The Minority Capital Solution for Family Businesses

- For privately owned family businesses, limited equity capital can often be an obstacle to achieving strategic growth objectives. Similarly, liquidity options are few for owners concerned about the concentration of their wealth in a private company or who may be looking to pursue different business interests or contribute more to charitable causes. Such challenges can cause family discord and even result in pressure to sell the company.

- When the company’s strategic objectives are being constrained or the continuation of the family business legacy is at risk, a minority capital investment can often be an effective solution. This strategy offers many potential benefits, and perhaps most importantly, the family business owners maintain control of their company.

- In this A Closer Look, we explore some of the major challenges faced by family business owners, the potential benefits of minority capital investments, the various structures, valuation considerations, and exit alternatives.

Key Challenges for Family Businesses

Family business owners must overcome many challenges to grow and develop their companies. Many of these challenges arise from the fact that family businesses are often privately owned with more limited access to capital than their public company counterparts.

In fact, access to equity capital is often a major constraint to achieving a family business owner’s strategic growth objectives. Significant expansion by a business requires capital investment and funding for acquisitions, but family business owners tend to prioritize a strong capital structure with minimal leverage. For example, when balance sheets were stretched during the economic downturn caused by the recent pandemic, many family business strategic plans were postponed rather than financing the growth with debt.

Similarly, there are few liquidity options for family business owners who are concerned about the concentration of their wealth in a private company and would appreciate a measure of diversification. Some family shareholders may also be resentful because they would prefer to pursue different business interests or contribute to charitable causes, but there is only modest liquidity available for their shares. A desire for diversification or a lack of support for the business strategy can cause family friction and even result in pressure to sell the company.

Minority Capital Offers a Solution

Families tend to place a premium on owning 100% of the equity in their companies, even though this may inhibit growth or lead to dissension among shareholders. When the strategic objectives of the company are being restricted or the continuation of the family business legacy is at risk, a different perspective regarding ownership may be required.

The top priority for family business owners is usually maintaining control of their company. This can be achieved, however, without family members owning all of the equity. In fact, a minority capital investment can provide a solution to many of the challenges facing the family business owner while still maintaining family control.

There are many benefits to broadening the shareholder base with an investor who owns a minority interest in the company. This is especially true if the minority capital partner is a carefully selected investor aligned with the family’s values and business strategy.

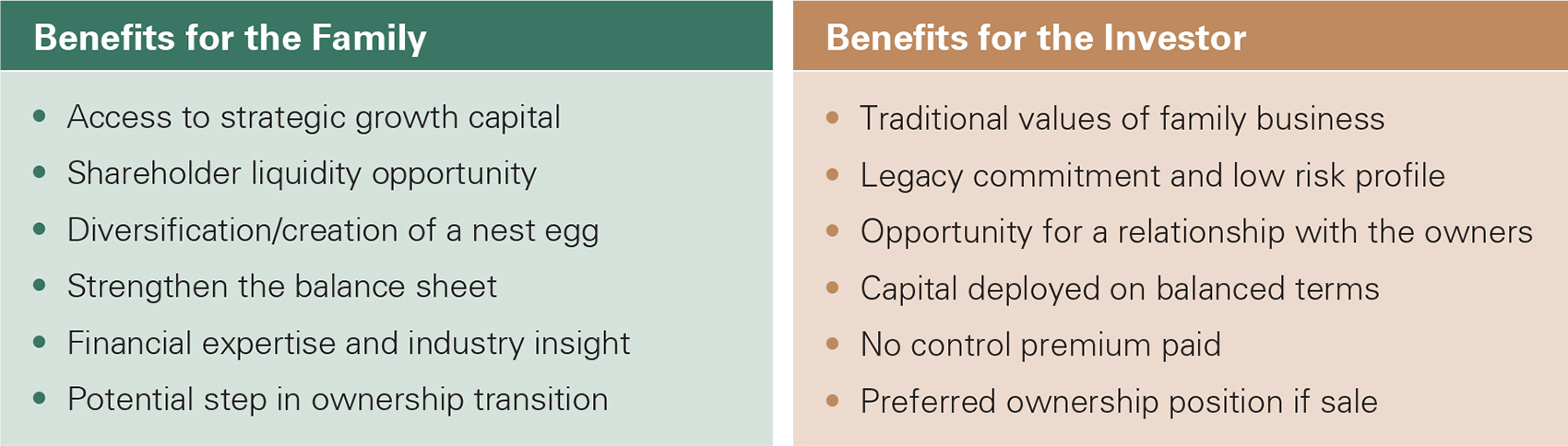

Benefits for the Family of Minority Capital Investments

Establishing a relationship with a minority capital partner has many benefits for a family business owner through the acceleration of strategic initiatives and/or providing liquidity to shareholders. Although outside equity is viewed by some owners as a last resort to address only extreme situations, a more proactive approach to minority capital can provide benefits that resolve many of the traditional challenges faced by family businesses.

- Access to strategic growth capital: Cash flow from operations is the foundation for growth, but often it is insufficient to fund the family’s ambitious strategic goals for the business. This is especially true if, in addition to capital expenditures for organic growth, the family has opportunities for acquisitions that would add important products or new markets to the business strategy.

- Shareholder liquidity opportunity: There may not always be a consensus among family shareholders regarding the strategy for the business or the balance between reinvesting in the business and distributing profits. These issues arise often in multigenerational businesses where the younger generation would like to pursue an entrepreneurial venture or needs liquidity to pay a mortgage or educational expenses for children. A sale of secondary shares by frustrated next generation family shareholders can alleviate these problems.

- Diversification and a nest egg: Frequently, family shareholders have concerns about the concentration of their wealth in a private company. A separate portfolio of listed securities or real estate investments acquired after a minority investment liquidity event can help address this issue. It also offers the added benefit of helping the family build its nest egg for the future.

- Strengthen the balance sheet: Although debt capital has the attributes of deductible interest payments and no dilution, family business owners generally prefer to avoid onerous bank covenants and the stress of high leverage. Raising minority equity capital to finance growth or reduce excessive bank debt can impart financial stability, especially in a period when interest rates are rising. It also provides a cushion during economic downturns.

- Financial expertise and industry insight: Ideally, a minority capital partner offers the family business more than just capital. The goal should be an investor who brings financial expertise, prior management experience, and perhaps governance insights from a prior role on a board of directors. Such capabilities can enhance meaningfully the competitive strength of the family business.

- Potential step in ownership transition: If a family business owner believes that an exit from the company may be appropriate in the years ahead, then a minority capital relationship can be an important first step in the sale process. An initial valuation benchmark is established with an experienced investor who gains an in-depth appreciation of the business during the relationship. Over time, the understanding developed may facilitate the negotiation of an ownership transition.

Benefits for Investors of Minority Capital Opportunities

There are many reasons why sophisticated investors have increasingly been attracted to minority capital opportunities. The rationale varies, but traditional minority investors appreciate moderating the risk profile of the investment, while more recent participants such as family office investors are seeking to generate longer-term, non-correlated returns that complement their other investment strategies.

- Traditional values of family businesses: The traditional values of family business owners are highly regarded by investors. Their dedication to the company tends to be exceptional, based on both the family’s concern for its reputation and its pride of ownership. Employees and customers are also often very loyal due to the personal commitment of the family to their well-being.

- Legacy commitment and low risk profile: Investors are reassured by the family business owner’s in-depth knowledge of their industry and often a multigenerational reputation for respected business practices. Typically, the company also has a conservative balance sheet and a more moderate approach to assuming business risk.

- Opportunity for a relationship with the owners: Investing in an operating company as a minority capital partner provides the investor with a special opportunity to develop a relationship with the owners. The investor also has time to develop an in-depth understanding of the company and the dynamics of the industry in which it operates without buying the entire company. If a next step in the relationship is contemplated, an introductory phase as an insider invested alongside the family can provide valuable insights.

- Capital deployed on balanced terms: Due to the nature of the relationship created, the terms for a minority investment take into consideration the continuing interests of both parties. Reflecting the illiquid nature of the investment and lack of management control, the valuation of the minority ownership stake is discounted somewhat from the fair market value of the business. Special minority rights and protections are also often granted to the investor, which may include approval rights for major corporate strategies, a right of first refusal/offer, and a board seat.

- No control premium paid: The inherent risk of the capital commitment when acquiring a company is intensified by the standard requirement that a premium to fair market value be paid for control. In a minority capital investment, however, the investor acquires an ownership stake and the opportunity to gain an understanding of the business as an insider at an attractive valuation that avoids paying a control premium. There are trade-offs, but many investors appreciate the reduced risk profile and lower cost of a non-control investment.

- Preferred ownership position if sale: Despite the initial intentions of family business owners, there is always the possibility that due to an extraordinary financial opportunity or a change in family relationships, the business may eventually be sold. If a minority capital investment is in place when a change in the family’s strategy occurs, the investor is in a preferred position to acquire the company. In many cases, this potential outcome is discussed as part of the negotiations and specific preferential acquisition rights are included in the investment agreement.

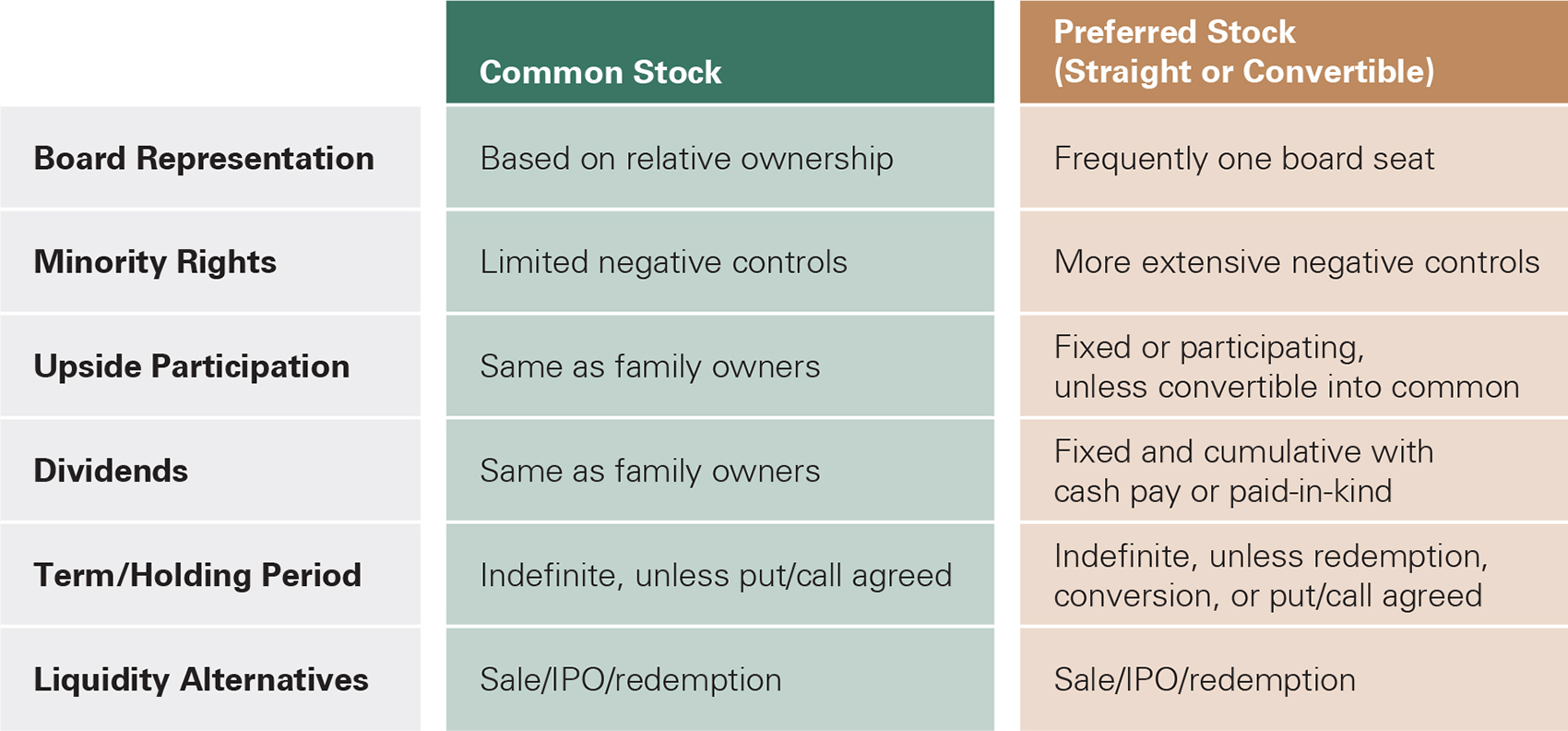

Flexible Structure of Minority Capital Investments

One of the attractions of a minority capital investment is the range of alternative security structures and investor’s rights that can be negotiated. Although the capital requirements faced by family businesses may be similar, each family has special considerations that cannot be addressed by a standardized approach. As a result, minority capital investments in family businesses tend to be highly customized and based on detailed negotiations that balance the interests of both parties.

- Equity investments up to 49%: There is no predetermined ownership interest for a minority capital investment. It may be as modest as 10% of the equity or up to 49% ownership, depending on the objectives of the parties. Some family business owners may be seeking to raise a target dollar amount, while others may be focused on selling a specific range of ownership interest. Similarly, the investor may have either a dollar threshold or minimum ownership percentage to justify their commitment of resources.

- Role in governance: An investor’s interest in playing a role in management decisions or joining the board can depend on the capital commitment made and the strategic rationale for the investment. For example, a private equity firm with a shorter investment horizon may want a stronger governance role, perhaps through negative controls, than a family office might require. Similarly, the willingness of the family business owner to share management decisions may be a function of the importance of the capital need being fulfilled and whether or not an ownership transition is under consideration.

- Wide variety of security structures and terms: The security structure and terms depend on a number of factors reflecting the circumstances of the investment. Some minority investors will hold the common stock owned by the family, but often a senior security in the form of preferred stock with a liquidation preference is negotiated. The terms of the securities can range from straight preferred with a fixed dividend, to participating preferred sharing the benefits of upside performance, or convertible preferred that can be redeemed either in cash or common stock. Generally, the greater the equity component of the preferred security structure, the lower the fixed yield on the security.

- Duration of the relationship: For many years, family business owners were often faced with short-duration minority capital investment opportunities of only five to seven years before a sale or a redemption would be required by the investor. More recently, however, increased flexibility in the time horizon of minority investors has become available, primarily from family office investors. Although private equity firms and many industry investors continue to make investments in family businesses primarily with the intention of either buying out the owners in a few years or monetizing the investment, family offices often have a meaningfully longer investment perspective of eight to 10 years or more. The family business owner’s future intentions are usually the decisive factor in determining the choice of capital partner and the duration of the investment.

Valuation Considerations and Exit Alternatives

Among the more important issues when family business owners evaluate a minority capital investment is the discount to fair market value required to attract the investment. Further, if the family has no current intention to sell the company, then alternative approaches for the investor to exit the relationship should also be considered.

- Minority discount: The valuation of a family business is always a sensitive issue given the strong personal connection and often a multigenerational legacy that influences the negotiations. The parties generally agree to a discount to the fair market value of the company due to the illiquidity of the private company shares and the lack of management influence the minority investor will have. The percentage discount is heavily negotiated, however, and the size of the discount can be influenced by offset terms that reduce the illiquidity of the shares and allow the investor greater influence in management’s decision-making.

- Buy/sell agreements: Many minority capital partners in family businesses are not comfortable with an open-ended commitment to the status quo. They will enter into the investment only if there is a legal framework for the future expansion of their ownership and/or an agreed approach for them to monetize their investment. A buy/sell agreement can provide the certainty these investors require through the negotiation of a fixed initial investment term, followed usually by either the repurchase of the minority interest by the family or a sale of control to the investor. Often the agreement also addresses the valuation for the subsequent transaction, either by defining a formula to be applied, such as an EV/EBITDA multiple, or by providing for the selection of an appraisal firm to set the price.

- Sales to third parties: Another exit alternative for minority investments is the sale of the minority stake to a third party approved by the family. This strategy can be particularly useful if the family would prefer to retain cash in the business, rather than repurchase the shares, or if a third party would be willing to pay the initial minority investor a premium to establish a relationship with the company. It can also help overcome an impasse where the family and the investor have developed different visions for the future of the business. In such cases, another minority investor more aligned with the family’s interests would be a better partner.

- Initial public offerings (IPOs): For some minority investors in family businesses, the investment remains attractive as a longer-term commitment, but over time they want to realize some value from the growth of the company and achieve a measure of liquidity to redeploy assets or distribute capital gains. These investor objectives may actually coincide with the family’s wishes, as well, because a lack of liquidity and an inability to reap the financial rewards of a successful business can be a source of friction among family business owners. An IPO of the family business with a stock exchange listing is a proven strategy for realizing the enhanced valuation of a growing business and establishing a liquid trading market for the company’s shares.

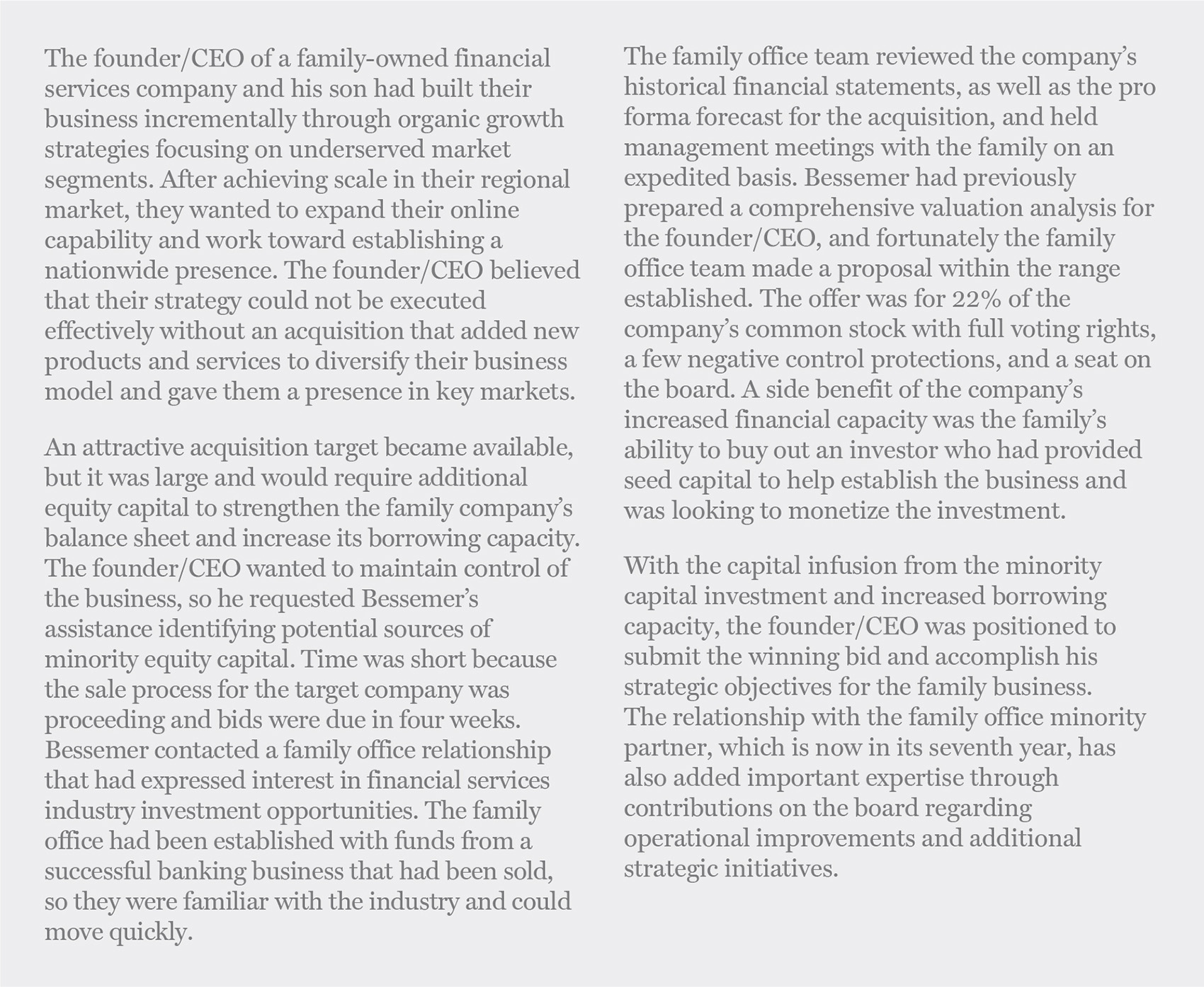

Conclusion: The Strong Rationale for Minority Capital Investments

The mutual benefits for both the family business owner and the minority capital partner, combined with the flexibility to customize the transaction structure and security terms, provide a strong rationale for such investments. It is important, however, that the family and the investor share a common vision for the future growth and development of the business. There should also be an alignment of interests with respect to the anticipated investment horizon and how a resolution of the investment will be managed. When these issues are addressed properly, a minority capital investment can generate significant benefits for both the family and the investor.

If you would like to learn more about a minority capital investment in the context of your own family business, our Family Company Advisory Group is highly experienced in developing this solution for business owners and would be happy to assist you.

This material is for your general information. It does not take into account the particular investment objectives, financial situation, or needs of individual clients. This material is based upon information obtained from various sources that Bessemer Trust believes to be reliable, but Bessemer makes no representation or warranty with respect to the accuracy or completeness of such information. Views expressed herein are current only as of the date indicated, and are subject to change without notice. Forecasts may not be realized due to a variety of factors, including changes in economic growth, corporate profitability, geopolitical conditions, and inflation. Bessemer Trust or its clients may have investments in the securities discussed herein, and this material does not constitute an investment recommendation by Bessemer Trust or an offering of such securities, and our view of these holdings may change at any time based on stock price movements, new research conclusions, or changes in risk preference.