Insuring Against Wildfire Damage

- Wildfire damages are increasing, and so are the difficulties in obtaining homeowners insurance covering fire risks.

- Traditional homeowners insurance in wildfire areas, where carriers are still offering policies, now often comes with lower coverage limits, higher premiums, and higher deductibles.

- Effective insurance solutions may still be available, but given the complexity of the insurance market — and insurance policies — it’s important to work with experienced insurance advisors.

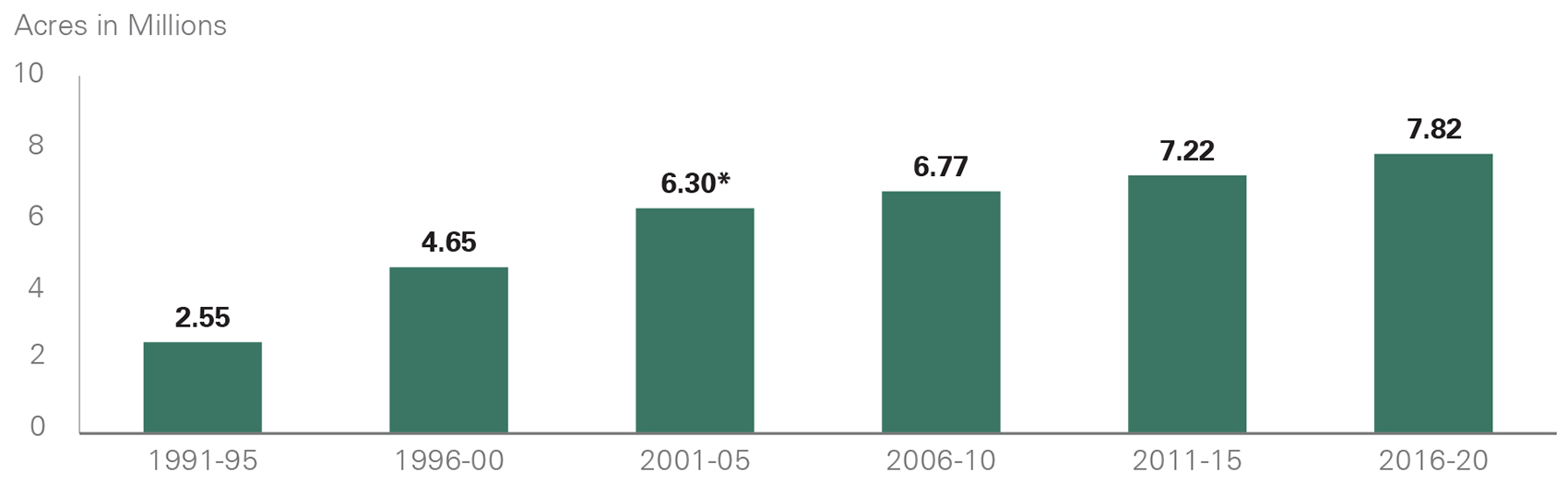

While the number of wildfires can vary from year to year, the damage they’re doing has been trending upward. Since the early ‘90s, the average number of U.S. acres burned annually has increased from about 2.5 million to almost 8 million (Exhibit 1), leaving lost lives and devastating economic damage in their wake. In fact, nine of the 10 costliest U.S. wildfires occurred between 2017 and 2020, with the biggest insured loss topping $10 billion.

Last year did bring a relatively mild wildfire season in California, at least in comparison to recent years, but many experts suspect it was most likely a result of year-to-year weather variability and not a change in overall trends. There has also been some speculation that this past winter’s heavy rains in Southern California could help reduce wildfires, but that is not the case. Heavy rains encourage increased vegetation growth, and that vegetation has the potential to dry out and become additional fuel for wildfires in the summer months. We note as well that wildfires broke records in other areas, including in Arizona, Nebraska, and New Mexico.1

Why is this happening? Many scientists point to climate change, which has led to lengthier dry seasons and more intense heat — fuel for wildfires. At the same time, more people are choosing to live in forested areas prone to wildfires, the area known as the wildland urban interface (WUI), and so more people and more buildings are in harm’s way.

Exhibit 1: Wildfires Are Becoming More Destructive

Key takeaway: Average Number of U.S. Acres Burned per Year by Wildfires

Exhibit 1: Wildfires Are Becoming More Destructive is a bar chart depicting the average number of U.S. acres burned per year by wildfires. From 1991 to 1995, the figure is 2.55 million acres. From 1996 to 2000, the figure is 4.55 million acres. From 2001 to 2005, the figure is 6.30 million acres (the number for 2004 is not complete for North Carolina). From 2006 to 2010, the figure is 6.77 million acres. From 2011 to 2015, the figure is 7.22 million acres. From 2016 to 2020, the figure is 7.82 million acres. The source is the National Interagency Coordination Center, published by the National Interagency Fire Center.

Source: National Interagency Coordination Center, published by the National Interagency Fire Center

Whatever the cause of the escalation in wildfire damage, homeowners hoping to protect their property are finding it increasingly difficult to find adequate insurance coverage, and when they do find it, they are often having to pay more (sometimes much more) for it than they did previously.

Fortunately, careful research and creative approaches — accessing wholesale brokers, considering state-run programs where offered, and combining different options — may provide an effective solution.

That said, since the insurance market is complicated, especially in high-risk areas, and insurance policies can be daunting in their length and complexity, it’s important to work with experienced insurance advisors when developing a strategy.

Fire Insurance Harder to Come By

Fire coverage in homeowners policies is becoming increasingly difficult to obtain in wildfire-prone areas, particularly in California.

More specifically, insurance companies are:

- Raising premiums: We’ve seen premium increases ranging from 1.5 to 10 times prior rates.

- Adding wildfire deductibles: These deductibles can be quite large. Part of the insurers’ rationale is to cut exposure to smaller losses. Although wildfires often completely destroy homes, sometimes smoke damage alone can require large-scale cleaning. Insurers would like to help insulate themselves from costs like those and also lower their payouts for fire damage.

- Limiting the amount of coverage: This can take the form of reductions of maximum payouts, changes in coverage terms, or caps on a home’s insured value. Regarding maximum payouts, for instance, we recently worked with a client who previously insured her home, related structures, and personal property for $30 million against fire — which covered complete replacement — but whose insurer has now limited payouts to a maximum of $10 million.

- Adding risk-mitigation requirements: These can make homes less vulnerable to wildfires, and many of them can be inexpensive, such as adding screens to attic vents or removing combustibles from nearby your home. Others can be more costly or burdensome from an aesthetic and lifestyle perspective — for example, replacing wood roofs with fire retardant roofs, removing cherished trees from near the home, or installing alternative water sources, such as a 10,000 gallon cistern (see “Reducing Your Fire Risk: A Checklist” below).

- Canceling policies and/or exiting wildfire regions: While this is particularly true for companies providing coverage for high-value homes in wildfire-prone areas, some of these companies are abandoning their homeowners insurance lines based on risk alone in areas where fires have not yet occurred.

Reducing Your Fire Risk: A Checklist

While wildfires are outside the control of any homeowner, you can do many things to help protect yourself, your family, and your home and property. Indeed, to purchase or renew insurance these days in areas with high wildfire risk, you may well need to take some of the steps below.

Outside the House

- Rake leaves, and remove leaves, rubbish, and flammable vegetation from on and under structures.

- Remove dead branches that extend over the roof.

- Maintain 15-foot spacing between trees, and remove limbs within 15 feet of the ground.

- Prune tree branches and shrubs.

- Plant fire-resistant shrubs and trees (like certain oaks, elms, cypresses, and fruit trees).

- Ask your power company to clear branches from power lines.

- Use nonflammable fencing and gates.

- Place stove, fireplace, and grill ashes in a metal bucket after use and soak in water for two days.

- Make sure fire vehicles can get to your home; display address prominently and mark driveway entrances.

On and in the House

- Regularly clean roof and gutters.

- Use fire-resistant or noncombustible materials on roof and house exterior.

- Install multi-pane or tempered-glass windows.

- Inspect chimneys at least twice a year.

- Install 1/8-inch mesh screens under porch, deck, and floor areas, and cover openings in floors, roof, and attic.

- Install dual-sensor smoke alarms on each level of the house.

- Install a non-electric backup generator in case power goes out.

- Consider installing protective shutters or fire-resistant drapes.

The more you do to help protect your property, the less damage a fire may wreak.

Securing or Renewing Your Coverage

While buying or renewing home insurance has become much more of a challenge if you’re living in a wildfire-prone area, options may still be available. They begin with understanding the types of brokers who offer service. Most homeowners work with an insurance agent, either an independent agent representing several insurance companies, including those that specialize in insuring expensive homes, or a captive agent who exclusively represents one insurer, known as a direct writer.

Direct writer insurers tend to offer standard policies that pay for common expenses after a loss but often do not include coverage specifically designed for properties with high values to rebuild. Sometimes, it may be possible to add endorsements to the basic policy to add or broaden specific coverage options.

The advantages of working with independent agents include access to multiple and often higher quality insurance companies that can offer superior policies, and so they have frequently been a better option than working with captive agents. In wildfire-prone areas, however, this appears to be changing.

While some insurance companies represented by independent agents have pulled out of areas at risk of wildfire, some of the largest direct writer insurers have remained and continue to offer good and competitively priced policies. They now represent a reasonable alternative. If you’re in the market for homeowners insurance or need to renew your policy in a high-risk area, it’s a good idea to do some comparative shopping: Insurance companies and agents may vary considerably in the services they offer and the charges you’ll incur.

Independent or captive agents may also be able to turn to wholesale insurance brokers as an alternative when the insurers they represent cannot offer a policy. Wholesale brokers offer access to specialized insurance companies (known as surplus-lines insurers), which may be exactly what’s needed for residents in wildfire geographies.

Surplus-lines companies are “non-admitted,” meaning that they don’t carry state licenses, and so they don’t need to obtain regulatory approval for their coverage or the rates they charge; as a result, they are willing to offer policies that “admitted” insurers won’t handle.

Lloyd’s of London is one example of a surplus-lines insurer, and some insurance companies that specialize in insuring high value properties have surplus-lines divisions.

It should be mentioned that surplus lines insurers aren’t backed by a guaranty fund as is typical for admitted insurers, so there’s no state backstop if they go insolvent. Also, these policies can be costly and can include severe restrictions, so they need to be considered carefully. The bottom line is that a surplus-lines policy is never the ideal choice, but it may be the best alternative for a homeowner in a fire zone.

State FAIR Plans: Mostly a Low-Priority Option

For homeowners looking to initiate or renew coverage but are shut out of the regular market because of a high risk of wildfires, coverage through a “FAIR” (Fair Access to Insurance Requirements) plan may be the only answer. FAIR plans are currently available in 32 states.

FAIR plan policies are specific to each of the states where they’re offered but are always designed for areas prone to high risk from exogenous threats, making it hard or impossible to get regular insurance.

FAIR plans may sound like a panacea for homeowners in wildfire areas, but in most cases, they’re not:

- Most charge high premiums (in line with the higher risks they underwrite).

- To buy into the plan, you often need to prove you’ve already been declined by an admitted traditional insurance company.

- Coverage amounts are usually capped. For example, in California, the total insured value for a house, other structures, and personal property is limited to $3 million.

- Coverage can be restricted to specific causes of loss such as fire, smoke, lightning, and internal explosion.

Sometimes a FAIR plan policy can be amended to include additional causes of loss. The California FAIR plan policy can be expanded to include payments for damage from windstorm, hail, aircraft, vehicles, vandalism, and malicious mischief.

For comprehensive homeowners insurance that pays for even more losses, it may be necessary to combine a FAIR plan policy with other insurance, such as a difference in conditions (DIC) policy. DIC policies, also known as “wraps,” add coverage for additional causes of loss, such as theft, falling objects, weight of ice or snow, accidental discharge of water or steam, and personal liability. The DIC and FAIR plan policies work together to provide the sort of comprehensive coverage included in a single homeowners policy, if one were available.

Protecting Valuable Art in an Evacuation

As we all know, sometimes, despite firefighters’ best efforts, homeowners facing imminent wildfire threat will need to evacuate.

Much has been written about evacuation preparedness: Have a plan with multiple escape routes before a wildfire strikes; identify water sources both within and outside your property; choose a designated place to meet in case family members are separated; take a first-aid kit, prescription medicines, bottled water, a flashlight, a battery-powered radio, and a computer; leave food and water for pets that you must leave behind — and most of all, evacuate when you’re asked.

Be Ready Beforehand

Less information has been disseminated about steps to help protect valuable fine art. Here, too, preparedness is the key. We’d emphasize the following suggestions:

- Arrange with a professional fine-arts mover to pack and move your artwork, assuming you have ample time before evacuation. Hiring a specialized moving company is critical for moving and saving art.

- The mover will probably have storage facilities or arrangements with a storage company; if not, contract with one.

- Take with you documentation of your ownership of the art and any documents establishing provenance of the pieces.

Decide on Priorities

If there’s limited time to evacuate, you may have to make some hard choices about which objects to remove from the home and which to leave behind. Determine those priorities before you face any immediate fire threat, and keep a written list of the priorities for the movers. Of course, your movers may well have the time to pack up your entire collection; the priority list is for a worst-case scenario.

It’s usually inadvisable for art owners to pack and move artwork themselves: Mistakes can easily be made that can mar pieces forever. However, you can help expedite the process for the movers by clearing furniture away as much as possible around the artwork.

A Few Conservation Tips

Do you have outdoor sculpture that’s extremely difficult or impractical to move into storage? If so and if possible, move the sculpture inside the home or one of the structures on your property. And try to set up irrigation around sculpture that you can’t move.

Finally, use plastic glazing sheets and backing sheets on paintings to help guard against heat, smoke, and fire damage. For art that you can’t evacuate, this advice may prove helpful. A professional should do this work, unless you’re comfortable handling valuable paintings.

Unsurprisingly, helping minimize loss and damage in the event of a wildfire evacuation requires skill, effort, and the ability to make trade-offs. But a successful result can be priceless.

Valuable Articles Policies

Another option, if you’ve put together a program that will cover fire damage, might be to increase that protection by pairing your home insurance policy or policies with a valuable articles policy.

Valuable articles policies are designed to insure treasured items such as antiques, fine art, jewelry, wine, and musical instruments. These policies include coverage for wildfire, are generally affordable, and often don’t include deductibles. Moreover, if you itemize your valuable articles as part of this policy, in the event of a major fire loss, the process of settling a claim may be much easier and faster.

If your overall coverage on the homeowners insurance side is capped for personal property or for the total insured amount for real property and personal property, a valuable articles policy can provide a significant amount of extra insurance.

Don’t Go It Alone

The complexities of structuring insurance that meets homeowners’ needs when they live in a fire zone are many: understanding the large print and the fine print in policies; finding the policy or combination of policies most suitable for each homeowner; balancing insurance needs vs. the generally higher premiums, higher deductibles, and lower payout caps of high-risk coverage; and more.

Even the most basic of insurance strategies shouldn’t be undertaken without the guidance of experienced, knowledgeable advisors. They can help you uncover and evaluate the available options, minimize the chances for unpleasant surprises, and help ensure that you assemble an insurance program that meets your coverage needs.

If you live in a wildfire-prone area and are interested in insurance coverage, Bessemer’s insurance advisory professionals are available to answer your questions, discuss alternatives, and guide you through the process.

- Source: “Why California’s 2022 Wildfire Season Was Unexpectedly Quiet,” Elena Shao, New York Times, December 20, 2022.

This material is for your general information. The discussion of any estate planning alternatives and other observations herein are not intended as legal or tax advice and do not take into account the particular estate planning objectives, financial situation or needs of individual clients. This summary is based upon information obtained from various sources that Bessemer believes to be reliable, but Bessemer makes no representation or warranty with respect to the accuracy or completeness of such information. Views expressed herein are current only as of the date indicated and are subject to change without notice. Forecasts may not be realized due to a variety of factors, including changes in law, regulation, interest rates, and inflation.