Enduring U.S. Leadership in a Changing World

- Recent fiscal, political, and geopolitical uncertainty has raised questions about whether U.S. economic and market leadership is poised to fade.

- The U.S. retains structural advantages in productivity, innovation, and capital markets. The dollar’s reserve currency status and the depth of the U.S. Treasury market continue to anchor global financial systems, while U.S. public and private markets benefit from leadership in technology and venture capital.

- Despite cyclical catch-up abroad, we see little evidence of a lasting shift away from U.S. outperformance.

After more than a decade of U.S. economic and equity market outperformance, recent policy uncertainty, rising fiscal debt, and increasing political polarization have led some to question whether America’s long-standing leadership is poised to fade — and whether this signals an end to what many have called U.S. exceptionalism.

While pockets of strength have emerged outside the U.S., we do not believe the U.S. economy — supported by the depth of its Treasury market and the dollar’s role as the world’s reserve currency — or its equity markets are likely to experience sustained structural underperformance in the coming years.

Reassessing Global Market Leadership

Both push and pull factors are fueling questions about America’s global standing. Our base case is that the peak of tariff uncertainty is behind us. While it is unlikely that we will see the mega cap technology stocks drive U.S. equities to the same magnitude of outperformance as in 2023 and 2024, we believe much of the cyclical catch-up by the rest of the world has already occurred this year. We believe it is important to distinguish between tactical shifts in investor behavior and genuine structural changes in the economy — and to avoid mistaking short-term sentiment changes for shifts in long-term fundamentals.

We remain confident in the global leadership of the U.S., supported by world-class companies, a strong culture of innovation and entrepreneurship, and deep, liquid capital markets. Despite some potential near-term headwinds, the U.S. remains uniquely advantaged across four strategic domains: its currency, capital markets, economic productivity, and innovation infrastructure.

In contrast, despite some recent promising fiscal reforms, Europe remains hampered by fragmented capital markets and more rigid labor regulations. Meanwhile, China’s economy remains heavily dependent on state-led investment rather than consumer demand, and its capital markets are firmly controlled by the government, often to the detriment of shareholders.

The U.S. Dollar: Still the World’s Default Currency

The U.S. dollar has served as the world’s primary reserve currency since World War II, replacing a war-damaged British pound. While its dominance has occasionally been challenged — and its market share has declined somewhat in recent years — the dollar remains the world’s preferred safe-haven currency.

A reserve currency does not need to be perfect, but it does need to be more secure than its alternatives. Factors such as liquidity, accessibility, economic stability, political stability, and rule of law all contribute to the dollar’s ongoing appeal.

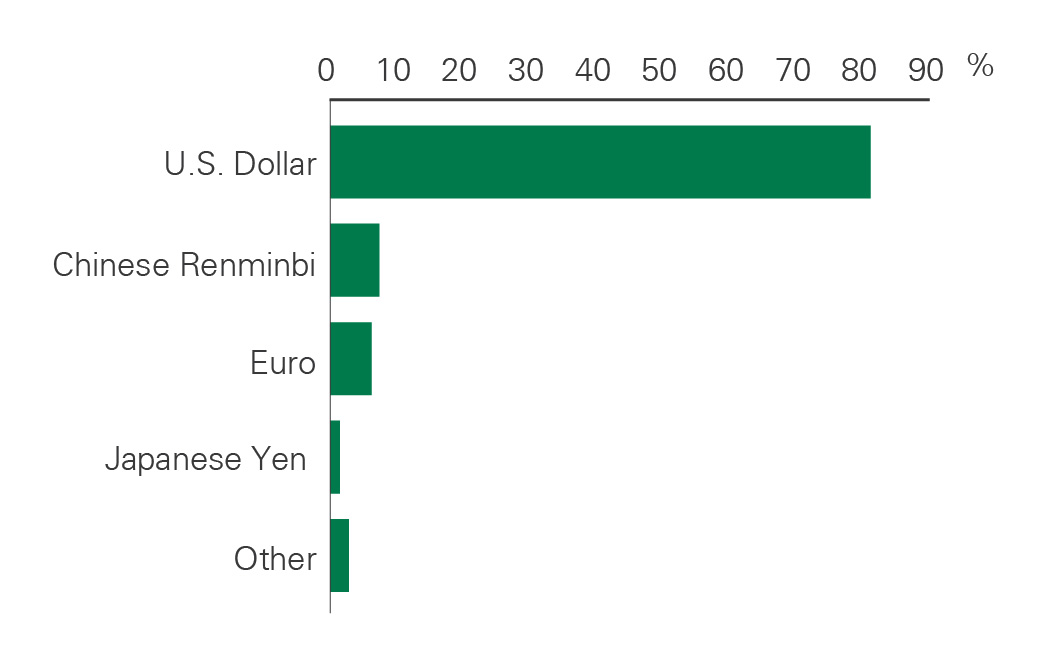

Recent tariff uncertainty and concerns about fiscal overspending have dampened sentiment toward the dollar, renewing interest in possible alternatives. Still, the dollar’s dominance is rooted in its unmatched liquidity. Nearly 80% of global trade finance transactions are conducted in U.S. dollars (Exhibit 1), and no other country comes close to matching the depth of the U.S. bond market.

For example, Germany’s bond market, considered Europe’s safe haven, is only one-tenth the size of the U.S. market. Given current fiscal projections, the U.S. bond market is unlikely to shrink anytime soon, making it extremely difficult to fully replace the U.S. Treasury market as the global destination for safe-harbor assets — and consequently the U.S. dollar as the world’s reserve currency.

Exhibit 1: Share of Global Trade Finance by Currency

Key takeaway: The U.S. dollar accounts for the majority of trade finance transactions worldwide.

A chart illustrating the distribution of global trade finance transactions by currency. The U.S. dollar accounts for the majority share, substantially more than any other currency. This exhibit underscores the dollar’s dominant role in global commerce as a preferred settlement and financing currency as of July 31, 2025, reinforcing its structural advantage in global markets.

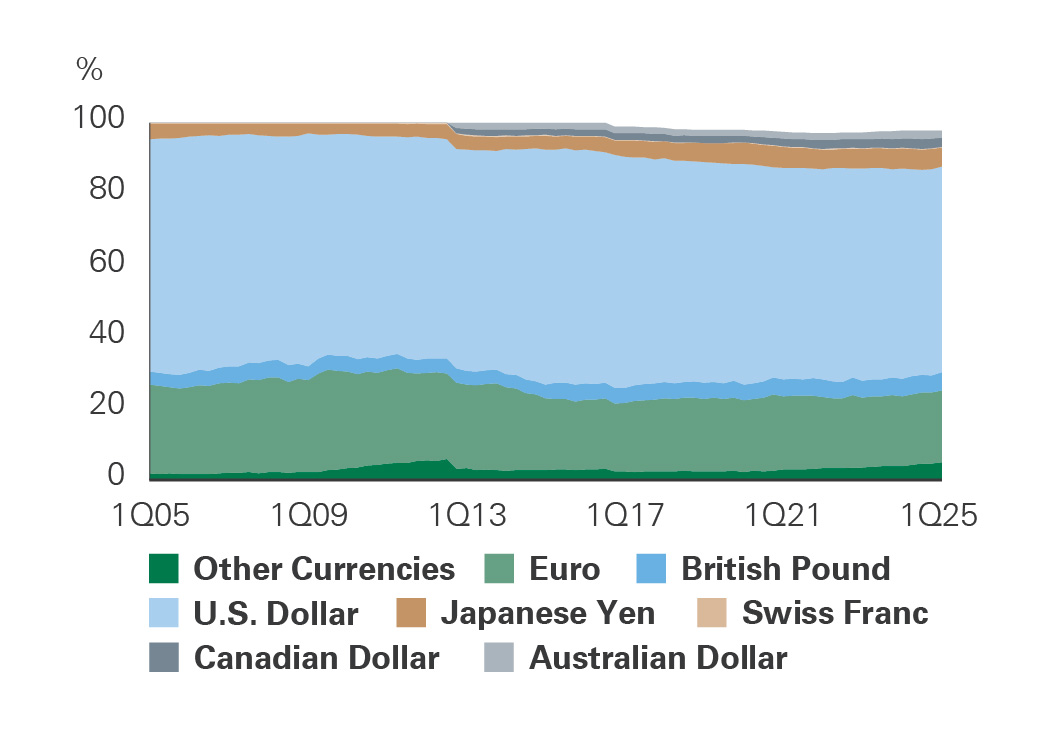

While other currencies have gained modest market share (Exhibit 2) and central banks have boosted gold reserves — particularly after the sanctions placed on Russia’s central bank — alternatives remain constrained. Gold’s function as a currency is structurally limited by its illiquidity, inflexibility in settlement mechanisms, and lack of integration into global financial infrastructure. Cryptocurrencies face even greater limitations, including high volatility, limited institutional and sovereign adoption, and regulatory uncertainty.

While reserve currency status comes with privileges, such as cheaper financing, it also comes with responsibilities. Political dysfunction or excessive fiscal spending can increase the risk premium on U.S. debt, as seen in recent bouts of Treasury yield volatility. 1 Still, U.S. interest rates remain well above those in the eurozone, helping sustain capital inflows. Although the U.S. dollar weakened in the first half of 2025, it began the year at a 40-year high in real terms.

Exhibit 2: Currency Composition of Official Foreign Exchange Reserves (%)

Key takeaway: The U.S. dollar dominates global foreign exchange reserves, though its share has gradually declined from 71% in 1999 to 58% today. The euro’s share is a distant second at 20%.

A pie (or donut) chart showing the relative weight of major currencies held in official foreign exchange reserves. The U.S. dollar represents the largest share, followed by the euro and other currencies. The data show the dollar remains dominant, though its share has declined from around 71% in 1999 to roughly 58% today. This exhibit illustrates the deep structural role of the U.S. dollar in central bank reserve portfolios globally.

In short, the U.S. dollar is unlikely to be replaced anytime soon. Such a transition would take years and require a viable successor — one that doesn’t currently exist. For now, the dollar remains the world’s default — not because it is perfect, but because no better alternative exists.

The U.S. Economy Maintains Structural Growth Advantages

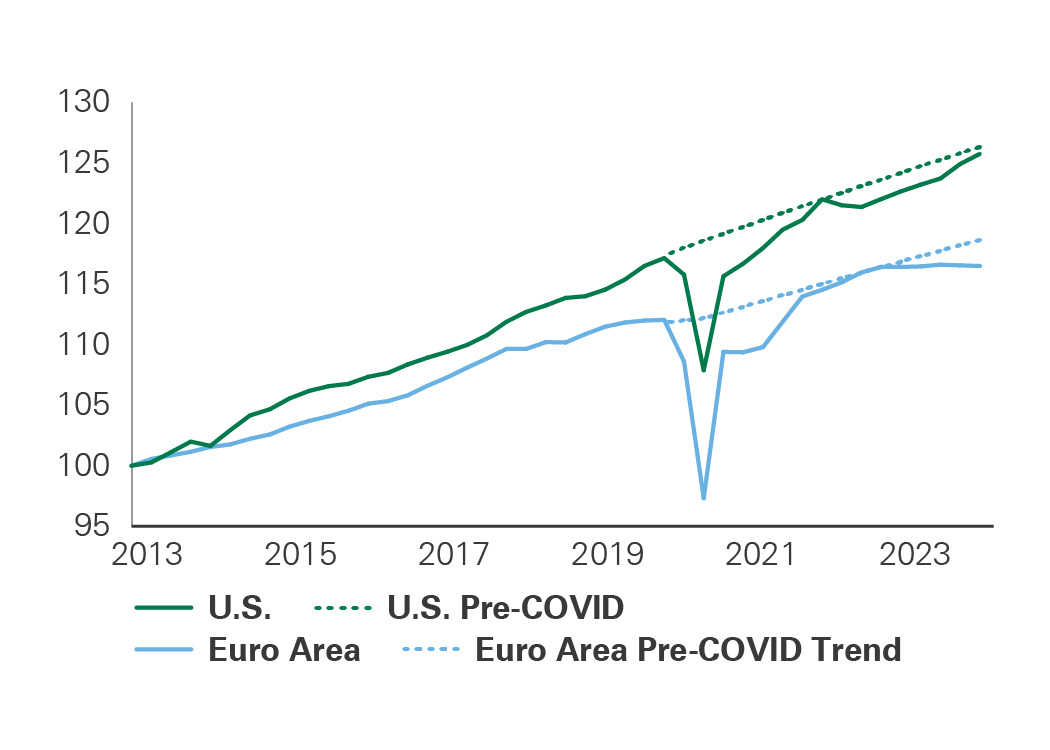

Since the Global Financial Crisis, the U.S. economy has consistently outpaced global peers, showing resilience in downturns and growing above or around 2% economic trend growth (Exhibit 3).

While there are questions about the long-term growth prospects of the U.S., several structural strengths remain. Notably, the U.S. is one of the most productive economies globally, driven by its highly educated labor force, strong innovation, and widespread adoption of technology. From the end of 2019 through the second quarter of 2024, labor productivity per hour worked rose 6.7% in the U.S., compared with only 0.9% in the euro area. Meanwhile, the eurozone has faced several structural challenges, including an economy with smaller, aging firms and stringent regulation — contributing to the widening productivity gap.

Exhibit 3: U.S. vs. Europe Real GDP Growth

Key takeaway: The U.S. has both outpaced European economic growth and recovered to its pre-pandemic trend growth quicker.

A time-series line chart contrasting real GDP growth in the U.S. with Europe, indexed to a baseline year (e.g., 2013). The chart shows that the U.S. has outpaced Europe’s economic growth and returned to trend more quickly following downturns. This exhibit highlights the U.S. economy’s structural resilience and relatively stronger growth trajectory.

Looking forward, the U.S. is likely to maintain and expand these advantages. Education is a key driver of productivity growth; the U.S. consistently holds one of the highest global education rankings and is home to seven of the top 10 universities in the world, according to Times Higher Education. Artificial intelligence (AI) adoption is also rising: According to the Federal Reserve, 20% to 40% of workers report using AI tools, with even higher usage in fields such as computer programming. As AI integration deepens, productivity should rise further.

The U.S. continues to lead the world in research and development (R&D), especially when it comes to business investment. In 2024, U.S. companies invested more than $109 billion in AI according to Stanford University’s AI Index Report — 12 times China’s investment and 24 times the U.K.’s. While China is increasing investment, including a new $8.2 billion AI fund, the U.S. holds a lead in both capital and infrastructure. For example, the U.S. is home to nearly half of the world’s data centers, compared with 16% in China. With a skilled workforce, growing AI adoption, and massive investments fueling innovation, we believe the U.S. is well-positioned for long-term economic growth.

The U.S. Equity Market Remains Uniquely Positioned

The U.S. equity market is the largest in the world, accounting for nearly two-thirds of global market capitalization — driven by dominant mega-cap technology companies with earnings power that does not exist elsewhere in the world.

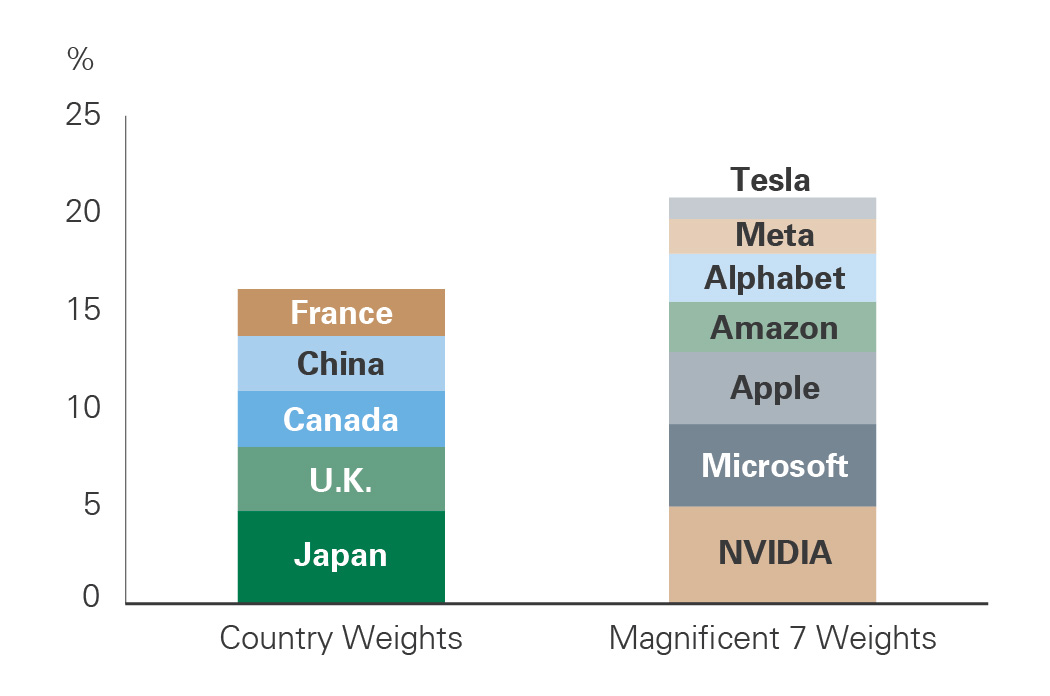

The “Magnificent 7” stocks now represent nearly a third of the S&P 500 and are collectively larger than the equity markets of Japan, Canada, China, the U.K., and France — the five largest non-U.S. countries — combined (Exhibit 4).

Their size stems from durable competitive advantages and strong secular growth trends, especially in digital platforms and enterprise AI. In 2025, the Magnificent 7 are forecast to spend more than $320 billion on capital expenditures and R&D — roughly 60% of operating cash flow and three times more than the rest of the S&P. These investments will reinforce their future growth and competitive edge.

They are deeply embedded in the global economy, with nearly 50% of revenues coming from outside the U.S. Unlike their international peers, these companies benefit from powerful network effects and superior corporate governance. U.S. firms are generally more aligned with shareholders — with mechanisms such as “say on pay,” shareholder activism, and a higher turnover rate for underperforming CEOs.

The U.S. equity market is structurally tilted toward high-growth, high-margin sectors; notably, technology and communication services make up 43% of the index. This positioning supports stronger long-term growth prospects, which is reflected in higher valuations. Comparing headline market valuations across countries can be misleading. By contrast, European and Japanese markets are more concentrated in financials and cyclicals — sectors with more volatile earnings that typically command lower valuations.

Exhibit 4: Weight in MSCI All Country World Index

Key takeaway: The seven largest U.S. companies have a greater combined weight in the MSCI AC World Index than the five largest non-U.S. countries.

A chart depicting the combined weight of the largest U.S. companies (often referred to as the “Magnificent 7”) in the MSCI All Country World Index versus non-U.S. markets. The exhibit shows that the largest U.S. firms collectively have a greater share of global market capitalization than the five largest non-U.S. countries combined, reflecting the dominant role of U.S. equity in global markets.

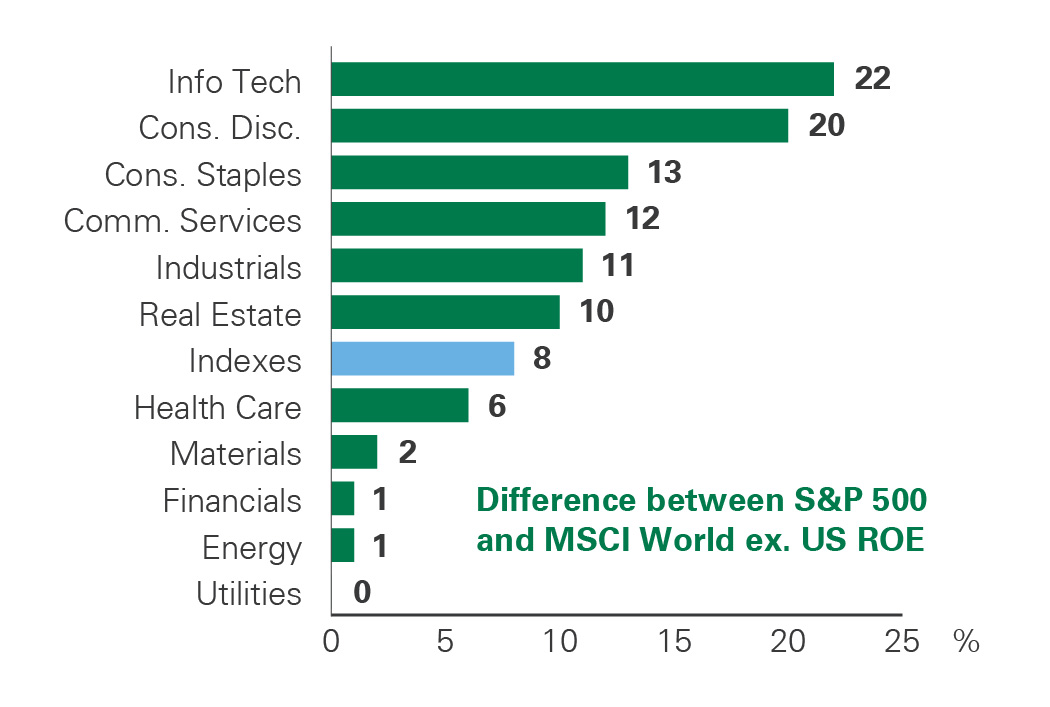

In addition, U.S. companies also lead globally in profitability, with every sector of the S&P 500 posting higher returns on equity (ROE) than their developed-market peers (Exhibit 5). The index’s ROE sits at 21%, compared to just 12% across other developed markets, a function of disciplined capital allocation, higher margins, and asset-light business models. Higher profitability tends to lead to higher valuations, and the faster pace of earnings per share growth in the U.S. over the past decade further supports the U.S. valuation premium.

Exhibit 5: Comparison of Sector-Level Return on Equity for the S&P 500 vs. International Developed Markets

Key takeaway: The S&P 500 has posted a higher return on equity than international developed markets equivalents across every sector.

A comparative bar chart showing sector-level return on equity (ROE) for the U.S. S&P 500 versus developed market peers. The chart demonstrates that U.S. sectors outperform their international equivalents in ROE across the board, indicating higher profitability tied to structural advantages in capital allocation, margins, and growth.

Private Markets Remain a Source for Innovation and Growth

Private equity (PE) and venture capital (VC) play a foundational role in driving U.S. innovation. All of the Magnificent 7 stocks, now representing more than $19 trillion in total market capitalization, began as startups backed by VC or angel funding.

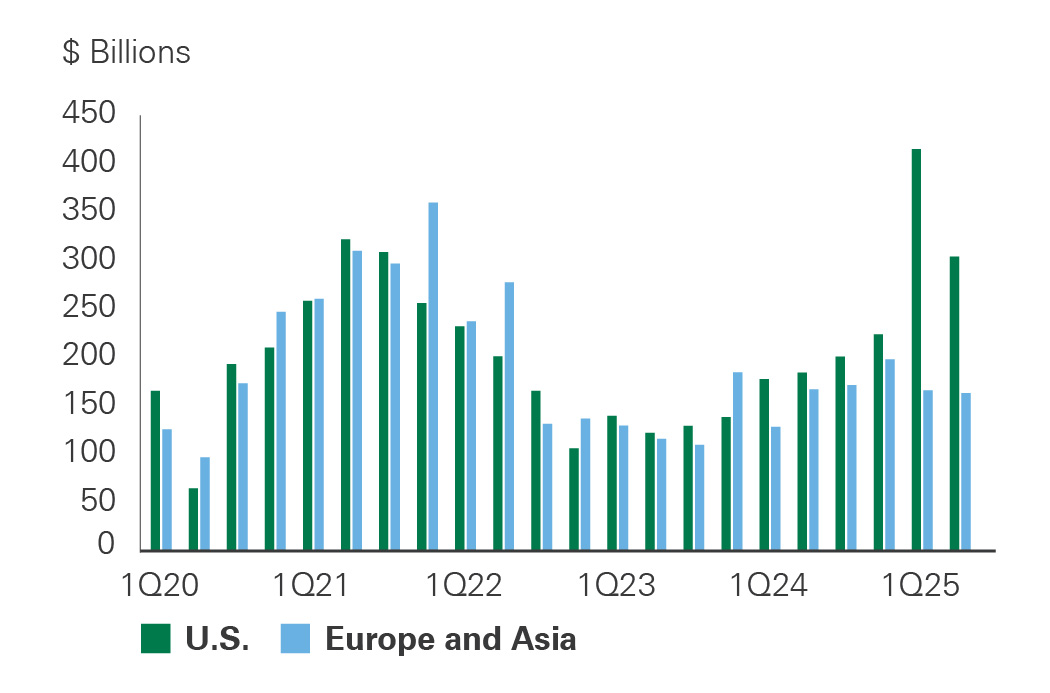

While private capital growth has slowed from the 2021 and 2022 highs, North America’s $8 trillion in private capital assets under management still accounts for 57% of the global total as of June 2024. Among the 15 U.S.-based VC ecosystems that rank in the global top 40, Silicon Valley continues to dominate — particularly as the epicenter of AI-focused investment and innovation.

The U.S. has the deepest and most liquid capital markets in the world, attracting businesses and entrepreneurs who seek to benefit from ample funding opportunities. VC activity in the U.S. continues to outpace that of global peers, largely driven by AI megadeals. Notably, OpenAI’s record-breaking $40 billion raise exceeded the combined VC investment in Europe and Asia for the first quarter of 2025. Roughly 87% of firms in the U.S. with revenues greater than $100 million are private and as companies stay private for longer, it provides more opportunity for PE investment and longer value-creation timelines before going public.

Despite slower deal flow in early 2025, the Americas remained the largest source of proposed PE deployment. Continued investor interest suggests underlying confidence in U.S. innovation potential (Exhibit 6).

The U.S. offers a uniquely supportive environment for entrepreneurship, backed by robust access to capital, a favorable regulatory environment, and a culture that embraces risk-taking.

The U.S. leads the world in intellectual property (IP) protection. According to the U.S. Chamber of Commerce, countries with strong IP protections are nearly 40% more attractive to PE and VC investors. In contrast, 55% of small- and medium-sized businesses in the European Union cite regulatory obstacles as their greatest obstacle. Deep capital markets, innovation infrastructure, and a favorable legal system give the U.S. a structural edge in funding and scaling new ventures.

Exhibit 6: Total Private Equity Deal Volume in the U.S. vs. Europe and Asia

Key takeaway: The U.S. consistently accounts for a greater share of private market deals than Europe and Asia combined.

A bar chart showing the total private equity deal volume in the U.S., Europe, and Asia, illustrating the U.S. consistently accounts for a larger share of private market deals. This exhibit underscores the depth and vibrancy of U.S. private markets relative to other regions, reinforcing a core advantage in innovation and capital deployment.

Resilience in a Changing World

While recent policy uncertainty has prompted questions about the durability of U.S. exceptionalism, we believe the structural foundation supporting American economic and market leadership remains intact. The U.S. continues to benefit from the world’s most liquid reserve currency, underpinned by deep capital markets and institutional trust.

The depth and liquidity of the Treasury market reinforces the stability and demand for dollar-denominated assets. Its equity markets are characterized by globally dominant, high-margin companies with robust shareholder alignment and sectoral advantages in innovation-heavy industries.

Structurally, the U.S. economy maintains a commanding lead in productivity, R&D, and AI adoption, fueled by demographic scale, world-class education, and a culture of innovation.

These advantages are amplified by the depth of private markets, which channel capital efficiently into transformative ventures, underpinned by strong intellectual property protections and entrepreneurial dynamism.

While international markets have experienced some cyclical catch-up, we see little evidence to suggest a sustained period of U.S. underperformance. The combination of company quality, innovation, leadership, shareholder-focused governance, and favorable sector composition continues to justify U.S. equities as the cornerstone of our long-term equity strategy. Far from fading, U.S. exceptionalism is evolving — and remains an enduring force in an increasingly complex global economy.

Past performance is no guarantee of future results. This material is provided for your general information. It does not take into account the particular investment objectives, financial situations, or needs of individual clients. This material has been prepared based on information that Bessemer Trust believes to be reliable, but Bessemer makes no representation or warranty with respect to the accuracy or completeness of such information. This presentation does not include a complete description of any portfolio mentioned herein and is not an offer to sell any securities. Views expressed herein are current only as of the date indicated, and are subject to change without notice. Forecasts may not be realized due to a variety of factors, including changes in economic growth, corporate profitability, geopolitical conditions, and inflation. The mention of a particular security is not intended to represent a stock-specific or other investment recommendation, and our view of these holdings may change at any time based on stock price movements, new research conclusions, or changes in risk preference. Index information is included herein to show the general trend in the securities markets during the periods indicated and is not intended to imply that any referenced portfolio is similar to the indexes in either composition or volatility. Index returns are not an exact representation of any particular investment, as you cannot invest directly in an index.