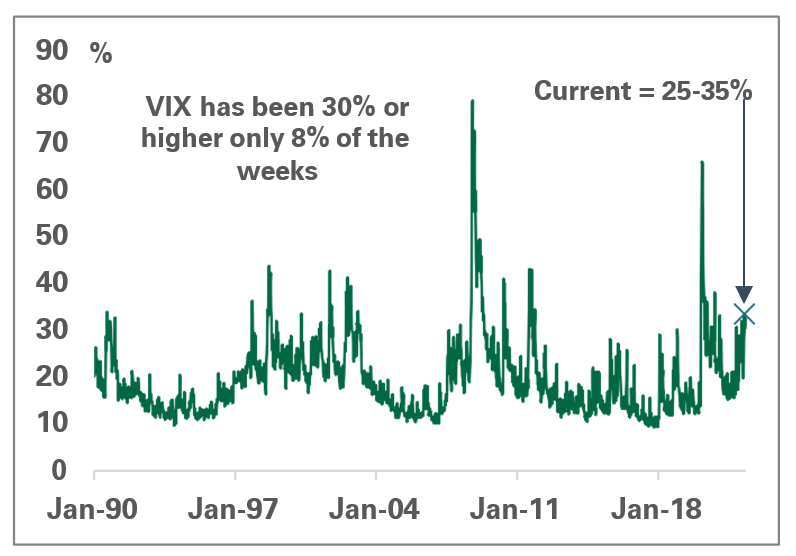

Equity markets have been challenged year to date (Exhibit 1), with the S&P 500 Index pulling back over 16%. The volatility, including intraday moves, has been pronounced as well. The VIX, which uses option prices to imply the volatility that the market is expecting, is pricing in an annualized move of 25% to 35%. For context, this is well above the normal range, which tends to sit in the mid-teens area (Exhibit 2).

Exhibit 1: S&P 500 Year-to-Date Total Return

Key takeaway: This year’s start has been challenging for equity markets.

A line chart of the S&P 500 index year-to-date total return through early May 2022, highlighting a notable pullback in equity returns compared with typical market range.

Exhibit 2: VIX Option Implied Volatility (Weekly)

Key takeaway: The VIX is currently pricing an annualized move above historical ranges.

A weekly line chart of the VIX option implied volatility index showing current readings well above historical mid-teens levels, indicating elevated expected market volatility.

What is driving this move?

To understand what is driving the market, it can help to take a step back and recall the basics — the market price is simply the weighted average equity price of all the companies that make up the market. Additionally, an equity investment is a claim on the future cash flows of these companies as they grow over time, discounted back in time for the opportunity cost of capital. In a rational market, one will pay up to a dollar for a dollar worth of future cash flows. The present value of future cash flows depends on how fast they grow and the discount rate needed to compensate for the time value of money and the risk of loss. There have been notable developments in both of these factors this year.

Discount rate

The discount rate that one applies to future cash flows can be broken into two pieces: 1) the risk-free rate, which is the amount one is compensated for the value of time, and 2) the equity risk premium, which is the compensation one requires for investing in cash flows that can be volatile. The Federal Reserve controls the risk-free rate as U.S. government bonds are considered to have a very low credit risk. With the Fed signaling that it will raise rates to combat inflation, the market is expecting a higher risk-free rate. Meanwhile, the equity risk premium is also increasing given heightened uncertainty around the globe. The equity markets are requiring higher returns to hold equities in the face of changing monetary policy, inflation, the pandemic’s reshaping of demand, and global geopolitical tensions. With both pieces of the discount rate moving up, and all else being equal, the value of future cash decreases.

Growth expectations

For most stocks, the cash flows that one has a claim on grow over time, and much of that growth is linked to the underlying growth of the economy. Since the beginning of the year, the rate of future growth has been revised downward. The market is pricing in the fact that rising rates work to slow inflation by restricting demand. Furthermore, the market is discounting the fact that stimulus from the previous two years is fading. Finally, the market is also seeing other countries start to slow, including Europe and China. That said, there are also structural nuances to note, with more speculative long-term growth-oriented companies coming into question.

Bessemer equity strategies performance

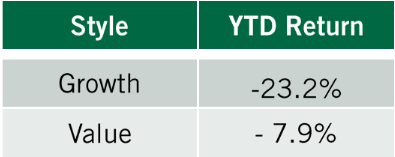

This repricing of the market’s discount rate and growth expectation has been challenging not just for the markets but also for Bessemer equity funds, which include internally managed and sub-advised strategies. After several years of solid returns, the portfolios have started the year in the negative, and some have underperformed their respective benchmarks. The major detractor from relative performance is the exposure to high-quality, sustainably growing companies. That, combined with the strategy of avoiding companies that don’t grow faster than the market in the long run, has not resonated in this environment. Growing, high-quality companies are more sensitive to changes in both their growth rate as well as discount rates. This can be seen in the year-to- date performance of the growth index, which is down 23.2% versus the value index, which is only down 7.9% (Exhibit 3). It should be no surprise that the strategies that employ a philosophy and process most focused on long-term growth investing have suffered the worst in this period.

Exhibit 3: Calendar-Year Performance

Key takeaway: Growth has underperformed value as it is more sensitive to changes in rates and growth expectations.

A bar chart comparing calendar-year performance of growth and value equity indexes, illustrating that growth stocks have underperformed value stocks amid rising discount-rate pressures.

It pays to be patient

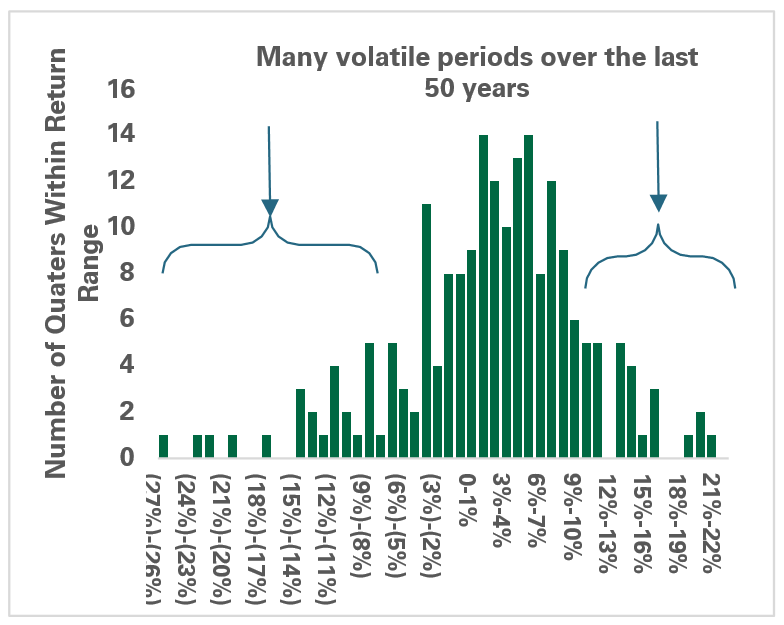

In the short term, these changes in growth rates and discount rates can be the main driver of equity values. However, in the long run, discount rates are cyclical, and growth expectations are mean reverting. As a result, it ends up being the underlying earnings growth of the companies that are the largest driver of value. In any one quarter over the last 50 years, the market has seen a wide range of performance (Exhibit 4).

Exhibit 4: S&P 500 Distribution of Quarterly Returns (Past 50 Years)

Key takeaway: Quarterly returns are volatile.

A histogram depicting the distribution of quarterly returns for the S&P 500 index over the past 50 years, underscoring the historical range and volatility of quarterly equity market performance.

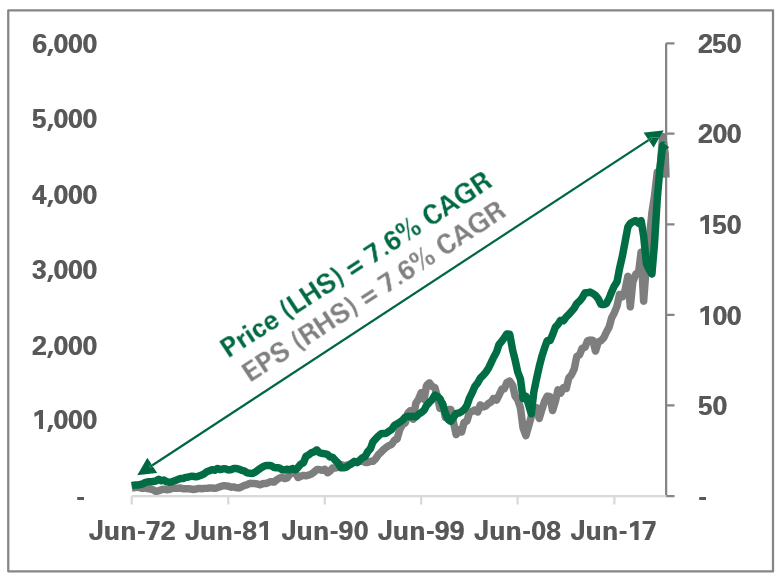

However, when you step back and sum the 50 years of quarterly performance, you have compounded returns of 7.6% annually, driven by earnings, which have compounded 7.6% annually over the same time period. The odds are in an investor’s favor if they can be patient and let the companies grow and compound their value (Exhibit 5).

Exhibit 5: S&P 500 Price (Past 50 Years)

Key takeaway: A longer-term horizon allows for investments to compound over time.

A long-term line chart illustrating the S&P 500 price index over the past 50 years, showing the compounding growth of equity prices over multiple decades and reinforcing the value of a long-term investment horizon.

Strategy and Positioning

Bessemer portfolios focus on owning higher-quality and sustainably growing companies at reasonable valuations. Those companies that can grow faster than the market for longer than the market expects have a history of being some of the best-performing stocks over a multiyear period. We continue to focus on these types of companies and ensure that they make up a majority of the portfolios. In the short run, to protect portfolios from the high levels of volatility, the portfolio teams have added a few defensive-oriented companies in the healthcare, consumer staples, and utility sectors. Examples include Costco, Walmart, and Berkshire Hathaway, which portfolio managers added to given their defensive properties.

Bessemer portfolios include external managers, which provide us access to expertise in various parts of the market and add diversification to our portfolios. Our sub-advisers manage strategies that run the gamut from growth to value, small to large cap, and across all markets. It is Bessemer’s external manager selection team’s responsibility to ensure that external managers continue to adhere to their investment process regardless of market environment and to adjust allocations to them, as necessary. Volatility creates opportunity for active managers. Most managers have taken advantage of indiscriminate market selling to upgrade their portfolios — including boosting quality or finding more attractive growth or increasing discounts in the businesses they target or that they currently own.

Update From 1Q22 Corporate Earnings

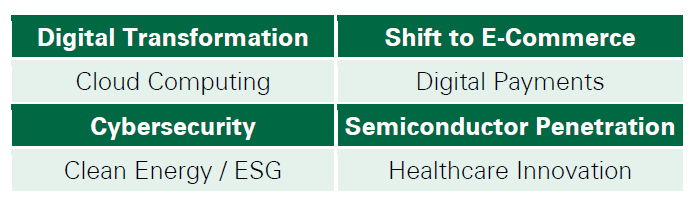

Over the last month, many of the companies that make up the market have reported on their earnings from the first quarter of 2022. We have multiple growth themes that are prominent in Bessemer portfolios (Exhibit 6). One theme that runs through the portfolios is the move to cloud computing. The value proposition of executing work in the cloud is undeniable, and we expect the cloud to grow for many years. To that end, during the first quarter, the major cloud providers noted that they grew 37%-53%, reaffirming our thesis on this sector and our holdings in Microsoft and Google. A growth theme that was less rosy in the quarter was the adoption of ecommerce. After two years of pandemic-driven growth, consumer spending on ecommerce slowed. At the same time, companies were in the process of hiring and building capacity to handle the tremendous growth. The result was some disappointing guidance for the remainder of the year. We appreciate that it will take some time to lap the very fast COVID-19-induced growth and have reduced exposure to companies such as Amazon, which is leveraged to this theme. However, penetration of e-commerce is set to continue in the long run, especially in emerging markets, where e-commerce is not as widely adopted.

Exhibit 6: Prominent Growth Themes in Bessemer Portfolios

Key takeaway: Multiyear secular trends continue.

A visual chart listing prominent secular growth themes in Bessemer Trust portfolios, such as cloud computing and other multiyear structural secular trends, demonstrating areas of strategic equity exposure.

Summary

The market is pricing in changes to discount rates and growth expectations and has done so in dramatic fashion. Moreover, the current high inflation and sharp move in interest rates, combined with a slowing growth rate, are a headwind for investing in growth companies. While this backdrop may continue for some time, we expect the inflation rate to start to subside, the Fed rate hikes to cool off the economy, the market to gradually rebound, and for those companies with enduring growth characteristics to once again be rewarded by the markets. In select strategies, in the short term, we have adjusted holdings to reduce volatility. For our sub-advised strategies, particularly those facing significant headwinds, we are encouraged by their discipline to stick to their process and take advantage of opportunities as they present themselves. Longer term, we continue to view quality and growth as a

winning strategy.

Past Performance is no guarantee of future results. This material is for your general information. It does not take into account the particular investment objectives, financial situation, or needs of individual clients. This material is based upon information obtained from various sources that Bessemer Trust believes to be reliable, but Bessemer makes no representation or warranty with respect to the accuracy or completeness of such information. Views expressed herein are current only as of the date indicated, and are subject to change without notice. Forecasts may not be realized due to a variety of factors, including changes in economic growth, corporate profitability, geopolitical conditions, and inflation. Bessemer Trust or its clients may have investments in the securities discussed herein, and this material does not constitute an investment recommendation by Bessemer Trust or an offering of such securities, and our view of these holdings may change at any time based on stock price movements, new research conclusions, or changes in risk preference.