Cooling a Hot Housing Market

- We expect the hot housing market sustained over the last two years to cool but not freeze over.

- The supply of housing is drastically tighter than that of the late 2000s; on the demand side, underwriting standards for loans are far more stringent, and affordability for consumers has generally eroded due to higher housing prices and mortgage rates.

- Bessemer investment teams continue to focus on identifying opportunities to gain exposure to housing related themes.

Cooling a Hot Housing Market

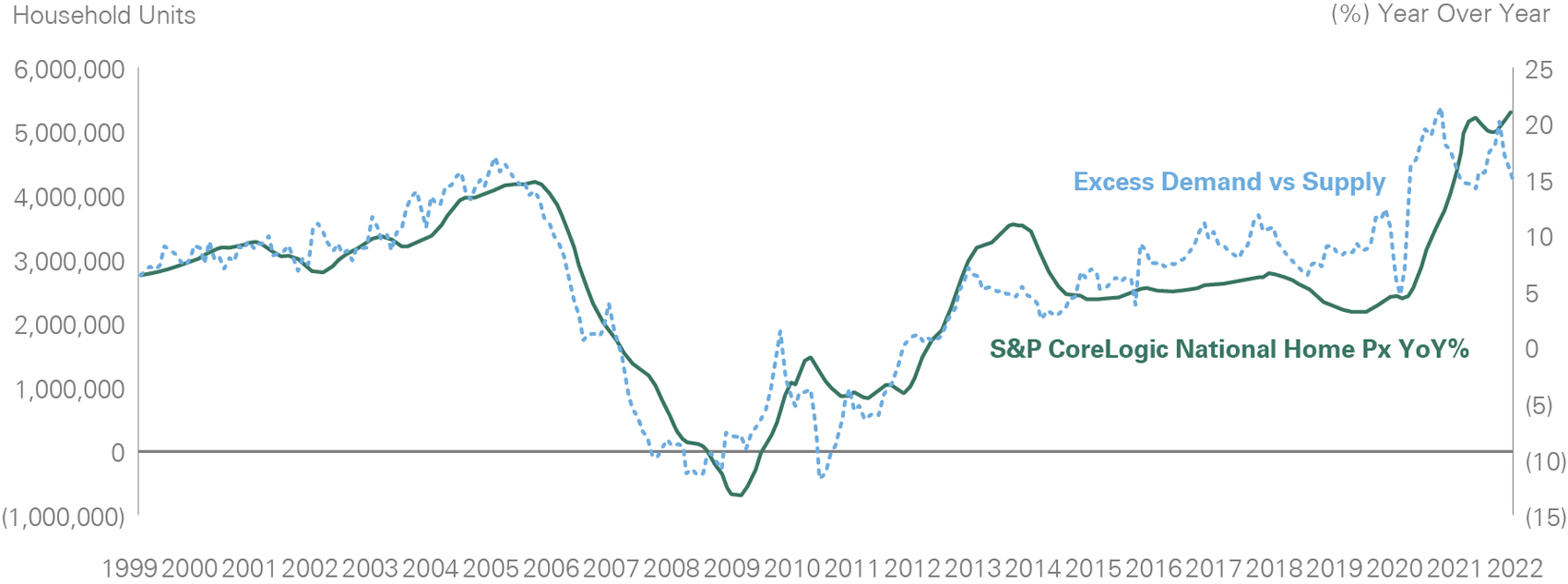

Since the summer of 2020, the U.S. housing market has experienced unprecedented price appreciation (Exhibit 1). We noted the underlying fundamentals of this dynamic in our A Closer Look “Facets of a Hot Housing Market” last year and are providing an update on the housing landscape. During this period, demand was driven by record-low mortgage rates, a flight from urban to suburban/rural dwellings (largely due to COVID-19), and a new segment of the millennial cohort entering homeownership. This influx of demand was met with a chronic undersupply of homes — a ripple effect of the Great Financial Crisis.

While much of the fundamental undertones remain, mortgage rates have adjusted higher in reaction to the Federal Reserve aiming to significantly reduce policy accommodation. In this Investment Insights, we examine the magnitude of this mortgage rate move and its impact on the housing market as well as potential implications for the macroeconomic environment. Our main takeaway is the hot housing market of the last two years will simply cool but not freeze over.

Exhibit 1: National Housing Demand vs. Supply

Key takeaway: While demand most likely cools, undersupply will keep home prices relatively supported.

Mortgage Rates and Their Impact

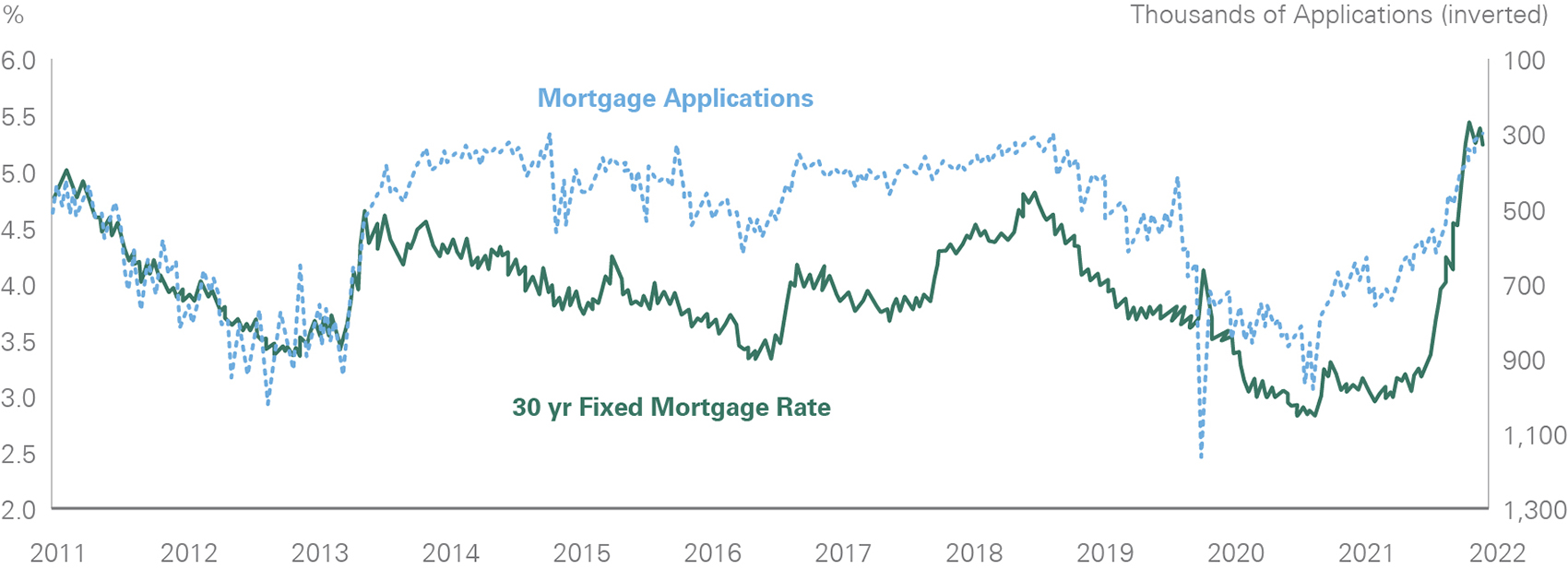

As the Federal Reserve reduces accommodation from the economy, the transmission mechanism to the U.S. consumer is largely felt through mortgage rates. Higher mortgage rates create a more costly environment for potential buyers to purchase homes as they pay more interest to borrow the required funds. Generally, these mortgage rate adjustments happen over a few quarters and are felt gradually. However, given the Federal Reserve’s hawkish pivot, mortgage rates have had a strong and abrupt adjustment higher (Exhibit 2).

The rapid move in rates is providing an incentive for homeowners who were considering offering their home for sale and potentially moving to another (whether an upgrade or downgrade) to reassess their timeline. This is especially true as current homeowners will naturally anchor to their current mortgage rate, which is most likely below current market rates. In turn, housing turnover should slow, which should cool the market. Additionally, higher rates start to cap potential buyers’ spending power. As a result, this should help calm bidding wars in this supply-constrained housing market.

Affordability

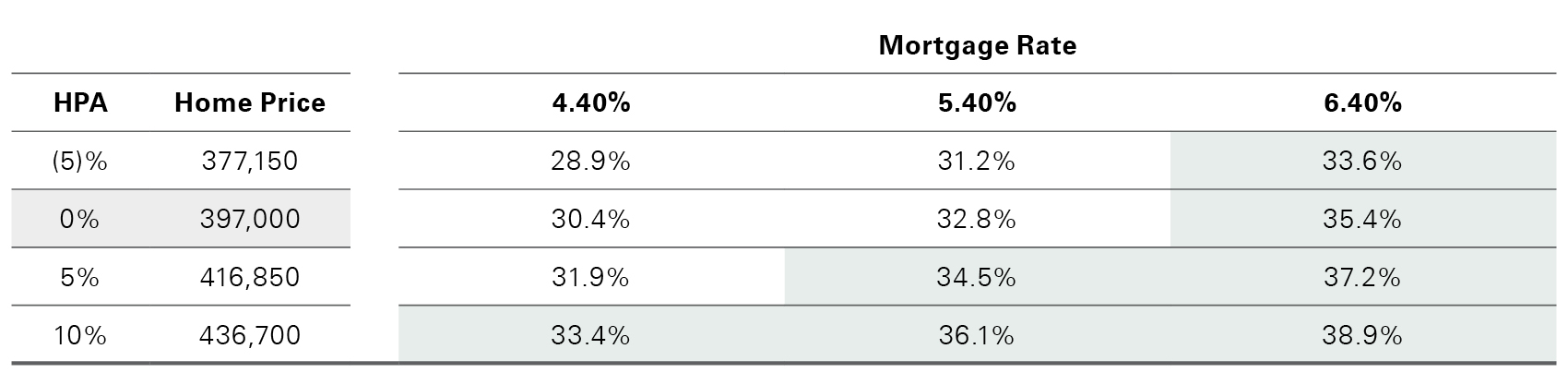

A barometer that we often analyze is housing affordability. On a national scale, a simplified way of examining this metric is by calculating the percentage of median family gross income relative to the median price of a home given the current mortgage rate. When mortgage payments (including taxes and insurance) approach the low to mid-30s percentages of gross income, it begins to raise some flags as to the sustainability of price appreciation, at least relative to history. Exhibit 3 shows potential home price movements relative to mortgage rates and how they compute to mortgage affordability. As an example, given current mortgage rates of approximately 5.40%, while it will most likely be a bumpy ride we would not be surprised if national housing prices were up single digits this year. For context, the S&P CoreLogic Case-Shiller national home price index was up 4.5% in 2018, 3.7% in 2019, and a whopping 10.4% and 18.9% in 2020 and 2021, respectively.

As consumers begin to earn higher wages, affordability and, therefore, home prices adjust in kind; our analysis is more conservative and does not incorporate recent wage increases. The tight labor market will most likely keep wage pressures supported. The adjustment higher in mortgage rates drives the cooling of housing turnover and, to some extent, home price appreciation as lenders are averse to loaning money to borrowers who require a large portion of their income to service their mortgage. Since the Great Financial Crisis, underwriting standards for loans are far more stringent, forcing lenders to be more conservative. Moreover, as we mentioned in our previous piece, the supply of housing is drastically different than that of the late 2000s.

Another consideration is that real estate investors account for nearly 20% of home purchases, according to RedFin. This, along with other structural factors at play, may ultimately distort metrics.

Exhibit 3: Debt to Income Ratios

Key takeaway: Higher mortgage rates can hinder affordability as evidenced by debt to income ratios.

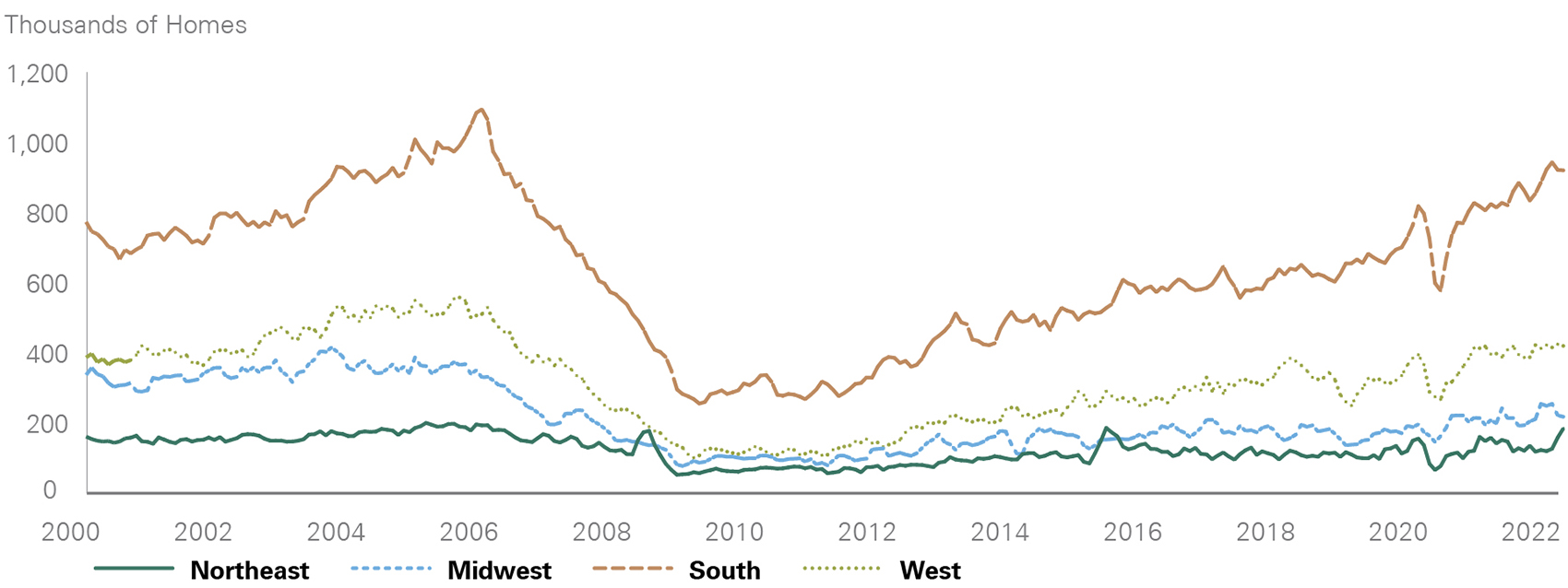

Geographic and Construction Dynamics

There are also regional undercurrents at play. As we all know, there are different costs of living across geographic areas in the U.S., and this dynamic can be observed in home construction. Breaking down housing starts into four regions helps us understand some of the balancing dynamics of the housing market. Since 2020, the hottest markets for construction have been the West and the South. While there has been a recent pick-up in construction in the Northeast, we do not anticipate anything close to the new supply coming to market in the West and South (Exhibit 4). New supply brought on by construction impacts housing prices, which tend to reflect either the scarcity or abundance of it. Beyond regional differences, there are state, city, and municipality contrasts as well. For example, while housing prices may be strong in Palm Beach, Florida, they may be softening in Nashville, Tennessee.

Broadening inflation permeates the construction process as well. The inflation dynamics range from wages to delivery costs to material input costs. While all of this supports the value of homes, it may also drag out lead times for construction, ultimately prolonging the supply imbalance.

Further Policy Pass-Through

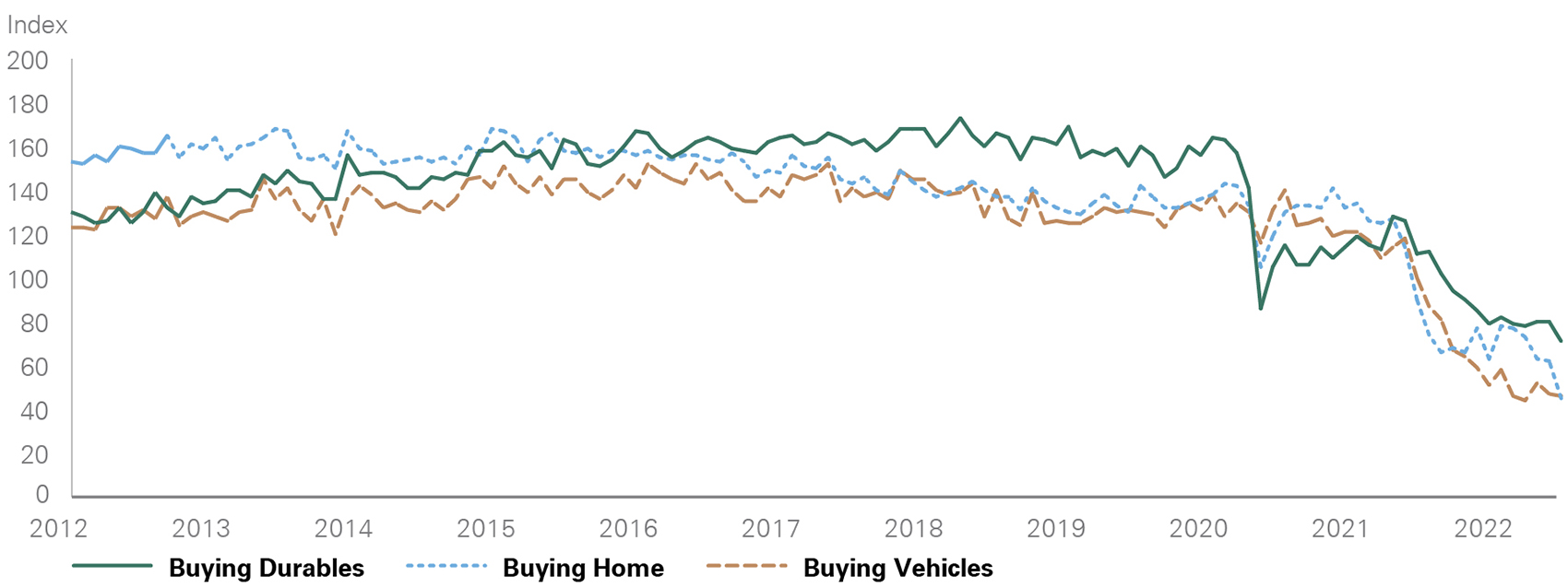

The economic pass-through from higher mortgage rates is not isolated to housing turnover but is also evident in many of the secondary effects of home purchasing. Whether a new or existing homeowner moves, many other large purchases accompany the transition. These purchases vary from things as large as an additional car to as small as a new rug, with items like refrigerators and couches in between. Many of these purchases are classified as durables, and they too are often financed. As rates move higher and housing turnover slows, so do these durable purchases (Exhibit 5), which has growth and inflation ramifications.

The Federal Reserve is also focused on the shelter aspect of inflation, often defined as Owners-Equivalent Rent (OER) — in short, the amount of rent that would have to be paid in order to substitute a currently owned house as a rental property. This inflation variable is one of the largest components of the Fed’s favorite inflation gauge, the price deflator for personal consumption expenditures (PCE). While there are certainly tradeoffs to buying and renting, along with regional differences, for the most part, the blunt force of higher rates should translate into cooling shelter-related pressures. As shelter inflation stabilizes, the Fed can feel more confident about achieving its price stability mandate.

Portfolio Implications

The equity team is looking for selective opportunities to gain exposure to the long-term undersupply of housing. We view today’s environment as an attractive time to be canvassing the landscape, as valuations for the sector are implying a significant, prolonged slowdown in housing. The fundamentals of these companies could be much stronger than anticipated over a longer time horizon. Within the housing value chain, we specifically research building products distributors, effectively the “picks and shovels” of the housing industry. We think that businesses in this space that have a leading share in local markets but also have national buying power should help to solve friction in the industry. By sourcing and offering lower-cost items to fill demand at a time when the supply chain is in flux, these advantaged building product distributors can take share from smaller regional players as the housing market potentially cools in the near term.

The Bessemer Credit Income strategy takes a diversified approach to investing in the credit universe. Current investments are geared to nearly 41% household/consumer debt, 31% corporate debt exposure, and 28% U.S. government/quasi-government debt. Underlying balance sheets for consumers are quite strong relative to history and support our confidence in the portfolio’s positioning.

The Credit Income strategy holds mortgage securities in the agency and non-agency space. The vast majority of these securities have strong loan-to-value characteristics along with lower loan balances. In the non-agency space, most of the securities have a floating rate component that, with this current rate backup, helps with longer-term yield return. We remain confident in the underlying fundamentals of these securities and continue to find the diversification properties within the portfolio to be attractive.

We are always looking for prospects to upgrade our platform and portfolios. The fluid aspects of the housing market, we believe, will continue to give us opportunities.

This material is for your general information. It does not take into account the particular investment objectives, financial situation, or needs of individual clients. This material is based upon information obtained from various sources that Bessemer Trust believes to be reliable, but Bessemer makes no representation or warranty with respect to the accuracy or completeness of such information. Views expressed herein are current only as of the date indicated, and are subject to change without notice. Forecasts may not be realized due to a variety of factors, including changes in economic growth, corporate profitability, geopolitical conditions, and inflation. Bessemer Trust or its clients may have investments in the securities discussed herein, and this material does not constitute an investment recommendation by Bessemer Trust or an offering of such securities, and our view of these holdings may change at any time based on stock price movements, new research conclusions, or changes in risk preference.