Social Security: How to Maximize Your Benefits

- Deciding when to file for Social Security benefits can be challenging, involving trade-offs that hinge on your retirement goals, marital status, age, and expected lifespan.

- A “break-even” analysis can identify when a stream of higher Social Security payments over a shorter period is likely to overtake lower payments that began earlier.

- If you’re at or near retirement age, working with an expert can help you determine the best time for you to file for Social Security benefits.

While Social Security isn’t often an important component of retirement income for high-net-worth Americans, we have found that, after a lifetime of paying into the program, our clients justifiably want to maximize their benefits. But determining the optimal solution for your particular circumstances can be challenging. In this A Closer Look, we review some of the main considerations and trade-offs involved when determining when to begin receiving your Social Security benefits.

Qualifying for Social Security Benefits

If you were born after 1928, to qualify for the retirement-insurance benefit you must have achieved the following:

- Worked for a total of 10 years, earning the threshold wage (at least $5,880 per year in 2021).

- Reached age 62, the earliest age of eligibility for most claimants. However, if you apply for benefits at 62, your monthly payment will be permanently and significantly lower than if you had waited until what Social Security deems your “Full Retirement Age” (FRA), or later. Moreover, benefits can be further reduced (temporarily) if you continue to work and receive checks before your FRA.

The FRA is currently 66 for those born between 1943 and 1954 and increases by two months for every birth year afterward, until it maxes out at age 67 for individuals born in or after 1960. If you postpone election past your FRA, you will receive “delayed retirement credits” that increase your monthly benefit up to age 70 but no later.

Starting Benefits Early — or Later

To determine your monthly retirement payment, the Social Security Administration employs a complex model that adjusts your highest 35 years of wages with an indexing factor. The indexing factor will, in turn, influence the monthly benefit amount.

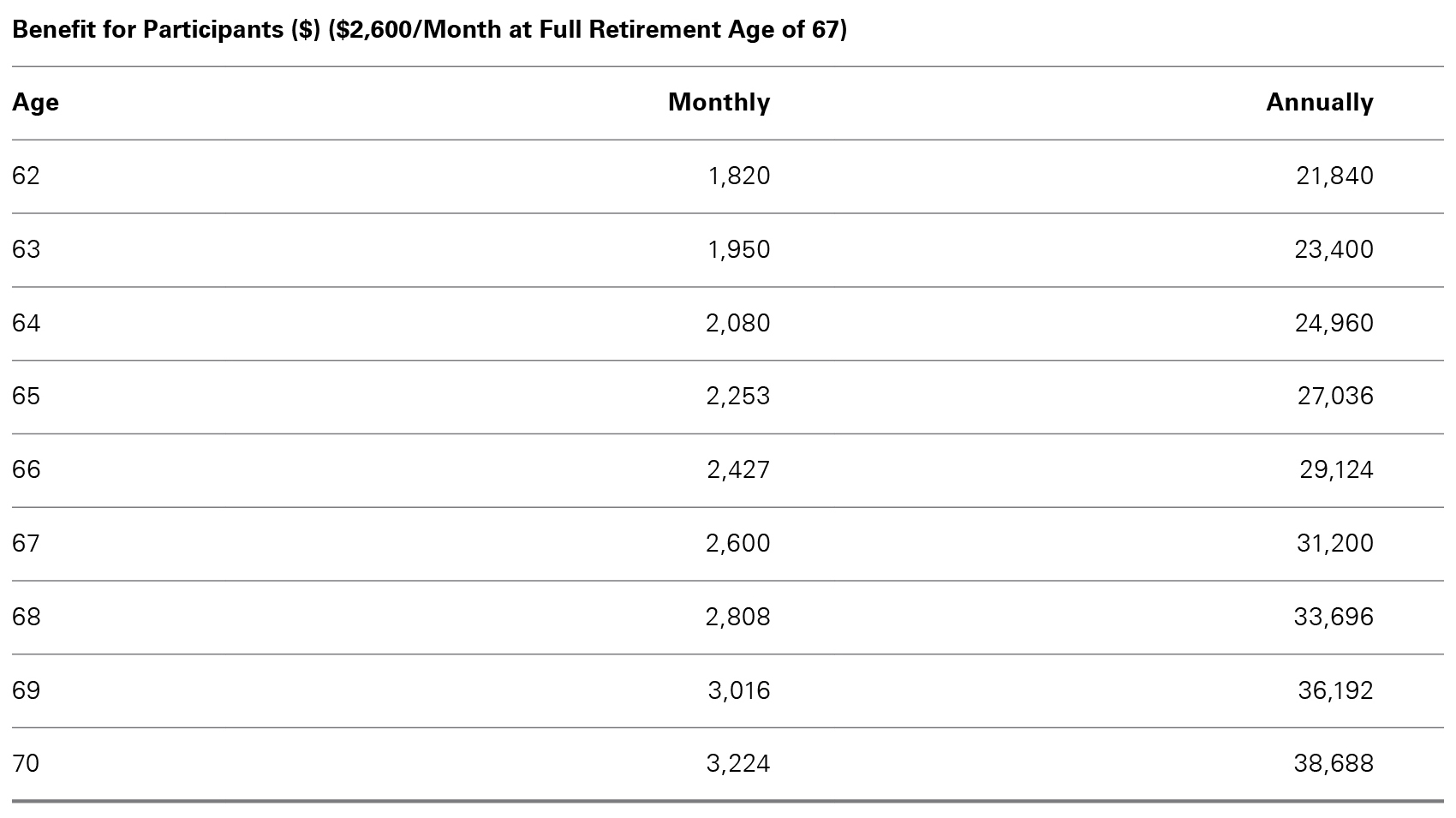

Here is what you should know when you are deciding to elect benefits, assuming an FRA of 67:

- Early election will permanently reduce your monthly benefit by as much as 30%.

- Delaying election past your FRA increases the monthly benefit by (a non-compounding) 8% per year, up to a maximum increase of 24% at age 70.

- If you expect to have higher earnings after reaching FRA, you will benefit from delaying election, all else being equal.

- The 8%-per-year enhancement for delaying your start date after your FRA, combined with the potential for higher earnings during the delay period, can produce total benefits nearly double that of electing to begin payouts at 62.

Exhibit 1: Social Security Benefits by Age

Key takeaway: The longer you wait before taking benefits, the higher your Social Security checks will be.

In summary, while choosing to elect Social Security benefits early may sometimes appear appealing, waiting until your FRA or later can significantly enhance your monthly, and hence annual, benefit (see Exhibit 1 for a representative schedule).

But waiting until 70 isn’t the best strategy for every retiree. Some may have reason to believe that they’re looking at a shorter lifespan than usual or wish to take advantage of retirement benefits when they’re younger. Some simply need the income sooner. And some — like those applying for spousal benefits — don’t receive higher amounts after they reach their FRAs.

So, how do you determine when the best time is for you to start drawing Social Security?

A decision to delay, or not, should factor in your life expectancy, family history of longevity, living expenses, and marginal tax rate.

If You’re Single: Finding the “Cross-Over Point”

Conventional advice often encourages unmarried individuals to delay their Social Security start date past their FRA. But it’s not that simple. A decision to delay, or not, should factor in your life expectancy, family history of longevity, living expenses, and marginal tax rate. Will you be better off starting Social Security payments earlier, at a lesser monthly amount, or deferring the start date of payments and collecting a higher amount? How long will it take for the higher monthly payments to reach the cross-over, or break-even point, beyond which they’ll provide you with more cumulative income than the lower payments? How long will it take past the time you’d start receiving Social Security benefits at the lower rate?

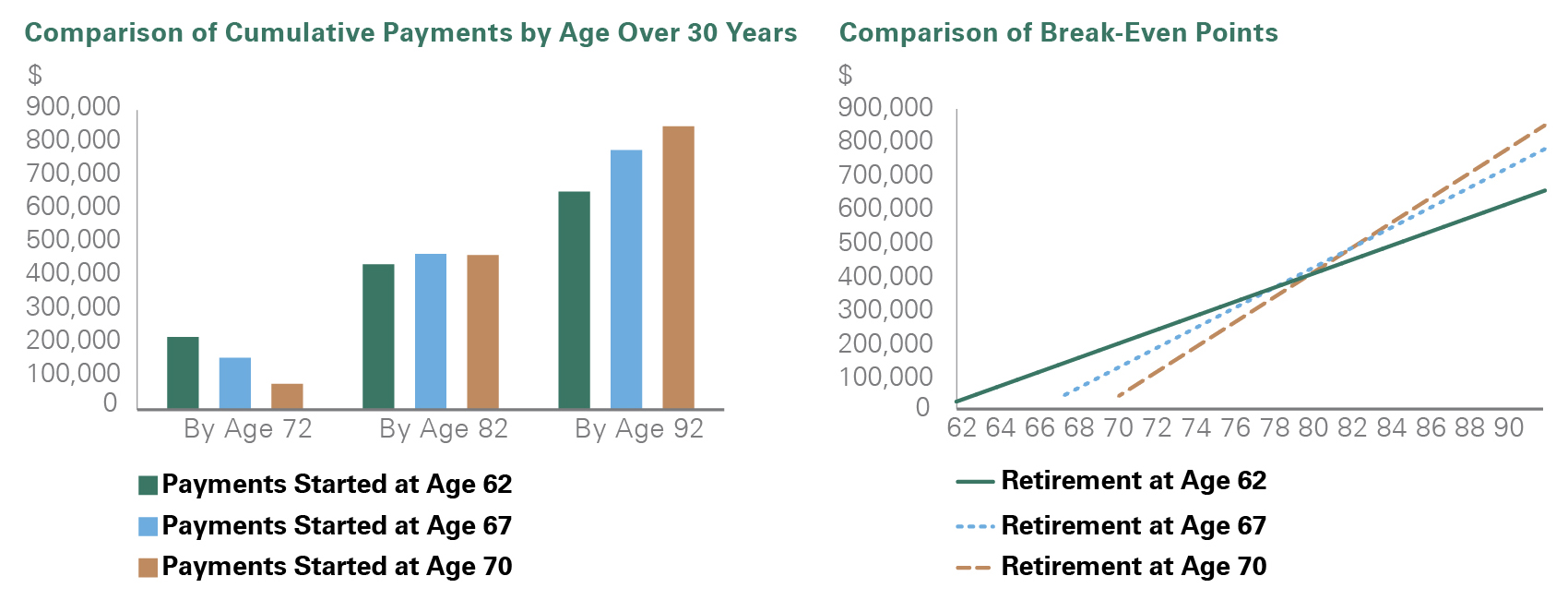

To answer that question, we incorporate background information about the effects of delaying the start date for receiving Social Security benefits. We then prepare a break-even analysis that compares the cumulative cash-flow impacts of early, full, and delayed election. These analyses pinpoint how long someone needs to live to make it more advantageous to delay their start date for Social Security benefits.

Once the break-even point is reached, future cumulative benefits increase in line with the length of the deferral period.

Consider a single individual born in 1960, with an FRA of 67, when they’d receive a projected monthly benefit of $2,600 (before taxes). If they waited three years until age 70, the monthly benefit would go up 24%, to $3,224.1 We estimate that the “break-even point” between beginning benefits at 67 and at 70 would occur at age 82 (Exhibit 2). This means it would take 15 years for deferring the start date for three years to pay off.

If the individual began taking payouts even earlier — say, at age 62 — break-even versus waiting until the FRA of 67 would occur at age 78: a 16-year period until break-even.

Finally, if they began Social Security benefits at age 62, versus starting at 70, break-even would occur at age 80.

Keep in mind that once the break-even point is reached, future cumulative benefits increase in line with the length of the deferral period. And while it would take a fair amount of time to realize the advantage of waiting, the trade-off is extra financial security if the beneficiary winds up living into his or her 80s or beyond.

Exhibit 2: Comparison of Cumulative Payments by Age Over 30 Years

Key takeaway: Cumulative Benefits: Monthly Social Security Payout of $2,600 at Full Retirement Age of 67

If You’re Married: Spousal Benefits Count

If you are married, the decision-making process is slightly more complicated. A married person will be entitled to retirement benefits based on his or her own earnings record, or up to half of their spouse’s benefit if it’s higher (but never both at the same time). The better choice will depend on each spouse’s earnings history, desired retirement age, anticipated longevity, and any substantial age difference between the two, as this can affect the total benefit paid to the couple. These factors determine whether each spouse should file for benefits early, wait until their FRAs, or delay elections further.

If your own projected benefit is less than half of your spouse’s (or if you aren’t eligible for a benefit), and you wait until your FRA to claim, you’ll receive 50% of your spouse’s FRA benefit. If you elect to file earlier, your spousal benefit will be reduced to as low as 35% if you file at age 62. In either case, you may receive the benefit for as long as you live — but to claim, your spouse must already be receiving his or her own benefit.

Note that if you claim a spousal benefit, it maxes out at your FRA, not 70. Waiting the additional years to start never makes sense, regardless of whether your spouse defers past his or her FRA.

A break-even analysis for a married couple must factor in the projected Social Security benefits and life expectancy of both spouses, which makes the exercise more challenging than for those who are unmarried.

Survivor benefits are also available to minor or disabled children of deceased, or parents of the deceased, in certain situations.

Survivor’s Benefits

If your spouse is a Social Security recipient, you’re most likely entitled to a survivor benefit when he or she dies.

Survivor benefits are more liberal than spousal benefits. Instead of a 50% limit, you’re entitled to 100% of the spouse’s benefit — the full amount he or she was taking or was eligible to take at death, even if no payouts were yet claimed, provided that (a) you were married at least nine months, (b) you’re at or past your FRA, and (c) you haven’t remarried before age 60.

Further, you are eligible to begin survivor benefits as early as age 60 (50 if you’re disabled) at a reduced amount of 71.5% of your full survivor benefit. And survivor benefits, unlike spousal benefits when both spouses are living, include any delayed credits earned by the deceased spouse. However, if you’re collecting your own benefits as well, you’ll receive the higher of your own or your spousal payment, not both. So, while survival benefits are richer than spousal benefits, after a spouse dies, the survivor’s benefit will certainly be less than the two checks combined that both spouses had been collecting.

Survivor benefits are also available to minor or disabled children of deceased parents, or parents of the deceased, in certain situations. All too often, survivors aren’t aware of those benefits.

Social Security Benefits and Divorce

In general, a divorced spouse is eligible for a maximum of 50% of his or her ex-spouse’s FRA benefit if he or she is at least 62, was married to the ex-spouse at least 10 years, and has not remarried if the ex is living. Divorced spouses can increase their benefits by waiting until their FRAs — but not beyond — and can be eligible for benefits from multiple ex-spouses, but can collect on the earnings record of only one at a time.

Filing a restricted application can be advantageous, but it’s available only for applicants of a certain age group.

A Sunsetting Strategy

For anyone born on or before January 2, 1954, a strategy known as the restricted spousal application remains available. This works best when both spouses were born before 1954 and are eligible for their own Social Security benefits. A restricted application allows a client to defer benefits at or after FRA until age 70 and at the same time collect spousal benefits on the lower-earning spouse, who must be receiving his or her own benefit.

Upon turning age 70, the higher-earning spouse switches to his or her own maximum benefit, and the lower-earning spouse either continues collecting on his or her earnings record or takes a spousal benefit, whichever is higher. With this strategy, the payout will be enhanced for the higher-earning spouse and the couple as a unit, and will be better as well for the surviving spouse if the higher earner is the first to die.

Filing a restricted application can be advantageous, but it’s available only for applicants of a certain age group, and the strategy will not be available after December 31, 2023, when the youngest in the age cohort reach 70.

Legislative Update

The laws about Social Security are often in flux. The latest legislative effort is the Social Security 2100 Act. It has received extensive support by Democrats and may prove attractive across the aisle as well. The bill is predicated on the assumption that it’s time to enrich Social Security benefits and improve the financial condition of the program as well.

The bill’s major provisions include the following:

- Setting a minimum benefit of 125% above the poverty line.

- Boosting benefits by about 2% on average.

- Improving benefits for widows and widowers from two-income households.

- Changing the inflation metric used for calculating annual cost-of-living adjustments to an index designed to better reflect senior spending needs.

- Raising the income floors for taxing Social Security benefits, but levying the Social Security payroll tax on the portion of any earned income at or above $400,000 rather than maxing out at a level well below that threshold.

Clearly, this is a bill with a broad array of changes. It’s impossible to say whether and when it will become law, and if it does, what provisions it will contain. We are watching carefully and will keep you apprised of meaningful developments.

Frequently Asked Questions

What happens if the Social Security trust fund is fully depleted, as projected in 2033?

This question assumes that Congress will let the Social Security trust fund fully deplete, which is highly unlikely. Many options are available, including raising FRA ages, raising the Social Security payroll tax or the level of income it applies to, raising taxes on Social Security benefits, and/or reducing benefits for new filers. In addition, even if the fund were to become exhausted, payroll taxes paid in annually are projected to fund 75%+ of benefits in 2033.

Can I work and still receive Social Security?

Yes. Once you reach your FRA, you can earn as much as you like, with no implications for Social Security (other than the higher taxes you’ll pay on the benefits). Prior to your FRA, your benefits will be reduced if your income (earned income only) is beyond certain (modest) limits. But the reduction is temporary. Any amounts that Social Security withholds because of your earnings will eventually be returned to you over time beginning at your FRA. However, as is always the case, your benefits will remain permanently reduced for starting prior to FRA.

How much can you earn prior to your FRA before some or all of your benefit is temporarily withheld?

Not much. The limits for 2022:

- Up to $19,560 before a benefit dollar is withheld for every $2 you earn;

- Up to $51,960 in your FRA year prior to your birthday month before a benefit dollar is withheld for every $3 you earn.2

Key Takeaways

Understanding your options can help you receive the maximum insurance benefit. If you’re at or nearing Social Security retirement age, we recommend the following:

- Work with a planner. Determining the financial break-even point for your benefit election can be time consuming and complex. It’s often worthwhile to seek the help of an expert.

- Think about timing. While an individual may elect benefits as early as age 62, delaying election will increase the monthly benefit. In many cases (though not all), delaying election past FRA maximizes the total value of Social Security benefits.

- Evaluate life expectancy. For a single person, this is one of the most important considerations.

- If you’re married, decide as a couple. For married persons, the optimal benefits depend on the desired retirement ages, each person’s earnings history and life expectancy, and the age difference between the spouses. Having these discussions with your spouse is an important step toward determining what is best for you and your family.

At Bessemer, we have a thorough understanding of the planning opportunities related to Social Security benefits and have assisted many clients in evaluating their various election alternatives.

If you have questions about Social Security, please speak with your client advisor, who will put you in touch with a member of the Client Tax Services Group with special expertise in this area.

- The amounts in all of our break-even analyses ignore cost-of-living adjustments, which can make delaying even more attractive, since the COLAs will compound off a higher base.

- The rules for the first year of retirement are more favorable for Social Security recipients who work.

This material is for your general information. It does not take into account the particular investment objectives, financial situation, or needs of individual clients. This material is based upon information obtained from various sources that Bessemer Trust believes to be reliable, but Bessemer makes no representation or warranty with respect to the accuracy or completeness of such information. Views expressed herein are current only as of the date indicated, and are subject to change without notice. Forecasts may not be realized due to a variety of factors, including changes in economic growth, corporate profitability, geopolitical conditions, and inflation. Bessemer Trust or its clients may have investments in the securities discussed herein, and this material does not constitute an investment recommendation by Bessemer Trust or an offering of such securities, and our view of these holdings may change at any time based on stock price movements, new research conclusions, or changes in risk preference.