Personal Wealth Planning Essentials Before Selling a Business

- When trying to maximize value in the sale of a business, the sale price should not be the only consideration. For owners hoping to create a legacy for family or charity, advance planning is essential to minimizing the potential impact of taxes.

- Planning starts with a careful consideration of your personal wealth transfer goals: How much you want to leave to individual family members, what level of complexity you are comfortable with, whether charity factors in, and more.

- With your goals in place, your advisors can help you consider a range of solutions to manage capital gains, gift, estate, and GST taxes and ensure that more of the wealth you earned can go to people or causes that matter most to you.

For many business owners, selling their company represents an ultimate reward for a career of hard work. A sizable payday not only validates a dream pursued against the odds, but it may also guarantee personal financial freedom and the ability to create a legacy for generations of family members.

Yet amid the pressures of running a business and preparing it for a sale, owners often put off personal wealth planning and see key planning questions — including tax implications — as items that can wait until after the sale has gone through and they have more time to focus on personal matters. Yet by that time, it may be too late for measures that, if enacted prior to the sale, could have meant considerably more value going to family or charity rather than to taxes.

Here, we examine some of the risks of delayed planning for the sale of a business and explore some of the approaches that can help avoid those risks.

If you are planning to sell your business, starting the personal wealth planning process months or (preferably) years in advance of the sale, carefully considering goals, and using tools and resources designed to transfer wealth efficiently, can help ensure that more wealth goes to your intended beneficiaries.

Plan Early, With Taxes in Mind

As you consider the price a buyer might pay for your business, your thoughts may go first to a top-line figure such as a multiple of earnings before interest, taxes, depreciation, and amortization (EBITDA). Yet, even if eight or 10 times EBITDA produces an eye-catching number, taxes could potentially take a big chunk out of what you keep or pass along to your heirs.

First, the proceeds could be subject to a 20% capital gains tax and 3.8% net investment income tax. And if transferred to family during life or as part of your estate, an additional 40% tax could apply to any amount that exceeds your lifetime gift and estate tax exemption.

A variety of strategies can help you minimize those taxes. But in many cases, these strategies are significantly more effective the earlier they are employed, due to making transfers using current relevant financial information for the company rather than a future “premium” offered price and the ability to take valuation discounts. Valuation discounts allow you to squeeze down the value of the interest gifted and transfer more underlying value outside of your taxable estate, using less lifetime gift tax exemption. However, you will only be able to take advantage of a low valuation of your business if the planning is completed well in advance of a sale being considered. Another timing factor involving discounts is considering whether you should gift interests in your business during life or at death. Making transfers to family members during your lifetime can shift significantly more value to those family members than if you wait to make transfers at your death.

Another reason to start planning now: The currently high gift and estate tax exemption ($13.61 million per person for 2024) is scheduled to drop in half starting January 1, 2026. Wealth transfer strategies that depend on the high exemption should therefore be put into place soon to capture the high exemption before it is reduced.

Finally, depending upon the structure of your business and the planning techniques you desire to employ, there may be several steps involved. For example, if you plan to transfer an interest in the business yet wish to remain in control of the business, you may need to make some structural adjustments, such as converting stock into voting and non-voting shares. Each of these decisions and steps needs to be thoughtfully considered and timed appropriately. Thus, even if you think a sale is years away, the time to start considering and discussing these questions with your advisors is now.

The Potential Cost of Delay

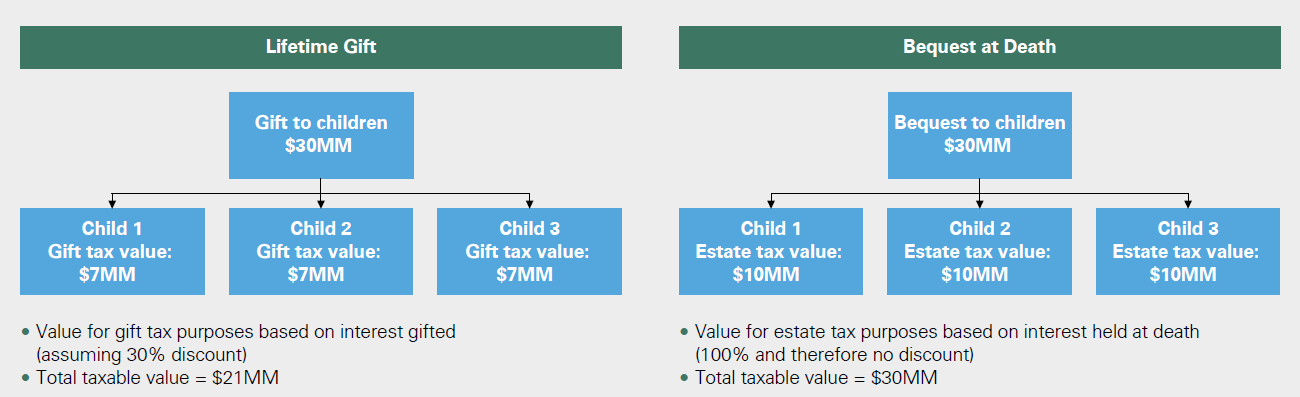

Consider two entrepreneurs, Sarah and Tom, each of whom plans one day to sell a business and divide $30 million among three children. Planning in advance of the sale, Sarah gifts one-third of the shares to each of her children. Because each child receives a non-controlling minority interest in the business, an appraiser determines each child’s share is worth $7 million, reflecting a 30% discount for gift tax purposes, meaning Sarah makes a taxable transfer of $21 million.

Tom delays planning, deciding that he can focus on making gifts after the sale of the business. His business sells for $30 million, and Tom gifts $10 million in liquid assets to each of his children, which would not be entitled to a valuation discount. Tom’s total taxable transfer is $30 million.

What if Tom instead decides not to do lifetime gifting or sell his business at all, leaving the business to his children as part of his estate? Because Tom still owns a controlling majority interest in the business at the time of his death, his estate cannot claim a valuation discount for estate tax purposes. Tom’s total taxable transfer is $30 million.

Either way, Tom is subjecting an additional $9 million (30% of $30 million) to a 40% transfer tax, or $3.6 million. Tom’s delay in planning means $1.2 million less for each child (see Exhibit 1 below).

Exhibit 1: Shifting Wealth During Life or at Death?

Key takeaway: Wealth transfers during life offer the potential for much greater tax benefits.

Exhibit 1: Shifting Wealth During Life or at Death?

Wealth transfers during life offer the potential for much greater tax benefits.

Source: Bessemer Trust

Clarify Your Goals

There are numerous effective and efficient strategies for transferring the proceeds from a business sale to family members. Yet because each works best for specific situations and purposes, the planning process starts not with discussing the solutions, but instead with defining the goals you are trying to achieve. Successful planning depends on carefully considering questions such as these:

- What portion of the proceeds will you need to retain to provide for your own needs? Do you have a spouse or anyone else who depends on you for support?

- Is your goal to transfer as much money to family members as efficiently as possible, or are you concerned that putting too much, too quickly into their hands might cause them to rely on your generosity and lose their drive to succeed on their own?

- Are you concerned mainly with transferring to the next generation, or would you like to provide for subsequent generations as well?

- Are you interested in saving as much as you can on taxes, even if doing so requires more complex processes? Or are you willing to pay higher taxes to keep the transaction and ongoing administration more simple?

- How does charitable planning factor into your goals?

Another important consideration is where you are in your career. Owners approaching retirement age may feel more urgency, and more certainty, around their specific goals. Younger owners may want to pursue strategies that leave them greater flexibility to adjust as their own — and their families’ — needs evolve.

When it comes to your goals, there are few absolute rights and wrongs, and answers will differ widely from business owner to business owner. The key is to thoughtfully consider your goals early in the process.

Consider the Strategies

Once you’ve defined your goals, you can consider which specific strategy or strategies can best help you achieve them. While the process may seem daunting, your Bessemer team, together with tax specialists and attorneys, can help ensure you consider the full range of potential solutions and understand the benefits and tradeoffs of each.

1. Direct gifting. If your goal is to transfer wealth to family members as simply and seamlessly as possible, the annual federal gift tax exclusion ($18,000 per recipient in 2024) plus the currently high lifetime gift tax exemption offer powerful tools to transfer interests in a business prior to a sale. As the name implies, direct gifts involve far less planning and administrative tasks than, say, setting up complicated trusts. Direct gifting can be a very effective tool — it removes the business interest gifted plus all future appreciation from your taxable estate. In addition, if you gift a non-controlling or non-marketable interest in your business, you may be able to take discounts on the valuation as discussed earlier.

Despite these advantages, direct gifts have some potential hurdles for you and your beneficiaries. While they are great to shift value outside of your taxable estate, you may cause your beneficiaries to have a taxable estate of their own, meaning that they too will need to do similar planning. In addition, since they will likely receive the interest in the business at a comparatively low basis, they may face sizable capital gains taxes when the business is ultimately sold.

2. Gifts to intentional grantor trusts (IGTs). For those willing to undertake more extensive planning, gifting to an IGT may allow owners to transfer more wealth from the business free from taxes than would be possible through direct gifts, and the IGT can also prevent the value from being subject to estate tax in your beneficiaries’ estates. Moreover, the trust structure enables grantors greater control over how and when the money reaches beneficiaries — an important consideration for those concerned about beneficiaries receiving too much money before they are prepared to handle it responsibly.

As with a direct gift, an irrevocable gift to an IGT counts against the grantor’s lifetime gift tax exemption. The reason utilizing an IGT shifts more value to beneficiaries than a direct gift is because the IGT is structured in such a way that the grantor remains responsible for all income taxes owed on the income generated by the assets in the IGT. This allows the assets to continue to grow, free from any income tax, while simultaneously further reducing the grantor’s taxable estate each time an income tax payment is made. Such income tax payments do not count as additional gifts to the IGT.

Regardless of how much the business appreciates or how much it sells for at a later date, the assets in the IGT will escape estate taxation at the grantor’s death, and the assets also will not be subject to estate tax at the death of the beneficiary in the future. Another advantage: IGTs can be structured to benefit multiple generations.

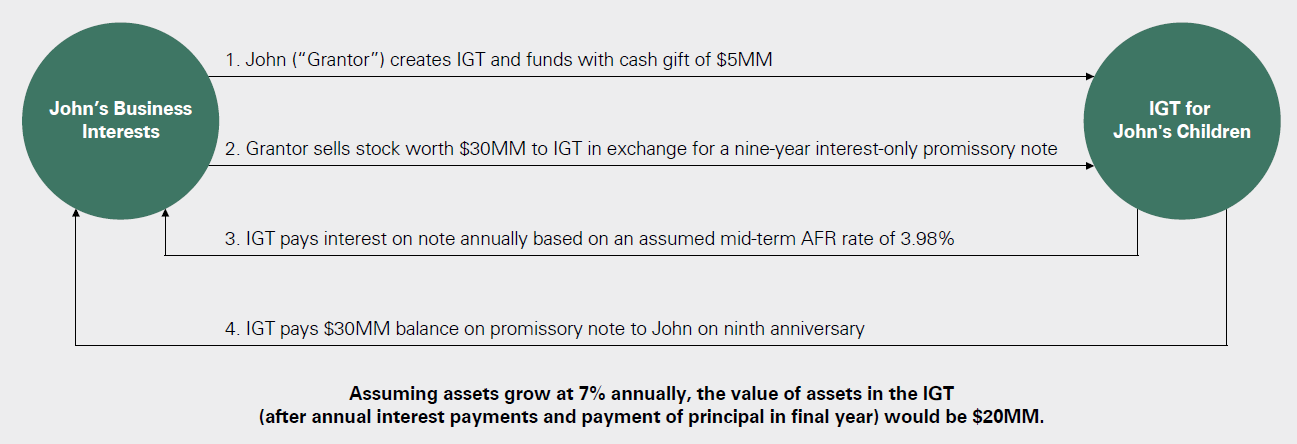

3. Sales to intentional grantor trusts. Owners who believe their business is likely to increase significantly in value and who wish to transfer more future appreciation to beneficiaries can take the IGT planning one step further with a sale (see Exhibit 2). After seeding the IGT with an initial gift, the business owner/grantor then sells an interest in the business to the IGT in exchange for a promissory note. The IGT must make annual interest payments to the grantor based on the applicable federal rate (AFR) determined by the IRS. Cash flow from the business can often be used to make these interest payments. At the end of the term of the note (most commonly nine years), the principal is repaid to the grantor. To the extent the assets appreciate at a rate higher than the AFR, additional value is shifted to the IGT. When the business itself is ultimately sold, the trust will receive potentially significant sales proceeds for its interest.

Because the grantor and the IGT are treated as the same taxpayer for income tax purposes, no gain is recognized when shares of the business are sold to the IGT, and the interest payments are not taxable income to the grantor. When the business is later sold to a third party, the grantor remains responsible for the income tax associated with the sale, allowing the IGT to receive the sale proceeds without the associated capital gains tax burden.

Exhibit 2: Sale to an Intentional Grantor Trust (IGT)

Key takeaway: A sale to an IGT offers the potential for greater tax benefits than either a direct gift to heirs or a gift to an IGT.

Exhibit 2: Sale to an Intentional Grantor Trust (IGT)

A sale to an IGT offers the potential for greater tax benefits than either a direct gift to heirs or a gift to an IGT.

Numbers shown do not show any benefit for a valuation discount. Source: Bessemer Trust

Source: Bessemer Trust

Minimizing the Gift and Estate Tax Obligation

Victoria plans to sell her company within the next two years. She’s expecting the company will sell at a premium and wants to share as much of the potential payoff as she can with her children, but she has already used up her lifetime gift tax exemption.

Victoria’s business is worth $60 million, and she transfers half of the stock to a two-year grantor retained annuity trust (GRAT). Because the stock transferred is non-voting, it is valued at $20 million after discounts. The GRAT is carefully structured so that the annuity payments equal the amount transferred, so for tax purposes, the gift is zero.

As she hoped, the business sells one year later at a premium, and the GRAT receives $40 million for its one-half interest in the business. After the two annuity payments are made to her for approximately $10 million each, the remaining $20 million will be transferred from the GRAT into a long-term trust for the benefit of her children, all without triggering gift taxes.

4. Grantor retained annuity trusts (GRATs). The mechanics of a GRAT operate much like a sale to an IGT, but with some key differences. A business owner can contribute an interest in the business to a GRAT and retain the right to be paid an annuity for a term (typically two or three years). Assets remaining in the GRAT at the end of the term may be transferred to individuals or a trust for selected beneficiaries. When the initial transfer is made, the present value of the remainder interest is a taxable gift, the amount of which can be controlled and even zeroed out. To the extent the assets grow in excess of the 7520 rate,* the business owner makes an additional tax-free gift to beneficiaries. GRATs can be especially successful when the original transfer involves discounted stock and the company subsequently sells at a premium (see “Minimizing the Gift and Estate Tax Obligation” above).

Since you can zero out the value of the gift to a GRAT, GRATs can be used by taxpayers who have already used their lifetime exemption and still want to do additional planning. GRATs also provide downside protection in case the business sale does not turn out as expected. If the business does not appreciate, all the assets are returned to the owner in the form of annuity payments, as though the GRAT never existed. There are no adverse tax consequences to a failed GRAT; the only downside is the administrative and transactional costs associated with setting up the trust.

Another big advantage to GRATs is that they are specifically set forth in the Internal Revenue Code, so they are typically less likely to attract IRS scrutiny.

One large disadvantage of GRATs is that they do not permit you to leverage your GST exemption efficiently, so they are typically not used to move assets down more than one generation.

5. Charitable remainder trusts (CRTs). A CRT can be a useful tool for business owners looking to combine income tax planning with philanthropy. The owner establishes the CRT and contributes highly appreciated company stock to it. During the term of the CRT, an annual payout is made to the business owner. The term can be for a number of years or for the life of the business owner.

No tax is triggered when the business is sold because the CRT is tax-exempt, and the trustee of the CRT can reinvest the assets and diversify on a tax-efficient basis. Some of the income is carried out to the business owner each year when the annual payout is made, effectively deferring income tax from the sale over the life of the CRT. At the end of the term, the remaining assets pass to charity.

The owner is entitled to an income tax deduction for the actuarial value of the charity’s remainder interest (calculated using the 7520 rate). Despite the personal advantages, the CRT at heart involves an irrevocable gift to charity, so owners should be sure that philanthropy is an important part of their goals.

Early Planning Is Always Better

These are just a few of the options available to business owners seeking to efficiently transfer proceeds from the sale of a business to their intended beneficiaries. Even if a sale seems like it is in the distant future, it is never too early to start a conversation. Your Bessemer advisory team can arrange conversations with Bessemer estate planning specialists, who can help you clarify your goals and explain the advantages and considerations of these various approaches. Then we can work with your attorneys, accountants, and other external advisors to help ensure that a lifetime spent building a business generates the rewards you envision.

After the Sale

Once you’ve sold your business, your financial life is likely to be considerably more complex. You may find yourself in need of a wide array of specialized services — from investments and estate planning to private banking, charitable giving, tax services, bill payment and accounting, human resource services, and more.

Depending on your needs, it could make sense to consider a family office. Numerous family office structures and service options are available, ranging from one person handling household administration to large full-service teams of investment and wealth planning professionals, with every conceivable combination of in-house and outsourced service functions in between.

If you would like to learn more about family offices, please read “Is a Family Office Right for You?” or reach out to your Bessemer advisor.

- * Named for the section of the Internal Code in which it appears, the 7520 rate is 120% of the mid-term AFR (applicable federal rate), compounded annually, and determined monthly. That rate is then rounded to the nearest two-tenths of 1%.

This material is for your general information. It does not take into account the particular investment objectives, financial situation, or needs of individual clients. This material is based upon information obtained from various sources that Bessemer Trust believes to be reliable, but Bessemer makes no representation or warranty with respect to the accuracy or completeness of such information. The views expressed herein do not constitute legal or tax advice; are current only as of the date indicated; and are subject to change without notice. Forecasts may not be realized due to a variety of factors, including changes in economic growth, corporate profitability, geopolitical conditions, and inflation. Bessemer Trust or its clients may have investments in the securities discussed herein, and this material does not constitute an investment recommendation by Bessemer Trust or an offering of such securities, and our view of these holdings may change at any time based on stock price movements, new research conclusions, or changes in risk preference.