Family Meetings — An Important Strategy for Creating Good Stewards

- More and more clients are having regular family meetings to prepare the next generation for what's ahead. The thoughtful use of today's technologies can often make these meetings easier and more effective.

- Early on, family meetings often focus on basic financial education and then move to values-based discussions and skill building over time, gradually revealing information about the family wealth plan.

- This staged long-term approach helps clients feel confident that, when they finally share their wealth plan, the next generation will not only be able to grasp its technical aspects but also the values and life lessons driving it.

- If you're interested, we can help you plan, design, and conduct thoughtful family meetings that make sense for your family.

Why Have Family Meetings?

Successfully preserving wealth across generations is not easy. Transferring values is even harder. Many wealth creators have suffered the heartbreak of seeing their money and family cohesiveness diluted after only one or two generations. Other families have created positive, enduring legacies that persist into third, fourth, and fifth generations.

What have the successful families done so differently? In our experience, these families have prepared wealth for the next generation through thoughtful planning, but they have also prepared the next generation for the wealth through a series of thoughtful family meetings.

In this A Closer Look, we discuss how a well-designed family meeting may help to create an atmosphere of trust, strengthen relationships, and instill a value system that will persist across generations. We also explain how Bessemer Trust helps its clients plan and facilitate family meetings to promote mutual understanding and refine expectations for the future.

The Perils of Wishful Thinking

For many generations, it was common for wealthy parents to fear that talking about money too early with their kids and grandkids would spark sense of entitlement. The prevailing wisdom was that allowing them to get "older and wiser" first would bring about a better outcome. Today, families are proactively asking for their advisor's help to educate their kids and grandkids, and they are starting when the next generation is much younger — typically when they are in their teens and early twenties, but sometimes even earlier.

Three trends are at work here:

The first is the internet. Parents are more willing to concede that their kids are doing some research. They often start with the value of their parents' home or homes, find other bits and pieces of information, and extrapolate from there. So deep down, parents know that keeping silent about the wealth is a bad idea because they lose the opportunity to frame a message about their values and life lessons.

Strategies for Raising Grounded Children

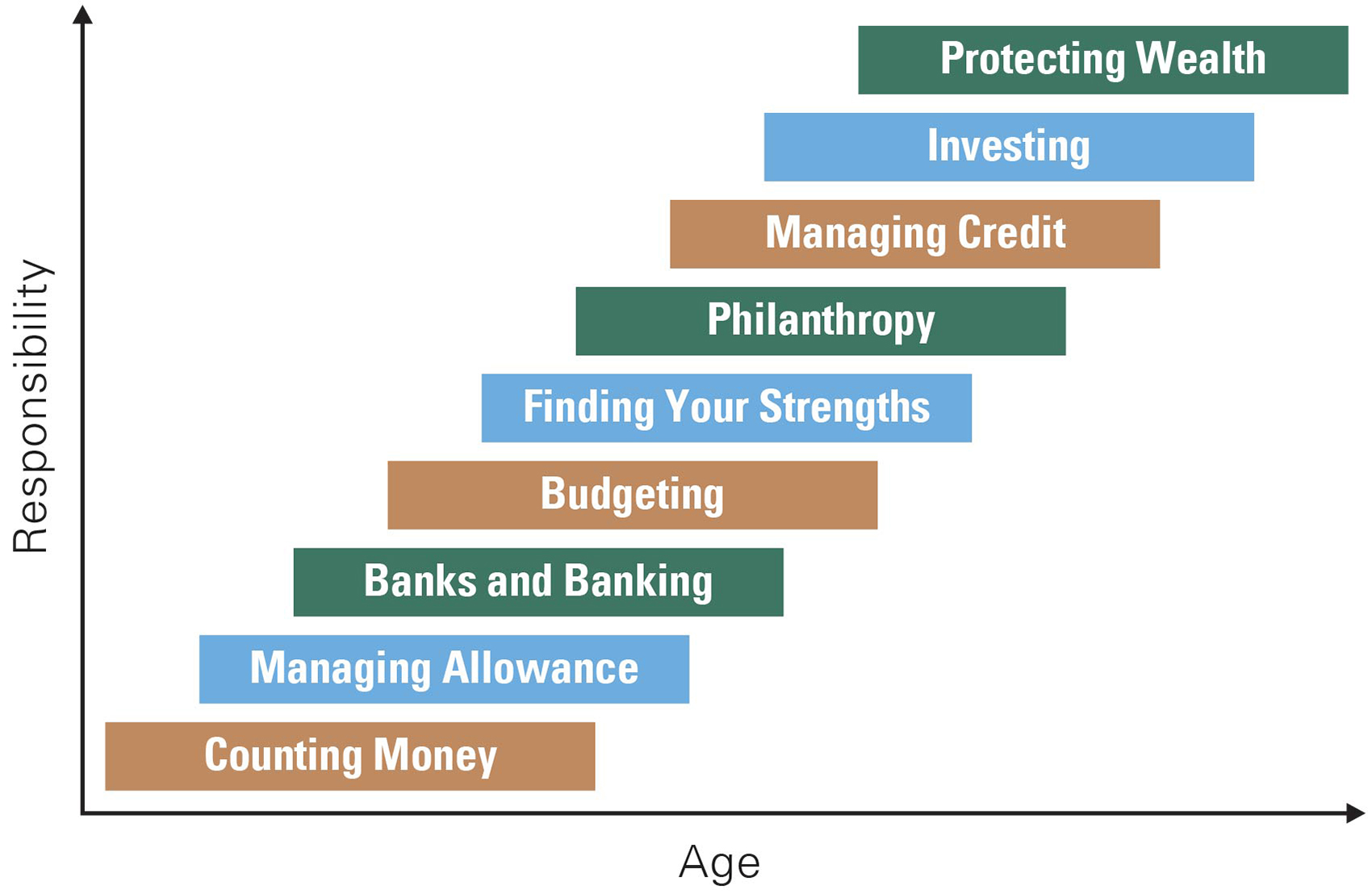

Key takeaway: Responsibilities increase with the child's age

Stewardship: The responsible oversight and protection of something worth caring for and preserving.

A second factor accelerating the preparation is a greater awareness among parents that not preparing the next generation adequately can have serious negative consequences. Research suggests that failure to maintain wealth across generations is largely attributable to lack of prepared heirs and a deficit of communication and trust.1

Finally, there is a generational factor. Recent Pew research suggests that younger millennials and older members of Gen Z do not consider money to be a taboo subject anymore. It's easy to understand — they grew up witnessing the Great Recession, and now they are living through the COVID-19 crisis and its economic fallout. They are anxious and tend to have a pragmatic approach to money matters. They are more than likely to ask about the plan.

In our experience, gradually sharing a wealth plan with the next generation in a series of conversations that can take place in stages, often over years, creates an atmosphere of trust. Often, the values of trusts and projected inheritances are the last — not the first — thing to be disclosed.

Families who have worked hard to prepare the next generation and gradually offer increased transparency and reduced uncertainty stand a greater chance of creating good future stewards.

What Goes on in a Family Meeting?

But what really happens in a family meeting? It's likely much more than an investment review. They come in all shapes and sizes, from a half-day meeting with two generations and one facilitator to a weekend retreat with three (now now even four) generations in which everyone, including all the family advisors, play a role. Retreats often include fun team-building activities to add to the family's collective bank of good will. Our Family Wealth Stewardship team has designed and facilitated well over 150 family meetings, and while families share common issues, each agenda is unique because it's based on what the family needs to accomplish and how the family is wired. We have an extensive toolbox of educational materials, communication exercises, and facilitation techniques to draw from when designing a family meeting series.

We also draw heavily from confidential one-on-one pre-meeting interviews with all participants (teenagers and above). We use this time to better understand who the participants are as individuals, how they learn/process information, and where their interests/concerns lie. For larger families or families with more straightforward issues, such as prioritizing financial education topics, or identifying common philanthropic interests, an online survey might replace or precede the interviews.

When Do I Start?

The timing to start a family meeting depends on several factors, including participants' ages and the meeting objectives. Ideally, family meetings start when the next-generation members are in their teens and early twenties, and focus on providing a basic financial education.

If members of the next generation are trust beneficiaries, we recommend starting this process well before they attain age of majority (typically 18 years old) and the trustee is required to notify the beneficiary of the trust. But families can start to have regular family meetings at any time, for a variety of important reasons, such as integrating new members into the family, preparing the family for a leadership transition, or highlighting a change of thought or tax-savings opportunity when it comes to an estate plan.

If the family owns a business, we typically encourage them to start formalizing their decision-making process, also known as governance, before the third generation is of employment age. It is no secret that family businesses start as complex systems that over time become exponentially more complex, which means starting earlier is best.

A recent trend we see among younger client families is the willingness to start regular family meetings when the youngest child is reading-age (typically six or seven years old). Family meetings for younger children may focus on the importance of developing savings plans from allowances or finding worthwhile charitable causes to support (see Encouraging Practical Conversations about Money and Values). These types of early meetings help children develop skills they will use to integrate family values with wealth stewardship pans (see Strategies for Raising Grounded Children). Bessemer can work behind the scenes with parents to set agendas and offer tools and exercises that engage a broad set of ages.

Sequencing the Meeting Topics

The sequencing of topics within a meeting and from meeting to meeting is especially important. Well-managed expectations among participants can ease anxiety and raise levels of engagement. For example, if the specific financial details in a plan are not going to be revealed for several meetings (or several years), participants should be aware that, and understand that interim meetings are laying the groundwork for that reveal. Or if spouses or partners are to be included only on certain topics or at certain times of year, that should be clear from the start.

Encouraging Practical Conversations about Money and Values

Can money buy happiness?

Why do you think a surgeon gets paid more than a teacher?

Is money a need or a want? Share an example.

Is paying with your phone the same as paying with cash? With a credit card?

Why does one pair of shoes cost more than another?

These questions — and many others — are part of The Box, an interactive tool we developed to encourage conversations about money and values. In this activity, which is appropriate for children as young as six years old, a series of question cards about money are placed in a box and then withdrawn one at a time and answered by the participants.

The questions — and the participants' answers — then help to facilitate ensuing discussions about managing resources, understanding the differences between wants versus needs, and exploring family values.

To illustrate the power of starting at the right time and thoughtful sequencing, here is a fairly common example for a family whose youngest generation is middle-school to college age:

- Series I: Basic financial education. We take a building-block approach, gradually increasing their knowledge of personal finance, investments, and wealth planning with interactive, hands-on, and age-appropriate activities. Specific curriculums are shaped to account for the level of knowledge of and interest in the topics at hand. Bessemer will work with parents to understand the family's values and balance sheet, so our teaching approach can reinforce the messages that come from adult family members during the meeting. Philanthropic families, for example, may want to begin with their foundation or donor-advised fund (see Philanthropy as a Powerful Teaching Tool). We also leverage technology to make the learning engaging and easily accessible. Among the many tools we employ are our Across the Board instructional videos, which explain basic financial concepts. These basic education meetings can easily occur in virtual classrooms, with numerous participants in different locations, using one of the many online hosting platforms, such as Zoom.

- Series II: Exploration of family history and values. As the next gen grows more familiar with concepts behind wealth preservation and growth (e.g., the power of compounding, the impact of credit card debt, how taxes work, the value of keeping a budget), families often seek to add learning about family's history to the meeting sequence as a way to understand how their life experiences forged their values. In advance of these get-togethers, we typically provide the elder family members with a list of questions, or prompts, to help them prepare to share their story in a meaningful way (see Sharing Your Family's History and Values). Often, we encourage families to record these stories in some way for future generations to refer to, perhaps in the form of a letter or short book. With many extended families now staying in touch through Zoom, it's easy to instantly record sessions in which younger family members interview their parents and grandparents. For many families, a sense of reflection, perspective, and gratitude in these trying times is something important to capture.

- Series III: Share all or part of the family wealth plan. Generally speaking, discussion of the wealth plan and transferring assets to the next generation occurs later in the meeting process, when parents and/or grandparents feel that the younger family members are adequately prepared — they're a bit older and have a strong understanding the family's intent for the use of the wealth. Presented in this sequence — toward the end of a series of family meetings — the younger generation can fully understand and appreciate not only the technical aspects of the plan but also the underlying values and motivations that formed the basis of the plan. We have found that this careful approach tends to minimize the potential for discord and bring families closer together. It also rewards the rising generation with a sense of trust and respect. As one next gen client put it, "Now I know what to expect, what not to expect, and what is expected of me." She felt confident and prepared to face the future.

Sharing Your Family's History and Values

In recent years, extensive research has revealed a startlingly simple truth: Families function better as a group — and so do their members individually — when they know their family’s history. In fact, awareness of the family narrative, whatever it happens to be, is the best predictor of family members’ health, happiness, and overall resiliency. Family meetings offer an ideal opportunity to tell these stories. Also, given today’s digital technologies, the meeting can be held virtually and easily recorded to capture the family history for later viewing. To help start these discussions, we often share the following questions:

- What do you want your loved ones to inherit, in the broadest sense of the word?

- What truths have you learned along the way:

- About being part of a family?

- About being a friend?

- About money — its meaning and its management?

- About taking care of oneself?

- About appreciating and enjoying one's life?

- What experiences forged your character?

Sources: Bruce Feiler. "The Stories That Bind Us." New York Times, March 15, 2013; Marshall Duke, Robyn Fivush, and Jennifer Bohanek. "Do you know? The power of family history in adolescent identity and well-being." Journal of Family Life, March 2010

Difficult Conversations

Most, if not all, families experience internal conflict from time to time, and wealthy families are no exception. The discord can come from many places — changing economic landscapes, differing ideas about what is fair, misunderstandings about the intent for the use of the family’s wealth. When multiple generations are involved, conflict can boil down to simple differences in communication styles and preferences.

With a skilled facilitator, a series of family meetings can help address charged issues while having the family practice the skills required to manage conflict now and in the future.

Among the specific skill sets we frequently teach in family meetings are how to structure a difficult conversation, how to handle your personal communication preferences in light of others with different preferences, and how to build consensus. Each new skill a family learns helps build its capacity to handle conflict productively, and not simply hope for it to go away. Unaddressed conflict can be quite costly to families down the road.

Philanthropy as a Powerful Teaching Tool

Involvement with family philanthropy — be it a foundation, donor-advised fund, or even informal personal giving — can increase the financial acumen of younger generations. For example, we have used a family’s donor-advised fund to teach asset allocation, the power of compounding, and effective decision-making given a limited budget. As such, philanthropy allows the family to have conversations about money and values without the distraction or anxiety of revealing the family’s net worth too soon in the process. Research and our own experience suggest that the younger generation is eager to begin to give:

- They are more strategic in their giving.

- They want to be active partners with the causes they support, often through age-appropriate volunteer work.

- Their philanthropy often reflects the values they learned from their families.

Especially in the current COVID-19 environment, when so many worthy charities are in such desperate need, the idea of convening the family to discuss grants and their potential impact can be a powerful teaching tool.

Source: Dorothy A. Johnson Center for Philanthropy and 21/64, Next Gen Donors.

The Process of Meeting Regularly Is Its Own Benefit

Regular family meetings can be essential to the wealth and well-being of families. Even if the first few meetings feel a bit awkward, over time, the process becomes more ingrained and valuable. Family members typically develop new talents to work with one another and learn from each other — better communication techniques, a deeper appreciation for healthy conflict, and a greater sense of engagement and contribution to the family as a whole. They can also gain a strong sense of their family’s history and values. For the younger generations in particular, improved interpersonal skills are often accompanied by a solid financial education that can lead to a deeper understanding of the family wealth plan.

In short, regular and carefully structured family meetings can help enhance communication and trust among generations and prepare the next generation to be effective stewards of the family’s wealth and legacy.

How We Can Help

Each family is in a different starting place with regard to establishing a family meeting. Bessemer Trust partners with families for each step of the process. We work hand-in-hand to shape agendas, secure the appropriate subject matter experts, and help set the family’s expectations.

Whatever the family’s goal, we can help craft a thoughtful strategy for enhanced multigenerational communication and education through the family meeting. In our experience, families who have prepared the next generation for wealth by creating a stewardship mindset view the family meeting as critical. They consider the investment of time and effort well worth it.

- Source: Roy Williams and Victor Priesser, Preparing Heirs.

Past Performance is no guarantee of future results. This material is for your general information. It does not take into account the particular investment objectives, financial situation, or needs of individual clients. This material is based upon information obtained from various sources that Bessemer Trust believes to be reliable, but Bessemer makes no representation or warranty with respect to the accuracy or completeness of such information. Views expressed herein are current only as of the date indicated, and are subject to change without notice. Forecasts may not be realized due to a variety of factors, including changes in economic growth, corporate profitability, geopolitical conditions, and inflation. Bessemer Trust or its clients may have investments in the securities discussed herein, and this material does not constitute an investment recommendation by Bessemer Trust or an offering of such securities, and our view of these holdings may change at any time based on stock price movements, new research conclusions, or changes in risk preference.