Qualified Small Business Stock (QSBS) Tax Benefits

- In 1993, Congress enacted an unusually generous tax provision that allowed a partial exclusion of gain from the sale of qualified small business stock (QSBS). Legislation since then — most recently the Tax Cuts and Jobs Act, which reduced the top corporate tax rate from 35% to 21% — has made QSBS even more attractive.

- For high-net-worth individuals, family offices, and venture capitalists, QSBS investment opportunities could be worth considering. If you are interested in QSBS investing, given the complex qualification requirements for both companies and investors, you should consult with a tax professional.

- In this A Closer Look, we review key provisions related to QSBS, issues to consider before investing, common pitfalls to avoid, and several advanced planning opportunities.

Seeking to promote the growth of small businesses, U.S. lawmakers enacted Internal Revenue Code Section 1202 in 1993. This addition to the tax code, which provided what is known as a qualified small business stock (QSBS) gain exclusion, sought to promote a mutually beneficial relationship between small business founders and investors, and legislation in the ensuing decades only made the QSBS gain exclusion more attractive.

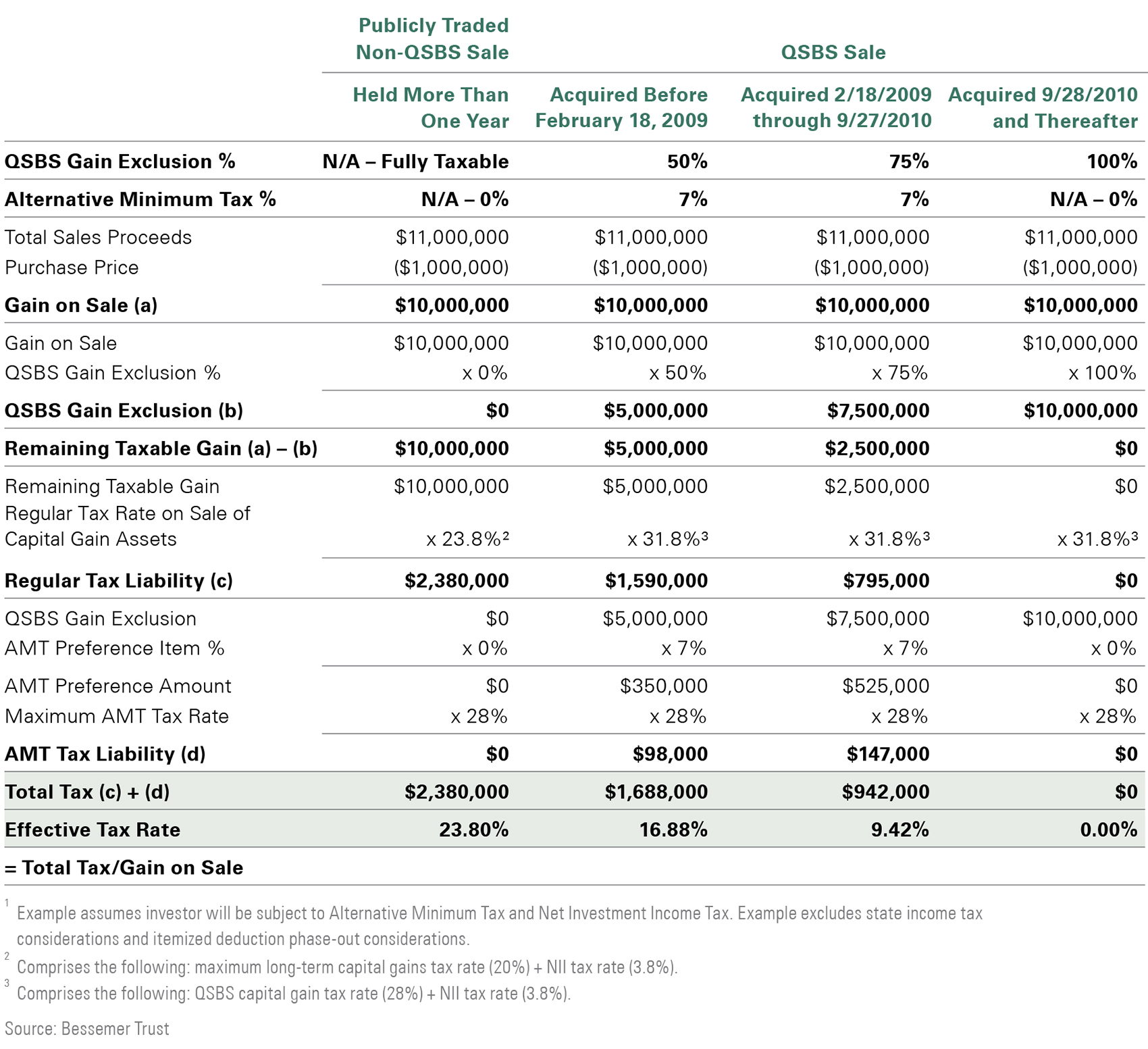

Today, when investors sell QSBS, they can exclude from taxable income a portion of gain on the sale — up to $10 million or 10 times the cost of the investor’s basis, whichever amount is greater. Below, Exhibit 1 walks through a step-by-step example comparing the tax implications of the sale of publicly held stock and QSBS.

Exhibit 1: Tax Comparison of QSBS and Regular Stock Sale¹

Key takeaway: The effective federal tax rate has remained unchanged for non-QSBS while dropping all the way to zero for QSBS.

Exhibit 1: Tax Comparison of QSBS and Regular Stock Sale

Key takeaway: The effective federal tax rate has remained unchanged for non-QSBS while dropping all the way to zero for QSBS.

Exhibit 1 is a table comparing in detail the tax implications of the sale of non QSBS held for more than one year and QSBS acquired before February 18, 2009; QSBS acquired after February 18, 2009, through September 27, 2010; and QSBS acquired September 28, 2010, and thereafter. After considering QSBS gain exclusions, regular tax liability, and alternative minimum tax liability as applicable, the effective tax rate is 23.80% for the non QSBS sale, 16.88% for QSBS acquired before February 18, 2009, 9.42% for QSBS acquired after February 18, 2009, through September 27, 2010; and 0.00% for QSBS acquired September 28, 2010, and thereafter. The example assumes the investor will be subject to alternative minimum tax and net investment income tax; it excludes state income tax considerations and itemized deduction phase-out considerations. Source is Bessemer Trust.

How Can You Benefit From the QSBS Gain Exclusion?

Numerous provisions relate to QSBS, including which individuals and entities can take advantage of the QSBS tax exclusion, when they can take it, which small businesses are “qualified” small businesses, and more. Below is a brief recap of the mechanics of QSBS.

- Issuers of QSBS must be domestic C corporations. That said, not all C corporations can issue QSBS. Entities that do not qualify include domestic international sales corporations, possessions corporations, regulated investment companies, and real estate investment trusts, as well as other types of businesses.

- The aggregate gross assets of the corporation must not have exceeded $50 million at any time from August 10, 1993, until immediately after the issuance of your stock. Generally, the term “aggregate gross assets” means the amount of cash plus the aggregate adjusted tax basis of property held by the corporation (see Exhibit 2 below).

Exhibit 2: Taking the Aggregate Gross Assets Test

- Pass. Sam contributes $10 million in cash to an existing corporation that holds assets with an aggregate adjusted tax basis of $40 million. Sam’s stock (issued by the corporation) qualifies as QSBS since the aggregate gross assets of the corporation do not exceed $50 million ($10 million + $40 million ≤ $50 million).

- Fail. Susan contributes property with a fair market value of $60 million to a newly formed corporation. Susan’s stock does not qualify as QSBS since the aggregate gross assets of the corporation exceed $50 million ($60 million > $50 million).

- QSBS must be acquired as part of an original issuance, either directly through the corporation or an underwriter, in exchange for money, property (other than stock), or as compensation for services provided to the corporation (other than as an underwriter).

- Ensure the business is qualified. Service businesses in the fields of health, law, engineering, consulting, or financial services do not qualify. The same is true for hotel, restaurant, oil, gas, banking, investment, farming, and certain other types of businesses.

- A corporation must meet the active business requirement during your holding period. At least 80% of the corporation’s assets (including intangible assets) must be used by the corporation in the active conduct of a trade or business. Research and start-up activities related to a future qualified trade or business generally may be treated as the active conduct of the qualified trade or business, regardless of whether these activities have generated any gross income.

- QSBS must be held for more than five years to be eligible for the exclusion. In general, the holding period begins when you buy the QSBS, but specialized rules apply. For instance, when QSBS is converted into other stock of the same corporation, the newly acquired stock is also treated as QSBS, and the prior stock-holding period is still used for purposes of the five-year requirement; the legal term for this is called “tacking.”

- A similar scenario arises when a taxpayer receives QSBS as a gift or by inheritance. When this occurs, the holding period of the transferor still pertains (or “tacks”) for the recipient (see Exhibit 3). It is important to note that while qualified businesses must be C corporations, the recipients of QSBS cannot be C corporations themselves.

Exhibit 3: How Does Holding-Period Tacking Work?

Tacking — the transfer of a previous stock owner’s already-accrued holding period to the new stock owner — can clearly work to the taxpayer’s advantage. Let’s take a look at tacking in action:

In our scenario, Mary purchases QSBS on January 1, 2011, and dies on January 1, 2013. Her son, Tom, inherits the QSBS from Mary and sells the QSBS on January 2, 2016.

Although Tom has only held the QSBS for three years, he has still satisfied the five-year holding period requirement for QSBS because he was able to “tack” the holding period of Mary’s stock.

- Sale before five years. If you sell QSBS before you have met the required five-year holding period, a rollover can be an effective planning tool; that is, it is possible to defer the gain on the sale of your QSBS if you fulfill several requirements:

- Your initial investment in QSBS must be held for more than six months.

- Stock must be sold.

- QSBS replacement stock must be purchased within 60 days of the sale of the initial QSBS.

- An election must be made on or before the due date or filing your income tax return for the taxable year in which the QSBS is sold.

- Once you satisfy these conditions, you will recognize gains only to the extent that the proceeds you received from the sale of QSBS exceed the cost of the replacement QSBS. Moreover, the replacement QSBS will now be subject to a new gain-exclusion limitation. If this technique is properly executed, it may result in the exclusion of more gain than was permitted on the sale of the initial QSBS.

- Calculating the exclusion amount. Depending on when the stock was acquired, a portion of the gain on the sale or exchange of QSBS held for more than five years by a non-corporate taxpayer can be excluded from income. The amount of gain that can be excluded is up to 100% of the greater of $10 million or 10 times the owner’s basis in the QSBS shares. As a reminder, there are smaller percentage exclusions for stock acquired during the years of 2009 and 2010.

- For shares acquired on or prior to February 17, 2009, the exclusion is limited to 50% of the greater of $10 million or 10 times the owner’s basis in the QSBS.

- For shares acquired after February 17, 2009, and before September 28, 2010, the exclusion is limited to 75% of the greater of $10 million or 10 times the owner’s basis in the QSBS.

- For shares acquired after September 27, 2010, the gain is limited to 100% of the greater of $10 million or 10 times the owner’s basis in the QSBS.

- An alternative minimum tax (AMT) adjustment is required on the disposition of QSBS acquired prior to September 28, 2010. This may reduce the tax benefit received, depending on the taxpayer’s AMT status.

- If your above-basis gain on a QSBS sale is greater than $10 million or 10 times your initial basis in the stock, the additional amount will generally be subject to long-term capital gains tax (currently at a rate of 20%) plus net investment income tax (at 3.8%).

- Shares acquired in merger transaction in exchange for QSBS can qualify for gain exclusion, but only gain on shares surrendered — not on subsequent gain on shares acquired as part of the exchange.

- Gifts of QSBS can be made to family members or non-grantor trusts. There is a “per taxpayer” limitation for gain exclusion, so multiple exclusions may be claimed. A common planning technique is called “stacking,” where gifts are made to one or more non-grantor trusts (see Potential for Advanced Planning Opportunities).

- QSBS can be received as a distribution from a partnership or LLC. A partnership that acquired QSBS may distribute these shares to its partners, who would then retain the QSBS benefits. Importantly, the underlying partners would need to have held their partnership interest at the time the QSBS shares were acquired by the partnership and at all times thereafter until the shares were distributed.

Avoiding Common Pitfalls

Numerous mistakes can lead to disqualification under the QSBS provisions:

- Selling shares prior to meeting the five-year holding period requirement. This could easily happen in a situation where new shares are received and the QSBS status is not known.

- Receiving certain stock redemptions during the holding period.

- Contributing QSBS to a partnership. As noted above, a partnership may distribute QSBS to its partners, who will retain the benefits. However, if an individual contributes QSBS to a partnership, the QSBS tax benefits will be lost.

- Rolling proceeds from the sale of stock into a new business that does not meet the active business requirement.

- Exercising stock options after the C corporation has exceeded $50 million in assets. Even if options were received prior to this point, the related shares must be acquired through an option exercise while the company still passes the test.

Potential for Advanced Planning Opportunities

Since the gain exclusion is limited to “per taxpayer,” there may be opportunities to multiply the benefit. Earlier, we mentioned that a scenario may arise when a taxpayer receives QSBS as a gift. A gift of QSBS to, for example, an individual’s children would result in the children stepping into the shoes of the individual who acquired the stock at original issuance and receiving the same holding period as the original owner (tacking). This allows you to multiply your gain exclusion via gift.

As such, QSBS can also be gifted to a spouse. Now, for spouses filing joint tax returns, the IRS treats each spouse as a separate taxpayer. If both taxpayer and spouse hold QSBS in their individual respective names, then it would make sense that the IRS allows separate gain exclusion amounts. However, there is a potential “marriage penalty.” For married individuals filing separate tax returns, the IRS states that each spouse is only allowed half of the $10 million gain exclusion. The guidance for this is still not certain, so we recommend careful coordination if both spouses have potential gain exclusions from the sale of QSBS.

In recent years, investors in QSBS have engaged in gifting their stock to non-grantor trusts. Gifts of QSBS to non-grantor trusts are considered completed gifts, subject to gift taxes and reportable on an individual’s gift tax returns. The reason this strategy works is because the ultimate beneficiary of the non-grantor trust is typically a different taxpayer (e.g., children).

What Should You Consider Prior to Investing in QSBS?

The first step should be to confirm the company’s stock will qualify as QSBS. Often, founders and investors may not be certain they will benefit from QSBS treatment. It is advisable for you to consult with a tax or legal professional who understands the QSBS requirements, or if you are a founder, you can engage legal counsel to ensure qualification with your CFO.

Careful monitoring of your holding period will make for efficient planning when considering exit strategies. There may be an opportunity to exit and maintain tax efficiency for your investment, while considering the anticipated growth of the company.

Keep careful records of stock certificates, which typically document the original cost, original issuance of stock, and date of acquisition.

Understand the QSBS rules to avoid disqualifying the tax benefits of gain exclusion.

QSBS Provisions: Still Attractive

QSBS provisions appear to work as lawmakers intended — they can assist in stimulating small business growth by promoting a mutually beneficial relationship between founders and investors. Companies that require sufficient capital to bring a product to market and rapidly scale the business may now be better able to attract investors. Likewise, investors — particularly high net worth individuals, family offices, and venture capitalists — may now be actively seeking entrepreneurial investment opportunities in these potentially high-growth companies.

When applicable, the QSBS tax incentive should not be overlooked. If you are contemplating — or have already made — an investment that you suspect may fit the QSBS requirements, you should consult with a tax professional sooner rather than later to ensure you take advantage of all the tax benefits available to you.

Bessemer’s tax consultants are available to discuss any questions you may have regarding QSBS.

This material is for your general information. It does not take into account the particular investment objectives, financial situation, or needs of individual clients. This material is based upon information obtained from various sources that Bessemer Trust believes to be reliable, but Bessemer makes no representation or warranty with respect to the accuracy or completeness of such information. The views expressed herein do not constitute legal or tax advice; are current only as of the date indicated; and are subject to change without notice. Forecasts may not be realized due to a variety of factors, including changes in economic growth, corporate profitability, geopolitical conditions, and inflation. Bessemer Trust or its clients may have investments in the securities discussed herein, and this material does not constitute an investment recommendation by Bessemer Trust or an offering of such securities, and our view of these holdings may change at any time based on stock price movements, new research conclusions, or changes in risk preference.