#Adulting: Helpful Tips

for Living an Adult Life

- During your 20s and 30s, you will inevitably take on many new roles and responsibilities and find yourself having to make more adult decisions — about your career, family, managing your money, and many more.

- At times, it may seem that all of these competing considerations are equally important, which can be challenging, but it does not have to be overwhelming if you approach each issue step by logical step.

- In this A Closer Look, we provide an overview of many decisions you may face during this time and how to tackle them, prioritizing what is most important to you.

While the term “adulting” is fairly new in popular usage, the transition to adulthood brings the same dizzying array of responsibilities and decisions it always has: What is best for your career? How do you envision your family life? How should you manage your money, technology, and other resources, including a possible inheritance? How might you begin realizing your philanthropic goals? In sum, how do you live a fulfilling adult life?

How do you successfully manage these often-competing priorities? While the transition to adult life can be challenging, it doesn’t have to be overwhelming. In the following pages, we provide an overview of many decisions you may face during this time and how to tackle them, prioritizing what is most important to you.

The Journey Begins: Personal Finances

Take Advantage of Your Employee Benefits

If you have an employer, you may be pleasantly surprised by the range of benefits offered beyond your salary or other incentive-based compensation. Here is an overview of a few common benefits offered to employees — which may kick in immediately when you start your job — and how to take advantage of them. Some of these benefits may also be available if you are self-employed. (We discuss retirement savings plans below.)

Choose a health plan. Healthcare is one of the most expensive line items in a household budget. Until age 26, you can stay on your parents’ plan; after that, you will have to decide whether this still makes sense. While you may be able to extend coverage of your existing plan under COBRA for 36 months, this is typically among the most expensive options, and you may want to look elsewhere. Among the many factors to consider in choosing a health plan are the cost of premiums, copays, and deductibles.

One option is a PPO plan, which generally pays a higher portion of your medical costs but also has higher monthly premiums. This may be better for you if you see your primary care physician or specialists regularly, take expensive medication on a regular basis, or are expecting a baby.

Another option is a high-deductible health plan, which has lower premiums and often comes paired with a health savings account, enabling you to put money aside tax-free for expenses.

Open an FSA and/or an HSA. The purpose of an FSA (flexible spending account) is to use pretax dollars to pay for medical expenses not covered by insurance, such as copays and deductibles. You may also use funds in an FSA toward certain other eligible health-related costs, including dental work, prescription eyewear, or over-the-counter medications. For 2023, the annual contribution limit to an FSA account is $3,050, and there are a few important things to note. First, if you would like to contribute to an FSA in any calendar year, you must elect to do so — and choose your contribution amount — at the end of the prior year, during a set period known as open enrollment. Once you have made your elections, you generally cannot make any changes unless you experience a “qualifying life event” (such as a change in marital status) and your particular employer’s plan allows you to do so. In addition, a possible downside of an FSA is that unused funds at the end of a plan year are forfeited, so it is worth considering your actual medical expenses prior to making any elections.

HSAs (health savings accounts) allow you to pay for current healthcare expenses and save for future healthcare expenses — all tax-deductible. For 2023, you can contribute up to $3,850 for individuals and $7,750 for family coverage. Some employers also contribute to an HSA for each employee, often to help offset a high-deductible plan. One benefit of an HSA is that if you don’t need all of the funds in a given year, they roll over for future years and can be invested for growth over time.

Parental leave. If you think children could be in your future, it is a good idea to research parental or child-related benefits sooner rather than later. In addition to parental leave, benefits may include coverage of certain adoption expenses, fertility treatments, or financial assistance related to childcare.

Review other benefits offered by your employer. In addition to health insurance, the most common employer-sponsored benefits include other insurance coverage (e.g., dental, vision, life, disability, and accidental death and dismemberment), commuter benefits, and tuition reimbursement. Other offerings can include therapy and childcare programs, wellness resources, legal services, and even perks like gym memberships and discount programs with major retailers. In some cases, members of your household may also be able to take advantage of the benefits offered by your employer.

Build a Solid Credit History

If you expect to make big purchases, you will need to have a documented credit history. To do that, you need to open individual accounts in your own name and under your own Social Security number — not by using a credit card from your parents. Start early — a long credit history helps your profile. And having a mix of different types of credit can be better for your credit score than only having credit cards. If possible, you should always pay off the entire credit card balance by the stated date; that will have the greatest impact on your credit score. You can get a credit report each year from the three big credit reporting companies: Equifax, Experian, and TransUnion.

Consider Whether to Rent or Buy

Deciding whether to buy or rent a home or apartment is an expensive decision. If you rent, the monthly cost may be less than a mortgage payment, depending on interest rates and other factors. While there may be some upfront charges (possibly first and last month’s rent, a security deposit, rental insurance, and other incidentals), there are no closing or maintenance costs. But you aren’t building equity as you are when you buy a home.

The decision to buy is a financial but also a lifestyle choice. If you feel that you are in a stable position and expect to remain in the home for several years, buying may be a good option. Currently, the IRS provides several tax breaks for homeowners who finance the purchase with a mortgage loan. Common tax deductions include those for mortgage interest, mortgage points, and private mortgage insurance. To claim the deduction, however, you have to itemize your deductions on your taxes. This is a decision to discuss with your financial advisor.

Many families choose to finance real estate through private loans from one family member to another. The rate for such loans, set monthly by the IRS, can be significantly lower than rates offered by commercial lenders.

Gather Your Important Documents and Files

Do you know where your Social Security card, birth certificate, and passport are? Put them in a secure place, and make sure key people know where they can be found. Also consider getting a metal firesafe box for your most important hardcopy files, although a securely stored electronic copy may be more helpful.

Understand Your Assets and Financial Accounts

There are several types of investment accounts available to you. These include standard brokerage accounts, retirement accounts (401[k]s and IRAs), 529 college savings accounts, and more. If you find that you need access to your funds, it may be preferable to draw on certain accounts before others. Generally, retirement accounts and trust assets should be tapped last, since 401(k) accounts, for example, charge a 10% penalty if you take out the funds before age 59½. Some trusts are also afforded tax-advantaged growth and may be shielded from creditors.

Set Money Aside for a Rainy-Day Fund

In an era of job layoffs and job market instability, it is good advice to have a reserve of three to six months of expenses held in a liquid account, such as a checking account or money market account. If you were to lose your job or have to take a leave, you would still need to pay your mortgage or rent and other fixed costs (although you might still have other streams of income, such as investment income). A rainy-day fund can pay your short-term expenses and tide you over until your situation improves.

Develop a Relationship With a Financial Advisor (and Other Advisors)

There are many seasoned professionals who can help you assess your goals, identify strategies, facilitate discussions among family members, and educate you about investment opportunities, current tax laws, etc. Trust and estate attorneys can provide legal advice and help draft documents like wills and trusts; accountants can advise on tax issues; and your Bessemer client advisor can help you with any of these important topics.

Looking Ahead: Marriage, Family, and More

If Marriage Is in Your Future, Consider a Prenuptial Agreement

The ultimate goals of marriage are to have a good relationship, to balance and protect each spouse’s interests, and to reduce the potential for future disputes about money and other assets. With that in mind, you may want to consider a prenuptial agreement (or prenup), which is a contract that defines each spouse’s separate property and any jointly held assets, and states how property is to be divided if there is a death or divorce.

The benefit of a prenup is that it provides certainty about financial matters, protects inherited wealth, avoids default state laws, and can deter protracted disputes. However, a prenup is only enforceable if it is voluntary and both parties had legal representation. Some states also require that all income, liabilities, and assets are adequately disclosed. This may include disclosing information about trusts of which one spouse is a beneficiary. Child custody and child support are not part of a prenup. When a prenup is discussed honestly and transparently, and with the help of a skilled advisor, it can result in clarity on both sides.

Postnuptial agreements (postnups) are an option when a prenup was not signed before the marriage. These agreements are entered into after a marriage begins, and they can be helpful for couples who had a short engagement period and did not have time to draft a thoughtful prenup or are months or years into a marriage and circumstances have changed. Not all states treat a postnup in the same way as a prenup in divorce, so a prenup is preferable when possible.

Plan for College

If you become a parent, it’s never too soon to start planning for college. For example, you can open a 529 education savings plan to which you and other relatives or friends can contribute, and which can be invested for growth over the years.

Sign Up For a Retirement Savings Plan

Even if it seems a long way off, there are decisions you can make right now that will contribute to your financial security when you eventually retire. Traditional 401(k)s are among the most popular and effective retirement plans. When you contribute to your 401(k), the money comes out of your paycheck pretax, and you won’t pay taxes on that money — or its investment returns — until you withdraw it in retirement. This reduces your taxable income for the year the money is earned, and if you earn less in your retirement (which is often the case), you may be in a lower tax bracket when the funds are withdrawn, resulting in lower tax payments overall. Many employers also offer a matching contribution program, such that for every dollar you contribute up to a certain limit, your employer will make an equal addition to your account. If a matching program is available to you, you should make every effort to contribute at least the amount that your employer will match to your retirement account each year.

You may also have access to another type of 401(k) known as a Roth 401(k). Unlike the traditional 401(k) described above, you contribute after-tax income to your account, but eventual withdrawals during retirement — of both principal and any earnings — are free from taxes. In 2023, you can contribute up to $22,500 to a traditional 401(k) or a Roth 401(k), assuming you are under age 50.

The other most common retirement savings vehicle is an IRA, or individual retirement account. There are several types of IRAs, but traditional IRAs and Roth IRAs are among the most popular. As with 401(k)s, the main difference between them is when the funds are taxed; with a traditional IRA, contributions to your account are tax-deferred until the funds are withdrawn in retirement, whereas with a Roth IRA, post-tax contributions ultimately result in tax-free withdrawals. In 2023, you can contribute up to $6,500 to a traditional IRA or a Roth IRA (again, assuming you are under age 50).

Providing for Loved Ones: Estate Planning

Make Sure Your Assets Are Correctly Titled and Beneficiary Designation Forms Are Up to Date

Titling assets refers to the way in which you own an asset, such as in your name, jointly with another person (“joint tenancy with right of survivorship”), with a spouse (“tenancy by the entirety”), or owned with another person but with no automatic survivorship rights (“tenancy in common”).

Assets such as real estate and bank accounts should be titled correctly so your property is passed down the way you wish.

Other accounts instead require you to name a beneficiary on a beneficiary designation form. These include retirement accounts, life insurance, payable-on-death (POD) accounts, and transfer-on-death (TOD) accounts. Incorrect designations or mistitled assets can result in outcomes you didn’t intend.

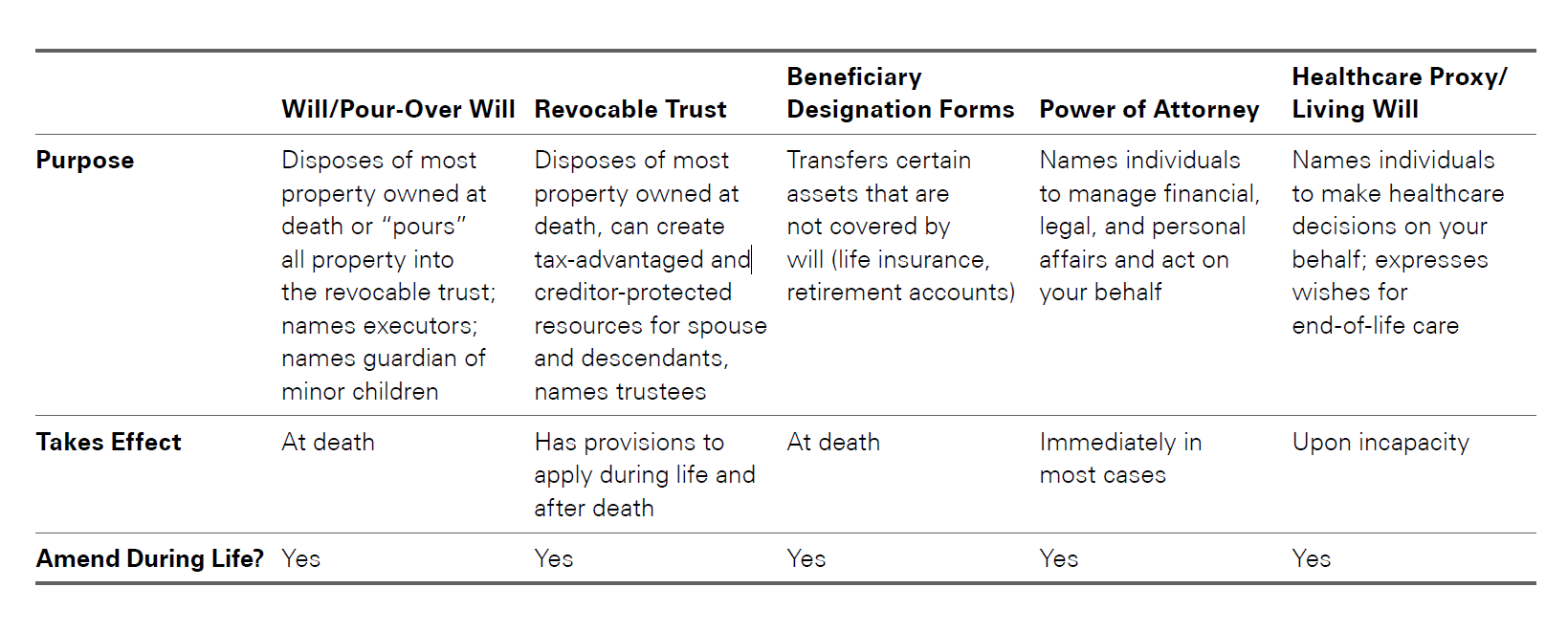

Prepare the Basic Estate Planning Documents

The core estate planning documents that you will need are the will, revocable trust, durable power of attorney, and a healthcare proxy and/or living will (or possibly an advance healthcare directive, which combines the information from a healthcare proxy and living will). These are important documents that clearly state your wishes regarding the transfer of assets and name people who can act on your behalf to manage health and financial decisions.

Look Into Buying Life Insurance

If you don’t have life insurance through an employer, you may be able to buy life insurance either through work or directly through a life insurance company or agent, in which case you can customize the policy to meet your needs. If you have children, life insurance becomes more important as you would want a policy that could replace possible lost income.

Living an Adult Life

If you are well into your adult years, you have probably faced some of these issues already and implemented some of these concepts. If so, you are on your way to feeling organized and financially secure.

If you would like to learn more about any of these topics in the context of your own situation, Bessemer’s experienced tax, estate planning, real estate, insurance, and other specialists will be happy to answer any questions you may have.

This material is for your general information. The discussion of any estate planning alternatives and other observations herein are not intended as legal or tax advice and do not take into account the particular estate planning objectives, financial situation or needs of individual clients. This material is based upon information obtained from various sources that Bessemer believes to be reliable, but Bessemer makes no representation or warranty with respect to the accuracy or completeness of such information. Views expressed herein are current only as of the date indicated and are subject to change without notice. Forecasts may not be realized due to a variety of factors, including changes in law, regulation, interest rates, and inflation.